Schroder Real Estate Significant Lettings Progress

March 02 2020 - 2:00AM

UK Regulatory

TIDMSREI

For release 2 March 2020

Schroder Real Estate Investment Trust Limited

("SREIT"/ the "Company" / "Group")

SIGNIFICANT LETTINGS PROGRESS

Schroder Real Estate Investment Trust, the actively managed UK-focused REIT,

provides an update on asset management activity.

Since 1 January, 16 new lettings, renewals and rent reviews have completed,

generating additional income of approximately GBP370,000 per annum. The Company

is currently actively progressing a number of other lettings which are

currently under offer that have the potential to generate additional annualised

income of GBP420,000 per annum.

Manchester, City Tower (mixed-use, GBP figures below represent SREIT's 25% share)

* Agreement for lease exchanged for a new ten year lease to Coalfire Systems,

a US based Cyber Risk Management advisor, for 5,500 sq ft situated on the

28th floor at GBP26 per sq ft, equating to GBP35,529 per annum. The tenant will

receive twelve months rent free, with a further three months if the break

is not exercised in the fifth year. The rent is in-line with the Estimated

Rental Value ("ERV") as at 30 December 2019.

* New short-term lease completed to Sheppard Robson, an architectural firm,

for 2,160 sq ft on 27th floor at GBP29.50 per sq ft equating to GBP15,900 per

annum. This compared with an ERV of GBP12,125 per annum. No rent free

incentive was granted.

* Following the recent letting to Lidl at City Tower good progress is being

made letting the ancillary retail and leisure. For example, a new ten year

letting has been completed with Triple Two Coffee for a 1,660 sq ft retail

unit at a rent of GBP17,500 per annum versus an ERV of GBP16,475 per annum in

return for 9 months rent free.

Norwich, Union Park (multi-let industrial estate)

* Agreement for lease exchanged for a new ten year term to Quentor Limited, a

motorsport manufacturer, for a 39,935 sq ft unit at a stepped rent rising

from GBP181,125 per annum (GBP4.50 per sq ft) in years 1 and 2, to GBP191,188 per

annum (GBP4.75 per sq ft) in year 3 and GBP201,250 per annum (GBP5.00 per sq ft)

in year 4 and 5. The tenant will receive six months rent free.

* New lease completed for a three year term to Qualitas Limited, a

telecommunications company, for a 3,400 sq ft unit at GBP5.34 per sq ft

equating to GBP18,260 per annum, in-line with ERV. The tenant will receive

four months rent free.

York, Clifton Park (office)

* Agreement completed with Balfour Beatty to remove the tenant break option

in June 2020 and fix the rent review at GBP138,348 per annum, equating to GBP

15.25 per sq ft, in return for six months rent free. The lease expires in

June 2025 and the new rent represents a 35% uplift on the previous headline

rent.

-ENDS-

For further information:

Schroder Real Estate Investment Management 020 7658 6000

Limited:

Duncan Owen / Nick Montgomery / Frank

Sanderson

Northern Trust: 01481 745529

James Machon

FTI Consulting: 020 3727 1000

Dido Laurimore / Richard Gotla

END

(END) Dow Jones Newswires

March 02, 2020 02:00 ET (07:00 GMT)

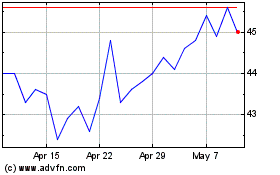

Schroder Real Estate Inv... (LSE:SREI)

Historical Stock Chart

From Mar 2024 to Apr 2024

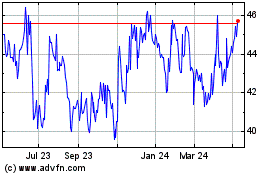

Schroder Real Estate Inv... (LSE:SREI)

Historical Stock Chart

From Apr 2023 to Apr 2024