Hess and CNX to Sell Interests in Utica Shale Joint Venture for About $800 Million

June 29 2018 - 8:54AM

Dow Jones News

By Aisha Al-Muslim

Oil-and-gas companies Hess Corp. (HES) and CNX Resources Corp.

(CNX) have agreed to sell assets part of their joint venture in the

Utica shale play in eastern Ohio to Ascent Resources-Utica LLC for

about $800 million.

In separate deal announcements Hess and CNX each said they would

sell their 50% interest in the venture for approximately $400

million. The transactions are retroactive to April 1, the companies

said Friday.

Oklahoma City-based Ascent Resources LLC, which conducts

business through Ascent Resources-Utica LLC, provides oil and gas

exploration and production services on the Utica Shale Play in

eastern Ohio.

The divestiture consists of about 39,000 net acres, including

about 26,000 net undeveloped acres. The divested assets are located

in the wet gas Utica Shale areas of Belmont, Guernsey, Harrison and

Noble counties.

Hess said the divestiture is part of efforts to shed lower

return and noncore assets. The company said proceeds from sale will

be used to invest in Hess's "higher return growth opportunities" in

Guyana and the Bakken shale formation. It will also be used fund

the company's previously announced share repurchase program.

CNX expects to use the proceeds from the transaction to pay down

debt, continue its continuing share repurchase program, invest in

drilling and completion activities, or make acreage acquisitions.

CNX expects to record a noncash gain of about $135 million in the

third quarter of 2018 as a result of the transaction.

Shares of Hess rose 0.7% to $66 and while CNX was unchanged at

$17.20 in premarket trading Friday.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

June 29, 2018 08:39 ET (12:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

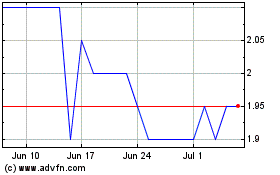

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024