TIDMSAV

RNS Number : 4795B

Savannah Resources PLC

21 September 2018

21 September 2018

Savannah Resources Plc

Interim Results

Savannah Resources plc (AIM: SAV, FWB: AFM and SWB: SAV)

('Savannah' or the 'Company'), the AIM quoted resource development

company, is pleased to announce its interim financial results for

the six months ended 30 June 2018.

HIGHLIGHTS

-- Portugal:

o Mineral Resource at the Mina do Barroso Lithium Project ("the

MdB Project") increased to over 20Mt (over 200,000t contained Li(2)

O) underpinning the project as the largest of its kind in Western

Europe

o Positive Scoping Study completed on the MdB Project - study

reports a base case pre-tax NPV(8%) of US$356m and pre-tax IRR of

63% generated from 175,000tpa of 6% spodumene concentrate

production over an 11 year life of mine

o Feasibility Study for the MdB Project on track for completion

Q2-2019

o MdB Project development decision expected Q2-2019

o Strong expansion potential - due diligence underway on option

to acquire Mining Lease application adjacent to the MdB Project and

rolling drill programme underway targeting resource upgrades and

expansions at the MdB Project

-- Oman: Awaiting anticipated decisions for Mining Lease

applications - Letters of No Objection received from all eight

Ministries for development of the Mahab 4 and Maqail South copper

projects

-- Mozambique: Mining Lease Applications submitted for Heavy

Mineral Sands project, and scoping phase of Pre-Feasibility Study

progressing

-- Corporate:

o Investments in intangible and exploration project assets of

GBP3.98m, primarily related to the MdB Project in Portugal

o Greatly strengthened cash position following GBP2.1m (gross)

equity raise completed at 5.5p per share in April 2018 and record

GBP12.5m (gross) equity raise at 9.0p per share in July 2018, which

included funds from existing shareholders and Tier 1 institutional

investors (Current cash position GBP11.4m)

o SAV now fully financed to development decision point for the

MdB Project

o Operating loss of GBP1.20m reflects the continued high tempo

of mine development activities

o Secondary listing completed on the Frankfurt Stock Exchange in

September 2018 to support increased European marketing

activities

CHAIRMAN'S STATEMENT

2018 to date has been a pivotal period for Savannah with the

acceleration of our work programmes at the Mina do Barroso lithium

Project ("the MdB Project"), culminating in a highly positive

Scoping Study on the asset and a 500%+ increase in its resource

base. The momentum created by this rapid and successful appraisal

programme allowed us to complete a record GBP12.5m equity financing

in July raised principally from existing shareholders and new

institutional investors. This will provide funding for the work

necessary to reach a mine development decision on the MdB Project,

and to progress our projects in Mozambique and Oman.

Mina do Barroso, Portugal

As the recent Scoping Study showed, the MdB Project's lithium

mineralogy and grade, along with its scale, near surface position

and geographical location combine to produce a very attractive

opportunity. Following the July 2018 fundraise, Savannah is now

fully financed past the expected mine development decision point in

Q2-2019 which is when the recently commissioned Feasibility Study

is due to have been completed.

This project is taking shape at a time of increasing pressure to

replace petrol and diesel cars with electric vehicles. For example,

the UK Government has set a target that three-fifths of new cars

should be electric by 2030 and that sales of conventional petrol

and diesel vehicles should be phased out by 2040. To deliver on

these targets, locking in supplies of key battery raw materials

such as lithium is critical.

With no current European producer of spodumene concentrate, the

dominant lithium mineral product traded internationally, we believe

the fast-tracked development of the MdB Project could help Savannah

become Western Europe's first major domestic spodumene supplier,

giving us a strong commercial advantage. Our recent secondary

listing on the Frankfurt Stock Exchange is the latest step in our

strategy to build our brand and investor base on the continent.

Critical to the viability of any mining project is its deposit.

The MdB Project has been proven to host Western Europe's largest

new spodumene (hard rock) lithium discovery. The Company recently

published its fourth Mineral Resource Estimate since acquiring the

project in May 2017. In that time Savannah has been able to

increase the overall Mineral Resource Estimate at the project by

over 500% to 20.1Mt with the contained lithium (Li O) inventory

growing by a similar percentage to 209,000t. This significant

increase in overall Mineral Resource Estimate tonnage and contained

metal has been accompanied by an equally significant increase in

the statistical confidence of the Mineral Resource Estimate. For

example, the latest estimate, announced on 10 September 2018,

placed over 50% of the 20.1Mt total in the higher, Measured and

Indicated JORC Resource categories, including 90% of the mining

inventory of Stage 1 of the Grandao pit as defined in the June 2018

Scoping Study. This bodes well for the maiden JORC-2012 Mineral

Reserve Estimate that will be taken from the Measured and Indicated

Resource Estimate as part of the Feasibility Study due for

completion in Q2-2019. Furthermore, the current JORC Exploration

Target* of 9-15Mt only includes the Grandao and Reservatorio

deposits. There is further upside potential from the other high

priority exploration targets within the project area.

*Cautionary Statement: The potential quantity and grade of the

Exploration Targets is conceptual in nature, there has been

insufficient exploration work to estimate a mineral resource and it

is uncertain if further exploration will result in defining a

mineral resource.

In June 2018, we completed a Scoping Study based on the then

current resource estimate of 13.9Mt. The study returned a base case

pre-tax NPV(8%) of US$356m and pre-tax IRR of 63%, with a Life of

Mine ('LOM') EBITDA of US$805m, annual average EBITDA of US$72m and

a pre-tax payback period of 1.7 years. These results are a very

positive indication of the project's commercial potential,

particularly given the increase in the resource estimate to 20.1 Mt

since the Scoping Study was carried out.

Drilling continues to advance across all three of our primary

target areas from which we have delineated the Mineral Resource

Estimate to date - Grandao, Reservatorio and NOA. In particular,

drilling results to date at Grandao have been very encouraging with

lithium mineralisation intersected over significant widths and

extensions to the known mineralised pegmatites, leading to the

discovery of a new Grandao Extended area. These extensions support

our belief in the potential for further increases in the Mineral

Resource Estimate. Experienced lithium consulting engineers,

Primero Group have been commissioned to lead a Feasibility Study

which is now underway to advance the project to the next point of

economic confidence so that a development decision can be made in

Q2-2019. Primero is a global leader in the evaluation, design and

construction of hard rock, open-cut, spodumene mines such as Mina

do Barroso.

In support of development, the project's estimated C1 cash costs

of US$210/t spodumene concentrate produced in the first four years

and US$271/t LOM average, put the project at the lower end of the

spodumene lithium cost curve. The initial CAPEX is estimated to be

US$109m. Based on these results, we are on track to become a

low-cost producer of quality spodumene lithium concentrate by

early-2020. We are working hard to deliver on this objective and

maximise shareholder value.

Looking at wider market dynamics, while some commentators have

suggested lithium prices will be affected by supply outweighing

demand, we remain confident in the commodity's prospects. We see a

need for several new mines to come into operation to meet projected

demand now and in the future. Even with new supply this year,

global contract prices for lithium salts remain strong. It is also

noteworthy that 28% of world's cumulative EV sales in H1-2018 have

been in Europe, but the continent currently has no lithium

production for battery grade chemicals, meaning all materials are

imported. Additionally, leading battery producers, like LG Chem and

Samsung SDI have opened or are planning to open battery plants in

Europe this year. Whilst there are a number of new lithium projects

vying to come on stream internationally, we believe our near-term

production potential, low cost profile, high quality product and

strategic location gives us a competitive edge.

Finally, looking at further growth opportunities, in July 2018

we entered into an exclusive due diligence and option agreement

with Aldeia & Irmão, S.A. ('Aldeia'), a private Portuguese

company, with a view to increasing our tenement holdings in the MdB

Project area. Under the terms of the agreement, we are looking to

acquire a Mining Lease, which, once granted, will include over

2.94km(2) of land abutting the southern end of the Reservatorio

target area. At least five known spodumene bearing lithium

pegmatites occur on these areas, and if acquired, this tenement not

only provides further resource expansion potential but also further

space to optimise the layout for any potential mine development.

Due diligence is now underway. All payments for the potential

acquisition will be on a staged basis and are expected to be made

principally from anticipated revenues generated from the MdB

Project mine, once developed.

Copper Projects, Oman

In Oman two high-grade, low CAPEX copper mine developments are

currently awaiting final licencing approval. Letters of approval or

"No Objection" have been received from all eight Ministries and we

are now working on concluding the mine licencing process with the

Public Authority of Mining for the issuance of the two Mining

Licences. In support of the overall strategy of developing a hub

and spoke copper development in Oman we have a drilling programme

underway on the promising Bayda and Hara Kilab copper deposits on

respectively Block 4 and Block 5 in Oman. These deposits could

provide further tonnages for the overall development.

Heavy Mineral Sands Projects, Mozambique

In Mozambique we are continuing to work on the world class

Mutamba Mineral Sands Project under a Consortium Agreement with Rio

Tinto. Three mining lease applications, covering a total area of

417km(2) for the Jangamo, Dongane, Ravene and Chilubane deposits,

are currently being considered by the Mozambican mines department.

Alongside this, work continues on several fronts in the lead up to

the anticipated grant of mining leases, with the scoping phase of

the Pre-Feasibility Study ('PFS') now well advanced and the initial

key studies underway. These studies include hydrology studies, port

options and the collection of a 10 tonne bulk sample, which will be

processed at our recently constructed and commissioned pilot plant.

The results from this test work and the PFS will guide us in the

infrastructure, power, mine planning and process plant

requirements, allowing us to progress to the next stage of

commercialisation.

Financial Summary

As is to be expected for an active and expanding resource

development group, Savannah is reporting a loss for the period of

GBP1.20m (30 June 2017: GBP1.53m) (31 December 2017: GBP2.84m),

which reflects the continued high tempo of mine development

activities. The decrease compared to the prior year is mainly due

to the non-cash costs relating to share options issued as long-term

incentives in H1-2017 amounting to GBP0.28m. Net assets have

increased to GBP15.68m (30 June 2017: GBP9.26m) (31 December 2017:

GBP13.14m) due to the increase in exploration activity during the

period, predominantly with the lithium project in Portugal, which

also saw the first of two milestones at the MdB Project being

triggered and settled, with additions to non-current assets

amounting to GBP3.61m.

In April 2018 Savannah raised GBP2.10m cash (before expenses)

that contributed towards the ongoing development of the Company's

projects in Portugal, Oman and Mozambique. After the reporting

date, in July 2018 the Company raised GBP12.5m cash (before

expenses). This has provided a current cash balance of GBP11.4m.

The Company's strong cash position means Savannah is fully funded

to deliver on the feasibility study of a mine development and to

add to the Mineral Resource inventory via a continuing programme of

resource drilling at the MdB Project, and to progress our projects

in Mozambique and Oman.

Outlook

The upcoming six months will be active for Savannah as we

finalise key economic studies at our MdB lithium project so that we

are able to make a development decision in Q2-2019. With low

technical risk thanks to its open pit mining and conventional

processing model, a quality resource that is proven to be highly

sought after by electric vehicle manufacturers, and a defined

development schedule that will see us commence concentrate

production in 2020, we are firmly focused on realising the full

value potential of this significant, near-term production

asset.

We believe that the MdB Project's spodumene lithium concentrate

will be highly sought after by end-users and look forward to

progressing discussions currently being undertaken with potential

offtake partners as part of our commercialisation process.

Alongside this, we will continue to prove up the resource potential

of the project, with drilling continuing to progress at pace, and

we are also completing due diligence with a view to increasing the

project area further via the proposed Aldeia acquisition. Both of

these work programmes have the potential to extend the current

11-year life of mine as defined in the Scoping Study and enhance

the already attractive economics of the project.

We look forward to updating shareholders on progress as we

advance the MdB Project further, maintaining the active development

approach we have implemented since first acquiring the project in

May 2017.

Finally, I would like to thank our long-term shareholders for

their continued support and also welcome the new investors to

Savannah's share register following our recent fundraise. We look

forward to continuing to build the value of our company for the

benefit of all stakeholders.

I would also like to give my thanks to our highly committed

management and operational team who have already proven their

ability to execute multiple fast-track work programmes to rapidly

build the value of our resource portfolio.

We look forward to delivering on the next commercial milestones

in the upcoming months.

Chairman

Matthew King

20 September 2018

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2018

Unaudited Unaudited Audited

Six months Six months Year ended

Notes to 30 June to 30 June 31 December

2018 2017 2017

GBP GBP GBP

CONTINUING OPERATIONS

Revenue - - -

Administrative expenses (1,126,994) (1,529,071) (2,835,684)

Impairment of assets classified

as held for sale (140,024) - -

Gain on disposal of investments 68,717 - -

OPERATING LOSS (1,198,301) (1,529,071) (2,835,684)

Finance income 342 - 948

Finance costs (3,841) (2,256) (7,549)

LOSS BEFORE AND AFTER TAX ATTRIBUTABLE

TO EQUITY OWNERS OF THE PARENT (1,201,800) (1,531,327) (2,842,285)

---------------------------------------- -------- ------------ ------------ -------------

OTHER COMPREHENSIVE INCOME

Items that will or may be reclassified

to profit or loss:

Change in market value of investments (58,665) (16,656) 45,644

Transfer to realised gain on

disposal of investments (68,717) - -

Exchange (losses)/gains on translation

of foreign operations 159,009 (54,052) (197,120)

---------------------------------------- -------- ------------ ------------ -------------

OTHER COMPREHENSIVE INCOME FOR

THE YEAR 31,627 (70,708) (151,476)

---------------------------------------- -------- ------------ ------------ -------------

TOTAL COMPREHENSIVE INCOME FOR

THE YEAR (1,170,173) (1,602,035) (2,993,761)

---------------------------------------- -------- ------------ ------------ -------------

Loss per share attributable

to equity owners of the parent

expressed in pence per share:

---------------------------------------- -------- ------------ ------------ -------------

Basic and diluted

From operations 3 (0.18) (0.31) (0.53)

---------------------------------------- -------- ------------ ------------ -------------

The notes form part of this Interim Financial Report.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2018

Unaudited Unaudited Audited

Notes 30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 4 13,907,901 7,888,034 9,809,994

Property, plant and equipment 5 1,195,292 197,729 1,196,084

Other receivables 6 270,876 165,852 239,300

Other non-current assets 7 215,681 - 220,213

---------------------------------- -------- ------------- ------------- -------------

TOTAL NON-CURRENT ASSETS 15,589,750 8,251,615 11,465,591

CURRENT ASSETS

Investments 32,168 107,816 170,203

Trade and other receivables 6 191,300 459,971 155,959

Other current assets 7 251,752 - 20,011

Cash and cash equivalents 786,764 1,294,539 2,455,968

---------------------------------- -------- ------------- ------------- -------------

1,261,984 1,862,326 2,802,141

Assets classified as held

for sale - - 138,543

TOTAL CURRENT ASSETS 1,261,984 1,862,326 2,940,684

---------------------------------- -------- ------------- ------------- -------------

TOTAL ASSETS 16,851,734 10,113,941 14,406,275

---------------------------------- -------- ------------- ------------- -------------

EQUITY AND LIABILITIES

SHAREHOLDERS' EQUITY

Share capital 9 7,016,155 5,345,401 6,358,504

Share premium 21,100,658 14,849,523 18,105,108

Foreign currency reserve 353,887 337,946 194,878

Warrant reserve 1,278,846 419,671 1,405,958

Share based payment reserve 600,416 752,523 691,194

Shares to be issued reserve 30,000 - -

Retained earnings (14,702,504) (12,448,310) (13,612,758)

TOTAL EQUITY ATTRIBUTABLE

TO EQUITY HOLDERS OF THE PARENT 15,677,458 9,256,754 13,142,884

LIABILITIES

NON-CURRENT LIABILITIES

Loans and borrowings 22,401 - 22,847

---------------------------------- -------- ------------- ------------- -------------

TOTAL NON-CURRENT LIABILITIES 22,401 - 22,847

---------------------------------- -------- ------------- ------------- -------------

CURRENT LIABILITIES

Loans and borrowings 6,630 - 10,276

Trade and other payables 8 1,145,245 857,187 1,228,757

---------------------------------- -------- ------------- ------------- -------------

1,151,875 857,187 1,239,033

Liabilities classified as

held for sale - - 1,511

---------------------------------- -------- ------------- ------------- -------------

TOTAL CURRENT LIABILITIES 1,151,875 857,187 1,240,544

TOTAL LIABILITIES 1,174,276 857,187 1,263,391

---------------------------------- -------- ------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 16,851,734 10,113,941 14,406,275

---------------------------------- -------- ------------- ------------- -------------

The interim financial report was approved by the Board of

Directors on 20 September 2018 and was signed on its behalf by:

........................................................

D S Archer

Chief Executive Officer

Company number: 07307107

The notes form part of this Interim Financial Report.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2018

Share Shares

Foreign based to be

Share Share currency Warrant payment issued Retained Total

capital premium reserve reserve reserve reserve earnings equity

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2017 4,509,465 11,226,706 391,998 386,794 455,309 - (10,900,327) 6,069,945

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

Loss for the

period - - - - - - (1,531,327) (1,531,327)

Other

comprehensive

income - - (54,052) - - - (16,656) (70,708)

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

Total

comprehensive

income for

the

period - - (54,052) - - - (1,547,983) (1,602,035)

Issue of share

capital (net

of expenses) 835,936 3,655,694 - - - - - 4,491,630

Issue of share

options - - - 297,214 - - 297,214

Lapse of - - - - - - -

options

Issue of

warrants - (32,877) - 32,877 - - - -

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

At 30 June

2017 5,345,401 14,849,523 337,946 419,671 752,523 - (12,448,310) 9,256,754

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

Loss for the

period - - - - - - (1,310,958) (1,310,958)

Other

comprehensive

income - - (143,068) - - - 62,300 (80,768)

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

Total

comprehensive

income for

the

period - - (143,068) - - - (1,248,658) (1,391,726)

Issue of share

capital (net

of expenses) 1,013,103 4,241,872 - - - - - 5,254,975

Issue of share

options - - - - 22,881 - - 22,881

Lapse of

options - - - - (84,210) - 84,210 -

Issue of

warrants - (986,287) - 986,287 - - - -

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

At 31 December

2017 6,358,504 18,105,108 194,878 1,405,958 691,194 - (13,612,758) 13,142,884

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

Loss for the

period - - - - - - (1,201,800) (1,201,800)

Other

comprehensive

income - - 159,009 - - - (127,382) 31,627

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

Total

comprehensive

income for

the

period - - 159,009 - - - (1,329,182) (1,170,173)

Issue of share

capital (net

of expenses) 657,651 2,995,550 - - - - - 3,653,201

Issue of share

options - - - - 21,546 - - 21,546

Exercise of

options - - - - (95,797) - 95,797 -

Lapse of

options - - - - (16,527) - 16,527 -

Exercise of

warrants - - - (35,972) - - 35,972 -

Lapse of

warrants - - - (91,140) - - 91,140 -

Warrants

pending

exercise - - - - - 30,000 - 30,000

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

At 30 June

2018 7,016,155 21,100,658 353,887 1,278,846 600,416 30,000 (14,702,504) 15,677,458

--------------- ------------ ------------ ------------ ---------- --------- --------- -------------- --------------

The notes form part of this Interim Financial Report.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 30 JUNE 2018

Notes Unaudited Unaudited Audited

Six months Six months Year ended

to June to June December

2018 2017 2017

GBP GBP GBP

Cash flows used in operating

activities

Loss for the period (1,201,800) (1,531,327) (2,842,285)

Depreciation and amortisation

charges 5 10,427 728 14,895

Impairment of assets classified

as held for sale 140,024 - -

Gain on disposal of investments (68,717) - -

Share based payments reserve

charge 21,546 297,214 320,095

Shares issued in lieu of payments

to extinguish liabilities - 82,431 98,630

Finance income (342) - (948)

Finance expense 3,841 2,256 7,549

Exchange losses (23,111) 47,925 75,156

Cash flow from operating activities

before changes in working capital (1,118,132) (1,100,773) (2,326,908)

Increase in trade and other

receivables (32,286) (466,095) (71,288)

(Decrease)/Increase in trade

and other payables (51,903) 218,251 39,620

--------------------------------------- -------- ------------- ------------- -------------

Net cash used in operating activities (1,202,321) (1,348,617) (2,358,576)

--------------------------------------- -------- ------------- ------------- -------------

Cash flow used in investing

activities

Purchase of intangible exploration

assets (2,487,352) (1,471,957) (3,276,715)

Purchase of tangible fixed assets (221,885) (120,816) (1,069,056)

Purchase of investments - - (87)

Proceeds from sale of investments 104,283 - -

Payments for guarantees for

mining activity (231,741) - (199,755)

Interest received 342 - 948

--------------------------------------- -------- ------------- ------------- -------------

Net cash used in investing activities (2,836,353) (1,592,773) (4,544,665)

--------------------------------------- -------- ------------- ------------- -------------

Cash flow from / (used in) financing

activities

Proceeds from issues of ordinary

shares (net of expenses) 2,348,287 3,093,000 8,257,418

Proceeds from warrants pending

exercise 30,000 - -

Interest paid (3,841) (2,256) (7,549)

--------------------------------------- -------- ------------- ------------- -------------

Net cash from financing activities 2,374,446 3,090,744 8,249,869

--------------------------------------- -------- ------------- ------------- -------------

(Decrease)/Increase in cash

and cash equivalents (1,664,228) 149,354 1,346,628

Cash and cash equivalents at

beginning of period 2,455,968 1,172,347 1,172,347

Exchange (losses)/gains on cash

and cash equivalents (4,976) (27,162) (63,007)

--------------------------------------- -------- ------------- ------------- -------------

Cash and cash equivalents at

end of period 786,764 1,294,539 2,455,968

--------------------------------------- -------- ------------- ------------- -------------

The notes form part of this Interim Financial Report.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT

FOR THE SIX MONTHSED 30 JUNE 2018

1. BASIS OF PREPARATION

The financial information set out in this report is based on the

consolidated financial statements of Savannah Resources Plc and its

subsidiary companies (together referred to as the 'Group'). The

interim financial report of the Group for the six months ended 30

June 2018, which is unaudited, was approved by the Board on 20

September 2018. The financial information contained in this interim

report does not constitute statutory accounts as defined by s434 of

the Companies Act 2006. The statutory accounts for the year ended

31 December 2017 have been filed with the Registrar of Companies.

The auditors' report on those accounts was unqualified and did not

contain a statement under section 498 (2) or 498 (3) of the

Companies Act 2006.

The financial information set out in this report has been

prepared in accordance with the accounting policies set out in the

Annual Report and Financial Statements of Savannah Resources Plc

for the year ended 31 December 2017. New standards and amendments

to IFRS effective as of 1 January 2018, including IFRS 15 and IFRS

9, have been reviewed by the Group and there has been no material

impact on the financial information set up on this report as a

result of these standards and amendments.

The Group interim financial report is presented in Pound

Sterling.

Going Concern

The financial statements have been prepared on a going concern

basis. Following the cash subscriptions approved in July 2018,

amounting to GBP12.5m (before expenses) (Note 12), the Group had a

cash balance of GBP11.4m on 20 September 2018. The Directors have

reviewed the cashflow projection for the Group and consider that it

has sufficient ability to meet its financial commitments for at

least 12 months.

2. SEGMENTAL REPORTING

The Group complies with IFRS 8 Operating Segments, which

requires operating segments to be identified on the basis of

internal reports about components of the Group that are regularly

reviewed by the chief operating decision maker, which the Company

considers to be the Board of Directors. In the opinion of the

Directors, the operations of the Group comprise of exploration and

development in Oman, exploration and development in Mozambique,

exploration and development in Portugal, former exploration in

Finland, headquarter and corporate costs and the Company's third

party investments.

Based on the Group's current stage of development there are no

external revenues associated to the segments detailed below. For

exploration and development in Oman, Mozambique, Portugal and

former exploration in Finland the segments are calculated by the

summation of the balances in the legal entities which are readily

identifiable to each of the segmental activities. In the case of

the Investments, this is calculated by analysis of the specific

related investment instruments. Recharges between segments are at

cost and included in each segment below. Inter-company loans are

eliminated to zero and not included in each segment below.

Oman Mozambique Portugal Finland HQ and Invest-ments Elimination Total

Copper Mineral Lithium Lithium Corporate

Sands

GBP GBP GBP GBP GBP GBP GBP GBP

Period 30

June 2018

Revenue - - - - 434,235 - (434,235) -

Interest

income - - - - 342 - - 342

Finance

costs - (3,841) - - - - - (3,841)

Share based

payments - - - - 21,546 - - 21,546

(Loss) for

the year (122,251) (249,791) (184,437) (144,196) (569,842) 68,717 - (1,201,800)

Total assets 4,632,337 4,928,165 6,558,838 2,343 697,883 32,168 - 16,851,734

Total

non-current

assets 4,510,283 4,619,171 6,449,096 - 11,200 - - 15,589,750

Additions

to

non-current

assets 201,272 206,447 3,609,894 - - - - 4,017,613

Total

current

assets 122,055 308,994 109,741 2,343 686,683 32,168 - 1,261,984

Total

liabilities (100,964) (105,335) (734,360) (2,098) (231,519) - - (1,174,276)

------------- ---------- ------------ ---------- ---------- ----------- -------------- ------------- ------------

Oman Mozambique Portugal Finland HQ and Invest-ments Elimination Total

Copper Mineral Lithium Lithium Corporate

Sands

GBP GBP GBP GBP GBP GBP GBP GBP

Period 31

December

2017

Revenue - - - - 639,108 (639,108) -

Interest

income - - - - 948 - - 948

Finance

costs (2,035) (1,166) - - (4,348) - - (7,549)

Share based

payments - - - - 320,095 - - 320,095

(Loss) for

the year (308,616) (631,731) (171,056) (8,164) (1,722,718) - - (2,842,285)

Total assets 4,365,898 4,640,081 2,902,257 138,543 2,189,293 170,203 - 14,406,275

Total

non-current

assets 4,224,672 4,387,977 2,833,907 - 19,035 - - 11,465,591

Additions

to

non-current

assets 951,312 2,801,960 2,823,802 - 19,035 - - 6,596,109

Total

current

assets 141,226 252,104 68,350 138,543 2,170,258 170,203 - 2,940,684

Total

liabilities (112,807) (398,825) (411,302) (1,511) (338,946) - - (1,263,391)

------------- ---------- ------------ ---------- --------- ------------ -------------- ------------- ------------

Oman Mozambique Portugal Finland HQ and Elimination Total

Copper Mineral Lithium Lithium Corporate

Sands

GBP GBP GBP GBP GBP GBP

Period 30

June 2017

Revenue - - - - 254,214 (254,214) -

Finance costs - 1,370 - - 886 - 2,256

Share based

payments 11,963 44,370 - - 240,881 - 297,214

(Loss) /

Gain for

the year (187,211) (281,801) (25,600) (4,980) (1,031,735) - (1,531,327)

Total assets 3,939,037 2,695,063 2,120,317 132,740 1,226,784 - 10,113,941

Total

non-current

assets 3,844,054 2,177,590 2,094,898 127,690 7,383 - 8,251,615

Additions

to

non-current

assets 457,852 640,400 2,094,128 5,103 7,382 - 3,204,865

Total current

assets 94,982 517,474 25,419 5,050 1,219,401 - 1,862,326

Total

liabilities (110,431) (395,701) (92,244) (4,831) (253,980) - (857,187)

--------------- ------------ ------------- ------------ ---------- -------------- -------------- --------------

3. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to the ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

In accordance with IAS 33 as the Group is reporting a loss for

both this and the preceding period the share options are not

considered dilutive because the exercise of share options and

warrants would have the effect of reducing the loss per share.

Reconciliations are set out below:

Unaudited Unaudited Audited

Six months Six months Year ended

to 30 June to 30 June 31 December

2018 2017 2017

Basic loss per share:

Loss from operations attributable

to ordinary shareholders (GBP) (1,201,800) (1,531,327) (2,842,285)

Loss attributable to ordinary

shareholders (GBP) (1,201,800) (1,531,327) (2,842,285)

----------------------------------- -------------- -------------- --------------

Weighted average number of shares

(number) 667,935,800 490,020,180 538,585,436

----------------------------------- -------------- -------------- --------------

Loss per share from operations

(pence) 0.18 0.31 0.53

Basic and diluted loss per share

(pence) 0.18 0.31 0.53

----------------------------------- -------------- -------------- --------------

4. INTANGIBLE ASSETS

Exploration

and evaluation

assets

GBP

At 1 January 2017 5,066,750

Additions 2,897,871

Exchange differences (76,587)

--------------------------------- ----------------

At 30 June 2017 7,888,034

Additions 2,142,425

Transfer to Assets classified

as Held for Sale (118,804)

Exchange difference (101,661)

--------------------------------- ----------------

At 31 December 2017 9,809,994

--------------------------------- ----------------

Additions 3,984,416

Exchange differences 113,491

--------------------------------- ----------------

At 30 June 2018 13,907,901

--------------------------------- ----------------

5. PROPERTY, PLANT AND EQUIPMENT

Motor Plant and

vehicles Office Equipment Machinery Land Total

GBP

Cost

At 1 January

2017 36,607 11,401 - - 48,008

Additions 6,991 1,735 119,081 44,819 172,626

Exchange difference (2,833) (174) 9,528 1,116 7,637

---------------------- ---------- ----------------- ----------- ------- ----------------

At 30 June 2017 40,765 12,962 128,609 45,935 228,271

---------------------- ---------- ----------------- ----------- ------- ----------------

Additions 34,206 11,025 924,940 837 971,008

Exchange difference 392 (75) 40,916 (497) 40,736

---------------------- ---------- ----------------- ----------- ------- ----------------

At 31 December

2017 75,363 23,912 1,094,465 46,275 1,240,015

---------------------- ---------- ----------------- ----------- ------- ----------------

Additions - 7,853 590 - 8,443

Exchange differences 557 354 1,430 (170) 2,171

---------------------- ---------- ----------------- ----------- ------- ----------------

At 30 June 2018 75,920 30,412 1,096,485 46,105 1,250,629

---------------------- ---------- ----------------- ----------- ------- ----------------

Depreciation

At 1 January 2017 21,164 10,674 - - 31,838

Charge for the

year 728 - - - 728

Exchange difference (1,598) (426) - - (2,024)

---------------------- -------- ------- --------

At 30 June 2017 20,294 10,248 - - 30,542

---------------------- -------- ------- --------

Charge for the

year 11,811 2,356 - - 14,167

Exchange difference (461) (317) - - (778)

---------------------- -------- ------- --------

At 31 December

2017 31,644 12,287 - - 43,931

---------------------- -------- ------- --------

Charge for the

year 9,290 1,137 - - 10,427

Exchange differences 774 205 - - 979

---------------------- -------- ------- --------

At 30 June 2018 41,708 13,629 - - 55,337

---------------------- -------- ------- --------

Net Book Value

At 30 June 2017 20,471 2,714 128,609 45,935 197,729

At 31 December

2017 43,719 11,625 1,094,465 46,275 1,196,084

----------------- ------- ------- ---------- ------- ----------

At 30 June 2018 34,212 16,783 1,096,485 46,105 1,195,292

----------------- ------- ------- ---------- ------- ----------

6. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

30 June 2018 30 June 2017 31 December

2017

GBP GBP GBP

Non-Current

Other receivables

- VAT 270,876 82,551 239,300

Other receivables

- Deposits - 83,301 -

-------------- -------------- -------------

270,876 165,852 239,300

-------------- -------------- -------------

Current

VAT recoverable 96,880 25,263 51,069

Other receivables 94,420 434,708 104,890

-------- -------- --------

191,300 459,971 155,959

-------- -------- --------

7. OTHER NON-CURRENT ASSETS

Unaudited Unaudited Audited

30 June 2018 30 June 2017 31 December

2017

GBP GBP GBP

Non-Current

Guarantees 202,237 - 199,755

Other receivables

- Deposits 13,444 - 20,458

-------------- -------------- -------------

215,681 - 220,213

-------------- -------------- -------------

Current

Guarantees 251,752 - 20,011

251,752 - 20,011

-------- -------

8. TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

30 June 2018 30 June 2017 31 December

2017

GBP GBP GBP

Current

Trade payables 647,636 286,985 481,436

Other payables 30,403 25,431 45,054

Accruals and deferred

income 467,206 544,771 702,267

1,145,245 857,187 1,228,757

-------------- -------------- -------------

9. SHARE CAPITAL

Allotted, issued and fully paid

Six months to Six months to Year ended

30 June 2018 30 June 2017 31 December 2017

GBP0.01 GBP0.01 GBP0.01

ordinary ordinary ordinary

shares shares shares

number GBP number GBP number GBP

At beginning of period 635,850,386 6,358,504 450,946,455 4,509,465 450,946,455 4,509,465

Issued during the

period:

Share placement 38,181,818 381,818 61,904,764 619,047 161,423,950 1,614,239

Bonus paid in shares - - 1,688,870 16,889 1,688,870 16,889

Exercise of share

options 4,708,336 47,083 - - - -

Exercise of warrants 1,875,000 18,750 - - - -

In lieu of cash for

acquisition of Portugal

lithium project 20,000,000 200,000 20,000,000 200,000 21,791,111 217,911

Issued as condition

of JV agreement 1,000,000 10,000 - - - -

-------------------------- ------------ ---------- ------------- ---------- ------------ ----------

At end of period 701,615,540 7,016,155 534,540,089 5,345,401 635,850,386 6,358,504

-------------------------- ------------ ---------- ------------- ---------- ------------ ----------

The par value of the Company's shares is GBP0.01.

10. GROUP CONTINGENT LIABILITIES

Details of contingent liabilities where the probability of

future payments is not considered remote are set out below, as well

as details of contingent liabilities, which although considered

remote, the Directors consider should be disclosed. The Directors

are of the opinion that provisions are not required in respect of

these matters, as at the reporting date have not been triggered, it

is not probable that a future sacrifice of economic benefits will

be required or the amount is not capable of reliable

measurement.

Deferred consideration payable in relation to the acquisition of

Gentor Resources Ltd (Oman copper project)

On 15 July 2014 the Company completed an acquisition of

interests in the highly prospective Block 5 and Block 6 copper

projects in the Semail Ophiolite belt in the Sultanate of Oman from

the TSX-Venture listed Gentor Resources Inc. The Company paid

initial consideration of USD $800,000 (GBP GBP615,000) with the

following deferred consideration (up to 50% payable in Savannah

shares) required to complete the acquisition of 100% of the issued

share capital of Gentor Resources Ltd ("GRL"):

(a) a milestone payment of USD $1,000,000 (GBP GBP769,000) upon

a formal final investment decision for the development of the Block

5 Licence;

(b) a milestone payment of USD $1,000,000 (GBP GBP769,000) upon

the production of the first saleable concentrate or saleable

product from ore derived from the Block 5 Licence; and

(c) a milestone payment of USD $1,000,000 (GBP GBP769,000)

within six months of the payment of the Deferred Consideration in

(b).

Deferred consideration payable in relation to the acquisition of

Slipstream PORT Pty Ltd (Portugal lithium project)

On 24 May 2017 the Group acquired a series of highly prospective

lithium projects with near-term production potential in the north

of Portugal. The Group paid an initial consideration of AUD$

1,000,000 (GBP GBP591,000) in cash and issued 20,000,000 ordinary

shares in the Company. Additional milestone payments, to be

satisfied by cash and the issue of ordinary shares in SAV, are

payable as follows:

(a) AUD$ 1,500,000 (GBP GBP886,500) cash and a further

20,000,000 ordinary shares of SAV upon the announcement by SAV of a

JORC-compliant Indicated Mineral Resource Estimate of 7.5 million

tonnes at no less than 1% Li(2) O. In February 2018 the Company

announced the completion of a revised JORC 2012 - Compliant

Inferred Mineral Resource Estimate of 9.1Mt at 1.03% Li(2) O and

this milestone was triggered. The Company paid AUD$ 1,500,000 (GBP

GBP842,028) in cash and issued 20,000,000 ordinary shares in the

Company in March 2018. This has been accounted for in this

financial report.

(b) AUD$1,500,000 (GBP GBP886,500) cash and an additional

20,000,000 ordinary shares of SAV upon the announcement by SAV of a

further JORC-compliant Indicated Mineral Resource Estimate of a

minimum of 7.5m tonnes at no less than 1% Li(2) O. In September

2018 the Company announced the completion of a revised JORC 2012 -

Compliant Inferred Mineral Resource Estimate of 20.1Mt at 1.04%

Li(2) O and this milestone was triggered (Note 12). This has not

been accounted for in this financial report as the milestone was

reached after the reporting date.

11. SHARE OPTIONS AND WARRANTS

Share options and warrants to subscribe for Ordinary Shares in

the Company are granted to certain employees, Directors and

investors. Some of the options issued vest immediately and others

over a vesting period and may include performance conditions.

Options are forfeited if the employee leaves the Group before the

options vest.

The Directors' interests in the share options and warrants of

the Company are as follows:

At 30 June 2018

Quantity Quantity Lapsed Options Exercise Date of First Final

at granted during / Warrants price the grant date date

1 Jan 2018 during the at of exercise of exercise

the period period 30 Jun

2018

Share

Options

Dale

Ferguson 5,321,776 - - 5,321,776 3.0p 21/07/13 20/07/14 20/07/18

Dale

Ferguson 2,000,000 - - 2,000,000 7.59p 01/03/17 01/03/17 28/02/21

Matthew

King 1,500,000 - - 1,500,000 3.0p 16/03/16 16/03/16 15/03/20

David Archer 7,000,000 - - 7,000,000 7.59p 01/03/17 01/03/17 28/02/21

Investor

Warrants

David Archer 11,111,112 - - 11,111,112 3.0p 24/09/13 24/09/13 19/07/18

David Archer 2,857,143 - - 2,857,143 6.0p 14/07/17 14/07/17 14/07/20

At 31 December 2017

Quantity Quantity Lapsed Options Exercise Date of First Final

at granted during / Warrants price the grant date date

30 June during the at of exercise of exercise

2017 the period period 31 Dec

2017

Share

Options

Dale

Ferguson 5,321,776 - - 5,321,776 3.0p 21/07/13 20/07/14 20/07/18

Dale

Ferguson 2,000,000 - - 2,000,000 7.59p 01/03/17 01/03/17 28/02/21

Matthew

King 1,500,000 - - 1,500,000 3.0p 16/03/16 16/03/16 15/03/20

David Archer 7,000,000 - - 7,000,000 7.59p 01/03/17 01/03/17 28/02/21

Warrants

David Archer 11,111,112 - - 11,111,112 3.0p 24/09/13 24/09/13 19/07/18

David Archer - 2,857,143 - 2,857,143 6.0p 14/07/17 14/07/17 14/07/20

At 30 June 2017

Quantity Quantity Lapsed Options Exercise Date of First Final

at granted during / Warrants price the grant date date

1 Jan 2017 during the at of exercise of exercise

the period period 30 Jun

2017

Share

Options

Dale

Ferguson 5,321,776 - - 5,321,776 3.0p 21/07/13 20/07/14 20/07/18

Dale

Ferguson - 2,000,000 - 2,000,000 7.59p 01/03/17 01/03/17 28/02/21

Matthew

King 1,500,000 - - 1,500,000 3.0p 16/03/16 16/03/16 15/03/20

David Archer 7,000,000 - 7,000,000 7.59p 01/03/17 01/03/17 28/02/21

Investor

Warrants

David Archer 11,111,112 - - 11,111,112 3.0p 24/09/13 24/09/13 19/07/18

12. EVENTS AFTER THE REPORTING DATE

In July 2018 the Company approved a cash Placing and

Subscription of GBP11.5m (before expenses) through the issue of

128,347,256 ordinary shares at an issue price of 9 pence per share.

Additionally, the Company received letter of intent for an

additional GBP1m cash subscription from Directors' related party

(Al Marjan Ltd) for when the Company is not in a "close period".

Subsequently Al Marjan acted upon this letter of intent and

subscribed for 11,111,111 ordinary shares at a price of 9 pence per

share, giving gross proceeds of GBP12.5m (together with the Placing

and Subscription).

In July 2018 the Company issued 860,000 new ordinary shares in

respect of 2016 Investors warrants at an exercise price of 6 pence

per share following the exercise of warrants, for proceeds of

GBP0.05m.

In July 2018 the Company issued 19,382,888 new ordinary shares

following the exercise of options and warrants over Ordinary

Shares. David Stuart Archer exercised Warrants over 11,111,112

Ordinary Shares at 3 pence each. Dale John Ferguson exercised

Options over 5,321,776 Ordinary Shares at 3 pence each. Other

employees exercised 1,200,000 Options, 1,500,000 Options and

250,000 Options at an exercise price of 4.62, 3.00 and 6.75 pence

each respectively, for proceeds of GBP0.61m.

In August 2018, the Company granted 343,432 warrants over

ordinary shares in the Company to a financial advisor of the

Company in connection with the Company's fundraise in July

2018.

In September 2018 the Company announced the completion of a

revised JORC 2012 - Compliant Inferred Mineral Resource Estimate of

20.1Mt at 1.04% Li(2) O. This triggered the second deferred

consideration (Milestone (b)) to be paid under the acquisition

agreement of Slipstream PORT Pty Ltd (Note 10). The Company is due

to pay AUD$ 1,500,000 (GBP GBP834,000) in cash and issue 20,000,000

ordinary shares in the Company in October 2018.

SHAREHOLDING

Shareholders as at 31 August 2018 which hold more than 3% in the

Company is disclosed as follows:

Beneficial owners (the ultimate underlying shareholders holding

shares either directly or indirectly through a bank, broker-dealer,

trust, or combination of these, which are the registered

shareholders):

Percentage

of Issued

Shareholder Shares Held Capital

Al Marjan Limited 208,262,589 24.18%

Husain Salman Ghulam Al-Lawati 42,019,792 4.88%

David Archer 41,756,649 4.85%

Slipstream Resources Investments

Pty Ltd 30,000,000 3.48%

Mr Karl-Erik von Bahr 30,052,525 3.49%

Total 352,091,555 40.88%

---------------------------------- ------------ -----------

Total Number of shares on issue 861,316,795

Registered shareholders (the shareholders holding shares

directly with the Company, either on its behalf or on behalf of the

beneficiary owner):

Percentage

of Issued

Shareholder Shares Held Capital

Al Marjan Limited 208,262,589 24.18%

Hargreaves Lansdown (nominees)

Limited 78,840,653 9.15%

Interactive Investor Services

Nominees Limited 47,702,560 5.54%

Hussain Salman Ghulam Al- Lawati 42,019,792 4.88%

Nortrust Nominees Limited 36,781,138 4.27%

Barclays Direct Investing Nominees

Limited 34,514,062 4.01%

Slipstream Resources Investments

Pty Ltd 30,000,000 3.48%

Securities Services Nominees

Limited 28,196,462 3.27%

------------------------------------ ------------ -----------

Total 506,317,256 58.78%

------------------------------------ ------------ -----------

Total Number of shares on issue 861,316,795

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Competent Person and Regulatory Information

The information in this announcement that relates to exploration

results is based upon information compiled by Mr Dale Ferguson,

Technical Director of Savannah Resources Limited. Mr Ferguson is a

Member of the Australasian Institute of Mining and Metallurgy

(AusIMM) and has sufficient experience which is relevant to the

style of mineralisation and type of deposit under consideration and

to the activity which he is undertaking to qualify as a Competent

Person as defined in the December 2012 edition of the "Australasian

Code for Reporting of Exploration Results, Mineral Resources and

Ore Reserves" (JORC Code). Mr Ferguson consents to the inclusion in

the report of the matters based upon the information in the form

and context in which it appears.

The Information in this report that relates to Mineral Resources

is based on information compiled by Mr Paul Payne, a Competent

Person who is a Fellow of the Australasian Institute of Mining and

Metallurgy. Mr Payne is a full-time employee of Payne Geological

Services. Mr Payne has sufficient experience that is relevant to

the style of mineralisation and type of deposit under consideration

and to the activity being undertaken to qualify as a Competent

Person as defined in the 2012 Edition of the "Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves". Mr Payne consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

**ENDS**

For further information please visit www.savannahresources.com

or contact:

David Archer Savannah Resources Tel: +44 20 7117

plc 2489

David Hignell / Dugald Northland Capital Tel: +44 20 3861

J. Carlean (Nominated Partners Ltd 6625

Adviser)

Christopher Raggett finnCap Ltd Tel: +44 20 7220

/ Camille Gochez (Broker) 0500

Grant Barker (Equity Whitman Howard Tel: +44 020 7659

Adviser) 1225

Charlotte Page / Lottie St Brides Partners Tel: +44 20 7236

Wadham (Financial PR) Ltd 1177

About Savannah

We are a diversified resources group (AIM: SAV) with a portfolio

of energy metals projects - lithium in Portugal and copper in Oman

- together with the world-class Mutamba Heavy Mineral Sands Project

in Mozambique, which is being developed in a consortium with the

global major Rio Tinto. We are committed to serving the interests

of our shareholders and to delivering outcomes that will improve

the lives of our staff and the communities we work with.

The Company is listed and regulated on AIM and the Company's

ordinary shares are also available on the Quotation Board of the

Frankfurt Stock Exchange (FWB) under the symbol FWB: AFM, and the

Börse Stuttgart (SWB) under the ticker "SAV".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEIESSFASESU

(END) Dow Jones Newswires

September 21, 2018 02:00 ET (06:00 GMT)

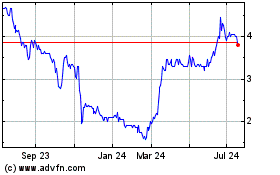

Savannah Resources (LSE:SAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

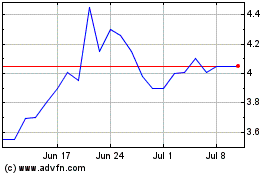

Savannah Resources (LSE:SAV)

Historical Stock Chart

From Apr 2023 to Apr 2024