Vastned Retail Belgium: Half-yearly financial report for the period 01.01.2017 to 30.06.2017

July 26 2017 - 12:00PM

The EPRA result in the first semester

of 2017 is € 1,24 per share (€ 1,18 for the first semester of

2016).

Continued execution of the strategy to

ensure that the share of core city assets in the real estate

portfolio exceeds 75% in the long term.

As at 30 June 2017, 59% of the real

estate portfolio consisted of core city assets and 41% of mixed

retail locations (inner-city shops outside of the premium cities,

high-end retail parks and retail warehouses).

Realisation of 13 rental transactions,

representing approximately 8% of the total annual rental

income.

Occupancy rate as at 30 June 2017: 98%

(98% as at 31 December 2016).

Increase in the fair value of the

existing real estate portfolio by 13,5 million in the first

semester of 2017, mainly as a result of the stronger yields of the

core city assets.

Limited debt ratio of 28% as at 30 June

2017.

Expected gross dividend for 2017

between € 2,40 and € 2,50 per share.

Full press release:

PB VRB Half-yearly results

2017_ENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Vastned Retail Belgium via Globenewswire

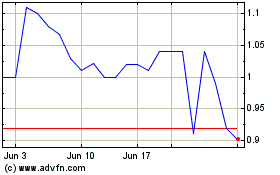

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

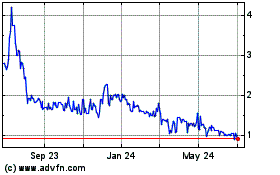

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024