UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) October 2, 2009

Charlotte Russe Holding, Inc.

(Exact name of

registrant as specified in charter)

|

|

|

|

|

|

|

Delaware

|

|

000-27677

|

|

33-0724325

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

4645 Morena Boulevard, San Diego, CA

|

|

92117

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (858) 587-1500

Not applicable

(Former name or former address if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

Charlotte Russe Holding, Inc. (the “Company”) has entered into a First Amendment (the “First Amendment”) to that certain Loan and Security Agreement (as amended, the “Loan

Agreement”) dated as of June 24, 2005 by and among Charlotte Russe, Inc., as borrower, the Company, Charlotte Russe Administration, Inc., and Charlotte Russe Merchandising, Inc., as guarantors, and Bank of America, N.A., as lender (the

“Lender”). Pursuant to the First Amendment, dated as of October 2, 2009, the Lender has waived any default or event of default that would arise as a result of the change of control of the Company. The First Amendment also modifies the

margins applicable to the interest rate on the loans made under the Loan Agreement. In addition, some of the covenants have been modified to permit, among other things, (a) the incurrence of debt subordinated to the obligations due the Lender

under the Loan Agreement; and (b) certain distributions, acquisitions and prepayments of debt so long as an availability and a fixed charge coverage ratio tests are met.

|

Item 5.01

|

Changes in Control of Registrant

|

On August 24, 2009, Charlotte Russe Holding, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Advent CR Holding, Inc. (“Parent”) and Advent CR, Inc.

(“Merger Sub”), pursuant to which Merger Sub commenced a tender offer to purchase all of the outstanding shares of Common Stock, par value $0.01 per share (the “Shares”), of the Company for $17.50 per share payable net to the

seller in cash and without interest (the “Offer Price”), upon the terms and conditions set forth in the Offer to Purchase dated August 31, 2009 and the related Letter of Transmittal (which, together with any amendments or supplements

thereto, collectively constitute the “Offer”), and described in a Tender Offer Statement on Schedule TO filed by Parent, Merger Sub, Advent International GPE VI Limited Partnership, Advent International GPE VI-A Limited Partnership, Advent

International GPE VI-B Limited Partnership, Advent International GPE VI-C Limited Partnership, Advent International GPE VI-D Limited Partnership, Advent International GPE VI-E Limited Partnership, Advent International GPE VI-F Limited Partnership,

Advent International GPE VI-G Limited Partnership, Advent Partners GPE VI 2008 Limited Partnership, Advent Partners GPE VI 2009 Limited Partnership, and Advent Partners GPE VI–A Limited Partnership, GPE VI GP Limited Partnership, GPE VI GP

(Delaware) Limited Partnership, Advent International LLC, and Advent International Corporation with the SEC on August 31, 2009, as amended.

The Offer expired at 12:00 A.M. midnight, New York City time, at the end of the day on Monday, September 28, 2009. According to Mellon Investor Services LLC, the depositary for the Offer, at the

expiration of the Offer, a total of approximately 18,501,056 shares of the Company’s Common Stock, which represents approximately 81.4519% of the outstanding shares of the Company’s Common Stock on a fully diluted basis and 87.8462% of the

currently outstanding shares, were validly tendered and not withdrawn. Effective October 2, 2009, Merger Sub has accepted for payment and paid for all Shares validly tendered and not withdrawn during the initial offering period. Merger Sub

funded the acquisition from available cash. As a result, a change in control of the Company has occurred and the Company has become an indirect subsidiary of Parent.

Subsequent to the expiration of the Offer, on September 29, 2009, and in accordance

with the terms of the Merger Agreement, Merger Sub commenced a subsequent offering period which will expire at 12:00 A.M. midnight, New York City time, at the end of the day on Tuesday, October 13, 2009. All shares of Charlotte Russe’s

Common Stock properly tendered during the subsequent offering period will be accepted, and tendering stockholders will receive the Offer Price. No shares of Charlotte Russe’s Common Stock tendered during the initial offering period or the

subsequent offering period may be withdrawn.

Pursuant to the Merger Agreement, Merger Sub will be merged with and into the

Company (the “Merger”) with the Company surviving the merger as a wholly-owned subsidiary of Parent. At the effective time of the Merger (the “Effective Time”), all remaining outstanding Shares not tendered in the Offer (other

than Shares owned by Parent, Merger Sub, the Company and its subsidiaries and Shares that are outstanding immediately prior to the Effective Time and that are held by any person who is entitled to demand and properly demands appraisal of such Shares

pursuant to, and who complies in all respects with, Section 262 of the Delaware General Corporation Law), will be acquired for cash at the Offer Price and on the terms and conditions set forth in the Merger Agreement.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors

|

Effective as of October 2, 2009, in connection with the Merger Sub’s acceptance for payment, and payment for all Shares validly tendered and not withdrawn during the initial offering period of

the Offer and pursuant to the terms of the Merger Agreement, the following directors of the Company resigned: Michael J. Blitzer, Paul R. Del Rossi, John D. Goodman, Emilia Fabricant and Herbert J. Kleinberger. Effective as of the same date, and

after such resignations, the board of directors of the Company filled the vacancies created by such resignations by appointing David Mussafer, Andrew W. Crawford, and Jenny Ming to serve as directors of the Company. Information about the directors

designated for appointment by Merger Sub has been previously disclosed in the Information Statement contained in the Schedule 14D-9 which was filed by the Company with the Securities and Exchange Commission (the “SEC”) on August 31, 2009,

as amended (the “Schedule 14D-9”) and is incorporated herein by reference.

Merger Sub has advised the Company that,

to the best of its knowledge, none of the directors designated for appointment by Merger Sub is currently a director of, or holds any position with, the Company or any of its subsidiaries. Merger Sub has advised the Company that, to the best of its

knowledge, none of its designees or any of his or her immediate family members (i) has a familial relationship with any directors, other nominees or executive officers of the Company or any of its subsidiaries, or (ii) has been involved in any

transactions with the Company or any of its subsidiaries, in each case, that are required to be disclosed pursuant to the rules and regulations of the SEC, except as may be disclosed in the Schedule 14D-9.

In addition, on October 5, 2009, Emilia Fabricant gave the Company notice that she was terminating her employment as President and Chief

Merchandising Officer for “good reason” pursuant to the terms of the Offer Letter dated November 11, 2008 between the Company and Emilia Fabricant (the “Fabricant Offer Letter”). The Company and Ms. Fabricant agreed to waive the

30 days’ notice provision in the Fabricant Offer Letter so Ms. Fabricant’s termination was effective as of October 5, 2009.

Also, effective October 5, 2009, the employment of Edward Wong as Chief Operating Officer terminated.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

CHARLOTTE RUSSE HOLDING, INC.

|

|

|

|

|

|

Date: October 8, 2009

|

|

By:

|

|

/s/ F

REDERICK

G.

S

ILNY

|

|

|

|

|

|

Frederick G. Silny

|

|

|

|

|

|

Chief Financial Officer, Principal Accounting Officer,

Executive Vice President, Corporate Secretary and Treasurer

|

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

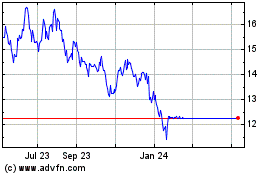

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Apr 2023 to Apr 2024