TIDMHUM

RNS Number : 2360J

Hummingbird Resources PLC

20 August 2021

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

20 August 2021

Hummingbird Resources plc

("Hummingbird" or the "Company")

Interim Results

Maintaining 2021 production and AISC guidance

Hummingbird Resources (AIM: HUM), is pleased to announce its

unaudited results for the six months ended 30 June 2021 ("the

Period").

OPERATIONAL AND FINANCIAL HIGHLIGHTS DURING THE PERIOD

-- 46,809 ounces ('oz) of gold sold at an average price of US$1,794/oz

-- Revenue of US$87 million (H1 2020: US$92 million) with an all

in sustaining cost ('AISC') of US$1,437/oz (improving in Q2 to

US$1,386/oz)

-- Adjusted EBITDA of US$16.2 million (H1 2020: $39.0 million)

and pre-tax loss of US$3.3 million for the Period (H1 2020 profit

of: US$23.8 million). I n line with Hummingbird's guidance

expectations with full year production to be weighted towards the

second half of the year

-- Net cash of US$12.4 million (inc. gold inventory value of

US$3.4 million), with US$4.7 million of final debt repayments made

during Q2 2021, taking the Company into a debt free position (H1

2020: net debt of US$20 million)

-- Maintaining 2021 production guidance of 100,000 - 110,000 oz

of gold, with an AISC of US$1,250 - 1,350 per oz of gold sold

DEVELOPMENT AND EXPLORATION

-- Yanfolila Mali: Material progress and success with the

Company's 2021 Yanfolila exploration and drilling programme during

H1 2021. 32,500 metres ('m') of the 44,600 m forecast for the year

drilled in H1 2021 (vs 21,000 m drilled in the whole of 2020) with

significant drill hole intercepts reported. The majority of assays

from the H1 drilling campaign are awaiting results from the labs in

Bamako and the Company anticipates being able to release these

results during H2 2021 along with final drilling programmes

-- The Company released a detailed Yanfolila mineral resource

estimate update of 1.929 million ounces (indicated and inferred).

The Company remains on track to release an updated reserve

statement later this year, to include Kouroussa in Guinea, and in

the future is looking to release a joint Company resource and

reserve update annually from H1 2022

-- Kouroussa, Guinea: Mining licences awarded in May 2021.

Detailed capex estimates are being finalised to then enable the

Company to complete key work streams, including financing for

construction of the mine. As previously stated, the Company will

update the market shortly with further details on development plans

and capital cost estimates

-- Dugbe, Liberia: Earn-in partner, Pasofino Gold Ltd

('Pasofino'), released the results of an independent Preliminary

Economic Assessment ('PEA') for Dugbe highlighting strong project

pre-tax NPV 5% economics ranging from US$825 - US$1,153 million

(dependent on gold price). Ongoing positive drilling results also

continued during H1 at Dugbe's two key deposits, Dugbe F and Tuzon,

showing upside potential to the PEA economics. Pasofino is working

towards a delivery of a Definitive Feasibility Study ('DFS')

ENVIRONMENTAL, SOCIAL & GOVERNANCE ('ESG') HIGHLIGHTS

-- Covid-19 : The Company's ongoing strict on-site testing,

quarantine procedures and overall hygiene protocols performed well

in mitigating virus spread during H1 2021. In Q2 2021 limited cases

were reported with on-site employee vaccinations beginning

-- Hummingbird Tree Initiative : The Company's locally supported

village nursery programmes continued to progress during H1 2021,

now with over 10,000 trees ready to be used in the coming months

for the Company's annual 20-hectare rehabilitation programme

-- Market gardens : Hummingbird successfully completed key

infrastructure for its local market garden programme, a market

centre for trading fruit, vegetables and poultry from locally

supported village market gardens completed in Q2 2021. This takes

the total Company supported market gardens to 10. The markets now

provide employment for over 800 mainly women from the local

communities. Water infrastructure improvements were also carried

out during H1 2021

-- Sanioumale East ('SE') resettlement: Progress continued

during the Period with workshops, technical services and risk

assessments taking place

-- World Gold Council ('WGC') Responsible Gold Mining Principles

('RGMPs') : Company GAP analysis was completed towards the end of

Q2 2021. This is now being evaluated internally and with external

ESG consultants to prioritise and address areas where gaps have

been identified in the Company's policies and procedures

-- Single Mine Origin ('SMO'): As a founding member of SMO, good

progress was made during the Period with this industry wide

initiative of traceable gold to responsibly operated mines. A

number of other gold mines joined as SMO members, increased

marketing took place in key publications advancing SMO brand

awareness, several new leading jewellery brands signed up to use

only SMO gold in their products, with future business plans and new

revenue streams developed

POST PERIOD

-- In July, Hummingbird announced drill results from the SE

deposit at Yanfolila where 14 new holes continued to showcase a

high grade open pit potential, with one hole demonstrating 5.33

grammes per tonne ("g/t") gold at surface for 40 m

-- In August, the Company provided an update on the exploration

programme at Yanfolila, releasing 18 new diamond drill hole results

from the Komana East deposit. Each hole intersected mineralisation

over the +300 m long strike length tested, to a depth of 200 m

below surface with grades of +3 g/t gold. The mineralisation

continues north showing future underground mining growth potential

and life of mine extension

-- Pasofino released results for a further six drill holes at

the Tuzon deposit ( please see link here ), in August. The results

included 36.3 m grading 2.06 g/t gold and 15 m grading 2.01 g/t.

These results are expected to have a positive impact on the updated

Mineral Resource Estimate due in September 2021

Dan Betts, CEO of Hummingbird, commented:

"We have yet again had another busy first half to the year. Our

key focus centred around productivity and predictability

improvements at Yanfolila in Mali, which was reflected in our Q2

2021 operational results, with gold ounces poured and AISC

improvements from Q1 2021 levels. Our new COO started in Q1 and has

settled into the role, having been to site and implementing a

number of processes and protocols aimed at cost reduction and

productivity improvements across the business.

"In H1 2021 we completed the repayment of all the debt raised to

build our Yanfolila operations, a key milestone of which we are

extremely proud.

"Further, the drilling success we achieved in 2020 continued

during the period. A material number of metres were drilled at

various deposits in H1 2021, and some stellar holes released with

many more awaiting assays which we are excited to receive in order

to continue to show the potential for extending the mine life at

Yanfolila.

"Our growth project, Kouroussa in Guinea, advanced in H1 2021,

and with the granting of the mining licences in May, our dedicated

project management team are now finalising capex estimates, to then

allow completion of financing and then begin construction. We are

nearing the finalisation of our capex estimates and anticipate

offering a more detailed update on the Kouroussa economics

soon.

"Our other development project, Dugbe in Liberia, continued to

advance via our joint venture partner Pasofino. Material drilling

has taken place at the two key deposits, Dugbe F and Tuzon, and

improvements in infrastructure in and around the asset have been

carried out. Additionally, a P EA was released showcasing the

robust economics of the project.

"With improving operational protocols and efficiencies gaining

traction at Yanfolila, Kouroussa moving towards beginning

construction, and Dugbe advancing well towards a DFS, we are

excited about the future prospects for the Company and look forward

to keeping the market updated on our progress for the remainder of

the year."

**S**

For further information, please visit

www.hummingbirdresources.co.uk or contact

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill, FD

Edward Montgomery,

CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer 3494

Nominated Adviser

-------------------------- ---------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

8000

Broker

-------------------------- ---------------------

Tim Blythe Blytheweigh Tel: +44 (0) 20 7138

Megan Ray 3205

Rachael Brooks Financial PR/IR

-------------------------- ---------------------

Notes to Editors:

Hummingbird Resources (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

company and member of the World Gold Council ('WGC'). Our vision is

to continue to grow our asset base, producing profitable ounces,

while central to all we do being our Environmental, Social &

Governance ('ESG') policies and practices. The Company currently

has two core gold projects, the Yanfolila Gold Mine in Mali, and

the Kouroussa Gold Project in Guinea. Further, the Company has a

controlling interest in the Dugbe Gold Project in Liberia that is

being developed by Pasofino Gold Limited through an earn-in

agreement.

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2021

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 30 31

June June December

Continuing operations Notes 2021 2020 2020

-------------------------------------- ------- ---------- ---------- -------------

Revenue 86,559 91,984 185,072

Production costs (56,014) (39,358) (93,975)

Amortisation and depreciation (20,325) (21,029) (41,367)

Royalties and taxes (3,383) (3,399) (6,747)

----------------------------------------------- ---------- ---------- -------------

Cost of sales (79,722) (63,786) (142,089)

Gross profit 6,837 28,198 42,983

Share based payments (1,036) (899) (2,081)

Other administrative expenses (4,139) (4,417) (8,928)

----------------------------------------------- ---------- ---------- -------------

Operating profit 1,662 22,882 31,974

Finance income 760 1,515 2,014

Finance expense (2,619) (3,499) (9,288)

Share of joint venture loss - - (17)

Reversals in impairment of financial

assets 42 3 397

(Losses)/gain on financial assets

measured at fair value (3,102) 2,851 1,203

----------------------------------------------- ---------- ---------- -------------

(Loss)/profit before tax (3,257) 23,752 26,283

Tax (840) (910) (1,135)

----------------------------------------------- ---------- ---------- -------------

(Loss)/profit for the period/year (4,097) 22,842 25,148

=============================================== ========== ========== =============

Attributable to:

Equity holders of the parent (4,704) 18,164 19,022

Non-controlling interests 607 4,678 6,126

------------------------------------ -------- ------- -------

(Loss)/profit for the period/year (4,097) 22,842 25,148

==================================== ======== ======= =======

(Loss)/earnings per share (attributable

to equity holders of the parent)

Basic ($ cents) 5 (1.32) 5.13 5.35

Diluted ($ cents) 5 (1.32) 4.92 5.02

----------------------------------------- ------- ----- -----

Consolidated Statement of Financial Position

As at 30 June 2021

Unaudited Unaudited Audited

30 30 31

June June December

2021 2020 2020

Notes $'000 $'000 $'000

-------------------------------------------------------- ------ ---------- ---------- ----------

Assets

Non-current assets

Intangible exploration and evaluation assets 82,062 74,653 75,574

Intangible assets software 156 240 204

Property, plant and equipment 143,803 120,997 150,247

Right of use assets 6 39,552 19,278 13,797

Investments in associates and joint ventures 175 192 175

Financial assets at fair value through profit or loss 2,279 9,352 7,721

Deferred tax assets 684 - 684

268,711 224,712 248,402

-------------------------------------------------------- ------ ---------- ---------- ----------

Current assets

Inventory 16,117 30,264 20,352

Trade and other receivables 18,520 13,831 12,724

Unrestricted cash and cash equivalents 4,558 1,417 6,552

Restricted cash and cash equivalents 4,379 4,123 4,516

43,574 49,635 44,144

-------------------------------------------------------- ------ ---------- ---------- ----------

Total assets 312,285 274,347 292,546

======================================================== ====== ========== ========== ==========

Liabilities

Non-current liabilities

Lease liability 6 25,897 13,256 2,380

Deferred consideration 5,599 - 5,402

Other financial liabilities 6,836 - 6,836

Provisions 16,157 14,921 16,125

-------------------------------------------------------- ------ ---------- ---------- ----------

54,489 28,177 30,743

-------------------------------------------------------- ------ ---------- ---------- ----------

Current liabilities

Trade and other payables 50,558 37,233 39,440

Lease liability 6 12,822 5,787 10,894

Other financial liabilities 15,000 15,000 15,000

Borrowings - 25,816 13,208

78,380 83,836 78,542

-------------------------------------------------------- ------ ---------- ---------- ----------

Total liabilities 132,869 112,013 109,285

-------------------------------------------------------- ------ ---------- ---------- ----------

Net assets 179,416 162,334 183,261

======================================================== ====== ========== ========== ==========

Equity

Share capital 7 5,344 5,309 5,344

Share premium 488 155 488

Shares to be issued 17,407 - 17,407

Retained earnings 145,794 148,542 150,246

-------------------------------------------------------- ------ ---------- ---------- ----------

Equity attributable to equity holders of the parent 169,033 154,006 173,485

======================================================== ====== ========== ========== ==========

Non-controlling interest 10,383 8,328 9,776

Total equity 179,416 162,334 183,261

======================================================== ====== ========== ========== ==========

Consolidated Statement of Cash Flows

For the six months ended 30 June 2021

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 30 31

June June December

2021 2020 2020

$'000 $'000 $'000

------------------------------------------------------------ ---- --------------- --------------- -----------

Operating activities

(Loss)/profit before tax (3,257) 23,752 26,283

Adjustments for:

Amortisation and depreciation 14,090 15,392 29,200

Amortisation and depreciation - right of use assets 6,348 5,796 12,485

Share based payments 1,098 1,293 2,551

Finance income (760) (1,515) (2,014)

Finance expense 2,619 3,499 9,288

Share of joint venture loss - - 17

Reversals in impairment of financial assets (42) (3) (397)

(Losses)/gains on financial assets measured at fair value 3,102 (2,851) (1,203)

------------------------------------------------------------------ --------------- --------------- -----------

Operating cash flows before movements in working capital 23,198 45,363 76,210

Decrease/(increase) in inventories 4,235 (12,181) (2,095)

(Increase)/decrease in receivables (6,346) (2,275) (1,796)

Increase/(decrease) in payables 11,657 (2,495) (4,297)

32,744 28,412 68,022

---- --------------- --------------- -----------

Taxation paid (1,475) (972) (1,766)

------------------------------------------------------------------ --------------- --------------- -----------

Net cash inflow from operating activities 31,269 27,440 66,256

------------------------------------------------------------------ --------------- --------------- -----------

Investing activities

Asset purchase, net of cash acquired - - (35)

Purchases of exploration and evaluation assets (5,618) (794) (2,601)

Purchases of property, plant and equipment (7,599) (6,612) (18,136)

Pasofino funding 6,308 - 5,559

Pasofino funding utilisation (7,178) - (4,673)

Purchase by non-controlling interest - - 1,883

Sale and purchase of shares in other companies 2,538 (393) (393)

Interest received - 9 11

Net cash used in investing activities (11,549) (7,790) (18,385)

------------------------------------------------------------------ --------------- --------------- -----------

Financing activities

Exercise of share options and warrants - 163 532

Lease principal payments (6,657) (5,684) (12,663)

Lease interest payments (356) (699) (1,201)

Loan interest paid (255) (1,672) (2,547)

Loans repaid (13,278) (14,368) (29,252)

Commission and other fees paid (341) - (571)

Net cash used in financing activities (20,887) (22,260) (45,702)

------------------------------------------------------------------ --------------- --------------- -----------

Net (decrease)/increase in cash and cash equivalents (1,167) (2,610) 2,169

Effect of foreign exchange rate changes (964) (379) 370

Cash and cash equivalents at beginning of period/year 11,068 8,529 8,529

Cash and cash equivalents at end of period/year 8,937 5,540 11,068

================================================================== =============== =============== ===========

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2021

Total

equity

Shares attributable

Share Share to be Retained to the Non-controlling

capital premium issued earnings parent interest Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

---------------------- --------- --------- -------- ---------- -------------- ---------------- ---------

As at 1 January

2020 5,301 - - 129,952 135,253 3,650 138,903

Profit for the

period - - - 18,164 18,164 4,678 22,842

----------------------

Total comprehensive

income for the

period - - - 18,164 18,164 4,678 22,842

Share based payments 8 155 - 426 589 - 589

As at 30 June 2020

(Unaudited) 5,309 155 - 148,542 154,006 8,328 162,334

====================== ========= ========= ======== ========== ============== ================ =========

As at 1 January

2020 5,301 - - 129,952 135,253 3,650 138,903

Profit for the

year - - - 19,022 19,022 6,126 25,148

----------------------

Total comprehensive

income for the

year - - - 19,022 19,022 6,126 25,148

Shares to be issued

as consideration

in asset purchase - - 17,407 - 17,407 - 17,407

Share based payments 43 488 - 1,272 1,803 - 1,803

As at 31 December

2020 (Audited) 5,344 488 17,407 150,246 173,485 9,776 183,261

====================== ========= ========= ======== ========== ============== ================ =========

As at 1 January

2021 5,344 488 17,407 150,246 173,485 9,776 183,261

Comprehensive (loss)/income

for the period:

(Loss)/profit for

the period - - - (4,704) (4,704) 607 (4,097)

-----------------------------

Total comprehensive

(loss)/income for

the period - - - (4,704) (4,704) 607 (4,097)

Share based payments - - - 252 252 - 252

As at 30 June 2021

(Unaudited) 5,344 488 17,407 145,794 169,033 10,383 179,416

============================= ====== ==== ======= ======== ======== ======= ========

1. General information

Hummingbird Resources PLC is a public limited company with

securities traded on the AIM market of the London Stock Exchange.

It is incorporated and domiciled in the United Kingdom and has a

registered office at 49-63 Spencer Street, Hockley, Birmingham,

West Midlands, B18 6DE.

The nature of the Group's operations and its principal

activities are the exploration, evaluation, development, and

operating of mineral projects, principally gold, focused currently

in West Africa.

2. Adoption of new and revised standards

The interim financial statements have been drawn up based on

accounting policies consistent with those applied in the financial

statements for the year ended 31 December 2020. There were several

accounting standards updates effective 1 January 2021, which did

not have any material impact on the financial statements of the

Group.

IFRS 9, IAS 39, IFRS 7, effective 1 January Interest Rate Benchmark

IFRS 4, IFRS 16 (Amendments) 2021 Reform - Phase 2

The following Standards and Interpretations which have not been

applied in the financial statements were in issue but not yet

effective.

IFRS 17 effective 1 January Insurance contracts

2023

3. Significant accounting policies

Basis of preparation

The consolidated interim financial information has been properly

prepared in accordance with International Accounting Standards in

conformity with the requirements of the Companies Act 2006, which

is expected to be applied in the Group's financial statements for

the year ended 31 December 2021.

The consolidated interim financial information for the period 1

January 2021 to 30 June 2021 is unaudited, does not include all the

information required for full financial statements and should be

read in conjunction with the Group's consolidated financial

statements for the year ended 31 December 2020. In the opinion of

the Directors the consolidated interim financial information for

the period represents fairly the financial position, results from

operation and cash flows for the period in conformity with

generally accepted accounting principles consistently applied. The

consolidated interim financial information incorporates comparative

figures for the interim period 1 January 2020 to 30 June 2020 and

the audited financial year to 31 December 2020. As permitted, the

Group has chosen not to adopt IAS34 'Interim Financial

Reporting'.

The annual financial statements of Hummingbird Resources plc are

prepared in accordance with International Financial Reporting

Standards ('IFRSs') as issued by the International Accounting

Standards Board ('IASB'. The Group's consolidated annual financial

statements for the year ended 31 December 2020, have been filed

with the Registrar of Companies and are available on the Company's

website www.hummingbirdresources.co.uk. The auditor's report on

those financial statements was unqualified.

At 30 June 2021, the Group had cash and cash equivalents of $9.0

million and total borrowings of $nil million. As at June 30, 2021,

the Company had a working capital deficiency (current assets less

current liabilities) of $34.8 million. The current liabilities

include Anglo Pacific royalty liability of $15 million which,

although current due to the nature of the agreement, is not

expected to be paid soon.

Going concern

The Group has prepared cash flow forecasts based on estimates of

key variables including production, gold price, operating costs,

capital expenditure through to December 2022 that supports the

conclusion of the Directors that they expect funding arrangements

currently in place to be sufficient to meet the Group's anticipated

cash flow requirements to this date.

These cashflow forecasts are subject to a number of risks and

uncertainties, in particular the ability of the Group to achieve

the planned levels of production and gold prices. The Board

reviewed and challenged the key assumptions used by management in

its going concern assessment.

The Board also considered sensitivities to those cash flow

scenarios (including where production is lower than forecast) which

in some cases showed tight cash flow months. Should this situation

arise, the Directors believe that they have a number of options

available to them, such as deferring certain expenditures, which

would allow the Group to meet its cash flow requirements through

this period.

Based on its review, the Board has a reasonable expectation that

the Group has adequate resources to continue operating for the

foreseeable future and hence the Board considers that the

application of the going concern basis for the preparation of the

Interim Financial Statements was appropriate.

Should the Group be unable to achieve the required levels of

production and associated cashflows, defer expenditures or obtain

additional funding such that the going concern basis of preparation

was no longer appropriate, adjustment would be required including

the reduction of balance sheet asset values to their recoverable

amounts and to provide for future liabilities should they

arise.

4. EBITDA and adjusted EBITDA

Earnings before interest, taxes, depreciation and amortisation

("EBITDA") is a factor of volumes, prices and cost of production.

This is a measure of the underlying profitability of the Group,

widely used in the mining sector. Adjusted EBITDA removes the

effect of impairment charges, foreign currency translation

gains/losses and other non-recurring expense adjustments but

including IFRS 16 lease payments.

Reconciliation of Net Earnings to EBITDA and Adjusted EBITDA

Unaudited

Unaudited six months

six months ended 30 ended 30 Audited year ended 31 December

June 2021 June 2020 2020

$'000 $'000 $'000

---------------------------------- --- --------------------- ------------ ---------------------------------

(Loss)/profit before tax (3,257) 23,752 26,283

Less: Finance income (760) (1,515) (2,014)

Add: Finance costs 2,619 3,499 9,288

Add: Depreciation and amortisation 20,438 21,188 41,685

----------------------------------- ------------------------- ------------ -------------------------------

EBITDA 19,040 46,924 75,242

----------------------------------- ------------------------- ------------ -------------------------------

IFRS 16 lease interest and

principal payments (7,013) (6,383) (13,864)

Share based payments 1,098 1,293 2,551

Share of joint venture loss - - 17

Reversals in impairment of

financial assets (42) (3) (397)

(Losses)/gains on financial assets

measured at fair value 3,102 (2,851) (1,203)

----------------------------------- ------------------------- ------------ -------------------------------

Adjusted EBITDA 16,185 38,980 62,346

=================================== ========================= ============ ===============================

5. (Loss)/earnings per ordinary share

Basic (loss)/earnings per ordinary share is calculated by

dividing the net (loss)/profit for the period/year attributable to

ordinary equity holders of the parent by the weighted average

number of ordinary shares outstanding during the period/year.

The calculation of the basic and diluted (loss)/earnings per

share is based on the following data:

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

$'000 $'000 $'000

---------------------------------------------------------- ------------ ------------ -------------

(Loss)/profit

(Loss)/profit for the purposes of basic (loss)/earnings

per share being net (loss)/profit attributable

to equity holders of the parent (4,704) 18,164 19,022

========================================================== ============ ============ =============

31 December

Number of shares 2020

30 June 30 June Number

2021 2020

Number Number

Weighted average number of ordinary shares

for the purposes of basic loss per share 357,428,368 354,215,944 355,380,149

Weighted number of shares to be issued as

part of asset purchase 35,248,441 - 11,685,100

Adjustments for share options and warrants 18,097,483 14,822,647 11,835,883

Weighted average number of ordinary shares

for the purposes of diluted (loss)/profit

per share 410,774,292 369,038,591 378,901,132

========================================================== ============ ============ =============

(Loss)/earnings per ordinary share 30 June 30 June 31 December

2020

2021 2020 $ cents

$ cents $ cents

---------------------------------------------------------- ------------ ------------ -------------

Basic (1.32) 5.13 5.35

Diluted (1.32) 4.92 5.02

========================================================== ============ ============ =============

At 30 June 2021 there were 53,345,924 potentially dilutive

ordinary shares. Potentially dilutive ordinary shares include share

options issued to employees and directors, warrants issued and in

2020 includes the 35,248,441 shares to be issued as part of the

Kouroussa Project acquisition. For period ended 30 June 2021,

because there is a reduction in loss per share resulting from the

assumption that the share options and warrants are exercised, the

latter are anti-dilutive and are ignored in the computation of

diluted loss per share and therefore there is no difference between

basic and diluted loss per share.

6. Right of use assets

Following the granting of a new mining contract to Junction

Contract Mining ('JCM') in April 2021, a reassessment right of use

assets and liabilities was initiated. This resulted in an both an

increase in the right of use assets and lease liabilities under

IFRS 16' Leases'.

These assets and liabilities were measured at the present value

of the remaining lease payments, discounted using the lessee's

incremental borrowing rates as of 9-10%.

7. Share capital

Authorised share capital

As permitted by the Companies Act 2006, the Company does not

have an authorised share capital.

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 30 June 2020

2021 2020 Number

Number Number

---------------------------------------------- -------------- -------------- --------------

Issued and fully paid

Ordinary shares of GBP0.01 each 357,428,368 354,755,378 357,428,368

---------------------------------------------- -------------- -------------- --------------

Shares to be issued (1)

Ordinary shares to be issued of GBP0.01 each 35,248,441 - 35,248,441

---------------------------------------------- -------------- -------------- --------------

Total Ordinary shares after issue - shares

of GBP0.01 each 392,676,809 354,755,378 392,676,809

============================================== ============== ============== ==============

31 December

2020

Issued and fully paid $'000

30 June 30 June

2021 2020

$'000 $'000

============================================== ============== ============== ==============

Issued and fully paid

Ordinary shares of GBP0.01 each 5,344 5,309 5,344

---------------------------------------------- -------------- -------------- --------------

Shares to be issued (1)

Ordinary shares to be issued of GBP0.01 each 470 - 470

Ordinary shares after issue of GBP0.01 each 5,814 5,309 5,814

============================================== ============== ============== ==============

(1) Following the acquisition of Kouroussa Project in Guinea

during the year, a total of 35,248,441 new Ordinary Shares in the

Company will be issued. These were issued on 13 July 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKCBQABKDQFD

(END) Dow Jones Newswires

August 20, 2021 02:00 ET (06:00 GMT)

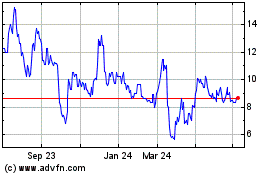

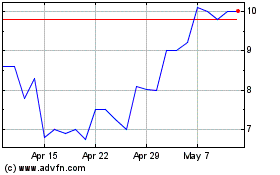

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Sep 2023 to Sep 2024