Ferguson Increases Liquidity to $800 Million via Loan Transactions

October 13 2022 - 7:33AM

Dow Jones News

By Anthony O. Goriainoff

Ferguson PLC said Thursday that its liquidity has increased to

$800 million after it carried out a series of financing

transactions, and that it will use the additional liquidity for

general working purposes.

The New York and London-listed supplier of plumbing and heating

products said it has agreed to a new $500 million syndicated

three-year bank term loan credit line, which matures in 2025.

The company said it has also increased its existing receivables

securitization facility by $300 million to $1.1 billion, and

increased its current revolving credit line to $1.35 billion from

$1.1 billion.

Ferguson said it reduced its existing 364-day bilateral

revolving facility to $250 million from $500 million, and that this

matures in March, 2023.

"This additional liquidity demonstrates the continued confidence

in our business model and provides additional flexibility to

continue to invest in our capital priorities," the company

said.

Shares in London at 1054 GMT were down 74 pence, or 0.8%, at

9,588 pence.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

October 13, 2022 07:18 ET (11:18 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

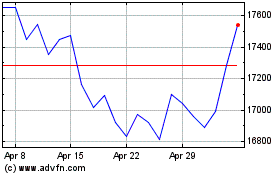

Ferguson (LSE:FERG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferguson (LSE:FERG)

Historical Stock Chart

From Apr 2023 to Apr 2024