Fourth Quarter 2017 Highlights

- Record net income of $9.2 million,

which included $701,000 of net expense relating to the enactment of

the Tax Cuts and Jobs Act of 2017

- Record adjusted EBITDA of $15.2

million; 36% increase versus third quarter 2017 and up 269%

year-over-year

- Record revenue of $25.2 million; 36%

increase versus third quarter 2017 and up 246% year-over-year

- Record 6,146 revenue days; 35% increase

versus third quarter 2017 and up 188% year-over-year

- Added 18 proppant management systems to

the rental fleet; total of 77 systems at year-end

Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) (“Solaris” or

the “Company”), a leading independent provider of supply chain

management and logistics solutions designed to drive efficiencies

and reduce costs for the oil and natural gas industry, today

reported financial results for the fourth quarter and fiscal year

2017, as further described in the Company’s Annual Report on Form

10-K for the year ended December 31, 2017, filed with the

Securities and Exchange Commission (the “SEC”) today.

Fourth Quarter 2017 Financial Review

Solaris reported net income of $9.2 million, or $0.13 per share,

for fourth quarter 2017, compared to net income of $3.0 million in

fourth quarter 2016 and net income of $7.4 million, or $0.13 per

share, in third quarter 2017. Fourth quarter 2017 net income

included certain non-recurring items, including approximately

$701,000 of net expenses resulting from the Tax Cuts and Jobs Act

of 2017 (the “Tax Act”), $581,000 of IPO-related compensation

expense, $47,000 related to a loss on disposal of assets and

$107,000 of non-recurring transaction costs.

Adjusted EBITDA for the fourth quarter was $15.2 million, an

increase of $11.1 million from fourth quarter 2016 and an increase

of $4.0 million compared to third quarter 2017. A description of

adjusted EBITDA and a reconciliation to net income, its most

directly comparable GAAP measure, is provided below.

Adjusted pro forma net income for the fourth quarter was $8.9

million, or $0.20 per fully exchanged and diluted share, an

increase of $7.0 million and $0.15 per diluted share from fourth

quarter 2016 and an increase of $3.4 million and $0.07 per diluted

share compared to third quarter 2017. A description of adjusted pro

forma net income and a reconciliation to net income attributable to

Solaris, its most directly comparable GAAP measure, and the

computation of adjusted pro forma earnings per fully exchanged and

diluted share are provided below.

Revenues were $25.2 million for the quarter, an increase of

$17.9 million, or 246%, compared to fourth quarter 2016, and an

increase of $6.7 million, or 36%, compared to third quarter

2017.

During fourth quarter 2017, the Company generated 6,146 revenue

days, the combined number of days that its systems earned revenue

during the quarter, a 188% increase from fourth quarter 2016, and

up 35% compared to third quarter 2017. Customer demand and adoption

rates for Solaris’ systems continue to grow as proppant consumption

levels increase across the industry and customers realize the

benefits of Solaris’ technology.

In December 2017, the Tax Act was enacted into law. The Tax Act

provides for significant changes to the U.S. Internal Revenue Code

of 1986, as amended, including a reduction of the U.S. federal

corporate income tax rate from 35% to 21%, among other provisions.

As a result of the Tax Act, the Company recognized a $21.9 million

benefit in other income related to the reduction in liabilities

under its tax receivable agreement in the fourth quarter of 2017.

The Company also recognized an additional $22.6 million of income

tax expense as a provisional amount, relating to the remeasurement

of its deferred tax assets.

Full-year 2017 Financial Review

Solaris reported net income of $22.5 million for the fiscal year

ended December 31, 2017, compared to net income of $2.8 million in

fiscal 2016. 2017 net income included certain non-recurring items,

including approximately $701,000 of net expenses resulting from the

Tax Act, $4.6 million of IPO-related compensation expense, $498,000

related to a loss on disposal of assets, $348,000 of non-recurring

organizational costs and $143,000 of non-recurring transaction

costs.

Adjusted EBITDA for fiscal 2017 was $39.9 million, an increase

of $33.1 million from fiscal 2016. A description of adjusted EBITDA

and a reconciliation to net income, its most directly comparable

GAAP measure, is provided below.

Adjusted pro forma net income for fiscal 2017 was $21.1 million,

or $0.48 per fully exchanged and diluted share, an increase of

$19.3 million and $0.44 per diluted share from fiscal 2016. A

description of adjusted pro forma net income and a reconciliation

to net income attributable to Solaris, its most directly comparable

GAAP measure, and the computation of adjusted pro forma earnings

per fully exchanged and diluted share are provided below.

Revenues were $67.4 million for fiscal 2017, an increase of

$49.2 million, or 271%, compared to fiscal 2016.

During fiscal 2017, the Company generated 16,712 revenue days, a

191% increase from fiscal 2016. Customer demand and adoption rates

for Solaris’ systems continue to grow as proppant consumption

levels increase across the industry and customers realize the

benefits of Solaris’ technology.

As a result of the Tax Act, the Company recognized a $21.9

million benefit in other income related to the reduction in

liabilities under its tax receivable agreement in fiscal year 2017.

The Company also recognized an additional $22.6 million of income

tax expense as a provisional amount, relating to the remeasurement

of its deferred tax assets.

Capital Expenditures and Liquidity

Driven by strong customer demand and continued customer adoption

of our proppant management systems and services, the Company

invested $49.9 million during the fourth quarter, which included

adding eighteen systems to the fleet, ending the year with 77

systems. Also, the Company’s fourth quarter capital expenditures

included $18.9 million in construction activities related to the

Kingfisher Facility and the acquisition of the assets of

Railtronix, LLC. These investments help address rising customer

demand and are expected to drive future earnings and cash flow

growth for Solaris.

During the fourth quarter, the Company completed a public

offering of 8,050,000 Class A Shares, including 3,000,000 primary

shares issued and sold by the Company. Net of underwriting

discounts and commissions and offering expenses, the Company

received net proceeds of approximately $44.5 million. The Company

contributed all of the net proceeds of the offering to its

subsidiary Solaris Oilfield Infrastructure, LLC (“Solaris LLC”) in

exchange for units in Solaris LLC (“Solaris LLC Units”).

As previously disclosed, the Company also entered into a new

credit agreement with certain lenders in January 2018. The credit

facility has a term of four years and is composed of a $20 million

revolver and a $50 million delayed draw term loan.

As of February 28, 2018, the Company had approximately $107.6

million of liquidity, including $43.4 million in cash and

approximately $64.2 million of availability under the undrawn

credit facility.

Operational Update and Outlook

We currently have 91 systems in the rental fleet, all of which

are deployed to customers. The Permian Basin continues to be our

most active area, followed by the Eagle Ford Shale, SCOOP/STACK

formations, Marcellus/Utica Shale and the Haynesville Shale. Our

systems are highly mobile and can be deployed quickly in response

to customer demand.

Proppant supply disruptions and continued logistic complexities

drive demand for our products and services. To meet growing demand,

we recently increased our manufacturing rate and expect to deliver

a total of eight systems to the rental fleet in March, which will

represent the highest monthly manufacturing rate the Company has

achieved in its history. We have been able to accelerate our

manufacturing rate through selective outsourcing of certain

components of our systems. Based on our current manufacturing

outlook, we expect to end the first quarter with 96 to 98 systems

in the fleet and expect to end the second quarter with 118 to 122

systems in the fleet.

Transloading and construction activity continues at the

Kingfisher Facility. Completion of the initial phase of

construction remains on track for August 2018. In the interim, we

are providing direct rail-to-truck transloading service for our

anchor customer. Since commencing transloading operations in

mid-January 2018, we have begun receiving regular shipments of

railcars.

Solaris’ Chief Executive Officer Greg Lanham commented, “We are

very proud of all that we accomplished in 2017. We more than

doubled our mobile proppant management system fleet – from 30

systems to 77 systems – and significantly expanded our market

share. We completed our initial public offering, commenced

construction of the Kingfisher Facility and completed the

Railtronix acquisition. We believe our current fleet of 91 systems

represents the industry’s leading market share for new technology

proppant handling solutions.”

“We look forward to reaching new milestones in 2018, including

delivering eight systems in a single month for the first time in

March and adding our 100th system to the fleet in April. Our strong

balance sheet, experienced team and unique value proposition

provide the opportunity to continue to build upon our success and

drive additional efficiencies for our customers.”

Conference Call

The Company will host a conference call to discuss its fourth

quarter and fiscal 2017 results on Wednesday, March 7, 2018 at 7:30

a.m. Central Time (8:30 a.m. Eastern Time). To join the conference

call from within the United States, participants may dial (844)

413-3978. To join the conference call from outside of the United

States, participants may dial (412) 317-6594. When instructed,

please ask the operator to be joined to the Solaris Oilfield

Infrastructure, Inc. call. Participants are encouraged to log in to

the webcast or dial in to the conference call approximately ten

minutes prior to the start time. To listen via live webcast, please

visit the Investor Relations section of the Company’s website,

http://www.solarisoilfield.com.

An audio replay of the conference call will be available shortly

after the conclusion of the call and will remain available for

approximately seven days. It can be accessed by dialing (877)

344-7529 within the United States or (412) 317-0088 outside of the

United States. The conference call replay access code is 10116267.

The replay will also be available in the Investor Relations section

of the Company’s website shortly after the conclusion of the call

and will remain available for approximately seven days.

About Solaris Oilfield Infrastructure, Inc.

Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) manufactures

and provides patented mobile proppant management systems that

unload, store and deliver proppant at oil and natural gas well

sites. These patented systems are deployed in many of the most

active oil and natural gas basins in the United States, including

the Permian Basin, the Eagle Ford Shale, the STACK/SCOOP formation

and the Haynesville Shale. Solaris’ high-capacity transload

facility in Kingfisher, Oklahoma serves customers with operations

in the STACK/SCOOP formation. Additional information is available

on the Solaris’ website, www.solarisoilfield.com.

Website Disclosure

We use our website (www.solarisoilfield.com) as a routine

channel of distribution of company information, including news

releases, analyst presentations, and supplemental financial

information, as a means of disclosing material non-public

information and for complying with our disclosure obligations under

SEC Regulation FD. Accordingly, investors should monitor our

website in addition to following press releases, SEC filings and

public conference calls and webcasts. Additionally, we provide

notifications of news or announcements on our investor relations

website. Investors and others can receive notifications of new

information posted on our investor relations website in real time

by signing up for email alerts.

None of the information provided on our website, in our press

releases, public conference calls and webcasts, or through social

media channels is incorporated by reference into, or deemed to be a

part of, this Current Report on Form 8-K or will be incorporated by

reference into any other report or document we file with the SEC

unless we expressly incorporate any such information by reference,

and any references to our website are intended to be inactive

textual references only.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Examples of

forward-looking statements include, but are not limited to,

statements we make regarding the outlook for the construction and

operation of our new Kingfisher Facility, current and potential

future long-term contracts and our future business and financial

performance. Forward-looking statements are based on our current

expectations and assumptions regarding our business, the economy

and other future conditions. Because forward-looking statements

relate to the future, by their nature, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, our actual results may differ

materially from those contemplated by the forward-looking

statements. Factors that could cause our actual results to differ

materially from the results contemplated by such forward-looking

statements include, but are not limited to the factors discussed or

referenced in our filings made from time to time with the SEC.

Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

Factors or events that could cause our actual results to differ may

emerge from time to time, and it is not possible for us to predict

all of them. We undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by law.

SOLARIS OILFIELD

INFRASTRUCTURE, INC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months Ended Year Ended December

31, September 30, December 31, 2017

2016 2017 2017 2016 Revenue

Proppant system rental $ 20,093 $ 5,915 $ 15,062 $ 54,653 $ 14,594

Proppant system services 4,906 1,374 3,416 12,537 3,563 Proppant

inventory software services 205 —

— 205 — Total revenue

25,204 7,289 18,478 67,395 18,157

Operating costs and

expenses Cost of proppant system rental (excluding $2,044,

$934, and $1,523 of depreciation and amortization for the three

months ended December 31, 2017 and 2016 and September 30, 2017,

respectively, and $5,792 and $3,352 for the years ended December

31, 2017 and 2016, respectively, shown separately) 1,033 250 641

2,627 1,431 Cost of proppant system services (excluding $178, $49,

and $129 of depreciation and amortization for the three months

ended December 31, 2017 and 2016 and September 30, 2017,

respectively, and $461 and $160 for the years ended December 31,

2017 and 2016, respectively, shown separately) 5,544 1,615 3,933

14,184 4,916 Cost of proppant inventory software services

(excluding $42 of depreciation and amortization for the three

months and year ended December 31, 2017, show separately) 76 — — 76

— Depreciation and amortization 2,359 1,053 1,742 6,635 3,792

Salaries, benefits and payroll taxes 3,522 1,069 2,942 9,209 3,061

Selling, general and administrative (excluding $95, $40 and $90 of

depreciation and amortization for the three months ended December

31, 2017 and 2016 and September 30, 2017, respectively, and $340

and $250 for the years ended December 31, 2017 and 2016,

respectively, shown separately) 1,424 254 1,176 5,077 2,096 Other

operating expenses 153 — 77

4,126 — Total operating cost and

expenses 14,111 4,241 10,511

41,934 15,296 Operating income

11,093 3,048 7,967 25,461 2,861 Interest expense (26 ) (9 ) (27 )

(97 ) (23 ) Income (loss) pursuant to Tax Receivable Agreements

22,939 — 83 23,022 — Other income — 1

— — 8 Total other income

(expense) 22,913 (8 ) 56

22,925 (15 ) Income before income tax expense 34,006

3,040 8,023 48,386 2,846 Provision for income taxes 24,762

17 617 25,899

43 Net income 9,244 3,023 7,406 22,487 2,803 Less:

net income loss related to Solaris LLC — (3,023 ) — (3,665 ) (2,803

) Less: net income related to non-controlling interests

(7,137 ) — (6,027 ) (15,186 ) —

Net income attributable to Solaris $ 2,107 $ —

$ 1,379 $ 3,636 $ —

Earnings per share

of Class A common stock - basic (1) $ 0.13 $ — $ 0.13

$ 0.28 $ — Earnings per share of Class A

common stock - diluted (1) $ 0.13 $ — $ 0.12 $

0.27 $ — Basic weighted average shares of

Class A common stock outstanding (1) 15,120 — 10,100 12,117 —

Diluted weighted average shares of Class A common stock outstanding

(1) 15,508 — 10,563 12,482 — (1) – Represents earnings per share of

Class A common stock and weighted average shares of Class A common

stock outstanding for the period following the reorganization

transactions and IPO.

SOLARIS OILFIELD INFRASTRUCTURE, INC

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

December 31, December 31, 2017

2016 Assets Current assets: Cash $ 63,421 $ 3,568

Accounts receivable, net 12,979 4,510 Prepaid expenses and other

current assets 3,622 403 Inventories 7,532

1,365 Total current assets 87,554 9,846 Property, plant and

equipment, net 151,163 54,350 Goodwill 17,236 13,004 Intangible

assets, net 5,335 36 Deferred tax assets 25,512 — Other assets

260 — Total assets $ 287,060 $ 77,236

Liabilities and Stockholders'/Members’ Equity Current

liabilities: Accounts payable $ 5,000 $ 705 Accrued liabilities

15,468 2,144 Current portion of capital lease obligations 33 26

Current portion of notes payable — 169 Current portion of senior

secured credit facility — 31 Total current

liabilities 20,501 3,075 Capital lease

obligations, net of current portion 179 213 Notes payable, net of

current portion — 282 Senior secured credit facility, net of

current portion — 2,320 Payables related to parties pursuant to tax

receivable agreement 24,675 — Other long-term liabilities

145 — Total liabilities 45,500

5,890 Commitments and contingencies Stockholders' and members’

equity Members’ equity — 69,267 Preferred stock, $0.01 par value,

50,000 shares authorized, none issued and outstanding — — Class A

common stock, $0.01 par value, 600,000 shares authorized, 19,027

issued and 19,011 outstanding as of December 31, 2017 and none

issued and outstanding as of December 31, 2016 190 — Class B common

stock, $0.00 par value, 180,000 shares authorized, 26,810 shares

issued and outstanding as of December 31, 2017 and none issued and

outstanding as of December 31, 2016 — — Additional paid-in capital

121,727 — Accumulated earnings 3,636 2,079 Treasury stock (at

cost), 16 shares and 0 shares as of December 31, 2017 and 2016,

respectively (261 ) — Total stockholders' equity

attributable to Solaris and members' equity 125,292

71,346 Non-controlling interest 116,268

— Total stockholders' and members' equity 241,560

71,346 Total liabilities, stockholders' and members’ equity

$ 287,060 $ 77,236

SOLARIS OILFIELD

INFRASTRUCTURE, INC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

For the Year Ended December 31, 2017

2016 Cash flows from operating activities: Net income $

22,487 $ 2,803 Adjustment to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

6,635 3,792 Loss on disposal of asset 498 — Provision for bad debt

— 131 Stock-based compensation 3,701 127 Amortization of debt

issuance costs 51 4 Change in payables related to parties pursuant

to tax receivable agreement (23,022 ) — Deferred income tax expense

25,652 — Other (28 ) — Changes in assets and liabilities: Accounts

receivable (8,469 ) (3,065 ) Prepaid expenses and other assets

(3,273 ) 109 Inventories (7,532 ) 327 Accounts payable 4,224 41

Accrued liabilities 5,805 252 Net cash

provided by operating activities 26,729 4,521

Cash flows from investing activities: Investment in

property, plant and equipment (93,912 ) (10,899 ) Cash paid for

Railtronix™ acquisition (5,000 ) — Investment in intangible assets

(72 ) (36 ) Net cash used in investing activities

(98,984 ) (10,935 ) Cash flows from financing

activities: Payments under capital leases (27 ) (25 ) Payments

under notes payable (451 ) (211 ) Proceeds from borrowings under

the credit facility 3,000 2,500 Repayment of credit facility (5,500

) — Payments related to debt issuance costs (111 ) (153 ) Proceeds

from members’ contributions — 948 Proceeds from issuance of Class A

common stock sold in initial public offering, net of offering costs

111,075 — Proceeds from issuance of Class A common stock sold in

secondary offering, net of offering costs 44,684 — Distributions

paid to unit and option holders (25,818 ) — Proceeds from pay down

of promissory note related to membership units 5,256

— Net cash provided by financing activities

132,108 3,059 Net increase (decrease) in cash

59,853 (3,355 ) Cash at beginning of period 3,568

6,923 Cash at end of period $ 63,421 $ 3,568

Non-cash activities Investing: Capitalized depreciation in

property, plant and equipment $ 668 $ 674 Property and equipment

additions incurred but not paid at year-end 7,765 264 Issuance of

shares in acquisition 4,505 — Financing: Notes payable issued for

property, plant and equipment — 397 Accrued interest from notes

receivable issued for membership units — 327 Cash paid for:

Interest 104 20 Income taxes 45 35

SOLARIS OILFIELD INFRASTRUCTURE, INC

AND SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

INFORMATION — ADJUSTED EBITDA(In

thousands)(Unaudited)

We view EBITDA and Adjusted EBITDA as important indicators of

performance. We define EBITDA as net income (loss), plus

(i) depreciation and amortization expense, (ii) interest

expense and (iii) income tax expense, including franchise

taxes. We define Adjusted EBITDA as EBITDA plus (i) unit-based

compensation expense and (ii) certain non-cash charges and

unusual or non-recurring charges.

We believe that our presentation of EBITDA and Adjusted EBITDA

provides useful information to investors in assessing our financial

condition and results of operations. Net income is the GAAP measure

most directly comparable to EBITDA and Adjusted EBITDA. EBITDA and

Adjusted EBITDA should not be considered alternatives to net income

presented in accordance with GAAP. Because EBITDA and Adjusted

EBITDA may be defined differently by other companies in our

industry, our definitions of EBITDA and Adjusted EBITDA may not be

comparable to similarly titled measures of other companies, thereby

diminishing their utility. The following table presents a

reconciliation of Net income (loss) to EBITDA and Adjusted EBITDA

for each of the periods indicated.

Three months ended

Year ended December 31, September 30,

December 31, 2017 2016 2017 2017

2016 Net income $ 9,244 $ 3,023 $ 7,406 $ 22,487 $

2,803 Depreciation and amortization 2,359 1,053 1,742 6,635 3,792

Interest expense, net 26 9 27 97 23 Income taxes (1) 24,762

17 617 25,899 43

EBITDA $ 36,391 $ 4,102 $ 9,792 $ 55,118 $ 6,661 IPO bonuses (2)

581 — 617 4,627 — Stock-based compensation expense (3) 1,039 19 795

2,211 127 Loss on disposal of assets 47 — 41 498 — Non-recurring

organizational costs (4) — — — 348 — Change in payables related to

parties pursuant to tax receivable agreement (5) (22,939 ) — (83 )

(23,022 ) — Other (6) 107 — 36

143 — Adjusted EBITDA $ 15,226 $ 4,121

$ 11,198 $ 39,923 $ 6,788

____________________________

(1) Income taxes include add back for federal and state

taxes, including $22,637 in the year ended December 31, 2017

related to the Tax Cuts and Jobs Act. (2) One-time cash

bonuses of $3.1 million for the year ended December 31, 2017 and

stock-based compensation expense of $0.6 million, $0.6 million and

$1.5 million related to restricted stock awards with one-year

vesting for the three months ended December 31, 2017 and September

30, 2017 and the year ended December 31, 2017, respectively, that

were paid or granted to certain employees and consultants in

connection with the Offering. (3) Represents stock-based

compensation expense of $1.0 million, $19 thousand, $0.8 million,

$1.9 million and $0.1 million for the three months ended December

31, 2017 and 2016, September 30, 2017 and the years ended December

31, 2017 and 2016, respectively, related to restricted stock awards

with three-year vesting and $0.3 million for the year ended

December 31, 2017 related to the options issued under our long-term

incentive plan. (4) Certain non-recurring organizational

costs associated with our IPO. (5) Other income related to

the change in payables related to parties pursuant to the tax

receivable agreement includes ($21,936) related to the Tax Cuts and

Jobs Act. (6) Non-recurring transaction costs.

SOLARIS OILFIELD INFRASTRUCTURE, INC

AND SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

INFORMATION — ADJUSTED PRO FORMA NET INCOME AND ADJUSTEDPRO

FORMA EARNINGS PER FULLY EXCHANGED AND DILUTED SHARE(In

thousands)(Unaudited)

Adjusted pro forma net income represents net income attributable

to Solaris assuming the full exchange of all outstanding membership

interests in Solaris LLC not held by Solaris Oilfield

Infrastructure, Inc. for shares of Class A common stock, adjusted

for certain non-recurring items that the Company doesn't believe

directly reflect its core operations and may not be indicative of

ongoing business operations. Adjusted pro forma earnings per fully

exchanged and diluted share is calculated by dividing adjusted pro

forma net income by the weighted-average shares of Class A common

stock outstanding, assuming the full exchange of all outstanding

Solaris LLC Units, after giving effect to the dilutive effect of

outstanding equity-based awards.

When used in conjunction with GAAP financial measures, adjusted

pro forma net income and adjusted pro forma earnings per fully

exchanged and diluted share are supplemental measures of operating

performance that the Company believes are useful measures to

evaluate performance period over period and relative to its

competitors. By assuming the full exchange of all outstanding

Solaris LLC Units, the Company believes these measures facilitate

comparisons with other companies that have different organizational

and tax structures, as well as comparisons period over period

because it eliminates the effect of any changes in net income

attributable to Solaris as a result of increases in its ownership

of Solaris LLC, which are unrelated to the Company's operating

performance, and excludes items that are non-recurring or may not

be indicative of ongoing operating performance.

Adjusted pro forma net income and adjusted pro forma earnings

per fully exchanged and diluted share are not necessarily

comparable to similarly titled measures used by other companies due

to different methods of calculation. Presentation of adjusted pro

forma net income and adjusted pro forma earnings per fully

exchanged and diluted share should not be considered alternatives

to net income (loss) and earnings (loss) per share, as determined

under GAAP. While these measures are useful in evaluating the

Company's performance, it does not account for the earnings

attributable to the non-controlling interest holders and therefore

does not provide a complete understanding of the net income

attributable to Solaris. Adjusted pro forma net income and adjusted

pro forma earnings per fully exchanged and diluted share should be

evaluated in conjunction with GAAP financial results. A

reconciliation of adjusted pro forma net income to net income

(loss) attributable to Solaris, the most directly comparable GAAP

measure, and the computation of adjusted pro forma earnings per

fully exchanged and diluted share are set forth below.

Three months ended Year ended

December 31, September 30, December 31,

2017 2016 2017 2017

2016 Numerator: Net income attributable to Solaris $ 2,107 $

— $ 1,379 $ 3,636 $ — Adjustments: Reallocation of net income

attributable to non-controlling interests from the assumed exchange

of LLC Interests(1) 7,137 3,023 6,027 18,851 2,803 IPO bonuses (2)

581 — 617 4,627 — Loss on disposal of assets 47 — 41 498 —

Non-recurring organizational costs (3) — — — 348 — Change in

payables related to parties pursuant to tax receivable agreement

(4) (21,936 ) — — (21,936 ) — Remeasurement of deferred tax assets

22,637 — — 22,637 — Other (5) 107 — 36 143 — Income tax

(expense)/benefit (1,751 ) (1,094 ) (2,570 )

(7,693 ) (1,025 ) Adjusted pro forma net income $

8,929 $ 1,929 $ 5,530 $ 21,111 $ 1,778

Denominator: Weighted average shares of Class A common stock

outstanding - diluted 15,508 — 10,563 12,482 — Adjustments: Assumed

exchange of Solaris LLC Units for shares of Class A common stock

(1) 29,888 42,466 32,726

31,622 42,466

Adjusted pro forma fully exchanged

weighted average shares of Class A common stock outstanding -

diluted

45,396 42,466 43,289

44,104 42,466 Adjusted pro forma

earnings per fully exchanged share - diluted $ 0.20 $ 0.05

$ 0.13 $ 0.48 $ 0.04 (1) Assumes

the exchange of all outstanding Solaris LLC Units for shares of

Class A common stock at the beginning of the relevant reporting

period, resulting in the elimination of the non-controlling

interest and recognition of the net income attributable to

non-controlling interests. (2) One-time cash bonuses of $3.1

million for the year ended December 31, 2017 and stock-based

compensation expense of $0.6 million, $0.6 million and $1.5 million

related to restricted stock awards with one-year vesting for the

three months ended December 31, 2017 and September 30, 2017 and the

year ended December 31, 2017, respectively, that were paid or

granted to certain employees and consultants in connection with the

Offering. (3) Certain non-recurring organizational costs

associated with our IPO. (4) Other income related to the

remeasurement of payables related to parties pursuant to the tax

receivable agreement of ($21,936) related to the Tax Cuts and Jobs

Act. (5) Non-recurring transaction costs.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180306006738/en/

Solaris Oilfield Infrastructure, Inc.Kyle Ramachandran, (281)

501-3070Chief Financial OfficerIR@solarisoilfield.com

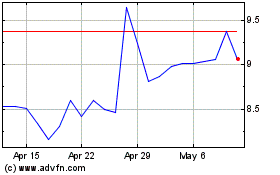

Solaris Oilfield Infrast... (NYSE:SOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solaris Oilfield Infrast... (NYSE:SOI)

Historical Stock Chart

From Apr 2023 to Apr 2024