Cardano Price Tumbles As Grayscale Sells All ADA From Large Cap Fund

April 05 2024 - 9:00AM

NEWSBTC

The Cardano (ADA) price is experiencing a notable decrease,

dropping by 12% since the start of the week, with a 2.6% dip

recorded today alone. Despite this, with a market capitalization of

$20.27 billion, ADA maintains its position as the 9th largest

cryptocurrency. This recent downturn comes amidst a broader crypto

market experiencing mostly sideways to downward movement, with ADA

recording more significant losses compared to its peers like ETH,

which is down by 7.4%, BNB by 6.4%, Solana by 6.3%, and XRP by

6.1%. Grayscale Dumps Cardano From GDLC A pivotal factor behind

Cardano’s sharper decline could be linked to the recent liquidation

of all ADA holdings by the Grayscale Digital Large Cap Fund (GDLC).

The fund, which currently boasts assets under management (AUM)

worth $579 million, had Cardano constituting 1.62% of its portfolio

on January 4, which amounts to approximately $9.4 million. Related

Reading: Cardano Rides The ETF Wave: Inflows Surge To Over $1

Million – Details On Thursday, Grayscale Investments announced the

decision as part of its first quarter 2024 review. According to the

official press release, the adjustment to GDLC’s portfolio entailed

the selling of Cardano and reallocating the cash proceeds to

existing Fund Components, proportional to their weightings. This

rebalancing led to the removal of ADA from GDLC’s portfolio. The

final composition of the fund as of April 3, 2024, includes Bitcoin

(70.96%), Ethereum (21.84%), Solana (4.52%), XRP (1.73%) and

Avalanche (0.95%). The press release detailed, “In accordance with

the CoinDesk Large Cap Select Index methodology, Grayscale has

adjusted GDLC’s portfolio by selling Cardano (ADA), and using the

cash proceeds to purchase existing Fund Components in proportion to

their respective weightings. As a result of the rebalancing,

Cardano (ADA) has been removed from GDLC.” Related Reading: Panel

Of Experts Reveal When The Cardano Price Will Reach $3 Grayscale

also highlighted the quarterly evaluations of the GDLC, DEFG, and

GSCPxE Fund compositions, aimed at updating existing Fund

Components or including new ones based on index methodologies

provided by the Index Provider. This practice ensures that the

funds’ holdings reflect the most current market trends and asset

performance. Notably, the Grayscale Smart Contract Platform

Ex-Ethereum Fund still contains Cardano. The cryptocurrency is the

second-largest position after Solana (58.41%), with a weighting of

14.56%. In response to these developments, Charles Hoskinson, the

founder of Cardano, offered a terse commentary via X, stating,

“Wall Street give; Wall Street take.” This succinct remark

encapsulates the volatile nature of crypto investments and the

significant impact that major financial players like Grayscale can

have on the market dynamics of digital assets. Wall Street give;

Wall Street take https://t.co/dkyrhHW4WS — Charles Hoskinson

(@IOHK_Charles) April 5, 2024 At press time, ADA was trading at

$0.57. In the short term, the 100-day EMA at $0.58 is the key

resistance that ADA needs to overcome in order to develop new

bullish momentum. The 100-day EMA has served as strong support

three times since mid-January. After the recent dip below this

indicator, ADA is struggling to reclaim it. In the medium term, the

bulls need to break above the $0.68 level. Featured image from

Guarda Wallet, chart from TradingView.com

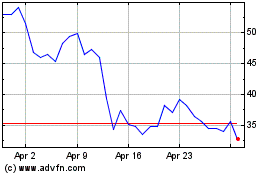

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024