TIDMADB

RNS Number : 9636M

Adnams PLC

20 September 2023

Adnams plc Interim Accounts 2023

""The UK economy remains a challenge for Brewing and

Hospitality".

Chairman's Statement

One year on from the removal of Covid restrictions, the UK

economic situation remained challenging in the first 6 months of

the year with inflationary pressures continuing to persist and

interest rates remaining stubbornly high. This has led to sales

across the sector remaining almost 15% below pre-pandemic levels

(source UK Hospitality). Lower levels of consumer confidence endure

with around 35% of people saying they were going to spend less on

going out (source: UK Hospitality) and KPMG citing in April this

figure may be as high as 65% (source: KPMG, April 2023).

Consequently, we continue to see the number of UK pubs continue to

fall with the current 46,000 down some 15% from a decade ago

(source: British Beer and Pub Association) and the cask beer market

around 25% smaller than 2019. In June the accountancy firm Mazars

reported some 45 breweries ceasing to trade in the 12 months to

March 2023.

It is against this backdrop I report turnover for the first half

of the year remaining at GBP30m consistent with the first half of

last year. Operating losses increased to GBP2.4m on the back of

continued pressure on input prices and reduced demand particularly

in quarter one of the year. Cash generation remains a focus for the

Company alongside managing levels of borrowing in the current

higher interest rate environment. We therefore cannot commit to

paying an interim dividend at this stage, but as is always the case

the board keeps the matter under regular review and intends to

return to paying dividends as soon as practicable.

The detail of the first half of the year from the company's

perspective needs to be divided into the two quarters. Quarter one

saw trading particularly subdued and we saw a consequent fall in

turnover by close to 5%. This was anticipated as continued

inflationary pressures and subdued consumer demand worked their way

through the system together with our cost mitigation activities

being only in their early stages.

The second quarter showed a marked improvement and generated a

compensatory level of growth as business levels improved as the

light evenings and warmer weather gave consumers a lift. Further,

our cost mitigation activities began to deliver savings through

headcount reductions, changes to brewery operations and a detailed

evaluation of each expenditure line. In the direct free trade, we

have seen customer numbers increase by close to 26% and this

indicates we are growing market share in our East Anglian heartland

and London. Average order size however remains challenging as rural

pubs still operate reduced opening hours. Our national on-trade

channel has been successful in winning new business in an extended

heartland area stretching into Northamptonshire and Bedfordshire

and we are in advanced conversations with several operators about

Adnams Lighthouse, a 3.4% beer that secures the duty advantage for

low strength beers that will be introduced by Government in August.

Our Boat Trip a Collaboration brew with Deya and Lazy SIPA also

both did well in the national on-trade. In the off trade the

premium bottled ale category remains challenging with the market

down by as much as 15% in March (source; BBPA March 2023). However,

we have gained additional distribution with Ghost Ship multipacks

in 440ml can. The Ghost Ship pairing of 4.5% and the market leading

0.5% remain the key focus across all distribution channels. Copper

House Gin has gained additional distribution with our supermarket

customers growing volumes by 2.5% over the first half of the year.

The export channel performed well and delivered volume growth on

last year.

Consistent with the rest of the business the half year for pubs

and hotels should be viewed as two distinct quarters. In quarter

one Managed Inns and Hotels were level with last year however, in

quarter two sales growth of 10% was delivered and this pattern of

trading was replicated by the leased and tenanted channel

delivering 9% sales growth in the second quarter. Whilst

encouraging, allowance needs to be made for systematic price

inflation contributing some of the sales uplift. Therefore, pubs

and hotels continue to be in the eye of the storm with food

inflation, the return of foreign holidays and for Adnams, a

dependence on good weather due to the coastal location of many of

our properties. In February, The White Hart, Blythburgh reopened

after a short refurbishment and kitchen upgrade. The pub is now

managed and focusing on a great welcome for locals, walkers and

visitors to the bar and gardens. In March we added a new experience

for Adnams guests and visitors by adopting the Southwold

Lighthouse. Working with Trinity House we are putting on daily

tours up the 113 steps to the top led by our tour guides. Great

views, some Southwold and Adnams history followed by a drink in The

Sole Bay Inn has proved a successful and enjoyable formula. In June

we received the Craft Guild of Chefs Sustainability Excellence

Award, recognising the excellent work our teams have done to reduce

food waste, work with local suppliers and making the most efficient

use of cooking techniques and energy use.

Trading conditions for our shops also remain demanding, in 2022

the visitor economy was still buoyed by staycations and there was

increased confidence in socialising following the end of Covid

restrictions. Notably, the comparable weather has also been less

good in 2023, impacting sales at key shops. Increased prices have

had to balance increased costs of production for our own beers and

spirits and increased supplier costs for our wines. We remain

highly conscious as to how much can be passed through to the end

customer before demand is significantly impacted therefore, we keep

competitor pricing under regular review. In April we opened our

14th shop at Frinton-on-Sea. The town has warmly welcomed Adnams

and the reputation of the shop, Adnams products and our friendly

service continues to grow. The Shop is beautifully presented and

the team there have embraced all things Adnams and Southwold. A

further positive is when customers do decide to enjoy and celebrate

occasions, they then choose Adnams. There have been excellent

trading periods around Easter, the Coronation and bank holidays,

and there is a direct correlation between improved sales with the

all-too-infrequent moments of good weather so far this year.

Continually improving retail standards and team training has played

a key role in achieving these results and we remain a shop of

choice when people do decide to celebrate and enjoy a drink. The

web business is undergoing some changes with a greater reliance on

organic growth in numbers of customers coupled with stronger

customer retention levels. There is a growing focus on local

deliveries from our network of shops using a fleet of mainly

electric vehicles. For wider UK distribution, operations are being

moved back to the Reydon Distribution Centre to reduce costs,

improve service, and provide local jobs.

In March we also welcomed HRH The Princess Royal, completing a

year of 150th Celebrations, who visited The Swan Hotel, Distillery,

Lighthouse, and Sole Bay Inn. Princess Anne met lots of our teams

who brought our stories to life.

Although trading conditions continue to be uncertain. We are

encouraged by the growth in new on-trade customer numbers, new

listings in the off-trade and the performance of Ghost Ship 0.5%.

Finally, our recent customer research gave an indication of a

younger cohort of consumers discovering Adnams.

Dr Jonathan Adnams OBE

Chairman

Profit and loss account

For the six months ended 30 June 2023

Unaudited Unaudited

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

Notes GBP000 GBP000 GBP000

---------------------------------------------- ----- ------------- --------- ------------

Turnover 29,990 30,075 64,215

Other operating income 2 - - 62

Operating expenses (32,508) (30,789) (65,504)

---------------------------------------------- ----- ------------- --------- ------------

Operating loss (2,518) (714) (1,227)

Gain on disposal of assets - - 2

---------------------------------------------- ----- ------------- --------- ------------

Loss before interest and taxation (2,518) (714) (1,225)

Gain on financial instruments at fair value 119 - (212)

Interest (734) (275) (759)

Other finance charge on pension scheme - (30) (89)

---------------------------------------------- ----- ------------- --------- ------------

Loss before taxation (3,133) (1,019) (2,285)

Tax on loss 3 686 208 757

---------------------------------------------- ----- ------------- --------- ------------

Loss (2,447) (811) (1,528)

---------------------------------------------- ----- ------------- --------- ------------

Loss per share 4

'A' Shares of 25p each, inc. asset disposals

(pence) (129.7)p (43.0)p (81.0)p

'B' Shares of GBP1 each, inc. asset disposals

(pence) (518.6)p (172.0)p (323.8)p

'A' Shares of 25p each, exc. asset disposals

(pence) (129.7)p (43.0)p (81.0)p

'B' Shares of GBP1 each, exc. asset disposals

(pence) (518.6)p (172.0)p (323.8)p

Balance sheet

As at 30 June 2023

Unaudited Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

--------------------------------------------------- --------- --------- -----------

Intangible assets 1,861 - 1,939

Tangible Fixed assets 34,354 37,792 34,900

36,215 37,792 36,839

--------------------------------------------------- --------- --------- -----------

Current assets

Derivative financial instruments 119 - 16

Stocks 9,702 10,463 10,615

Debtors 5,971 5,447 5,171

Cash at bank and in hand (757) 44 693

--------------------------------------------------- --------- --------- -----------

15,035 15,954 16,495

--------------------------------------------------- --------- --------- -----------

Creditors: amounts falling due within one year (17,429) (15,705) (16,288)

--------------------------------------------------- --------- --------- -----------

Net current assets/(liabilities) (2,394) 249 207

--------------------------------------------------- --------- --------- -----------

Total assets less current liabilities 33,821 38,041 37,046

--------------------------------------------------- --------- --------- -----------

Creditors: amounts falling due after more than one

year (10,186) (10,192) (10,180)

Derivative financial instruments - - (228)

Provision for liabilities 421 (414) (1,106)

--------------------------------------------------- --------- --------- -----------

(9,765) (10,606) (11,514)

--------------------------------------------------- --------- --------- -----------

Net assets excluding pension liability 24,056 27,435 25,532

Pension liability - (5,005) -

--------------------------------------------------- --------- --------- -----------

Net assets including pension liability 24,056 22,430 25,532

--------------------------------------------------- --------- --------- -----------

Capital and reserves

Called up share capital 472 472 472

Share premium 144 144 144

Profit and loss account 23,440 21,814 24,916

--------------------------------------------------- --------- --------- -----------

Equity shareholders' funds 24,056 22,430 25,532

--------------------------------------------------- --------- --------- -----------

Notes

1 Basis of preparation

The interim accounts, which have not been audited, have been

prepared under the recognition and measurement principles of FRS

102 using the accounting policies consistent with those disclosed

in the 2022 annual report. These are the policies expected to be

applied in the preparation of the audited financial statements for

the year ended 31 December 2023.

The financial information for the year ended 31 December 2022

does not constitute the full statutory accounts for that period.

The Annual Report and Financial Statements for the year ended 31

December 2022 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 December 2022 was unqualified, did

not draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Despite the major uncertainties at this time across the economy

as a whole, and the challenges of this industry, Adnams continues

to operation within its banking covenants on its debt facility. The

business manages cash carefully and has concluded, based on its

cash management ability and current projections, that it is

appropriate for Adnams to adopt the going concern basis for these

accounts.

2 Other operating income

The inclusion of the other operating income line within the

profit and loss account is to reflect correct accounting treatment

of furlough claims and grant income in all periods.

3 Taxation

The taxation charge is based on the estimated tax rate for the

year.

4 Earnings per share

Earnings per share is calculated by dividing the earnings

available to ordinary shareholders by the issued ordinary share

capital of GBP471,842. The earnings per share calculation is the

same for basic and diluted earnings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBSGDCDDBDGXC

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

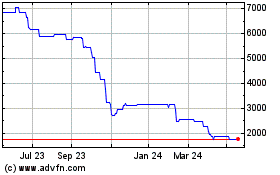

Adnams (AQSE:ADB)

Historical Stock Chart

From Mar 2024 to Apr 2024

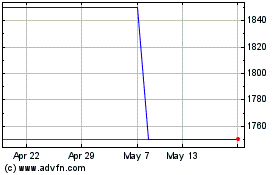

Adnams (AQSE:ADB)

Historical Stock Chart

From Apr 2023 to Apr 2024