Tether Asset Reserves Figures Record Significant Plunge Compared To 2021

August 20 2022 - 7:30AM

NEWSBTC

Following the collapse of Terra and its ecosystem, there is a

considerable reduction of confidence in stablecoins, especially

Tether. Most participants in the crypto space have increased doubts

about the level of stability with stablecoins. While many are

treading more caution on most projects, some have made a complete

back-out. That’s why the pressure has risen on some of the top

stablecoins. Investors have been demanding more transparency in the

reserves that back them up. Tether USDT is the leading stablecoin

and has received several demands to disclose its reserve to the

public. Related Reading: Investor Sentiment Falls As Crypto Market

Sheds $100 Billion In a recent development, Tether has finally

revealed the details of its reverse to the public. The firm did so

on Friday during the announcement of its collaboration with BDO

Italia, a public accounting company. The statement from the backing

firm for the stablecoin indicated that Tether has up to $66.4

billion as its reserves. Also, the company mentioned that it has

cut down its backing, which was holdings commercial paper against

its report for the previous quarter. Currently, the firm stated

that it is maintaining more of its holdings as cash and bank

deposits which had risen by 32% within the quarter under review.

The company cited its plan of eliminating commercial papers as part

of its reserves. It said within the last quarter; that the

stablecoin reduced its holdings on commercial papers by over 58%.

Also, Tether mentioned that it would provide updates regarding

issued tokens and reserves daily. And it plans to be releasing

assurance opinions monthly. Finally, Tether maintained that it had

proved the robust nature of its operation and its reserve

management for careful practices. Tether Total Assets Value

Decreases According to the report from BDO for the end of June,

Tether’s assets are worth about $66.4 billion. This indicated a

drop of about $16 billion between the two quarters for the

stablecoin. The consolidated total liabilities for Tether are at

$66.22 billion in the quarterly report. But most of them are

digital token issuance. Tether reiterated that its report displays

its resiliency and ability to stand firm through other storms.

Also, it’s a measure of its commitment to transparency to its users

and the general public. Additionally, the firm has expressed that

transparency and accountability would remain its core value. It

revealed its plan to release data monthly to facilitate more

progressive moves toward openness. Related Reading: Ethereum Sends

Red Signals, But Should You Worry About The Long Term? This is a

new change from its old practice of providing a quarterly report of

its operations and standing. In addition, USDT disclosed its new

official partnership with a new accounting company. Featured image

from Pixabay, chart from TradingView.com

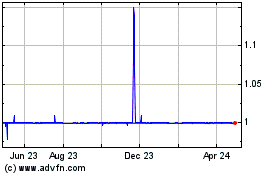

Tether USD (COIN:USDTUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tether USD (COIN:USDTUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024