Nestlé, Pet-Food Maker Talk Deal -- WSJ

July 03 2018 - 3:02AM

Dow Jones News

By Ben Dummett, Dana Mattioli and Dana Cimilluca

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 3, 2018).

Nestlé SA is angling to take control of Canada's Champion

Petfoods for more than $2 billion, according to people familiar

with the matter, as the consumer-goods giant seeks out

higher-growth businesses to help offset its struggling

packaged-foods operations.

Nestlé is in talks to acquire a majority stake in the closely

held maker of specialty cat and dog food, whose owners include

Toronto buyout firm Bedford Capital. The talks, however, could

still break down before a deal is completed.

The interest in Champion comes about a year after Nestlé first

disclosed a far-reaching plan to revive its stock price by

investing in areas such as pet care, bottled water and coffee amid

pressure from U.S. activist investor Daniel Loeb. Since then, the

company has made several deals, including its $7 billion

acquisition of the rights to sell Starbucks Corp.'s coffee and tea

in grocery and retail stores.

Still, Mr. Loeb remains dissatisfied with these efforts. On

Sunday he made public a letter to Nestlé Chief Executive Mark

Schneider and the board, criticizing the company for not selling

underperforming and nonstrategic businesses fast enough and

described the company's strategic approach as "muddled."

Switzerland-based Nestlé is already established in the pet-food

market through its well-known Purina brand, and in April it

acquired a majority stake in Tails.com, a direct-to-consumer dog

nutrition business in the U.K. for an undisclosed amount.

Nestlé's pet-care operation generated organic sales growth of 3%

last year, second only the coffee division's growth on an organic

sales basis, which excludes such factors as foreign-exchange

fluctuations. By comparison, the company's confectionery and

prepared dishes and cooking aids businesses grew by 0.3% and 2.2%

respectively.

The acquisition of Champion could help Nestlé sustain the

momentum of its pet-food operation, while providing the Edmonton,

Alberta-based company with a broader customer base.

Champion, as a closely held company, doesn't disclose financial

information. But it and other natural pet-food makers are growing

faster than their more traditional rivals as health-conscious

consumers increasingly do for their pets what they have done for

themselves by favoring natural food and high-end treats -- a trend

that has had many packaged-foods companies playing catch up.

Champion sells its dog and cat food under the Orijen, and Acana

brands, listing fresh meat, free-run poultry and wild-caught fish

among the ingredients it uses. The company sells its products in

more than 80 countries through a network of pet food distributors

and veterinarian practices, as well as in-store and online,

according to its website.

Nestlé isn't the only packaged-foods company betting on the

acquisition of higher-end pet-care businesses to reinvigorate

growth. In February, General Mills Inc. agreed to buy natural

pet-food maker Blue Buffalo Pet Products Inc. for about $8 billion

to help offset slumping sales of its yogurt and cereal brands.

And last month, Mars Inc., best known for its candy bar and gum

brands, acquired European veterinary operator AniCura Holding AB

from European buyout firm Nordic Capital for about EUR2 billion

($2.32 billion), the latest in a series of deals in the pet-care

sector for the privately held company. Mars is also a major

pet-food provider with brands such as Iams, Pedigree and Royal

Canin.

Write to Ben Dummett at ben.dummett@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

July 03, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Aug 2024 to Sep 2024

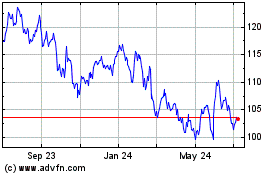

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Sep 2023 to Sep 2024