Bitcoin Back Above $70,000 Despite Negative Taker Volume

April 11 2024 - 6:00PM

NEWSBTC

Bitcoin has surged back above the $70,000 level during the past day

despite the negative Net Taker Volume for the asset. Bitcoin Net

Taker Volume Has Seen Some Large Negative Spikes Recently As

explained by CryptoQuant Netherlands community manager Maartunn in

a post on X, selling spikes of a significantly heavier scale than

before have recently appeared in the Bitcoin Net Taker Volume.

Related Reading: Bitcoin 2 Months Through “Euphoria Wave,” How Long

Was The Last One? The “Net Taker Volume” is an indicator that keeps

track of the difference between the Bitcoin taker buy and taker

sell volumes in perpetual swaps. How can the sell and buy volumes

be different? As CryptoQuant explains in its data guide: This

concept is often confusing because every trade requires both a

buyer and a seller of the given underlying asset. However,

depending on whether the order taker is a buyer or seller (whether

a transaction occurs at the ask price or the bid price), you can

distinguish between long volume from taker seller volume. When the

value of this metric is positive, it means that the taker buy

volume is overwhelming the taker sell volume right now. Such a

trend implies a bullish sentiment is shared by the majority. On the

other hand, the negative indicator suggests that more sellers are

willing to sell the coin at a lower price, a sign that a bearish

mentality is the dominant one. Now, here is a chart that shows the

trend in the Bitcoin Net Taker Volume over the past year: The value

of the metric seems to have been quite red in recent days | Source:

@JA_Maartun on X As the above graph shows, the Bitcoin Net Taker

Volume has recently registered a sharp negative spike, implying

that the taker sell volume has been higher than the taker buy

volume. The Net Taker Volume has been seeing some large red spikes

for a while, as the analyst highlighted in the chart. “Bitcoin is

being hammered down massively, with selling spikes on the Net Taker

Volume significantly heavier than before,” says Maartunn.

Interestingly, despite this bearish sentiment in the market, the

Bitcoin price has managed to hold up relatively well. Obviously,

the coin’s bullish momentum has gone while these negative Net Taker

Volume spikes have taken hold, but the fact that BTC has shown

strength against any sustained drawdowns is still impressive.

Related Reading: Dogecoin Slows Down: What Needs To Happen For New

DOGE Highs? A pattern that’s perhaps visible in the chart is that

although the Net Taker Volume has continued to see red spikes

recently, their scale has gradually decreased. Thus, if this trend

continues, it’s possible that the bearish mentality will eventually

run out, and buying pressure will take over Bitcoin. It now remains

to be seen how the indicator develops shortly. BTC Price Bitcoin

declined below $68,000 just yesterday, but today, the asset has

already bounced back and is now trading around $70,800. Looks like

the price of the coin has made some recovery over the past 24 hours

| Source: BTCUSD on TradingView Featured image from Jievani

Weerasinghe on Unsplash.com, CryptoQuant.com, chart from

TradingView.com

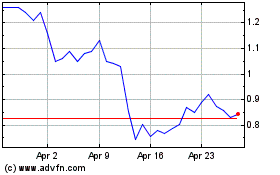

Mina (COIN:MINAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024