TIDMEQIP

RNS Number : 0739A

Equipmake Holdings PLC

18 January 2024

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

18 January 2024

EQUIPMAKE HOLDINGS PLC

("Equipmake" or the "Company")

RESULTS FOR THE SIX MONTHSED 30 NOVEMBER 2023

Equipmake, the UK-based engineering specialist pioneering the

development and production of electrification products across the

automotive, aerospace, bus, coach and off-highway industries, is

pleased to announce its unaudited results for the six-month period

ended 30 November 2023 ("H1 FY24") and a trading update for the

financial year ending May 2024 ("FY24").

Financial Highlights

-- H1 FY24 revenue (including grants) of GBP2.07m represents a 97% year-on-year increase (H1 FY23: GBP1.05m).

-- Improvement in gross margins for repowered vehicles reported in Powertrain (inc. integration) (H1 FY24: 9.2%,

full year FY23: -12.9% gross loss), reflects initial progress on the cost reduction initiatives that are expected

to deliver further significant margin improvements in the near term.

-- Operating losses of GBP2.97m, (H1 FY23: loss of GBP2.08m before exceptional items). The increase in

administrative costs are aligned with the Company's financial plan and reflect the expansion of the business

since the IPO in July 2022.

-- Contracted order book1 of GBP11.17m as of 17 January 2024.

-- Investment in tangible fixed assets and product development of GBP1.33m.

-- Cash as of 30 November 23 was GBP3.91m (30 November 22: GBP7.44m).

Operational Highlights

-- Delivered seven repowered buses to First Group, increasing the in-service fleet to 12 vehicles, meeting all

operational KPIs.

-- Secured new bus re-powering orders totalling GBP3.23m from Newport Transport and Big Bus Tours.

-- Commenced production-intent motor/inverter development project with Perkins Engines Company Ltd ("Perkins") (a

wholly owned subsidiary of Caterpillar Inc., a global OEM leader in the off-road market), securing up to GBP3.24m

of associated government grant funding through the Advanced Propulsion Centre UK ("APC") over the

three-and-a-half-year life of the project.

-- Secured an order from a global specialist vehicle OEM for GBP0.56m to integrate the Company's powertrain into an

airside operational vehicle.

-- Additional facility of 50,000 sq. ft fully operational, including relocation of vehicle repowering team.

Trading update

Since the end of H1 FY24, Equipmake has:

-- Secured a second order from Big Bus Tours for a further 10 buses, totalling GBP1.75m.

-- Secured a new order for GBP0.72m for a production-intent development project with H55, further supporting

aerospace sector growth.

-- Secured a second order from a global specialist vehicle OEM for GBP0.4M to provide 2 EV powertrains for airside

operational vehicles.

-- Strengthened the Executive team and Board with the appointment of Dr Nick Moelders as COO.

-- Increased the pipeline of opportunities to enter US electric vehicle ("EV") markets, through a partnership

models.

Whilst our order pipeline remains strong and our cost reduction

initiatives remain on target to deliver the anticipated gross

margin improvements, there have been some delays in implementation

due to operational and supply chain challenges. As a result, the

Company has taken a prudent approach to its production ramp up and

anticipates revenue for the full financial year being below market

expectations, however strong cost control measures mean that

operating losses are expected to be broadly in line with market

expectations.

(1) The contracted orderbook is orders that have been contracted

but where revenue hasn't been recognised.

Commenting of the results and trading update Ian Foley, CEO of

Equipmake said:

"I am pleased to share an update on our progress on delivering

our ambitious strategy, as laid out originally at the time of our

initial public offering in July 2022. We continue to see excellent

demand for the leading-edge electric vehicle ("EV) products and

integrated solutions that we can supply. Our half-year results

demonstrate strong progress on our journey to building revenue and

operational profitability with revenue in this half year of

GBP2.1m, being 97% ahead of the equivalent period in FY23. We are

increasing gross margins on repowering vehicles, whilst also

investing in an additional facility and adding to our operations

and sales teams. We are anticipating strong revenue growth in FY24

vs FY23, however we are anticipating this being lower than our

previous revenue expectations for the full year.

"As we have built our business over this interim period, we have

been judicial in our approach to new opportunities, ensuring that

we prioritise those directly in our target sectors (both end market

and geography) and those that are most complementary in the nearer

term with our existing product offering. Additionally, we have

taken a view on opportunities that could build short-term revenue

but would at this time not deliver the margins we require, ahead of

our cost reduction initiatives being materially delivered by the

end of FY24."

CEO Statement

A key tenet of our value proposition has always been our

state-of-the-art products, developed from 20 years of experience,

that work seamlessly as an integrated EV solution for our

customers. This provides a strong competitive positioning for those

very substantial markets where customers have specific needs to

repower from ICE, or to develop new product, that requires proven,

expertly engineered EV product in what remains an emerging field of

technology. In this interim period, we have not only secured

substantial new orders from new customers, but also extended our

capacity and in-house capabilities through targeted investment and

driven hard on productionising to realise unit cost reductions that

are already beginning to have an impact.

Strengthening the Leadership Team

I was delighted earlier this month to announce the appointment

of Dr Nick Moelders to the Board as COO, replacing James Bishop.

Nick brings a wealth of proven delivery capability in our sector,

as well as significant knowledge and network in the US market.

In his most recent role, Nick led the development and scaling to

production of the electrification division of Sensata, a $5bn

market cap Tier 1 and 2 sensor business. This is the latest step of

an ongoing process by the Board to ensure the Company has the scope

and scale of leadership talent to deliver its strategy.

Equipmake Strategy

We firmly believe that the world is on an irreversible path to

far greater electrification, and the transport sector is front and

centre of that. The internal combustion engine has dominated this

sector for over 100 years, from micro-mobility to passenger cars,

mass transit and industrial vehicles. All these applications are,

and will continue, transitioning to electrification. Opportunities

abound for those companies that offer proven, high quality EV

products and systems that are fit for purpose. The overall

transport market for electrification is enormous, and the

sub-sectors of that, including mass transit (bus & coach),

industrial (generally off-road) and aerospace each represent very

significant market segments, in their own rights. Even when further

segmented into new vehicles and solutions to repower existing

vehicles - necessary in many sectors to meet new emission targets

in time - the addressable markets remain enormous. These markets

are our North Star, and we think carefully about how we will be

successful in our chosen ones, using common core products and Zero

Emission Drivetrain solutions from our established portfolio.

The adoption of many new technologies follows a well-researched

"S curve", with 3 phases: early adoption then rapid acceleration,

followed by maturity. These periods of new technology adoption

often result in existential crises for incumbents and create

opportunities for new entrants who can think differently, and

deliver real product, when it is needed. One particular feature of

large incumbents, and why they often struggle, is their need to

operate out-dated facilities and supply chain models which attempt

to compromise customers' needs into existing business models and

product solutions. This is the advantage that new entrants,

particularly those with vertically integrated product solutions

like ours that are designed to meet today's customers' needs, bring

to the competitive landscape. The strong value proposition of the

integrated solutions approach we have is substantial and worthy of

highlight. We design, engineer and manufacture our own motors,

inverters, control units and other key components in house,

providing us not only with huge flexibility to meet our customers'

requirements, but also strong cost competitive advantage. Many of

our competitors purchase these components externally at retail

prices and consolidate them into their "solutions". The economics

of these operating models are materially different, providing a

distinct cost and flexibility advantage to Equipmake, something we

increasingly see in our conversations with customers.

Our long-established presence in the EV sector, delivering

products for many years into different end markets has prepared us

well for scaling our activities, as the adoption cycle moved from

early adoption into rapid acceleration. We are addressing the

challenges of driving costs from our products as volume has

increased and have also proven our ability to consistently deliver

high quality, customer-ready products that literally hit the ground

running. Our market-leading uptime within the buses we have

repowered to date is a strong testament to this, as are the repeat

orders we are seeing across our customer base. Building the

business does take time, and creating the customer relationships

and driving product costs down also consumes time and other

resources on the path to true scaling.

We are seeing our strategy play out as anticipated, although

taking a little longer in this phase than we had originally

planned, as we became more selective in the opportunities we pursue

whilst we ensured our product costs and manufacturing capabilities

were ready for the next phase. We have successfully built relations

(and taken initial orders) with several global customers and,

whilst this has taken some time, the future business potential from

these customers is very significant.

Vehicle Repowering and Original Equipment supply - Equipmake

positioning

Repowering is the process of converting an existing vehicle

(usually powered via an ICE) to a Zero Emission Drivetrain powered

vehicle. Original Equipment ("OE") supply is the supply of EV

components or wider systems to customers that manufacture new

vehicles.

Equipmake is addressing both these market opportunities in

particular sectors, within repowering most notably bus, coach and

industrial vehicles, with OE adding aerospace as a further

market.

Repowering enables us to address substantial markets that exist

today and that we believe will continue to grow for many years. It

provides the opportunity to prove our products in multiple

real-world uses, build our knowledge, customer base and reputation.

Examples are our repowering with First Group (13 vehicles), Big Bus

Tours (now 20), and Newport Transport (8).

Simultaneously, we are building our capability and product

offering to scale into the OE market. Our recent announcement with

Perkins, where we are now developing motor and inverter products

for potential future OE application, is a recent example. Perkins

is a wholly owned subsidiary of Caterpillar, the world's largest

off-road vehicle manufacturer. Perkins specialise in the supply of

diesel engines for niche off road applications, manufacturing

200,000 units per annum at their Peterborough factory. Under the

terms of our contract, Equipmake will design and manufacture

bespoke motors and inverters for a "drop in" replacement for a

diesel engine. Under this project Equipmake will develop a bespoke

motor / inverter which will be integrated by Perkins into a hybrid

system. The project is part funded with a grant to Equipmake of up

to GBP3.2m from the Advanced Propulsion Centre. The target is to

begin production in 2028.

Prior to awarding this project, Caterpillar undertook 12 months'

due diligence comparing Equipmake technology and production

readiness with competitors.

A further example of our expanding product offering is our

presence in the EV Fire Truck market, where we supply Emergency

One, the largest Fire Truck manufacturer in the UK (80% UK market

share). Through this relationship we have delivered a complete

drivetrain for REV Group, the second largest manufacturer of Fire

Trucks in the US. Emergency One are marketing their product, with

the Equipmake powertrain, globally, with the first European order

taken. REV Group have begun production delivery in North America

with further orders being taken. A final example is our work with a

Global ground support equipment company to supply a full electric

drivetrain for a special vehicle application. Equipmake's vertical

integration capability was key with the ability to deliver the

project within 6 months.

Other commercial initiatives

Our project to develop an aerospace certified electric motor to

integrate with a full electric powertrain being developed by H55

continues on target. We recently won the next stage of this

contract for GBP0.7m for the development of the production

version.

In May we announced entering into a licence agreement with Sona

Comstar in India. Sona is a leading manufacturer of low voltage

automotive motors, selling over two million units per annum,

including to customers outside India such as General Motors and

Ford. Sona has licenced certain motors and inverters from Equipmake

to support their entry into the high voltage traction market in

India. Their initial focus is buses, and the parties are working to

accelerate the start of production, which is currently targeted by

the end of the 2025 calendar year.

Opportunities in the USA

Following approaches from potential partners we have recently

begun a review of the growing opportunity to supply our products in

the USA, initially focussed on repowering of existing ICE buses.

The opportunity is significant, with appealing economics and

substantial volume of existing vehicles that would be suitable for

repower. There are over 80,000 transit buses in the USA, and almost

500,000 school buses.

Our intention is to leverage our existing IP through high

quality partnerships to address different sectors and territories.

However, if the review deems an alternative approach is more

appropriate, then we will modify our strategy accordingly. We have

identified a number of such partners and evaluation is underway, to

build suitable business and supply chain models that optimise our

economics and manage any execution risks.

In summary, we have successfully completed the delivery of

vehicles into service, the orderbook is building, and interest in

repowering is increasing. We remain confident in achieving our

margin targets. We have signed 2 major Global OEMs as customers and

we are seeing increasing interest in our value proposition.

CFO Statement

The financial performance for H1 of FY24 shows year-on-year

revenue growth (including grants) of 96.5%, including the delivery

of 7 repowered buses into service for First York, taking the

in-service fleet up to 12 buses for this client. We have continued

to invest in collaborative R&D and the funding of the grant

projects secured during the past 12 months has contributed to the

year-on-year revenue growth. Total gross margin for H1 of FY24

includes a GBP157k gross loss on grants due to the partially funded

nature of these match-funded projects. Whilst grant projects are

extremely valuable to the business, funding levels for current

projects is between 50% and 60% of costs incurred, which translates

in a reported gross loss for grant funded projects.

Excluding grants, there was improvement in margin rates across

key product lines but the overall blended gross margin of 14.65%

(H1 FY23: 18.3%) was slightly lower than the previous year, due to

a difference in product mix.

The 34.8% growth in administrative costs is a reflection of the

business expansion and capability development that has taken place

since the IPO in July 2022, including:

-- the addition of a 50,000 sq ft unit to support the production of vehicle repowers,

-- significant investment in headcount. Total headcount increased by 30 people or 37% over the past 12 months

(November 2023: 111, November 2022: 81).

Other operating income, which primarily consists of the gross

RDEC revenue, shows a year-on-year increase of 28.7% and should

continue to compare favourably to prior year figures following the

increase in the RDEC rate from 13% to 20% from April 2023.

During H1, GBP653k of development costs have been capitalised,

reflecting the ongoing investment in products and system

development. The GBP678k investment in tangible fixed assets

relates to plant and machinery for the new production site.

As part of our strategy to manage supply chain risks, we have

invested significantly in stock over the past 12 months. The

GBP1.8m increase since May 23 is primarily to support the delivery

of revenue in the second half of FY24.

The cash balance of GBP3.9m at the end of November (2023) was

aligned with our expectations following the investments made during

the first half of the year.

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 NOVEMBER 2023

Period Ended Period Ended Year Ended

30 November 30 November 31 May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

Revenue 2 2,072,750 1,054,857 5,053,540

Cost of sales (1,949,576) (823,889) (3,845,263)

Gross profit 123,174 230,968 1,208,277

Administrative expenses (3,267,845) (2,423,063) (5,346,307)

Other operating income 196,801 152,968 280,658

Share based payment charge (26,831) (40,749) (475,321)

Exceptional items - (615,064) (615,064)

Operating loss (2,974,701) (2,694,940) (4,947,757)

Interest receivable and

similar income 35,414 13 16,908

Interest payable and similar

expenses (20,786) (66,346) (86,505)

Loss before taxation (2,960,073) (2,761,273) (5,017,354)

Tax on loss 3 (17,862) (24,775) 185,979

Loss for the period (2,977,935) (2,786,048) (4,831,375)

============= ============= ============

Total comprehensive income

for the period (2,977,935) (2,786,048) (4,831,375)

============= ============= ============

Loss for the period attributable

to:

Non--controlling interests -- -- --

Owners of the parent Company (2,977,935) (2,786,048) (4,831,375)

(2,977,935) (2,786,048) (4,831,375)

============= ============= ============

Basic loss per share in

pence 5 (0.3) (0.4) (0.6)

INTERIM CONSOLIDATED BALANCE SHEET

AS AT 30 NOVEMBER 2023

30 November 30 November 31 May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

Fixed assets

Intangible assets 1,390,816 460,418 783,037

Tangible assets 1,286,999 604,516 772,681

2,677,815 1,064,934 1,555,718

Current assets

Stocks 4,743,020 1,638,213 2,958,325

Debtors: amounts falling due

within one year 2,418,113 1,820,115 4,501,978

Cash at bank and in hand 3,913,331 7,442,678 6,999,686

11,074,464 10,901,006 14,459,989

Creditors: amounts falling

due within one year (2,514,085) (2,047,254) (1,957,276)

Net current (liabilities)/assets 8,560,379 8,853,752 12,502,713

Total assets less current

liabilities 11,238,194 9,918,686 14,058,431

Creditors: amounts falling

due after more than one year (385,772) (328,853) (255,183)

Provisions for liabilities

Other provisions - (99,080) -

Net (liabilities)/assets 10,852,422 9,490,753 13,803,248

============= ============= =============

Capital and reserves

Called up share capital 4 95,101 82,353 94,823

Share premium 19,128,427 13,217,647 19,128,427

Other reserves 5,748,311 5,748,311 5,748,311

Profit and loss account (15,195,796) (10,172,534) (12,217,861)

Share-based payments reserve 1,076,379 614,976 1,049,548

Equity attributable to owners

of the parent Company 10,852,422 9,490,753 13,803,248

Non--controlling interests - - -

10,852,422 9,490,753 13,803,248

============= ============= =============

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 NOVEMBER 2023

Called Share Other Profit Share-based Equity Non-- Total

up premium reserves and loss payments attributable controlling equity

share account reserve to owners interests

capital of parent

Company

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 June 2023

(Audited) 94,823 19,128,427 5,748,311 (12,217,861) 1,049,548 13,803,248 - 13,803,248

Total

comprehensive

income

for the year

Loss for the

period - - - (2,977,935) - (2,977,935) - (2,977,935)

Issue of

shares 278 - - - - 278 - 278

Share-based

payments

movement - - - - 26,831 26,831 - 26,831

At 30 November

2023

(Unaudited) 95,101 19,128,427 5,748,311 (15,195,796) 1,076,379 10,852,422 - 10,852,422

======== =========== ========== ============= ============ ============= ============== ============

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 NOVEMBER 2022

Called Share Other Profit Share-based Equity Non-- Total

up premium reserves and loss payments attributable controlling equity

share account reserve to owners interests

capital of parent

Company

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 June

2022

(Audited) 50,000 - 5,748,311 (7,386,486) 574,227 (1,013,948) - (1,013,948)

Total

comprehensive

income

for the year

Loss for the

period -- - -- (2,786,048) - (2,786,048) - (2,786,048)

Loan

conversion 8,824 3,741,176 - -- -- 3,750,000 - 3,750,000

Issue of

shares 23,529 9,976,471 - -- -- 10,000,000 - 10,000,000

Share issue

costs -- (500,000) - -- -- (500,000) - (500,000)

Share-based

payments

movement -- - -- -- 40,749 40,749 - 40,749

At 30

November

2022

(Unaudited) 82,353 13,217,647 5,748,311 (10,172,534) 614,976 9,490,753 - 9,490,753

======== =========== ========== ============= ============ ============= ============== ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MAY 2023

Called Share Other Profit Share-based Equity Non-- Total

up premium reserves and loss payments attributable controlling equity

share account reserve to owners interests

capital of parent

Company

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 June

2022

(Audited) 50,000 - 5,748,311 (7,386,486) 574,227 (1,013,948) - (1,013,948)

Total

comprehensive

income

for the year

Loss for the

year - - - (4,831,375) - (4,831,375) - (4,831,375)

Total

transactions

with owners

Loan

conversion 8,824 3,741,176 - - - 3,750,000 - 3,750,000

Issue of

shares 35,999 16,199,001 - - - 16,235,000 - 16,235,000

Share issue

costs - (811,750) - - - (811,750) - (811,750)

Share-based

payments

charge - - - - 475,321 475,321 - 475,321

At 31 May

2023

(Audited) 94,823 19,128,427 5,748,311 (12,217,861) 1,049,548 13,803,248 - 13,803,248

======== =========== ========== ============= ============ ============= ============ ============

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 NOVEMBER 2023

Period Ended Period Ended Year Ended

30 November 30 November 31 May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Cash flows from operating activities

Loss for the financial year (2,977,935) (2,786,048) (4,831,375)

Adjustments for:

Amortisation of intangible assets 45,381 - 27,380

Depreciation of tangible assets 139,403 83,436 187,108

Loss on disposal of tangible

assets 24,390 (15,617) (14,951)

Interest paid 20,786 66,346 86,505

Interest received (35,414) (13) (16,908)

RDEC Taxation credit (net) (152,709) (105,619) (197,854)

SME R&D credit (17,958) - (232,389)

(Increase)/decrease in stocks (1,784,695) (830,238) (2,150,351)

(Increase)/decrease in debtors 1,834,183 206,230 (2,137,644)

Increase/(decrease) in creditors 511,736 (62,609) (156,025)

Increase/(decrease) in provisions - 55,023 (44,057)

Corporation tax received 435,575 - -

Share--based payments charge 26,831 40,749 475,321

Net cash generated from operating

activities (1,930,426) (3,348,360) (9,005,240)

------------- ------------- ------------

Cash flows from investing activities

Purchase of tangible fixed assets (678,111) (170,696) (443,198)

Sale of tangible fixed assets - 25,500 25,500

Intangible assets - capitalisation

of development costs (653,161) (460,418) (810,417)

Net cash from investing activities (1,331,272) (605,614) (1,228,115)

------------- ------------- ------------

Period Ended Period Ended Year Ended

30 November 30 November 31 May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Cash flows from financing activities

New finance leases and hire purchase

contracts 255,324 106,779 106,779

Repayment of obligations under

finance leases and hire purchase

contracts (79,662) (68,370) (144,177)

Interest paid (20,786) (17,853) (32,434)

Interest received 20,189 13 3,540

Issue of ordinary shares 278 13,750,000 16,235,000

Conversion of convertible loan - (3,750,000) -

Share issue costs - (500,000) (811,750)

Net cash from financing activities 175,343 9,520,569 15,356,958

Net increase/(decrease) in cash

and cash equivalents (3,086,355) 5,566,595 5,123,603

Cash and cash equivalents at

beginning of year 6,999,686 1,876,083 1,876,083

Cash and cash equivalents at

the end of period 3,913,331 7,422,678 6,999,686

Cash and cash equivalents at

the end of period comprise:

Cash at bank and in hand 3,913,331 7,422,678 6,999,686

3,913,331 7,422,678 6,999,686

NOTES TO THE FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 NOVEMBER 2023

1. Basis of preparation

The group consists of the parent Equipmake Holdings PLC and

subsidiary Equipmake Limited. All group entities are included

within the consolidation.

These interim consolidated financial statements are for the six

months to 30 November 2023. The interim results are not audited and

are not the statutory accounts of the group as defined in section

434 of the Companies Act 2006.

The accounting policies and presentation that have been applied

in preparing the interim consolidated financial statements are

consistent with those applied in the preparation of the group's

annual report and financial statements for the year ended 31 May

2023, which were prepared under FRS 102. These interim consolidated

financial statements should be read in conjunction with the annual

report.

Going concern

These financial statements have been prepared on a going concern

basis. The Directors have reviewed the financial forecasts and have

identified a potential requirement to raise additional funding over

the next 12 months. Whilst the Directors expect that additional

funding can be raised, this presents a material uncertainty which

may cast doubt over the Company's ability to continue as a going

concern and therefore its ability to realise its assets and

discharge its liabilities in the normal course of business. The

financial statements do not reflect any adjustments that would be

required to be made if they were prepared on a basis other than the

going concern basis.

Whilst the Directors acknowledge the uncertainty described

above, they have concluded that on the basis of expected cashflows

and available sources of finance, that the Company will continue as

a going concern for at least 12 months from the date of signing

these financial statements and therefore it remains appropriate to

prepare the financial statements on a going concern basis.

2. Segmental Reporting and Turnover

Segmental information is presented in respect of the Group's

operating segments based on the format that the Group reports to

its chief operating decision maker, for the purpose of allocating

resources and assessing performance. The Group considers that the

chief operating decision maker comprises the Executive Directors of

the business.

The Directors manage the Group as a single business delivering

electric power train solutions across a range of markets.

Information that was made available to the chief operating decision

maker in the reporting period included a split of gross margin by

customer project, and therefore segmental information is presented

along the same lines. Operating segments that share similar

characteristics have been aggregated where the criteria for

aggregation have been met.

Segmental Analysis for the Six Months Ended 30 November

2023 (Unaudited)

Powertrain Powertrain EV Engineering Other Total Grants Total

(inc. (supply components projects (excluding

vehicle only) Grants)

integration)

Turnover 1,260,000 259,048 140,926 251,319 - 1,911,293 161,456 2,072,750

Cost of sales (1,144,584) (216,244) (84,269) (186,204) - (1,631,300) (318,275) (1,949,576)

Gross Margin 115,416 42,804 56,657 65,116 - 279,993 (156,819) 123,174

Administrative

expenses - - - - - - - (3,294,676)

Other operating

income - - - - - - - 196,801

Operating loss - - - - - - - (2,974,701)

Net interest - - - - - - - 14,628

Loss before

taxation - - - - - - - (2,960,073)

Tax on loss - - - - - - - (17,862)

Loss for the

financial

year - - - - - - - (2,977,935)

============= =========== =========== ============ ====== ============ ========== ============

Segmental Analysis for the Year Ended 31 May 2023

(Audited)

Powertrain Powertrain EV Engineering Other Total Grants Total

(inc. (supply components projects (excluding

vehicle only) Grants)

integration)

Turnover 900,000 849,700 1,575,545 1,311,951 300,000 4,937,196 116,344 5,053,540

Cost of sales (1,016,277) (875,551) (956,171) (831,472) - (3,679,471) (165,792) (3,845,263)

Gross Margin (116,277) (25,851) 619,374 480,479 300,000 1,257,725 (49,448) 1,208,277

Administrative

expenses - - - - - - - (6,436,692)

Other operating

income - - - - - - - 280,658

Operating loss - - - - - - - (4,947,757)

Net interest - - - - - - - (69,597)

Loss before

taxation - - - - - - - (5,017,354)

Tax on loss - - - - - - - 185,979

Loss for the

financial

year - - - - - - - (4,831,375)

============= =========== =========== ============ ======== ============ ========== ============

Analysis of turnover by

class of business:

30 November 30 November 31 May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Powertrain (inc.

vehicle integration) 1,260,000 180,000 900,000

Powertrain (supply

only) 259,048 185,000 849,700

EV components 140,926 434,843 1,575,545

Engineering projects 251,319 209,023 1,311,951

Grants receivable 161,456 45,991 116,344

Other - 300,000

2,072,750 1,054,857 5,053,540

============ ============ ==========

Analysis of turnover by

destination:

30 November 30 November 31 May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

United Kingdom 1,716,027 361,288 2,550,385

Rest of Europe 299,223 352,904 1,265,000

Asia (exc. Far East) - - 300,000

Rest of world 57,500 340,665 908,955

Far East - - 29,200

2,072,750 1,054,857 5,053,540

============ ============ ==========

3. Taxation

The tax charge has been estimated for the six months to 30

November 2023 based on the anticipated tax rate and estimates of

eligible R&D expenditure against which a research and

development expenditure credit (RDEC) and SME credit can be claimed

for the period. The gross RDEC claim is included within other

operating income and the SME tax credit in taxation.

4. Share Capital

30 November 30 31 May

November

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Allotted, called up and fully paid

951,004,051 Ordinary shares (Nov 2022

- 823,529,409) of GBP0.0001 (Nov 2022:

GBP0.0001) each 95,101 82,353 94,823

============ ============ ==========

The following amendments to Share Capital took place in

the period:

At 30 November 2022 -- Ordinary shares

of GBP0.0001 each 82,353

Share issue - 124,700,000 Ordinary Shares

of GBP0.0001 each 12,470

At 31 May 2023 -- Ordinary shares of

GBP0.0001 each 94,823

Share issue - 2,775,132 Ordinary Shares

of GBP0.0001 each 278

At 30 November 2023 -- Ordinary shares

of GBP0.0001 each 95,101

5. Earnings per share

The calculation of basic loss per share of 0.3 pence for the six

months ended 30 November 2023 is based on the loss for the period

of GBP2,977,935 and the weighted average number of shares in issue

during the period of 948,456,879.

The group was loss-making for all periods presented in these

statements; therefore, the dilutive effect of share options has not

been taken into account in the calculation of diluted earnings per

share, since this would decrease the loss per share for each

reporting period.

6. Share-based payments

The company operates a share-based remuneration scheme for employees,

directors and stakeholders. A charge has been recognised in respect

of employee share options in the period based on the fair value

of the options at the grant date, estimated using the Black Scholes

model.

No new options were granted in the 6 months to 30 November 2023.

30 30 31

November November May

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Equity--settled schemes recognised

in the profit or loss for the

period 26,831 40,749 475,321

26,831 40,749 475,321

**ENDS**

For further information, please contact:Equipmake Via St Brides Partners

Ian Foley, Founder and CEO

Steven McGillivray, CFO

Panmure Gordon (Corporate Adviser & Joint Tel: +44 (0) 20 7886

Broker) 2500

James Sinclair-Ford / Freddie Twist

Hugh Rich / Sam Elder

VSA Capital Limited (Joint Broker) Tel: +44 (0) 20 3005

Simon Barton / Simba Khatai / Alex Cabral 5000

St Brides Partners (Financial PR Adviser) Tel: +44 (0) 20 7236

Susie Geliher / Paul Dulieu 1177

equipmake@stbridespartners.co.uk

About Equipmake

Equipmake is the UK-based engineering specialist pioneering the

development and production of electrification products to meet

the needs of the automotive, aerospace and other sectors in support

of the transition from conventional fossil-fuelled to zero-emission

powertrains.

Equipmake is a leader in ultra-high performance electric motors

and complete EV drivetrains and ultra-fast power electronic systems.

As well as developing proprietary technology - such as an ultra-compact,

lightweight high performance spoke motor - it also offers industry-leading

EV consultancy.

Equipmake has developed a vertically integrated solution providing

fully bespoke solutions. The Company has built a significant

pipeline of opportunities, as demand for electric vehicles increases

as part of the global decarbonisation movement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSFEFUWELSEIF

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

Equipmake (AQSE:EQIP)

Historical Stock Chart

From Apr 2024 to May 2024

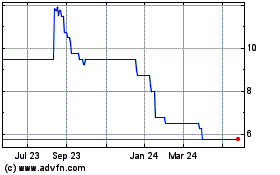

Equipmake (AQSE:EQIP)

Historical Stock Chart

From May 2023 to May 2024