U.S. Dollar Trades Higher Against Most Majors

August 07 2019 - 5:21AM

RTTF2

The U.S. dollar traded higher against its most major

counterparts in the European session on Wednesday, as fears over a

full-blown currency war receded and investors cheered dovish policy

action by three Asian central banks to support their economies from

a global slowdown.

China's central bank set its reference rate for the yuan below

the psychologically important 7-per-dollar level. Investors

welcomed indications of China stepping in to steady the yuan that

could prevent the trade war from turning into a currency war.

Speaking to CNBC, President Donald Trump's top economic adviser

Larry Kudlow said that the U.S-China trade talks are likely to

resume in September.

The U.S. is willing to negotiate, he said, adding that the

President and his team is planning for a Chinese visit in

September.

The central banks of New Zealand, India and Thailand surprised

markets by delivering interest rate cuts than had been

expected.

While NZ's central bank unexpectedly reduced its benchmark rate

to a record low, the Bank of Thailand and the Reserve Bank of India

also joined global easing to cope up with slowing economic

growth.

On the economic front, U.S. consumer credit for June is due at

3:00 pm ET.

The currency slipped against its major opponents in the Asian

session.

The greenback appreciated to a 2-day high of 0.9797 against the

franc from Tuesday's closing value of 0.9764. If the greenback

rises further, 0.99 is likely seen as its next resistance

level.

The greenback rose to 1.1179 against the euro, from a low of

1.1220 hit at 9:45 pm ET. On the upside, 1.10 is possibly seen as

the next resistance level for the greenback.

Data from Destatis showed that Germany's industrial production

declined more than expected in June.

Industrial production fell 1.5 percent on a monthly basis in

June, reversing a revised 0.1 percent rise in May. Output was

forecast to drop moderately by 0.5 percent.

The U.S. currency strengthened to a 2-day high of 1.2122 against

the pound from yesterday's closing quote of 1.2161. The currency is

likely to face resistance around the 1.20 level.

Figures from the Lloyds Bank subsidiary Halifax and IHS Markit

showed that UK house prices decreased for the second straight month

in July.

House prices fell unexpectedly by 0.2 percent month-on-month in

July, after falling 0.4 percent in June. This was the second

consecutive drop in prices. Economists had forecast a 0.3 percent

rise.

The greenback climbed to 1.3337 against the loonie, its highest

since June 19. The greenback is seen finding resistance around the

1.35 level.

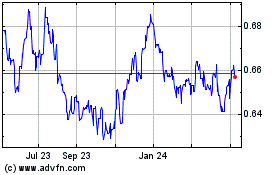

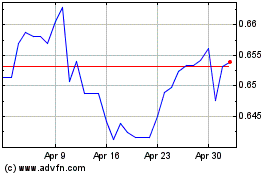

The greenback held steady against the aussie amd the kiwi, after

having advanced to more than a 10-year high of 0.6677 and a

3-1/2-year high of 0.6377, respectively in the Asian session. The

greenback had ended Tuesday's trading at 0.6759 against the aussie

and 0.6524 versus the kiwi.

In contrast, the greenback declined to 105.71 against the

Japanese currency, compared to 106.46 hit late New York Tuesday.

The greenback is poised to find support around the 104.00

region.

Looking ahead, U.S. consumer credit for June and Canada Ivey PMI

for July are scheduled for release in the New York session.

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Aug 2024 to Sep 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Sep 2023 to Sep 2024