TIDMONE

RNS Number : 0246R

Oneiro Energy PLC

24 October 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310

24 October 2023

Oneiro Energy plc

("Oneiro" or the "Company")

Half Yearly Results for the 6 Months to 31 July 2023

Oneiro plc (LSE:ONE), the LSE-quoted Company focused on energy

transition, is pleased to announce its unaudited financial results

for the 6 months to 31 July 2023 (the "Interims"). The full report

of the Interims is being published on the Company's website

(https://oneiro.energy/investors/) today, with key elements

extracted below.

For further information, please contact:

Oneiro Energy plc

Robert Jones

c/o Peterhouse Capital Limited

+44 (0) 20 7469 0930

Allenby Capital Limited (Financial Adviser)

Nick Harriss / Alex Brearley / Lauren Wright

+44 (0) 20 3328 5656

Peterhouse Capital Limited (Broker)

Lucy Williams / Duncan Vasey

+44 (0) 20 7469 0930

Company Registration Number 13139365 (England and Wales)

ONEIRO ENERGY PLC

UNAUDITED HALF YEAR RESULTS

FOR THE SIX MONTHSED 31 JULY 2023

Chairman's Statement

I am pleased to present the results for the six-month period

ending 31 July 2023.

Strategic focus

The Company's current strategic priority is to identify,

evaluate and rank potential reverse takeover (RTO) targets in the

energy space, utilising our strong in-house expertise. Exploration

& appraisal activities have been led by Rob Jones, a former

Head of Exploration at Cairn Energy, supported by Rod Murray who is

an experienced oilfield operations manager.

Scope

To date, our search has focused primarily on transition energy

natural gas plays, de-risked by existing discoveries and

encompassing sizable upside exploration targets. Initially

spreading the search through North, Central and South America, West

Africa and South-East Asia the Company has compiled and high graded

a number of opportunities. These are ranked and risked reflecting

the best net present value (NPV) and Expected Monetary Value (EMV)

value moving forward through acquisition and speculative resource

addition.

Opportunities

Opportunities reviewed have included a West African play with

1.6 Trillion Cubic Feet (TCF) P50 prospective resource, a Gulf of

Mexico 1.1TCF prospective resource and a South-East Asian 800

Billion Cubic Feet (BCF) discovery with multi TCF exploration

upside potential.

The Board has been pleased with the quality of the opportunities

they have had a chance to review so far and are working to compile

a shortlist which they believe would be attractive to current and

future shareholders. We look forward to updating the market when

circumstances allow.

Corporate Changes

Moving on from the Company's GBP1.2m (gross) Placing and

Admission to the Official List (by way of a Standard Listing) in

May 2023, we have made two key appointments. Firstly, we have

appointed an independent Non-Executive Chairman and secondly

Allenby Capital has come on board as Financial Adviser.

Financial results and current financial position

The Company generated a loss of GBP265,777 in the six month

period ended 31 July 2023 as it continued with its current

strategic priority of identifying, evaluating and executing a RTO

in the energy space.

Cash and cash equivalents as at 31 July 2023 were

GBP969,924.

Warrants

On admission to the London Stock Exchange on 25 May 2023, the

company granted the following warrants to certain investors and

Directors of the company.

Please refer to Note 8 for details of warrants that were granted

to Directors.

I would like to take this opportunity to thank my fellow

Directors, management and advisors for their continued support and

hard work. I remain confident that the Company is well-placed to

execute a successful RTO in the near-term.

Andy Yeo

Non-executive Chairman

24 October 2023

Statement of Comprehensive Income

For the half-year ended 31 July 2023

Statement of Financial Position

At 31 July 2023

Statement of Changes in Equity

For the half-year ended 31 July 2023

Statement of Cash Flows

For the half-year ended 31 July 2023

Principal accounting policies for the Financial Statements

For the half-year ended 31 July 2023

Reporting entity

Oneiro Energy plc (the "Company") is a company incorporated and

registered in England and Wales, with a company registration number

of 13139365. The address of the Company's registered office is

1(st) Floor, 5-6 Argyll Street, London, England, W1F 7TE.

Basis of preparation

The interim financial statements for the half-year ended 31 July

2023 are prepared in accordance with IFRS as adopted by the UK and

IAS 34 'Interim Financial Reporting'. The same accounting policies

are followed in this set of interim financial statements as

compared with the most recent audited annual financial statements

for the year ended 31 January 2023.

The financial information relating to the half-year ended 31

July 2023 is unaudited and does not constitute statutory financial

statements as defined in section 434 of the Companies Act 2006. The

comparative figures for the year ended 31 January 2023 have been

extracted from the annual financial statements, of which the

auditors gave an unqualified audit opinion. The annual financial

statements for the year ended 31 January 2023 has been filed with

the Registrar of Companies.

The Company's financial risk management objectives and policies

are consistent with those disclosed in the year ended 31 January

2023 annual financial statements.

The half-yearly report was approved by the board of directors on

24 October 2023.

Changes in accounting standards, amendments and

interpretations

The accounting policies adopted in the preparation of the

financial information for the half-year ended 31 July 2023 are

consistent with those followed in the preparation of the Company's

annual financial statements for the year ended 31 January 2023. An

additional policy for share based payments was adopted in relation

to the share warrants that were granted to Directors during the

period.

(a) Share-based payments

The company allows for Directors to acquire shares of the

company and all options and warrants are equity-settled. The fair

value of options granted is recognised as an expense with a

corresponding increase in equity. The fair value is measured at

grant date and spread over the period during which the Directors or

employees become unconditionally entitled to the options. The fair

value of the options granted is measured using the Black-Scholes

model, taking into account the terms and conditions upon which the

options were granted. The amount recognised as an expense is

adjusted to reflect the actual number of share options that

vest.

At the date of authorisation of the financial statements, the

following amendments to Standards and Interpretations issued by the

IASB that are effective for an annual period that begins on or

after 1 January 2023. These have not had any material impact on the

amounts reported for the current and prior periods.

Standard or Interpretation Effective Date

IFRS 17 - Insurance Contracts 1 January 2023

IAS 8 - Definition of Accounting Estimates 1 January 2023

IAS 1 - Disclosure of Accounting Policies 1 January 2023

IAS 12 - Deferred Tax Arising from a Single Transaction 1

January 2023

Initial Application of IFRS 17 and IFRS 9 - Comparative

Information

1 January 2023

New and revised Standards and Interpretations in issue but not

yet effective

At the date of authorisation of these financial statements, the

Company has not early adopted the following amendments to Standards

and Interpretations that have been issued but are not yet

effective:

Standard or Interpretation Effective Date

IAS 1 Classification of liabilities as current or

non-current

1 January 2024

IAS 1 - Non-current liabilities with covenants 1 January

2024

IFRS 7 - Supplier finance arrangements 1 January 2024

IFRS 16 - Lease liability in a Sale and Leaseback 1 January

2024

As yet, none of these have been endorsed for use in the UK and

will not be adopted until such time as endorsement is confirmed.

The directors do not expect any material impact as a result of

adopting standards and amendments listed above in the financial

year they become effective.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of financial statements in conformity with IFRS

as adopted by the UK requires management to make judgments,

estimates and assumptions that affect the application of policies

and reported amounts of assets and liabilities, income and

expenses.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about carrying values of assets and

liabilities that are not readily apparent from other sources. The

resulting accounting estimates may differ from the related actual

results.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

In the process of applying the Company's accounting policies,

the Directors' do not believe that they have had to make any

assumptions or judgements that would have a material effect on the

amounts recognised in the financial statements.

Notes to the Financial Statements

For the half-year ended 31 July 2023

1. Operating loss

2. Staff costs and numbers

Further details on Directors' remuneration is given in the

Directors' report.

3. Earnings per share

The basic and diluted earnings per share figures are set out

below:

4. Trade and other receivables

5. Trade and other payables

6. Share capital

7. Financial instruments

Fair value of financial assets and liabilities

All financial assets and liabilities that are recognised in the

financial statements are short term in nature and shown at their

carrying value which is also approximate to their fair value.

8. Share based payments

On 25 May 2023, the company granted share warrants to Directors

on admission to the London Stock Exchange. A summary of the

warrants granted to directors is as follows:

The fair value of the share warrants at the date of grant was

measure using the Black Scholes pricing model, which takes into

account factors such as the option life, share price volatility and

the risk free rate.

Risk free interest rate

The risk-free interest rate is based on the UK 10-year Gilt

yield.

Expected term

The expected term represents the maximum term that the company's

share options in relation to employees of the company are expected

to be outstanding.

Estimated volatility

The estimated volatility is the amount by which the price is

expected to fluctuate during the period. The estimated volatility

for the share options was determined based on the standard

deviation of share price fluctuations of the company since its

listing.

Expected dividends

The company's board of directors may from time to time declare

dividends on its outstanding shares. Any determination to declare

and pay dividends will be made by the board of directors and will

depend upon the company's results, earnings, capital requirements,

financial condition, business prospects, contractual restrictions

and other factors deemed relevant by the board of directors. If a

dividend is declared, there is no assurance with respect to the

amount, timing or frequency of any such dividends. Based on this

uncertainty and unknown frequency, no dividend rate was used in the

assumptions to calculate the share based compensation expense.

The number and weighted average exercise prices of the share

warrants were as follows:

A share-based payment charge of GBP29,913 was recognised during

the period in relation to the share warrants granted in the period.

Additionally, a deferred tax asset amount of GBP21,922 was

recognised directly in the share based payment reserve in respect

of the estimated future tax deduction that exceeds the cumulative

share based payment expense.

9. Deferred tax

The deferred tax asset set out above is related to share based

payments where a tax deduction will not be received until the

exercise date, which will be based on the intrinsic value of the

option.

10. Subsequent events

After the end of the interim period, 6,000,000 Director warrants

became exercisable. The warrants are subject to lock-in agreements

with the Company which would prevent the sale of these instruments

and ordinary shares created therefrom. The lock-in agreements have

a duration of 12 months following Admission, which took place on 25

May 2023. Subsequent to the expiry of the lock-in agreements, any

shares resulting from the exercise of these warrants will be

subject to orderly market agreements for a further 12 months, which

requires Board approval to make any sales.

11. Ultimate controlling party

The Company has a number of shareholders and is not under the

control of any one person or ultimate controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRBDGLDDDGXX

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

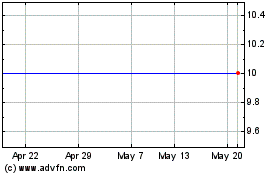

Oneiro Energy (LSE:ONE)

Historical Stock Chart

From Mar 2024 to Apr 2024

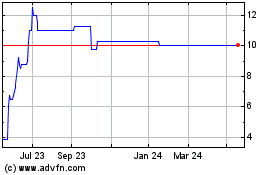

Oneiro Energy (LSE:ONE)

Historical Stock Chart

From Apr 2023 to Apr 2024