Abbott Laboratories Sees Nutrition Uptick -- Earnings Review

April 18 2018 - 8:47AM

Dow Jones News

By Austen Hufford

Abbott Laboratories (ABT) released results for its first quarter

Wednesday. Here is what you need to know:

REVENUE: Revenue increased 17% to $7.39 billion, rising 6.9% on

an organic basis, which excludes foreign exchange costs and

divested businesses. Analysts polled by Thomson Reuters had

expected $7.29 billion.

PROFIT: The company brought in a net income of $418 million, or

23 cents a share, compared to $419 million, or 24 cents a share in

the same quarter last year. On an adjusted basis, the company

brought in 59 cents a share in earnings, compared to the 58 cents

expected by analysts.

OUTLOOK: For 2018, the company expects adjusted EPS of $2.80 to

$2.90, compared to the $2.86 expected by Wall Street analysts.

CEO QUOTE: "We're particularly pleased with the continued strong

growth in Medical Devices and improving performance in our

Nutrition business," Chief Executive Miles White said.

ORGANIC GROWTH: It posted organic growth of 9.4% in its medical

devices division. In its nutrition unit, 4.7% organic growth was

driven by gains across Asia, including Greater China, U.S. market

share gains in the infant nutrition category and gains in Ensure

and Glucerna, its diabetes-specific nutrition brand.

SHARES: In pre-market trading, Abbott Laboratories shares fell

2%.

Write to Austen Hufford at Austen.Hufford@wsj.com

(END) Dow Jones Newswires

April 18, 2018 08:32 ET (12:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

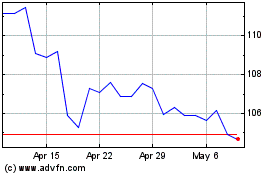

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2024 to May 2024

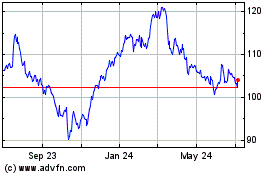

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From May 2023 to May 2024