Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 26 2023 - 12:46PM

Edgar (US Regulatory)

Portfolio of Investments (unaudited)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS—81.5%

|

|

| AUSTRALIA—9.1%

|

|

|

| Australia & New Zealand Banking Group Ltd.

|

|

|

|

| (fixed rate to 06/15/2026, variable rate thereafter), 6.75%, 06/15/2026(a)(b)

| $

| 200,000

| $ 199,324

|

| (fixed rate to 02/10/2033, variable rate thereafter), 6.74%, 02/10/2038(a)(c)

| AUD

| 1,300,000

| 888,578

|

| Commonwealth Bank of Australia, (fixed rate to 03/15/2033, variable rate thereafter), 6.70%, 03/15/2038(c)

|

| 1,800,000

| 1,227,679

|

| Mineral Resources Ltd., 8.00%, 11/01/2027(a)(c)

| $

| 1,520,000

| 1,524,152

|

| National Australia Bank Ltd.

|

|

|

|

| FRN, (fixed rate to 08/03/2027, variable rate thereafter), 6.32%, 08/03/2032(a)(c)

| AUD

| 1,000,000

| 678,343

|

| (fixed rate to 03/09/2028, variable rate thereafter), 6.16%, 03/09/2033(c)

|

| 800,000

| 537,253

|

| Total Australia

|

| 5,055,329

|

| BARBADOS—0.4%

|

|

|

| Sagicor Financial Co. Ltd., 5.30%, 05/13/2028(a)(c)

| $

| 210,000

| 199,290

|

| BRAZIL—1.6%

|

|

|

| Banco do Brasil SA, (fixed rate to 04/15/2024, variable rate thereafter), 6.25%, 04/15/2024(a)(b)

|

| 620,000

| 570,400

|

| BRF SA, 5.75%, 09/21/2050(a)(c)

|

| 200,000

| 141,867

|

| Guara Norte Sarl, 5.20%, 06/15/2034(a)(d)

|

| 176,852

| 157,841

|

| Total Brazil

|

| 870,108

|

| CANADA—2.0%

|

|

|

| Enerflex Ltd., 9.00%, 10/15/2027(a)(c)

|

| 238,000

| 239,474

|

| GFL Environmental, Inc.

|

|

|

|

| 5.13%, 12/15/2026(a)(c)

|

| 23,000

| 22,368

|

| 4.75%, 06/15/2029(a)(c)

|

| 78,000

| 71,149

|

| Rogers Communications, Inc., (fixed rate to 03/15/2027, variable rate thereafter), 5.25%, 03/15/2082(a)(c)

|

| 124,000

| 114,383

|

| Teck Resources Ltd., 3.90%, 07/15/2030(c)

|

| 354,000

| 319,638

|

| Titan Acquisition Ltd. / Titan Co-Borrower LLC, 7.75%, 04/15/2026(a)(c)

|

| 125,000

| 116,104

|

| TransAlta Corp., 7.75%, 11/15/2029(c)

|

| 220,000

| 228,250

|

| Total Canada

|

| 1,111,366

|

| CHILE—0.8%

|

|

|

| Corp. Nacional del Cobre de Chile, 3.75%, 01/15/2031(a)(c)

|

| 330,000

| 298,641

|

| Empresa Nacional del Petroleo, 3.45%, 09/16/2031(a)(c)

|

| 200,000

| 168,638

|

| Total Chile

|

| 467,279

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| CHINA—2.3%

|

|

|

| China Evergrande Group, 8.75%, 06/28/2025(a)(c)(e)(f)

| $

| 200,000

| $ 8,278

|

| China Huadian Overseas Development 2018 Ltd., (fixed rate to 06/23/2025, variable rate thereafter), 3.38%,

06/23/2025(a)(b)

|

| 200,000

| 190,620

|

| Huarong Finance II Co. Ltd.

|

|

|

|

| 5.50%, 01/16/2025(a)

|

| 619,000

| 595,041

|

| 5.00%, 11/19/2025(a)

|

| 200,000

| 186,017

|

| Kaisa Group Holdings Ltd., 11.95%, 11/12/2023(a)(c)(e)(f)

|

| 200,000

| 8,878

|

| Logan Group Co. Ltd.

|

|

|

|

| 7.50%, 08/25/2022(a)(c)(e)(f)

|

| 200,000

| 17,267

|

| 6.50%, 07/16/2023(a)(c)(e)(f)

|

| 200,000

| 17,267

|

| Shandong Iron & Steel Xinheng International Co. Ltd., 6.50%, 11/05/2023(a)

|

| 200,000

| 199,796

|

| Sunac China Holdings Ltd., 6.80%, 10/20/2024(a)(c)(e)(f)

|

| 200,000

| 22,100

|

| Zhenro Properties Group Ltd., 6.63%, 01/07/2026(a)(c)(e)(f)

|

| 200,000

| 5,152

|

| Total China

|

| 1,250,416

|

| COLOMBIA—1.1%

|

|

|

| Bancolombia SA, (fixed rate to 12/18/2024, variable rate thereafter), 4.63%, 12/18/2029(c)

|

| 200,000

| 176,574

|

| Ecopetrol SA

|

|

|

|

| 5.38%, 06/26/2026(c)

|

| 351,000

| 337,816

|

| 8.88%, 01/13/2033(c)

|

| 105,000

| 107,713

|

| Total Colombia

|

| 622,103

|

| DOMINICAN REPUBLIC—0.3%

|

|

|

| AES Espana BV, 5.70%, 05/04/2028(a)(c)

|

| 202,000

| 182,810

|

| ECUADOR—0.3%

|

|

|

| International Airport Finance SA, 12.00%, 03/15/2033(a)(c)(d)

|

| 194,529

| 184,965

|

| FRANCE—0.8%

|

|

|

| Altice France SA, 5.88%, 02/01/2027(a)(c)

| EUR

| 100,000

| 84,550

|

| BNP Paribas SA, (fixed rate to 02/25/2030,variable rate thereafter), 4.50%, 02/25/2030(a)(b)

| $

| 200,000

| 152,763

|

| Chrome Bidco SASU, 3.50%, 05/31/2028(a)(c)

| EUR

| 130,000

| 123,996

|

| Electricite de France SA, (fixed rate to 01/22/2026, variable rate thereafter), 5.00%,

01/22/2026(a)(b)

|

| 100,000

| 106,012

|

| Total France

|

| 467,321

|

| GEORGIA—0.6%

|

|

|

| Georgian Railway JSC, 4.00%, 06/17/2028(a)(c)

| $

| 359,000

| 309,422

|

| GERMANY—2.3%

|

|

|

| CT Investment GmbH, 5.50%, 04/15/2026(a)(c)

| EUR

| 100,000

| 102,632

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| GERMANY (continued)

|

|

|

| Deutsche Bank AG

|

|

|

|

| 2.63%, 12/16/2024(a)

| GBP

| 100,000

| $ 121,266

|

| (fixed rate to 04/30/2026, variable rate thereafter), 7.13%, 04/30/2026(a)(b)

|

| 100,000

| 109,541

|

| Gruenenthal GmbH, 3.63%, 11/15/2026(a)(c)

| EUR

| 100,000

| 104,727

|

| HT Troplast GmbH, 9.38%, 07/15/2028(a)(c)

|

| 110,000

| 120,761

|

| IHO Verwaltungs GmbH PIK, 8.75%, 05/15/2028(a)(c)(g)

|

| 103,347

| 119,027

|

| PrestigeBidCo GmbH, 3 mo. Euribor + 6.000%, 9.66%, 07/15/2027(a)(c)(h)

|

| 109,000

| 120,445

|

| Schaeffler AG

|

|

|

|

| 2.88%, 03/26/2027(a)(c)

|

| 60,000

| 63,001

|

| 3.38%, 10/12/2028(a)(c)

|

| 100,000

| 101,484

|

| Techem Verwaltungsgesellschaft 675 mbH, 2.00%, 07/15/2025(a)(c)

|

| 106,000

| 112,035

|

| TK Elevator Midco GmbH, 4.38%, 07/15/2027(a)(c)

|

| 100,000

| 100,041

|

| ZF Europe Finance BV, 2.50%, 10/23/2027(a)(c)

|

| 100,000

| 98,818

|

| Total Germany

|

| 1,273,778

|

| GHANA—0.4%

|

|

|

| Tullow Oil PLC, 7.00%, 03/01/2025(a)(c)

| $

| 362,000

| 231,680

|

| HONG KONG—0.9%

|

|

|

| AIA Group Ltd., 5.63%, 10/25/2027(a)(c)

|

| 500,000

| 512,267

|

| INDIA—4.3%

|

|

|

| GMR Hyderabad International Airport Ltd., 5.38%, 04/10/2024(a)

|

| 200,000

| 198,300

|

| HDFC Bank Ltd., 8.10%, 03/22/2025(a)

| INR

| 110,000,000

| 1,324,710

|

| India Green Power Holdings, 4.00%, 02/22/2027(a)(c)(d)

| $

| 200,000

| 178,755

|

| Indiabulls Housing Finance Ltd., Series 6B, 9.00%, 09/26/2026

| INR

| 50,000,000

| 515,839

|

| REC Ltd., 5.25%, 11/13/2023(a)

| $

| 200,000

| 199,308

|

| Total India

|

| 2,416,912

|

| INDONESIA—1.4%

|

|

|

| Medco Laurel Tree Pte. Ltd., 6.95%, 11/12/2028(a)(c)

|

| 221,000

| 202,952

|

| Medco Oak Tree Pte Ltd., 7.38%, 05/14/2026(a)(c)

|

| 200,000

| 196,745

|

| Perusahaan Perseroan Persero PT, Perusahaan Listrik Negara, 5.25%, 10/24/2042(a)

|

| 400,000

| 361,483

|

| Total Indonesia

|

| 761,180

|

| ISRAEL—0.9%

|

|

|

| Energian Israel Finance Ltd., 8.50%, 09/30/2033(a)(c)

|

| 230,000

| 230,000

|

| Teva Pharmaceutical Finance Netherlands III BV, 7.13%, 01/31/2025(c)

|

| 276,000

| 277,465

|

| Total Israel

|

| 507,465

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| ITALY—0.4%

|

|

|

| Lottomatica SpA 3 mo. Euribor + 4.125%, 7.59%, 06/01/2028(a)(c)(h)

| EUR

| 100,000

| $ 110,488

|

| Telecom Italia Capital SA, 6.38%, 11/15/2033

| $

| 140,000

| 118,486

|

| Total Italy

|

| 228,974

|

| KAZAKHSTAN—1.6%

|

|

|

| KazMunayGas National Co. JSC

|

|

|

|

| 3.50%, 04/14/2033(a)(c)

|

| 200,000

| 157,968

|

| 5.75%, 04/19/2047(a)

|

| 870,000

| 729,953

|

| Total Kazakhstan

|

| 887,921

|

| KUWAIT—0.4%

|

|

|

| MEGlobal Canada ULC, 5.00%, 05/18/2025(a)

|

| 200,000

| 195,816

|

| LUXEMBOURG—1.7%

|

|

|

| Albion Financing 1 SARL/Aggreko Holdings, Inc., 5.25%, 10/15/2026(a)(c)

| EUR

| 100,000

| 105,691

|

| Altice Financing SA, 5.75%, 08/15/2029(a)(c)

| $

| 204,000

| 152,983

|

| Altice France Holding SA

|

|

|

|

| 8.00%, 05/15/2027(a)(c)

| EUR

| 100,000

| 42,331

|

| 10.50%, 05/15/2027(a)(c)

| $

| 200,000

| 84,628

|

| Cidron Aida Finco Sarl, 6.25%, 04/01/2028(a)(c)

| GBP

| 100,000

| 111,972

|

| Cullinan Holdco Scsp, 4.63%, 10/15/2026(a)(c)

| EUR

| 100,000

| 90,874

|

| LHMC Finco 2 Sarl PIK, 7.25%, 10/02/2025(a)(c)(g)

|

| 4,866

| 5,275

|

| Matterhorn Telecom SA, 3.13%, 09/15/2026(a)(c)

|

| 200,000

| 207,256

|

| Monitchem HoldCo 3 SA, 8.75%, 05/01/2028(a)(c)

|

| 110,000

| 118,448

|

| Total Luxembourg

|

| 919,458

|

| MEXICO—3.1%

|

|

|

| BBVA Bancomer SA, (fixed rate to 01/17/2028, variable rate thereafter), 5.13%, 01/18/2033(a)(c)

| $

| 470,000

| 408,900

|

| Braskem Idesa SAPI, 6.99%, 02/20/2032(a)(c)

|

| 200,000

| 128,975

|

| Cemex SAB de CV, (fixed rate to 03/14/2028, variable rate thereafter), 9.13%, 03/14/2028(a)(b)

|

| 200,000

| 208,009

|

| Petroleos Mexicanos

|

|

|

|

| 7.19%, 09/12/2024(a)

| MXN

| 4,200,000

| 233,264

|

| 7.19%, 09/12/2024(a)

|

| 3,378,800

| 187,655

|

| 7.69%, 01/23/2050(c)

| $

| 530,000

| 368,839

|

| Sixsigma Networks Mexico SA de CV, 7.50%, 05/02/2025(a)(c)

|

| 210,000

| 191,495

|

| Total Mexico

|

| 1,727,137

|

| MOROCCO—0.4%

|

|

|

| Vivo Energy Investments BV, 5.13%, 09/24/2027(a)(c)

|

| 255,000

| 233,070

|

| NETHERLANDS—1.0%

|

|

|

| Nobel Bidco BV, 3.13%, 06/15/2028(a)(c)

| EUR

| 100,000

| 87,768

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| NETHERLANDS (continued)

|

|

|

| OCI NV, 3.63%, 10/15/2025(a)(c)

| EUR

| 90,000

| $ 96,135

|

| Stichting AK Rabobank Certificaten, 6.50%, 12/29/2049(a)(b)(i)

|

| 60,000

| 62,144

|

| Summer BidCo BV PIK, 9.00%, 11/15/2025(a)(c)(g)

|

| 104,875

| 105,078

|

| UPCB Finance VII Ltd., 3.63%, 06/15/2029(a)(c)

|

| 100,000

| 98,228

|

| VZ Vendor Financing II BV, 2.88%, 01/15/2029(a)(c)

|

| 100,000

| 88,304

|

| Total Netherlands

|

| 537,657

|

| NIGERIA—2.1%

|

|

|

| Access Bank PLC, 6.13%, 09/21/2026(a)

| $

| 216,000

| 186,970

|

| BOI Finance BV, 7.50%, 02/16/2027(a)

| EUR

| 196,000

| 187,211

|

| IHS Netherlands Holdco BV, 8.00%, 09/18/2027(a)(c)

| $

| 230,000

| 209,401

|

| SEPLAT Energy PLC, 7.75%, 04/01/2026(a)(c)

|

| 297,000

| 263,038

|

| United Bank for Africa PLC, 6.75%, 11/19/2026(a)

|

| 380,000

| 328,791

|

| Total Nigeria

|

| 1,175,411

|

| PERU—0.5%

|

|

|

| Petroleos del Peru SA, 5.63%, 06/19/2047(a)

|

| 400,000

| 268,000

|

| PHILIPPINES—0.9%

|

|

|

| International Container Terminal Services, Inc., 4.75%, 06/17/2030(a)

|

| 260,000

| 249,574

|

| Manila Water Co., Inc., 4.38%, 07/30/2030(a)(c)

|

| 243,000

| 222,880

|

| Total Philippines

|

| 472,454

|

| REPUBLIC OF IRELAND—0.3%

|

|

|

| Cimpress PLC, 7.00%, 06/15/2026(c)

|

| 160,000

| 151,000

|

| RUSSIA—0.0%

|

|

|

| Sovcombank Via SovCom Capital DAC, (fixed rate to 05/06/2025, variable rate thereafter), 7.75%,

05/06/2025(a)(b)(e)(j)(k)

|

| 250,000

| –

|

| SINGAPORE—1.1%

|

|

|

| DBS Group Holdings Ltd., (fixed rate to 12/11/2023, variable rate thereafter), 4.52%, 12/11/2028(a)(c)

|

| 200,000

| 198,764

|

| Puma International Financing SA, 5.00%, 01/24/2026(a)(c)

|

| 210,000

| 191,503

|

| Vena Energy Capital Pte Ltd., 3.13%, 02/26/2025(a)

|

| 210,000

| 197,292

|

| Total Singapore

|

| 587,559

|

| SOUTH AFRICA—2.8%

|

|

|

| Eskom Holdings SOC Ltd.

|

|

|

|

| 7.13%, 02/11/2025(a)

|

| 410,000

| 406,925

|

| 0.00%, 12/31/2032(f)(l)

| ZAR

| 28,700,000

| 335,571

|

| Liquid Telecommunications Financing PLC, 5.50%, 09/04/2026(a)(c)

| $

| 446,000

| 297,036

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

|

|

|

|

| Sasol Financing USA LLC, 5.50%, 03/18/2031(c)

| $

| 400,000

| $ 329,644

|

| Transnet SOC Ltd., 8.25%, 02/06/2028(a)

|

| 200,000

| 199,074

|

| Total South Africa

|

| 1,568,250

|

| SPAIN—1.4%

|

|

|

| Banco Bilbao Vizcaya Argentaria SA, (fixed rate to 03/05/2025, variable rate thereafter), Series 9, 6.50%,

03/05/2025(b)

|

| 200,000

| 190,440

|

| Banco de Sabadell SA

|

|

|

|

| FRN, (fixed rate to 06/16/2027, variable rate thereafter), 0.88%, 06/16/2028(a)(c)

| EUR

| 100,000

| 94,241

|

| FRN, (fixed rate to 02/07/2028, variable rate thereafter), 5.25%, 02/07/2029(a)(c)

|

| 100,000

| 109,968

|

| Cellnex Finance Co. SA

|

|

|

|

| 1.50%, 06/08/2028(a)(c)

|

| 100,000

| 95,817

|

| 2.00%, 09/15/2032(a)(c)

|

| 100,000

| 87,961

|

| Lorca Telecom Bondco SA, 4.00%, 09/18/2027(a)(c)

|

| 100,000

| 102,945

|

| Unicaja Banco SA FRN, (fixed rate to 11/15/2026, variable rate thereafter), 7.25%,

11/15/2027(a)(c)

|

| 100,000

| 112,932

|

| Total Spain

|

| 794,304

|

| SWEDEN—0.2%

|

|

|

| Verisure Holding AB, 3.88%, 07/15/2026(a)(c)

|

| 100,000

| 103,671

|

| SWITZERLAND—0.4%

|

|

|

| Consolidated Energy Finance SA, 5.63%, 10/15/2028(a)(c)

| $

| 150,000

| 129,485

|

| Dufry One BV, 2.50%, 10/15/2024(a)(c)

| EUR

| 100,000

| 107,476

|

| Total Switzerland

|

| 236,961

|

| TANZANIA—0.3%

|

|

|

| HTA Group Ltd., 7.00%, 12/18/2025(a)(c)

| $

| 200,000

| 190,632

|

| TRINIDAD—0.5%

|

|

|

| Heritage Petroleum Co. Ltd., 9.00%, 08/12/2029(a)(c)

|

| 291,000

| 302,349

|

| UKRAINE—0.7%

|

|

|

| Kernel Holding SA, 6.75%, 10/27/2027(a)(c)(f)

|

| 206,000

| 119,480

|

| MHP Lux SA, 6.95%, 04/03/2026(a)(f)

|

| 218,000

| 122,579

|

| NPC Ukrenergo, 6.88%, 11/09/2028(a)(e)(f)

|

| 200,000

| 53,465

|

| Ukraine Railways Via Rail Capital Markets PLC, 8.25%, 07/09/2026(a)(e)(f)

|

| 200,000

| 78,900

|

| Total Ukraine

|

| 374,424

|

| UNITED ARAB EMIRATES—0.4%

|

|

|

| MAF Global Securities Ltd., (fixed rate to 03/20/2026, variable rate thereafter), 6.38%, 03/20/2026(a)(b)

|

| 200,000

| 194,414

|

| UNITED KINGDOM—1.7%

|

|

|

| Bellis Acquisition Co. PLC, 4.50%, 02/16/2026(a)(c)

| GBP

| 124,000

| 139,562

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED KINGDOM (continued)

|

|

|

| Ithaca Energy North Sea PLC, 9.00%, 07/15/2026(a)(c)

| $

| 200,000

| $ 189,995

|

| Jerrold Finco PLC, 4.88%, 01/15/2026(a)(c)

| GBP

| 100,000

| 112,101

|

| Phoenix Group Holdings PLC, 6.63%, 12/18/2025(a)

|

| 150,000

| 190,874

|

| Pinewood Finance Co. Ltd., 3.25%, 09/30/2025(a)(c)

|

| 100,000

| 118,068

|

| Virgin Media Vendor Financing Notes III DAC, 4.88%, 07/15/2028(a)(c)

|

| 200,000

| 208,921

|

| Total United Kingdom

|

| 959,521

|

| UNITED STATES—29.4%

|

|

|

| Academy Ltd., 6.00%, 11/15/2027(a)(c)

| $

| 169,000

| 163,296

|

| ACI Worldwide, Inc., 5.75%, 08/15/2026(a)(c)

|

| 229,000

| 225,817

|

| Adams Homes, Inc., 7.50%, 02/15/2025(a)(c)

|

| 117,000

| 114,932

|

| Adient Global Holdings Ltd.

|

|

|

|

| 3.50%, 08/15/2024(a)(c)

| EUR

| 17,635

| 19,052

|

| 7.00%, 04/15/2028(a)(c)

| $

| 45,000

| 45,324

|

| 8.25%, 04/15/2031(a)(c)

|

| 45,000

| 46,260

|

| Affinity Interactive, 6.88%, 12/15/2027(a)(c)

|

| 182,000

| 161,012

|

| Arsenal AIC Parent LLC, 8.00%, 10/01/2030(a)(c)

|

| 5,000

| 5,100

|

| ASP Unifrax Holdings, Inc., 5.25%, 09/30/2028(a)(c)

|

| 70,000

| 52,150

|

| Ball Corp.

|

|

|

|

| 2.88%, 08/15/2030(c)

|

| 137,000

| 113,021

|

| 3.13%, 09/15/2031(c)

|

| 34,000

| 27,912

|

| Builders FirstSource, Inc., 4.25%, 02/01/2032(a)(c)

|

| 110,000

| 95,450

|

| Caesars Entertainment, Inc., 7.00%, 02/15/2030(a)(c)

|

| 4,000

| 4,040

|

| Carnival Corp.

|

|

|

|

| 10.50%, 02/01/2026(a)(c)

|

| 21,000

| 22,136

|

| 6.00%, 05/01/2029(a)(c)

|

| 56,000

| 50,338

|

| CCM Merger, Inc., 6.38%, 05/01/2026(a)(c)

|

| 151,000

| 147,111

|

| CCO Holdings LLC / CCO Holdings Capital Corp.

|

|

|

|

| 5.38%, 06/01/2029(a)(c)

|

| 38,000

| 34,726

|

| 4.25%, 02/01/2031(a)(c)

|

| 225,000

| 184,971

|

| 4.75%, 02/01/2032(a)(c)

|

| 63,000

| 52,013

|

| 4.25%, 01/15/2034(a)(c)

|

| 486,000

| 373,550

|

| Centene Corp.

|

|

|

|

| 4.25%, 12/15/2027(c)

|

| 23,000

| 21,665

|

| 4.63%, 12/15/2029(c)

|

| 39,000

| 36,259

|

| 3.38%, 02/15/2030(c)

|

| 233,000

| 200,475

|

| Chart Industries, Inc.

|

|

|

|

| 7.50%, 01/01/2030(a)(c)

|

| 93,000

| 95,311

|

| 9.50%, 01/01/2031(a)(c)

|

| 20,000

| 21,450

|

| Cheniere Energy Partners LP

|

|

|

|

| 4.50%, 10/01/2029(c)

|

| 189,000

| 175,711

|

| 4.00%, 03/01/2031(c)

|

| 64,000

| 56,952

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

|

|

|

|

| Civitas Resources, Inc.

|

|

|

|

| 8.38%, 07/01/2028(a)(c)

| $

| 73,000

| $ 75,085

|

| 8.75%, 07/01/2031(a)(c)

|

| 73,000

| 75,555

|

| Clarios Global LP / Clarios US Finance Co., 6.75%, 05/15/2028(a)(c)

|

| 87,000

| 87,388

|

| Clean Harbors, Inc.

|

|

|

|

| 4.88%, 07/15/2027(a)(c)

|

| 233,000

| 223,494

|

| 5.13%, 07/15/2029(a)(c)

|

| 16,000

| 15,238

|

| 6.38%, 02/01/2031(a)(c)

|

| 29,000

| 29,139

|

| Cleveland-Cliffs, Inc., 6.75%, 04/15/2030(a)(c)

|

| 83,000

| 80,742

|

| Consensus Cloud Solutions, Inc.

|

|

|

|

| 6.00%, 10/15/2026(a)(c)

|

| 37,000

| 34,213

|

| 6.50%, 10/15/2028(a)(c)

|

| 104,000

| 89,960

|

| Cornerstone Building Brands, Inc., 6.13%, 01/15/2029(a)(c)

|

| 171,000

| 141,502

|

| Crescent Energy Finance LLC, 9.25%, 02/15/2028(a)(c)

|

| 100,000

| 101,720

|

| CSC Holdings LLC

|

|

|

|

| 6.50%, 02/01/2029(a)(c)

|

| 200,000

| 169,823

|

| 5.75%, 01/15/2030(a)(c)

|

| 200,000

| 103,535

|

| Darling Ingredients, Inc., 6.00%, 06/15/2030(a)(c)

|

| 95,000

| 93,572

|

| DISH Network Corp., 11.75%, 11/15/2027(a)(c)

|

| 105,000

| 105,691

|

| Encore Capital Group, Inc., 4.88%, 10/15/2025(a)(c)

| EUR

| 100,000

| 103,371

|

| EnLink Midstream LLC, 6.50%, 09/01/2030(a)(c)

| $

| 118,000

| 118,771

|

| EnLink Midstream Partners LP, 5.45%, 06/01/2047(c)

|

| 186,000

| 153,855

|

| Ford Motor Co.

|

|

|

|

| 6.63%, 10/01/2028

|

| 44,000

| 45,316

|

| 9.63%, 04/22/2030(c)

|

| 148,000

| 172,732

|

| Ford Motor Credit Co. LLC

|

|

|

|

| 4.54%, 03/06/2025

| GBP

| 211,000

| 258,601

|

| 2.39%, 02/17/2026

| EUR

| 100,000

| 104,160

|

| Frontier Communications Holdings LLC

|

|

|

|

| 6.00%, 01/15/2030(a)(c)

| $

| 60,000

| 43,583

|

| 8.75%, 05/15/2030(a)(c)

|

| 83,000

| 80,077

|

| 8.63%, 03/15/2031(a)(c)

|

| 63,000

| 60,281

|

| GLP Capital, LP/GLP Financing II, Inc. REIT, 5.75%, 06/01/2028(c)

|

| 137,000

| 134,237

|

| Goodyear Europe BV, 2.75%, 08/15/2028(a)(c)

| EUR

| 116,000

| 113,143

|

| Goodyear Tire & Rubber Co. (The)

|

|

|

|

| 9.50%, 05/31/2025(c)

| $

| 230,000

| 235,750

|

| 5.00%, 07/15/2029(c)

|

| 120,000

| 110,653

|

| Graphic Packaging International LLC, 3.75%, 02/01/2030(a)(c)

|

| 463,000

| 402,810

|

| HCA, Inc.

|

|

|

|

| 5.88%, 02/15/2026(c)

|

| 114,000

| 114,318

|

| 5.63%, 09/01/2028(c)

|

| 337,000

| 338,291

|

| Hess Midstream Operations LP

|

|

|

|

| 4.25%, 02/15/2030(a)(c)

|

| 129,000

| 113,197

|

| 5.50%, 10/15/2030(a)(c)

|

| 20,000

| 18,800

|

| Hilcorp Energy I LP / Hilcorp Finance Co., 5.75%, 02/01/2029(a)(c)

|

| 99,000

| 91,575

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED STATES (continued)

|

|

|

| Howard Midstream Energy Partners LLC, 8.88%, 07/15/2028(a)(c)

| $

| 113,000

| $ 115,554

|

| Howmet Aerospace, Inc.

|

|

|

|

| 6.88%, 05/01/2025(c)

|

| 7,000

| 7,107

|

| 3.00%, 01/15/2029(c)

|

| 370,000

| 322,989

|

| 5.95%, 02/01/2037

|

| 76,000

| 77,268

|

| Hyundai Capital America, 6.38%, 04/08/2030(a)(c)

|

| 200,000

| 206,436

|

| International Game Technology PLC, 3.50%, 06/15/2026(a)(c)

| EUR

| 179,000

| 190,414

|

| IQVIA, Inc., 1.75%, 03/15/2026(a)(c)

|

| 125,000

| 127,831

|

| Iron Mountain, Inc.

|

|

|

|

| 5.00%, 07/15/2028(a)(c)

| $

| 23,000

| 21,298

|

| 4.88%, 09/15/2029(a)(c)

|

| 60,000

| 54,121

|

| 5.25%, 07/15/2030(a)(c)

|

| 122,000

| 110,288

|

| ITT Holdings LLC, 6.50%, 08/01/2029(a)(c)

|

| 179,000

| 153,089

|

| JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc., 5.75%, 04/01/2033(a)(c)

|

| 328,000

| 315,214

|

| JPMorgan Chase & Co. 3mo. USD SOFR + 2.580%, Series CC, 8.21%, 11/01/2023(b)(h)

|

| 180,000

| 179,550

|

| JPMorgan Chase Bank NA, 11.67%, 11/27/2023(a)(f)

| UAH

| 10,041,000

| 217,506

|

| Lennar Corp., 4.88%, 12/15/2023(c)

| $

| 280,000

| 279,087

|

| Level 3 Financing, Inc., 10.50%, 05/15/2030(a)(c)

|

| 102,000

| 105,658

|

| Macy's Retail Holdings LLC

|

|

|

|

| 5.88%, 04/01/2029(a)(c)

|

| 139,000

| 129,124

|

| 5.88%, 03/15/2030(a)(c)

|

| 3,000

| 2,709

|

| 6.13%, 03/15/2032(a)(c)

|

| 9,000

| 8,032

|

| MajorDrive Holdings IV LLC, 6.38%, 06/01/2029(a)(c)

|

| 175,000

| 143,160

|

| Mauser Packaging Solutions Holding Co., 9.25%, 04/15/2027(a)(c)

|

| 48,000

| 44,594

|

| MGM Resorts International, 5.75%, 06/15/2025(c)

|

| 113,000

| 111,749

|

| MIWD Holdco II LLC / MIWD Finance Corp., 5.50%, 02/01/2030(a)(c)

|

| 281,000

| 237,445

|

| NCL Corp. Ltd.

|

|

|

|

| 5.88%, 02/15/2027(a)(c)

|

| 87,000

| 84,723

|

| 8.38%, 02/01/2028(a)(c)

|

| 34,000

| 35,446

|

| 7.75%, 02/15/2029(a)(c)

|

| 41,000

| 39,256

|

| Neptune Bidco US, Inc., 9.29%, 04/15/2029(a)(c)

|

| 151,000

| 138,898

|

| Netflix, Inc.

|

|

|

|

| 4.63%, 05/15/2029

| EUR

| 134,000

| 150,403

|

| 6.38%, 05/15/2029

| $

| 63,000

| 66,613

|

| New Enterprise Stone & Lime Co., Inc., 5.25%, 07/15/2028(a)(c)

|

| 87,000

| 80,910

|

| Northern Oil & Gas, Inc., 8.75%, 06/15/2031(a)(c)

|

| 94,000

| 94,709

|

| Novelis Corp., 3.25%, 11/15/2026(a)(c)

|

| 163,000

| 148,114

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

|

|

|

|

| NRG Energy, Inc.

|

|

|

|

| 3.38%, 02/15/2029(a)(c)

| $

| 15,000

| $ 12,383

|

| 5.25%, 06/15/2029(a)(c)

|

| 134,000

| 120,932

|

| 3.63%, 02/15/2031(a)(c)

|

| 202,000

| 158,525

|

| 3.88%, 02/15/2032(a)(c)

|

| 68,000

| 52,621

|

| 7.00%, 03/15/2033(a)(c)

|

| 56,000

| 55,871

|

| Occidental Petroleum Corp.

|

|

|

|

| 5.50%, 12/01/2025(c)

|

| 26,000

| 25,902

|

| 5.55%, 03/15/2026(c)

|

| 22,000

| 21,885

|

| 6.38%, 09/01/2028(c)

|

| 43,000

| 44,148

|

| 6.63%, 09/01/2030(c)

|

| 46,000

| 48,243

|

| 6.45%, 09/15/2036

|

| 130,000

| 136,480

|

| OI European Group BV, 6.25%, 05/15/2028(a)(c)

| EUR

| 100,000

| 113,313

|

| Organon & Co. / Organon Foreign Debt Co-Issuer BV, 2.88%, 04/30/2028(a)(c)

|

| 196,000

| 189,873

|

| Owens-Brockway Glass Container, Inc., 7.25%, 05/15/2031(a)(c)

| $

| 76,000

| 77,233

|

| Perrigo Finance Unlimited Co., 4.65%, 06/15/2030(c)

|

| 200,000

| 179,233

|

| Post Holdings, Inc.

|

|

|

|

| 5.63%, 01/15/2028(a)(c)

|

| 70,000

| 67,644

|

| 5.50%, 12/15/2029(a)(c)

|

| 120,000

| 111,441

|

| Royal Caribbean Cruises Ltd.

|

|

|

|

| 11.50%, 06/01/2025(a)(c)

|

| 17,000

| 18,010

|

| 3.70%, 03/15/2028(c)

|

| 136,000

| 118,658

|

| Sabre GLBL, Inc.

|

|

|

|

| 7.38%, 09/01/2025(a)(c)

|

| 94,000

| 84,835

|

| 11.25%, 12/15/2027(a)(c)

|

| 41,000

| 36,273

|

| Sirius XM Radio, Inc., 4.13%, 07/01/2030(a)(c)

|

| 143,000

| 117,771

|

| Six Flags Entertainment Corp., 5.50%, 04/15/2027(a)(c)

|

| 116,000

| 109,330

|

| Six Flags Theme Parks, Inc., 7.00%, 07/01/2025(a)(c)

|

| 105,000

| 105,256

|

| Southwestern Energy Co., 4.75%, 02/01/2032(c)

|

| 210,000

| 186,593

|

| Sprint Capital Corp.

|

|

|

|

| 6.88%, 11/15/2028

|

| 61,000

| 64,663

|

| 8.75%, 03/15/2032

|

| 224,000

| 269,893

|

| Staples, Inc., 7.50%, 04/15/2026(a)(c)

|

| 84,000

| 69,396

|

| SunCoke Energy, Inc., 4.88%, 06/30/2029(a)(c)

|

| 191,000

| 164,472

|

| Talen Energy Supply LLC, 8.63%, 06/01/2030(a)(c)

|

| 124,000

| 128,697

|

| Tempur Sealy International, Inc., 3.88%, 10/15/2031(a)(c)

|

| 123,000

| 99,552

|

| Tenet Healthcare Corp., 6.13%, 10/01/2028(c)

|

| 145,000

| 138,126

|

| TransDigm, Inc., 6.75%, 08/15/2028(a)(c)

|

| 118,000

| 118,352

|

| Travel & Leisure Co.

|

|

|

|

| 5.65%, 04/01/2024(c)

|

| 115,000

| 114,218

|

| 6.00%, 04/01/2027(c)

|

| 80,000

| 78,408

|

| 4.63%, 03/01/2030(a)(c)

|

| 25,000

| 21,587

|

| Trident TPI Holdings, Inc., 12.75%, 12/31/2028(a)(c)

|

| 5,000

| 5,295

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED STATES (continued)

|

|

|

| Turning Point Brands, Inc., 5.63%, 02/15/2026(a)(c)

| $

| 108,000

| $ 100,406

|

| Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC, 10.50%, 02/15/2028(a)(c)

|

| 81,000

| 80,516

|

| Univision Communications, Inc.

|

|

|

|

| 6.63%, 06/01/2027(a)(c)

|

| 97,000

| 94,378

|

| 8.00%, 08/15/2028(a)(c)

|

| 9,000

| 9,068

|

| 7.38%, 06/30/2030(a)(c)

|

| 95,000

| 92,465

|

| Venture Global Calcasieu Pass LLC

|

|

|

|

| 3.88%, 08/15/2029(a)(c)

|

| 73,000

| 63,211

|

| 6.25%, 01/15/2030(a)(c)

|

| 114,000

| 111,472

|

| 4.13%, 08/15/2031(a)(c)

|

| 145,000

| 122,994

|

| 3.88%, 11/01/2033(a)(c)

|

| 98,000

| 79,530

|

| Venture Global LNG, Inc.

|

|

|

|

| 8.13%, 06/01/2028(a)(c)

|

| 138,000

| 140,261

|

| 8.38%, 06/01/2031(a)(c)

|

| 138,000

| 140,031

|

| Viatris, Inc., 2.70%, 06/22/2030(c)

|

| 401,000

| 327,688

|

| Viper Energy Partners LP, 5.38%, 11/01/2027(a)(c)

|

| 117,000

| 112,320

|

| Vistra Operations Co. LLC, 4.38%, 05/01/2029(a)(c)

|

| 126,000

| 111,214

|

| Weatherford International Ltd., 8.63%, 04/30/2030(a)(c)

|

| 97,000

| 99,413

|

| Western Midstream Operating LP

|

|

|

|

| 3.95%, 06/01/2025(c)

|

| 142,000

| 136,930

|

| 4.65%, 07/01/2026(c)

|

| 84,000

| 81,501

|

| 6.15%, 04/01/2033(c)

|

| 114,000

| 115,622

|

| Wolverine World Wide, Inc., 4.00%, 08/15/2029(a)(c)

|

| 113,000

| 88,767

|

| Total United States

|

| 16,358,406

|

| ZAMBIA—0.7%

|

|

|

| First Quantum Minerals Ltd.

|

|

|

|

| 7.50%, 04/01/2025(a)(c)

|

| 200,000

| 199,330

|

| 8.63%, 06/01/2031(a)(c)

|

| 200,000

| 204,750

|

| Total Zambia

|

| 404,080

|

| Total Corporate Bonds

|

| 45,295,160

|

| GOVERNMENT BONDS—44.2%

|

|

| ANGOLA—1.0%

|

|

|

| Angolan Government International Bond, 9.13%, 11/26/2049(a)

|

| 701,000

| 566,057

|

| ARGENTINA—2.0%

|

|

|

| Argentine Republic Government International Bond

|

|

|

|

| 1.00%, 07/09/2029(c)(l)

|

| 71,292

| 23,938

|

| 3.63%, 07/09/2035(c)(i)(l)

|

| 449,075

| 139,260

|

| 4.25%, 01/09/2038(c)(i)(l)

|

| 1,609,200

| 578,146

|

| 3.63%, 07/09/2046(c)(i)(l)

|

| 1,293,010

| 402,122

|

| Total Argentina

|

| 1,143,466

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| AUSTRALIA—3.2%

|

|

|

| Australia Government Bond,Series 154, 2.75%, 11/21/2029(a)

| AUD

| 1,700,000

| $ 1,067,585

|

| Queensland Treasury Corp., 3.50%, 08/21/2030(a)

|

| 1,100,000

| 699,810

|

| Total Australia

|

| 1,767,395

|

| BAHRAIN—1.3%

|

|

|

| Bahrain Government International Bond

|

|

|

|

| 4.25%, 01/25/2028(a)

| $

| 390,000

| 361,600

|

| 5.45%, 09/16/2032(a)

|

| 229,000

| 209,821

|

| 6.25%, 01/25/2051(a)

|

| 210,000

| 172,127

|

| Total Bahrain

|

| 743,548

|

| BRAZIL—4.3%

|

|

|

| Brazil Notas do Tesouro Nacional

|

|

|

|

| Series NTNF, 10.00%, 01/01/2027

| BRL

| 2,076,000

| 435,940

|

| Series NTNF, 10.00%, 01/01/2029

|

| 7,434,000

| 1,537,012

|

| Brazilian Government International Bond, 7.13%, 01/20/2037

| $

| 370,000

| 401,289

|

| Total Brazil

|

| 2,374,241

|

| CHILE—0.6%

|

|

|

| Chile Government International Bond, 4.34%, 03/07/2042(c)

|

| 386,000

| 340,588

|

| COLOMBIA—1.4%

|

|

|

| Colombia Government International Bond, 5.20%, 05/15/2049(c)

|

| 200,000

| 145,215

|

| Colombia TES,Series B, 9.25%, 05/28/2042

| COP

| 2,757,800,000

| 632,973

|

| Total Colombia

|

| 778,188

|

| DOMINICAN REPUBLIC—2.6%

|

|

|

| Dominican Republic International Bond

|

|

|

|

| 9.75%, 06/05/2026(a)

| DOP

| 15,300,000

| 276,133

|

| 5.50%, 02/22/2029(a)(c)

| $

| 200,000

| 189,964

|

| 5.88%, 01/30/2060(a)

|

| 1,230,000

| 971,698

|

| Total Dominican Republic

|

| 1,437,795

|

| EGYPT—1.4%

|

|

|

| Egypt Government International Bond

|

|

|

|

| 7.63%, 05/29/2032(a)

|

| 400,000

| 258,176

|

| 7.90%, 02/21/2048(a)

|

| 566,000

| 312,471

|

| 7.90%, 02/21/2048(a)

|

| 426,000

| 235,182

|

| Total Egypt

|

| 805,829

|

| GEORGIA—0.5%

|

|

|

| Georgia Government International Bond, 2.75%, 04/22/2026(a)

|

| 306,000

| 274,938

|

| GHANA—0.3%

|

|

|

| Ghana Government International Bond, 7.63%, 05/16/2029(a)(d)

|

| 385,000

| 174,212

|

| HUNGARY—0.6%

|

|

|

| Hungary Government Bond,Series 24/C, 2.50%, 10/24/2024

| HUF

| 128,420,000

| 333,067

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

|

| Shares or

Principal

Amount

| Value

|

| GOVERNMENT BONDS (continued)

|

|

| INDONESIA—4.7%

|

|

|

| Indonesia Government International Bond

|

|

|

|

| 7.75%, 01/17/2038(a)

| $

| 100,000

| $ 125,370

|

| 3.70%, 10/30/2049

|

| 1,180,000

| 943,770

|

| Indonesia Treasury Bond

|

|

|

|

| Series FR77, 8.13%, 05/15/2024

| IDR

| 14,800,000,000

| 997,626

|

| Series FR81, 6.50%, 06/15/2025

|

| 780,000,000

| 52,158

|

| Series FR82, 7.00%, 09/15/2030

|

| 341,000,000

| 23,448

|

| Series FR83, 7.50%, 04/15/2040

|

| 6,535,000,000

| 467,274

|

| Total Indonesia

|

| 2,609,646

|

| IRAQ—1.0%

|

|

|

| Iraq International Bond

|

|

|

|

| 5.80%, 01/15/2028(a)(c)(d)

| $

| 445,500

| 412,875

|

| 5.80%, 01/15/2028(a)(c)(d)

|

| 140,625

| 130,327

|

| Total Iraq

|

| 543,202

|

| IVORY COAST—0.7%

|

|

|

| Ivory Coast Government International Bond, 6.63%, 03/22/2048(a)(d)

| EUR

| 444,000

| 366,964

|

| KENYA—1.3%

|

|

|

| Republic of Kenya Government International Bonds, 8.25%, 02/28/2048(a)

| $

| 932,000

| 727,762

|

| MALAYSIA—1.6%

|

|

|

| Malaysia Government Bond

|

|

|

|

| Series 0411, 4.23%, 06/30/2031

| MYR

| 1,100,000

| 250,646

|

| Series 0419, 3.83%, 07/05/2034

|

| 800,000

| 175,365

|

| Series 0519, 3.76%, 05/22/2040

|

| 1,000,000

| 212,802

|

| Series 0120, 4.07%, 06/15/2050

|

| 1,100,000

| 236,240

|

| Total Malaysia

|

| 875,053

|

| MEXICO—2.2%

|

|

|

| Mexican Bonos

|

|

|

|

| Series M, 5.75%, 03/05/2026

| MXN

| 6,120,200

| 332,804

|

| Series M, 7.75%, 11/13/2042

|

| 16,497,100

| 879,189

|

| Total Mexico

|

| 1,211,993

|

| MOROCCO—0.5%

|

|

|

| Morocco Government International Bond, 2.38%, 12/15/2027(a)

| $

| 328,000

| 285,360

|

| NIGERIA—0.9%

|

|

|

| Nigeria Government International Bond

|

|

|

|

| 7.14%, 02/23/2030(a)

|

| 200,000

| 174,750

|

| 7.63%, 11/28/2047(a)

|

| 435,000

| 324,510

|

| Total Nigeria

|

| 499,260

|

| OMAN—2.6%

|

|

|

| Oman Government International Bond, 7.00%, 01/25/2051(a)

|

| 1,400,000

| 1,425,049

|

| PERU—2.1%

|

|

|

| Peruvian Government International Bond, 6.90%, 08/12/2037(a)

| PEN

| 4,138,000

| 1,154,285

|

| POLAND—0.6%

|

|

|

| Republic of Poland Government Bond,Series 0432, 1.75%, 04/25/2032

| PLN

| 1,894,000

| 354,813

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| QATAR—0.9%

|

|

|

| Qatar Government International Bond, 4.40%, 04/16/2050(a)

| $

| 576,000

| $ 520,335

|

| REPUBLIC OF KOREA—0.5%

|

|

|

| Industrial Bank of Korea, 5.13%, 10/25/2024(a)

|

| 300,000

| 298,040

|

| RWANDA—0.6%

|

|

|

| Rwanda International Government Bond, 5.50%, 08/09/2031(a)

|

| 400,000

| 311,000

|

| SAUDI ARABIA—0.7%

|

|

|

| Saudi Government International Bond, 4.38%, 04/16/2029(a)

|

| 410,000

| 400,234

|

| TURKEY—1.9%

|

|

|

| Turkey Government International Bond, 9.38%, 01/19/2033

|

| 1,001,000

| 1,055,154

|

| UKRAINE—0.2%

|

|

|

| Ukraine Government International Bonds, 7.75%, 09/01/2029(a)(g)

|

| 424,000

| 132,267

|

| URUGUAY—1.3%

|

|

|

| Uruguay Government International Bond

|

|

|

|

| 4.38%, 12/15/2028(d)

| UYU

| 11,555,142

| 323,795

|

| 7.88%, 01/15/2033

| $

| 165,000

| 199,238

|

| 7.63%, 03/21/2036(d)

|

| 146,000

| 177,722

|

| Total Uruguay

|

| 700,755

|

| UZBEKISTAN—0.7%

|

|

|

| National Bank of Uzbekistan, 4.85%, 10/21/2025(a)

|

| 200,000

| 190,000

|

| Republic of Uzbekistan International Bond, 3.70%, 11/25/2030(a)

|

| 252,000

| 207,126

|

| Total Uzbekistan

|

| 397,126

|

| Total Government Bonds

|

| 24,607,622

|

| WARRANTS—0.0%

|

|

| BRAZIL—0.0%

|

|

|

| OAS SA(f)(j)(m)

|

| 61,465

| –

|

| UNITED STATES—0.0%

|

|

|

| Delco, Series A(f)(j)(m)

|

| 73,666

| –

|

| Total Warrants

|

| –

|

| SHORT-TERM INVESTMENT—7.0%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.19%(n)

|

| 3,859,187

| 3,859,188

|

| Total Short-Term Investment

|

| 3,859,188

|

Total Investments

(Cost $81,207,037)—132.7%

|

| 73,761,970

|

| Liabilities in Excess of Other Assets—(32.7%)

|

| (18,166,904)

|

| Net Assets—100.0%

|

| $55,595,066

|

| (a)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (b)

| Perpetual maturity. Maturity date presented represents the next call date.

|

| (c)

| The maturity date presented for these instruments represents the next call/put date.

|

| (d)

| Sinkable security.

|

See accompanying

Notes to Portfolio of Investments.

Portfolio of Investments (unaudited) (continued)

As of July 31, 2023

abrdn Global Income Fund, Inc.

| (e)

| Security is in default.

|

| (f)

| Illiquid security.

|

| (g)

| Payment-in-kind security for which part of the income earned may be paid as additional principal.

|

| (h)

| Variable or Floating Rate security. Rate disclosed is as of July 31, 2023.

|

| (i)

| Step bond. Rate disclosed is as of July 31, 2023.

|

| (j)

| Level 3 security. See Note 1(a) of the accompanying Notes to Portfolio of Investments.

|

| (k)

| The Fund’s adviser has deemed this security to be illiquid based upon procedures approved by the Board of Trustees. Illiquid securities held by the Fund represent 0.00% of net

assets as of July 31, 2023.

|

| (l)

| Zero coupon bond. Rate represents yield to maturity.

|

| (m)

| Non-income producing security.

|

| (n)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of July 31, 2023.

|

| AUD

| Australian Dollar

|

| BRL

| Brazilian Real

|

| CNY

| Chinese Yuan Renminbi

|

| COP

| Colombian Peso

|

| DOP

| Dominican Republic Peso

|

| EUR

| Euro Currency

|

| FRN

| Floating Rate Note

|

| GBP

| British Pound Sterling

|

| HUF

| Hungarian Forint

|

| IDR

| Indonesian Rupiah

|

| INR

| Indian Rupee

|

| KRW

| South Korean Won

|

| MXN

| Mexican Peso

|

| MYR

| Malaysian Ringgit

|

| PEN

| Peruvian Sol

|

| PIK

| Payment-In-Kind

|

| PLC

| Public Limited Company

|

| PLN

| Polish Zloty

|

| REIT

| Real Estate Investment Trust

|

| SGD

| Singapore Dollar

|

| UAH

| Ukraine Hryvna

|

| USD

| U.S. Dollar

|

| UYU

| Uruguayan Peso

|

| ZAR

| South African Rand

|

| At July 31, 2023, the Fund held the following forward foreign currency contracts:

|

Purchase Contracts

Settlement Date*

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| Chinese Renminbi/United States Dollar

|

|

|

|

|

|

| 09/22/2023

| Citibank N.A.

| CNY

| 17,905,483

| USD

| 2,492,924

| $2,521,711

| $28,787

|

| Euro/United States Dollar

|

|

|

|

|

|

| 08/16/2023

| Morgan Stanley & Co.

| EUR

| 88,475

| USD

| 98,060

| 97,342

| (718)

|

| 08/16/2023

| UBS AG

| EUR

| 28,959

| USD

| 32,557

| 31,861

| (696)

|

| Indonesian Rupiah/United States Dollar

|

|

|

|

|

|

| 09/20/2023

| UBS AG

| IDR

| 31,055,400,000

| USD

| 2,068,718

| 2,055,967

| (12,751)

|

| Singapore Dollar/United States Dollar

|

|

|

|

|

|

| 08/01/2023

| Citibank N.A.

| SGD

| 5,428,895

| USD

| 4,088,757

| 4,082,643

| (6,114)

|

| 10/16/2023

| Royal Bank of Canada

| SGD

| 3,690,288

| USD

| 2,787,480

| 2,785,195

| (2,285)

|

| South Korean Won/United States Dollar

|

|

|

|

|

|

| 09/05/2023

| Citibank N.A.

| KRW

| 5,257,108,190

| USD

| 4,077,174

| 4,124,160

| 46,986

|

|

| $15,698,879

| $53,209

|

Sale Contracts

Settlement Date*

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| United States Dollar/British Pound

|

|

|

|

|

|

| 08/16/2023

| Deutsche Bank AG

| USD

| 1,290,855

| GBP

| 1,010,674

| $1,297,125

| $(6,270)

|

| United States Dollar/Euro

|

|

|

|

|

|

| 08/16/2023

| Deutsche Bank AG

| USD

| 4,788,981

| EUR

| 4,380,688

| 4,819,717

| (30,736)

|

| 08/16/2023

| UBS AG

| USD

| 113,065

| EUR

| 101,460

| 111,628

| 1,437

|

| United States Dollar/Singapore Dollar

|

|

|

|

|

|

| 08/01/2023

| Royal Bank of Canada

| USD

| 4,087,506

| SGD

| 5,428,895

| 4,082,643

| 4,863

|

See accompanying Notes

to Portfolio of Investments.

Portfolio of Investments (unaudited) (concluded)

As of July 31, 2023

abrdn Global Income Fund, Inc.

Sale Contracts

Settlement Date*

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| United States Dollar/South African Rand

|

|

|

|

|

|

| 08/16/2023

| Morgan Stanley & Co.

| USD

| 301,592

| ZAR

| 5,544,000

| $309,626

| $(8,034)

|

|

| $10,620,739

| $(38,740)

|

| Unrealized appreciation on forward foreign currency exchange contracts

| $82,073

|

| Unrealized depreciation on forward foreign currency exchange contracts

| $(67,604)

|

| *

| Certain contracts with different trade dates and like characteristics have been shown net.

|

| At July 31, 2023, the Fund held the following centrally cleared interest rate swaps:

|

| Currency

| Notional

Amount

| Expiration

Date

| Counterparty

| Receive

(Pay)

Floating

Rate

| Floating

Rate

Index

| Fixed

Rate

| Frequency of

Paid

Payments

Made

| Premiums

Paid

(Received)

| Value

| Unrealized

Appreciation/

(Depreciation)

|

| USD

| 7,350,000

| 03/17/2033

| UBS AG

| Receive

| 12-month SOFR

| 3.38%

| Annually

| $-

| $234,695

| $234,695

|

| USD

| 5,000,000

| 03/17/2030

| UBS AG

| Receive

| 12-month SOFR

| 3.46%

| Annually

| -

| 136,032

| 136,032

|

| USD

| 5,000,000

| 03/17/2032

| UBS AG

| Receive

| 12-month SOFR

| 3.40%

| Annually

| -

| 150,315

| 150,315

|

| USD

| 3,000,000

| 07/13/2033

| Barclays Bank PLC

| Receive

| 12-month SOFR

| 3.72%

| Annually

| -

| (2,411)

| (2,411)

|

|

|

| $-

| $518,631

| $518,631

|

See accompanying Notes

to Portfolio of Investments.

Notes to Portfolio of Investments

July 31, 2023 (unaudited)

1. Summary of Significant

Accounting Policies

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the Investment Company Act of 1940,

as amended (the "1940 Act"), the Board designated abrdn Asia Limited (“abrdn Asia” or the “Investment Manager”) as the valuation designee ("Valuation Designee") for the Fund to perform the

fair value determinations relating to Fund investments for which market quotations are not readily available.

Long-term debt and other

fixed-income securities are valued at the last quoted or evaluated bid price on the valuation date provided by an independent pricing service provider. If there are no current day bids, the security is valued at the

previously applied bid. Pricing services generally price debt securities assuming orderly transactions of an institutional “round lot” size and the strategies employed by the Valuation Designee generally

trade in round lot sizes. In certain circumstances, some trades may occur in smaller “odd lot” sizes which may be effected at lower, or higher, prices than institutional round lot trades. Short-term debt

securities (such as commercial paper and U.S. treasury bills) having a remaining maturity of 60 days or less are valued at the last quoted or evaluated bid price on the valuation date provided by an independent

pricing service, or on the basis of amortized cost, if it represents the best approximation of fair value. Debt and other fixed-income securities are generally determined to be Level 2 investments.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Registered

investment companies are valued at their NAV as reported by such company. Generally, these investment types are categorized as Level 1 investments.

Derivatives are valued at fair

value. Exchange traded derivatives are generally Level 1 investments and over-the-counter and centrally cleared derivatives are generally Level 2 investments. Forward foreign currency contracts are generally valued

based on the bid price of the forward rates and the current spot rate. Forward exchange rate quotations are available for scheduled settlement dates, such as 1-, 3-, 6-, 9- and 12-month periods. An interpolated

valuation is derived based on the actual settlement dates of the forward contracts held. Futures contracts are valued at the settlement price or at the last bid price if no settlement price is available. Interest rate

swaps agreements are generally valued by an approved pricing agent based on the terms of the swap agreement (including future cash flows).

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued

at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. Under normal circumstances

the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE") (usually 4:00 p.m. Eastern Time). A security that has been fair valued by the Manager may be classified as Level 2

or Level 3 depending on the nature of the inputs.

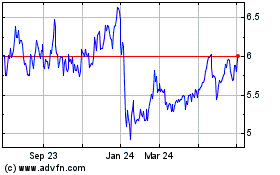

abrdn Global Income (AMEX:FCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

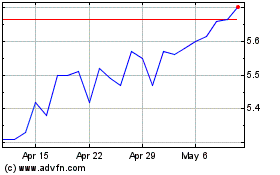

abrdn Global Income (AMEX:FCO)

Historical Stock Chart

From Apr 2023 to Apr 2024