What's News: Business & Finance -- WSJ

February 13 2018 - 3:02AM

Dow Jones News

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 13, 2018).

U.S. stocks advanced for a second consecutive session as

commodity prices stabilized. The Dow climbed 410.37 points, or

1.7%, to end at 24601.27.

Walgreens has made a takeover approach to drug distributor

Amerisource, a move that could help boost the chain's

profitability.

A CME flaw that can help high-speed traders at the expense of

ordinary investors is said to have resurfaced.

General Dynamics said it agreed to buy CSRA for $6.8 billion as

part of the defense contractor's expansion in government IT

services.

A new tax provision could throw off the comparison of a firm's

earnings to cash flow, a traditional way of assessing earnings

quality.

Icahn wants to kill Xerox's deal to cede control to Fujifilm,

opening up what could be a protracted fight.

Wynn Resorts' board hired a law firm with deep ties to the

company to investigate allegations against Steve Wynn.

Steven Cohen's investment firm was accused in a lawsuit by a

female employee of being a sexist work environment.

Fox offered to bolster the editorial independence of Sky's news

operations, aiming to ease approval of its bid.

The White House proposed levying fees on derivatives users to

bolster the CFTC's budget.

Oracle plans to quadruple its number of data centers as it tries

to challenge Amazon's cloud-infrastructure lead.

(END) Dow Jones Newswires

February 13, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

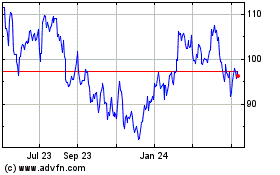

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024