Securities Act File No. 333-233040

Investment Company Act File No. 811-21432

FORM N-2

(check appropriate box or boxes)

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

[X]

|

|

|

|

|

Pre-Effective Amendment No.

|

[ ]

|

|

|

|

|

Post-Effective Amendment No. 1

|

[X]

|

|

|

|

|

and/or

|

|

|

|

|

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

[X]

|

|

|

|

|

Amendment No. 18

|

[X]

|

Reaves Utility

Income Fund

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Address of principal executive offices)

(303) 623-2577

(Registrant’s Telephone Number)

Karen Gilomen

Reaves Utility Income Fund

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Names and addresses of agents for service)

Copies to:

Allison M. Fumai

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

Approximate Date of Proposed Public Offering: As soon as

practicable after the effective date of the Registration Statement.

If any securities being registered on this

form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other than securities

offered in connection with a dividend reinvestment plan, check the following box. [X]

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the

Registration Statement on Form N-2 (File Nos. 333-233040 and 811-21432) of Reaves Utility Income Fund (as amended, the “Registration

Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”),

solely for the purpose of filing Exhibits (h)(2) and (h)(3) to the Registration Statement. No changes have been made to Part A,

B or Part C of the Registration Statement, other than Item 25(2) of Part C as set forth below. Accordingly, this Post-Effective

Amendment No. 1 consists only of the facing page, this explanatory note and Item 25(2) of the Registration Statement setting forth

the exhibits to the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No.

1 shall become effective immediately upon filing with the Securities and Exchange Commission. The contents of the Registration

Statement are hereby incorporated by reference.

PART C

OTHER INFORMATION

Item 25. Financial Statements and Exhibits

Financial Statements Included in Part A:

Financial Highlights for fiscal years ended October 31,

2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017 and 2018. Financial Highlights for the fiscal period ended April 30,

2019 (unaudited).

Financial Statements Included in Part B:

Incorporated by reference in the Statement of Additional

Information included herein are the Registrant’s audited financial statements for the fiscal year ended October 31, 2018,

notes to such financial statements and the report of independent registered public accounting firm thereon, as contained in the

Fund’s Form N-CSR filed with the Securities and Exchange Commission on January 4, 2019. The unaudited Semi-Annual Report

for the fiscal period ending April 30, 2019, is incorporated by reference.

|

|

(a)

|

Agreement and Declaration of Trust dated September 15, 2003 (Incorporated by reference from post-effective amendment no. 1

to Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on October

22, 2003)

|

|

|

(b)

|

Amended and Restated Bylaws dated March 10, 2009 (Incorporated by reference from amendment no. 9 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(1)

|

Form of Certificate for Common Shares of Beneficial Interest (Incorporated by reference from amendment no. 9 to Registrant’s

registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(2)

|

Form of Subscription Certificate for Rights Offering

+

|

|

|

(3)

|

Form of Notice of Guaranteed Delivery for Rights Offering

+

|

|

|

(e)

|

Dividend Reinvestment Plan dated February 20, 2004 (Incorporated by reference from amendment no. 9 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(g)

|

Investment Advisory and Management Agreement dated August 26, 2010 (Incorporated by reference from amendment no. 9 to Registrant’s

registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(1)

|

Underwriting Agreement (Incorporated by reference from

post-effective amendment no. 8 to Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2

filed with the SEC on June 25, 2004)

|

|

|

(2)

|

Distribution Agreement between Registrant and ALPS Distributors,

Inc. *

|

|

|

(3)

|

Sub-Placement Agent Agreement between ALPS Distributors,

Inc. and UBS Securities LLC *

|

|

|

(j)

|

Custody Agreement dated February 24, 2004 (Incorporated by reference from amendment no. 9 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(1)

|

Stock Transfer Agency Agreement dated February 24, 2004

(Incorporated by reference from amendment no. 9 to Registrant’s registration statement under the Investment Company Act

of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

(2)

|

|

(a)

|

Administration, Bookkeeping and Pricing Services Agreement dated February 24, 2004 (Incorporated by reference from amendment

no. 9 to Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May

17, 2012)

|

|

|

(b)

|

Amendment to Administration, Bookkeeping and Pricing Services Agreement dated September 1, 2006 (Incorporated by reference

from amendment no. 9 to Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2 filed with

the SEC on May 17, 2012)

|

|

|

(c)

|

Amendment to Administration, Bookkeeping and Pricing Services Agreement dated December 4, 2011 (Incorporated by reference from

amendment no. 9 to Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2 filed with the

SEC on May 17, 2012)

|

|

|

(3)

|

Form of Subscription Agent Agreement +

|

|

|

(4)

|

Form of Information Agent Agreement +

|

|

|

(5)

|

Chief Compliance Officer Services Agreement dated September 8, 2009 (Incorporated by reference from amendment no. 9 to Registrant’s

registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(6)

|

Amended and Restated Committed Facility Agreement dated

October 25, 2013 (Incorporated by reference from amendment no. 9 to Registrant’s registration statement under the Investment

Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(7)

|

Rehypothecation Side Letter dated December 9, 2013 (Incorporated

by reference from amendment no. 13 to Registrant’s registration statement under the Investment Company Act of 1940 on Form

N-2 filed with the SEC on November 6, 2015)

|

|

|

(a)

|

Special Custody and Pledge Agreement dated November 9, 2010 (Incorporated by reference from amendment no. 9 to Registrant’s

registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(b)

|

Amendment to the Special Custody and Pledge Agreement dated July 29, 2011 (Incorporated by reference from amendment no. 9 to

Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(9)

|

U.S. PB Agreement dated November 9, 2010 (Incorporated by reference from amendment no. 9 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(10)

|

Form of Credit Agreement (Incorporated by reference from amendment no. 15 to Registrant’s registration statement under

the Investment Company Act of 1940 on Form N-2 filed with the SEC on August 7, 2017)

|

|

|

(l)

|

Opinion and Consent of Dechert LLP (Incorporated by reference

from amendment no. 17 to Registrant’s registration statement under the Investment Company Act of 1940 on Form N-2 filed

with the SEC on November 8, 2019)

|

|

|

(n)

|

Consent of Deloitte & Touche LLP *

|

|

|

(p)

|

Initial Subscription Agreement (Incorporated by reference from post-effective amendment no. 4 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on February 24, 2004)

|

(r)

|

|

(1)

|

Code of Ethics of the Fund dated March 14, 2006 (Incorporated by reference from amendment no. 9 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(2)

|

Code of Ethics of the Adviser dated July 18, 2011 (Incorporated by reference from amendment no. 9 to Registrant’s registration

statement under the Investment Company Act of 1940 on Form N-2 filed with the SEC on May 17, 2012)

|

|

|

(3)

|

Code of Ethics of the Principal Executive and Financial Officers of the Fund dated February 20, 2004 (Incorporated by reference

from post-effective amendment no. 4 to Registrant’s registration statement under the Investment Company Act of 1940 on Form

N-2 filed with the SEC on February 24, 2004)

|

|

|

(s)

|

Powers of Attorney (Incorporated by reference from amendment no. 16 to Registrant’s registration statement under the

Investment Company Act of 1940 on Form N-2 filed with the SEC on August 6, 2019)

|

|

|

+

|

To be filed by amendment

|

Item 26. Marketing Arrangements

None.

Item 27. Other Expenses of Issuance and Distribution

The approximate expenses in connection with the offering are as

follows:

|

Registration and Filing Fees

|

$77,880

|

|

NYSE American LLC Fees

|

$65,000

|

|

FINRA Fees

|

$90,500

|

|

Accounting Fees and Expenses

|

$31,500

|

|

Legal Fees and Expenses

|

$300,000

|

|

Miscellaneous

|

$30,000

|

|

Total

|

$594,880

|

Item 28. Persons Controlled by or Under Common Control With Registrant

None.

Item 29. Number of Holders of Securities

Set forth below is the number of record holders as of October 23,

2019 of each class of securities of the Registrant:

|

Title of Class

|

Number of Record Holders

|

|

Common Shares of Beneficial Interest

|

63,026

|

Item 30. Indemnification

Article IV of the Registrant's Agreement and Declaration of Trust

provides as follows:

4.1 No Personal Liability

of Shareholders, Trustees, etc. No Shareholder of the Trust shall be subject in such capacity to any personal liability whatsoever

to any Person in connection with Trust Property or the acts, obligations or affairs of the Trust. Shareholders shall have the same

limitation of personal liability as is extended to stockholders of a private corporation for profit incorporated under the general

corporation law of the State of Delaware. No Trustee or officer of the Trust shall be subject in such capacity to any personal

liability whatsoever to any Person, other than the Trust or its Shareholders, in connection with Trust Property or the affairs

of the Trust, save only liability to the Trust or its Shareholders arising from bad faith, willful misfeasance, gross negligence

or reckless disregard for his duty to such Person; and, subject to the foregoing exception, all such Persons shall look solely

to the Trust Property for satisfaction of claims of any nature arising in connection with the affairs of the Trust. If any Shareholder,

Trustee or officer, as such, of the Trust, is made a party to any suit or proceeding to enforce any such liability, subject to

the foregoing exception, he shall not, on account thereof, be held to any personal liability.

4.2 Mandatory Indemnification.

(a) The Trust shall indemnify the Trustees and officers of the Trust

(each such person being an "indemnitee") against any liabilities and expenses, including amounts paid in satisfaction

of judgments, in compromise or as fines and penalties, and reasonable counsel fees reasonably incurred by such indemnitee in connection

with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative

or investigative body in which he may be or may have been involved as a party or otherwise (other than, except as authorized by

the Trustees, as the plaintiff or complainant) or with which he may be or may have been threatened, while acting in any capacity

set forth above in this Section 4.2 by reason of his having acted in any such capacity, except with respect to any matter as to

which he shall not have acted in good faith in the reasonable belief that his action was in the best interest of the Trust or,

in the case of any criminal proceeding, as to which he shall have had reasonable cause to believe that the conduct was unlawful,

provided, however, that no indemnitee shall be indemnified hereunder against any liability to any person or any expense of such

indemnitee arising by reason of (i) willful misfeasance, (ii) bad faith, (iii) gross negligence (negligence in the case of Affiliated

Indemnitees), or (iv) reckless disregard of the duties involved in the conduct of his position (the conduct referred to in such

clauses (i) through (iv) being sometimes referred to herein as "disabling conduct"). Notwithstanding the foregoing, with

respect to any action, suit or other proceeding voluntarily prosecuted by any indemnitee as plaintiff, indemnification shall be

mandatory only if the prosecution of such action, suit or other proceeding by such indemnitee was authorized by a majority of the

Trustees.

(b) Notwithstanding the foregoing, no indemnification shall be made

hereunder unless there has been a determination (1) by a final decision on the merits by a court or other body of competent jurisdiction

before whom the issue of entitlement to indemnification hereunder was brought that such indemnitee is entitled to indemnification

hereunder or, (2) in the absence of such a decision, by (i) a majority vote of a quorum of those Trustees who are neither Interested

Persons of the Trust nor parties to the proceeding ("Disinterested Non-Party Trustees"), that the indemnitee is entitled

to indemnification hereunder, or (ii) if such quorum is not obtainable or even if obtainable, if such majority so directs, independent

legal counsel in a written opinion conclude that the indemnitee should be entitled to indemnification hereunder. All determinations

to make advance payments in connection with the expense of defending any proceeding shall be authorized and made in accordance

with the immediately succeeding paragraph (c) below.

(c) The Trust shall make advance payments in connection with the

expenses of defending any action with respect to which indemnification might be sought hereunder if the Trust receives a written

affirmation by the indemnitee of the indemnitee's good faith belief that the standards of conduct necessary for indemnification

have been met and a written undertaking to reimburse the Trust unless it is subsequently determined that he is entitled to such

indemnification and if a majority of the Trustees determine that the applicable standards of conduct necessary for indemnification

appear to have been met. In addition, at least one of the following conditions must be met: (1) the indemnitee shall provide adequate

security for his undertaking, (2) the Trust shall be insured against losses arising by reason of any lawful advances, or (3) a

majority of a quorum of the Disinterested Non-Party Trustees, or if a majority vote of such quorum so direct, independent legal

counsel in a written opinion, shall conclude, based on a review of readily available facts (as opposed to a full trial-type inquiry),

that there is substantial reason to believe that the indemnitee ultimately will be found entitled to indemnification.

(d) The rights accruing to any indemnitee under these provisions

shall not exclude any other right to which he may be lawfully entitled.

(e) Notwithstanding the foregoing, subject to any limitations provided

by the 1940 Act and this Declaration, the Trust shall have the power and authority to indemnify Persons providing services to the

Trust to the full extent provided by law provided that such indemnification has been approved by a majority of the Trustees.

4.3 No Duty of Investigation;

Notice in Trust Instruments, etc. No purchaser, lender, transfer agent or other person dealing with the Trustees or with any officer,

employee or agent of the Trust shall be bound to make any inquiry concerning the validity of any transaction purporting to be made

by the Trustees or by said officer, employee or agent or be liable for the application of money or property paid, loaned, or delivered

to or on the order of the Trustees or of said officer, employee or agent. Every obligation, contract, undertaking, instrument,

certificate, Share, other security of the Trust, and every other act or thing whatsoever executed in connection with the Trust

shall be conclusively taken to have been executed or done by the executors thereof only in their capacity as Trustees under this

Declaration or in their capacity as officers, employees or agents of the Trust. The Trustees may maintain insurance for the protection

of the Trust Property, its Shareholders, Trustees, officers, employees and agents in such amount as the Trustees shall deem adequate

to cover possible liability, and such other insurance as the Trustees in their sole judgment shall deem advisable or is required

by the 1940 Act.

4.4 Reliance on Experts,

etc. Each Trustee and officer or employee of the Trust shall, in the performance of its duties, be fully and completely justified

and protected with regard to any act or any failure to act resulting from reliance in good faith upon the books of account or other

records of the Trust, upon an opinion of counsel, or upon reports made to the Trust by any of the Trust's officers or employees

or by any adviser, administrator, manager, distributor, selected dealer, accountant, appraiser or other expert or consultant selected

with reasonable care by the Trustees, officers or employees of the Trust, regardless of whether such counsel or other person may

also be a Trustee.

Item 31. Business and Other Connections of Investment Adviser

None.

Item 32. Location of Accounts and Records

All applicable accounts, books and documents required to be maintained

by the Registrant by Section 31(a) of the 1940 Act and the Rules promulgated thereunder are in the possession and custody of the

Registrant, c/o ALPS Fund Services, Inc., 1290 Broadway, Suite 1000, Denver, Colorado 80203.

Item 33. Management Services

Not applicable.

Item 34. Undertakings

|

|

1.

|

The Registrant undertakes to suspend the offering of its Common Shares of Beneficial Interest until the prospectus is amended

if (1) subsequent to the effective date of this registration statement, the net asset value declines more than 10 percent from

its net asset value as of the effective date of this registration statement or (2) the net asset value increases to an amount greater

than its net proceeds as stated in the prospectus.

|

|

|

3.

|

If the securities being registered are to be offered to existing shareholders pursuant to warrants or rights, and any securities

not taken by shareholders are to be reoffered to the public, the Registrant undertakes to supplement the prospectus, after the

expiration of the subscription period, to set forth the results of the subscription offer, the transactions by underwriters during

the subscription period, the amount of unsubscribed securities to be purchased by underwriters, and the terms of any subsequent

reoffering thereof. If any public offering by the underwriters of the securities being registered is to be made on terms differing

from those set forth on the cover page of the prospectus, the Registrant further undertakes to file a post-effective amendment

to set forth the terms of such offering.

|

|

|

4.

|

The Registrant undertakes:

|

|

|

a.

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration statement:

|

|

|

(1)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(2)

|

to reflect in the prospectus any facts or event after the effective date of the Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the Registration Statement; and

|

|

|

(3)

|

to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement

or any material change to such information in the Registration Statement;

|

|

|

b.

|

that for the purpose of determining any liability under the Securities Act, each post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof;

|

|

|

c.

|

to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering;

|

|

|

d.

|

that, for the purpose of determining liability under the Securities Act to any purchaser, if the Registrant is subject to Rule

430C: Each prospectus filed pursuant to Rule 497(b), (c), (d) or (e) under the Securities Act as part of a registration statement

relating to an offering, other than prospectuses filed in reliance on Rule 430A under the Securities Act shall be deemed to be

part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that

no statement made in a registration statement or prospectus that is part of the registration or made in a document incorporated

or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will,

as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such date of first use; and

|

|

|

e.

|

that for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution

of securities:

|

The undersigned Registrant undertakes that in a primary

offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method

used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities

to the purchaser:

|

|

(1)

|

any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant

to Rule 497 under the Securities Act;

|

|

|

(2)

|

the portion of any advertisement pursuant to Rule 482 under the Securities Act relating to the offering containing material

information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

|

|

|

(3)

|

any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

|

|

5.

|

The Registrant undertakes that:

|

|

|

a.

|

for the purpose of determining any liability under the Securities Act, the information omitted from the form of prospectus

filed as part of this registration statement in reliance upon Rule 430A and contained in the form of prospectus filed by the Registrant

pursuant to 497(h) under the Securities Act shall be deemed to be part of the registration statement as of the time it was declared

effective; and

|

|

|

b.

|

for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of

prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

6.

|

The Registrant undertakes to send by first class mail or other means designed to ensure equally prompt delivery, within two

business days of receipt of an oral or written request, its Statement of Additional Information.

|

SIGNATURES

Pursuant to requirements of the Securities Act of 1933 and the Investment

Company Act of 1940, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized in the city of Denver, and the state of Colorado, on the 14th day of November, 2019.

|

|

REAVES UTILITY INCOME FUND

|

|

|

|

|

|

|

|

By:

|

/s/ Bradley J. Swenson

|

|

|

|

|

Name:

|

Bradley J. Swenson

|

|

|

|

|

Title:

|

President

|

|

Pursuant to the requirements of the Securities

Act of 1933, registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

|

|

Trustee

|

|

November 14, 2019

|

|

Mary K. Anstine

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Trustee

|

|

November 14, 2019

|

|

Jeremy W. Deems

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Trustee

|

|

November 14, 2019

|

|

Michael F. Holland

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Jill A. Kerschen

|

|

Treasurer

|

|

November 14, 2019

|

|

Jill A. Kerschen

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Trustee

|

|

November 14, 2019

|

|

Jeremy O. May

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Trustee

|

|

November 14, 2019

|

|

E. Wayne Nordberg

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Trustee

|

|

November 14, 2019

|

|

Larry W. Papasan

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

President

|

|

November 14, 2019

|

|

Bradley J. Swenson

|

|

|

|

|

|

|

|

|

|

|

|

* By:

|

/s/ Karen Gilomen

|

|

|

|

|

|

|

Karen Gilomen

|

|

|

|

|

|

|

Attorney-in-fact

|

|

|

|

|

INDEX TO EXHIBITS

|

Exhibit No.

|

Description

|

|

(h)(2)

|

Distribution Agreement with ALPS Distributors, Inc.

|

|

(h)(3)

|

Sub-Placement Agent Agreement between ALPS Distributors, Inc. and UBS Securities LLC

|

|

(n)

|

Consent of Deloitte & Touche LLP

|

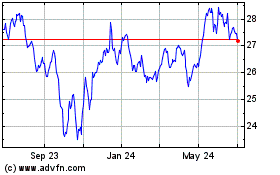

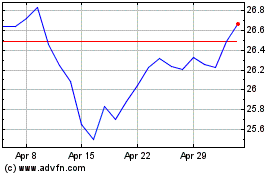

Reaves Utility Income (AMEX:UTG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Reaves Utility Income (AMEX:UTG)

Historical Stock Chart

From Sep 2023 to Sep 2024