2nd UPDATE: Newcastle Coal Export Plan Could Double Exports

September 18 2009 - 3:31AM

Dow Jones News

Coal miners in the Hunter Valley region of New South Wales state

have agreed to a coal export plan that the state's government said

could see Australia's biggest coal export port of Newcastle double

its capacity in the next six years.

The port has long been a notorious bottleneck, crimping

Australian export earnings and costing miners millions of dollars

in demurrage charges as dozens of bulk carriers queued offshore

waiting to be loaded.

The Newcastle Coal Infrastructure Group, made up of six miners

led by BHP Billiton Ltd. (BHP.AU), has now agreed to the new plan

for distributing port capacity, a plan already supported by the

government and Port Waratah Coal Services, whose shareholders

include Rio Tinto Ltd. (RTP) and Xstrata PLC (XTA.LN).

New South Wales Premier Nathan Rees said Friday the plan will

support thousands of new jobs and boost Australia's annual coal

export revenue by about A$6.5 billion by 2016.

"This plan cements Newcastle's position as the world's biggest

coal port with export capacity expected to double to 180 million

tons over the next six years," he said.

The export plan will see NCIG grant new coal producers access to

some of the capacity of future expansions of its export facilities

at Newcastle.

Federal Infrastructure Minister Anthony Albanese said in a

statement that the plan complemented the A$1.2 billion investment

the government and the Australian Rail Track Corporation is making

to more than double the capacity of the Hunter Valley's rail

network.

The accord allows coal loading and rail operations to be

underpinned by 10-year contracts, giving producers as well as rail

and port operators the certainty they need to make long-term

investment decisions and grow their businesses, he said.

It will also guaranteed access to new producers wanting to enter

the market, Albanese said.

The port group, made up of BHP Billiton, Centennial Coal Co.

Ltd. (CEY.AU), Peabody Energy Corp. (BTU), Donaldson Coal, Felix

Resources Ltd. (FLX.AU) and Whitehaven Coal Ltd. (WHC.AU), is close

to completing the first stage of its coal terminal development,

which will have a capacity of 30 million tons a year.

Under the agreement, they will make available up to 12 million

tons a year of any further expansion to new coal producers.

"With these agreements in place, the coal industry will have

long-term certainty over future access to vital port capacity,

which will support our future expansions and growth of the region,"

BHP Billiton President of Energy Coal Jimmy Wilson said in a

statement.

A spokesman for NCIG confirmed that all the capacity framework

documents for the access regime have now been signed by all parties

and said the agreements are now subject to approval by the

Australian Competition and Consumer Commission.

PWCS General Manager Graham Davidson said the agreement set the

scene for historic change in the way coal is exported from the

Hunter Valley.

"We now effectively have all key players reading off the one

road map, meaning everyone has a far better idea of what

infrastructure should be built, and where and when," he said.

The plan gave certainty to coal producers in terms of their

export capacity and would deliver capacity for those seeking to

expand mines or launch new operations, he said.

PWCS operates the two existing coal terminals at Newcastle and

is close to completing a A$458 million upgrade that takes its

capacity to 113 million tons a year, although the limitations of

the rail system mean exports are capped at 91 million tons a year

for now.

As part of the new export plan, the government has agreed to

lease more land to PWCS on Kooragang Island for the construction of

another coal loading terminal, and PWCS said feasibility work on

this development is already underway.

Currently, with export capacity falling short of demand from

Hunter Valley miners, a capacity balancing system has been in place

to allocate tons to producers.

PWCS said it is now applying to the ACCC to allow it to continue

this system for the remainder of 2009, until the new export plan

comes into place at the start of 2010.

-By Alex Wilson, Dow Jones Newswires; 61-3-9292-2094; alex.wilson@dowjones.com

(Andrew Harrison in Melbourne also contribute to this story.)

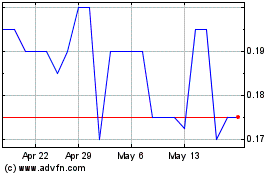

Felix (ASX:FLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Felix (ASX:FLX)

Historical Stock Chart

From Apr 2023 to Apr 2024