Kinovo PLC Further update re DCB Kent Limited (9076R)

July 11 2022 - 2:00AM

UK Regulatory

TIDMKINO

RNS Number : 9076R

Kinovo PLC

11 July 2022

11 July 2022

Kinovo plc

("Kinovo" or the "Company")

Further update re DCB Kent Limited ("DCB")

Kinovo Plc (AIM: KINO), the specialist property services Group

that delivers compliance and sustainability solutions, today

announces an update on trading and developments relating to DCB,

its former subsidiary.

The Company reports that its 3 year visible revenues for the

continuing business have increased from GBP105 million as at 31

March 2021 to GBP139 million as at 31 March 2022, with further

additional wins totalling over GBP3 million post-period end.

We are pleased to see further progress in the first two months

of the current financial year to end May 2022, a seasonally quieter

period, with 28% growth in revenues to GBP9.1 million and 35%

growth in Adjusted EBITDA to GBP0.5 million, compared to the prior

period.

The Company has continued to reduce its debt facilities with its

lending bank HSBC UK Bank plc ("HSBC") to GBP4.5 million,

structured as a GBP2.0 million term loan and a GBP2.5 million

overdraft facility at 30 June 2022. Kinovo continues to facilitate

constructive discussions with HSBC regarding the refinancing of its

existing facilities. With respect to its financial covenants, the

EBITDA calculations are based on continuing EBITDA, which excludes

adjustments related to DCB. Based on current financial

expectations, the Company expects to be in compliance with its

financial covenants for the year ended 31 March 2022 when the

year-end audit is finalised.

Kinovo is working with specialist consultants in order to

establish the costs to complete for the relevant construction

projects which are subject to parent company guarantees provided in

respect of DCB. Kinovo notes that there has been speculation

regarding the costs to complete, however, these will only be able

to be determined once Kinovo has reached agreement with the

respective clients under the relevant projects and the joint

administrators of DCB, for the final costing to complete for each

project. The Company reports that the discussions with clients are

both productive and encouraging, with all parties committed to

provide positive solutions to complete the outstanding projects in

a timely manner. Kinovo is also the largest creditor of DCB and at

this stage, Kinovo's expectation is that there will be limited

recovery of the amounts owed.

Kinovo continues to strongly uphold its legal position that any

claim from MCG Global Limited ("MCG") is without merit, whilst also

continuing to pursue counter-claims, including claims for

misrepresentation, against MCG and its associates, as set out in

the announcement dated 24 May 2022.

A further announcement will be made to shareholders as and when

appropriate. The Company expects to report that revenues for

continuing operations for the year ending 31 March 2022 have

increased by 35% to GBP53.3 million (2021: GBP39.4 million) with

Adjusted EBITDA (after the effect of a charge for lease payments)

rising by 100% to GBP4.2 million (2021: GBP2.1 million).

Enquiries

Kinovo plc

Sangita Shah, Chairman +44 (0)20 7796 4133

David Bullen, Chief Executive Officer (via Hudson Sandler)

Canaccord Genuity Limited (Nominated Adviser

and Sole Broker) +44 (0)20 7523 8000

Andrew Potts

Bobbie Hilliam

Hudson Sandler (Financial PR) +44 (0)20 7796 4133

Dan de Belder

Harry Griffiths

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSEDLITIIF

(END) Dow Jones Newswires

July 11, 2022 02:00 ET (06:00 GMT)

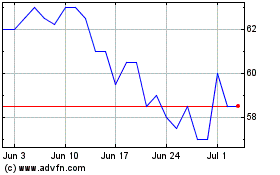

Kinovo (LSE:KINO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kinovo (LSE:KINO)

Historical Stock Chart

From Apr 2023 to Apr 2024