TIDMDCTA

RNS Number : 1864O

Directa Plus PLC

30 September 2019

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF

AMERICA, CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH

AFRICA, THE RUSSIAN FEDERATION, THE REPUBLIC OF IRELAND OR JAPAN OR

IN ANY OTHER JURISDICTION IN WHICH OFFERS OR SALES WOULD BE

PROHIBITED BY APPLICABLE LAW. THIS ANNOUNCEMENT IS NOT AN OFFER TO

SELL OR A SOLICITATION TO BUY SECURITIES IN ANY JURISDICTION,

INCLUDING THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA, NEW

ZEALAND, THE REPUBLIC OF SOUTH AFRICA, THE RUSSIAN FEDERATION, THE

REPUBLIC OF IRELAND OR JAPAN. NEITHER THIS ANNOUNCEMENT NOR

ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF, OR BE RELIED

UPON IN CONNECTION WITH, ANY OFFER OR COMMITMENT WHATSOEVER IN ANY

JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU. IN ADDITION, MARKET

SOUNDINGS WERE TAKEN IN RESPECT OF THE MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

SUCH INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION

OF INSIDE INFORMATION.

30 September 2019

Directa Plus plc

("Directa Plus" or the "Company")

Proposed acquisition of 51 per cent. of Setcar S.A

Placing, Open Offer and Notice of General Meeting

Directa Plus (AIM: DCTA), a leading producer and supplier of

graphene nanoplatelets based products for use in consumer and

industrial markets, today announces that it is has entered into a

conditional agreement to acquire 51 per cent. of the issued share

capital of Setcar S.A. ("Setcar"), a Romanian waste management and

decontamination services business, for a total cash consideration

(together with its acquisition partner, GVC) of EUR4.1 million,

(the "Acquisition").

In addition the Company announces a conditional placing of new

ordinary shares in the Company and the launch of an open offer to

raise up to GBP8.24 million before expenses.

Acquisition highlights

-- Directa Plus has today agreed to acquire 51 per cent. of Setcar.

-- Setcar is being jointly acquired with GVC Investment Company

Limited, a company owned by the ultimate beneficial owner of GSP

Group, a leading provider of offshore integrated services for the

oil and gas industry with rigs in operation in Romania, Turkey,

Greece and Mexico, who have today agreed to acquire 47.03 per cent.

of Setcar.

-- The total consideration payable by the Company and GVC, in

proportion to their shareholdings in Setcar, is EUR4.1 million. An

existing shareholder in Setcar will remain a minority shareholder

and immediately following Completion will hold 1.97 per cent.

-- Privately owned Setcar, established in 1994, is a highly

regarded environmental remediation services company based in

Braila, Romania, and operating in the Black Sea region.

-- Setcar has been a commercial partner of Directa Plus since

2014 and has contributed to the industrial development of

Grafysorber mobile decontamination units.

-- For the year ended 31 December 2018, in accordance with

Romanian GAAP, Setcar reported audited revenues of EUR3.96 million

and EBITDA of EUR0.25 million.

Placing highlights

Directa Plus has conditionally raised approximately GBP7.24

million before expenses by the placing of 9,648,000 Placing Shares

at a price of 75 pence per Placing Share.

The Company is also making an Open Offer, for up to 1,345,169

million new Ordinary Shares, to raise up to approximately GBP1

million, on the basis of 1 Open Offer Share for every 38 Existing

Ordinary Shares held by Qualifying Shareholders at the Record Date.

The Open Offer will provide Qualifying Shareholders with the

opportunity to subscribe for new Ordinary Shares from the date of

this announcement to 17 October 2019.

The Company intends to use the proceeds of the Placing as

follows:

-- EUR2.1 million for the acquisition of 51 per cent. of Setcar;

-- EUR1.3 million to invest in revenue growth in the

environmental sector and applications development;

-- EUR1.0 million to improve the G+ production facility in order

to deliver the on-going reduction of production cost, increased

production capacity and automation;

-- EUR1.4 million to fund research and development activities on

the improvement of G+ applications in key markets, to develop new

IP and to maintain the Company's existing patents portfolio;

and

-- EUR2.44 million for general working capital.

In addition, any further monies received under the Open Offer

will be used to further support the Company's strategy as well as

for general working capital purposes.

The Placing and the Open Offer are conditional, amongst other

matters, on the passing of the Resolutions respectively at the

General Meeting to be held at 11 a.m. on 18 October 2019 at the

offices of Directa Plus plc, 3rd floor, 11-12 St. James's Square,

London, SW1Y 4LB at which the resolutions required to give effect

to the Placing and Open Offer will be proposed.

The Company intends to publish the Circular setting out details

of the Acquisition. Placing, the terms and conditions of the Open

Offer and the Notice of General Meeting together with application

forms for the Open Offer later today. The Circular will be

available at this time on the Company's website at

www.directa-plus.com.

Giulio Cesareo, Chief Executive Officer of Directa Plus,

commented:

"This is a transformational transaction for Directa Plus. Just

as we are seeking to do in textiles, we are now proposing to take

more control of the environmental supply chain to capture maximum

value from the commercial offering made possible by our Grafysorber

technology.

"We are acquiring the expertise, the engineering ingenuity and

the ability to operate from a well-established service provider

which will drastically reduce the time to capture a share of the

large global market for hydrocarbon remediation and recovery.

Setcar is being jointly acquired with GVC, a company owned by the

ultimate beneficial owner of GSP Group. Our Industrial partner will

bring us important commercial relationships which will enable us to

enter and grow in this market."

This summary should be read in conjunction with the full text of

the following announcement.

For further information please visit

http://www.directa-plus.com/ or contact:

Directa Plus plc +39 02 36714458

Giulio Cesareo, CEO

Marco Ferrari, CFO

Cantor Fitzgerald Europe (Nominated Adviser

and Joint Broker) +44 20 7894 7000

Rick Thompson, Philip Davies Will Goode

(Corporate Finance)

Caspar Shand Kydd (Sales)

N+1 Singer (Joint Broker) +44 20 7496 3069

Mark Taylor, Lauren Kettle, Mia Gardner

Tavistock (Financial PR and IR) +44 20 7920 3150

Simon Hudson, Edward Lee, Barnaby Hayward

About Directa Plus

Our focus is principally on the two sectors in which we have

strong commercial advantage through developed and launched products

and a technological lead: environmental (based on our

Grafysorber(R) product) and textiles (based on our G+ products). In

addition, we will continue to pursue opportunities in elastomers

and composites (including tyres and asphalt), also using our G+

products. All our products are hypoallergenic, non-toxic and

sustainably produced.

Proposed Acquisition of 51 per cent. of Setcar S.A.

Placing of 9,648,000 new Ordinary Shares

Open Offer of up to 1,345,169 new Ordinary Sharesin each case at

75 pence per share and Notice of General Meeting

1. Introduction

Directa Plus announced today that it has conditionally agreed to

acquire 51 per cent. of the issued share capital of Setcar S.A., a

Romanian waste management and decontamination services business,

for a total cash consideration (together with its acquisition

partner, GVC) of EUR4.1 million.

The Company has also announced today a Fundraising to raise a

total of up to approximately GBP8.24 million (before expenses) by

way of:

-- a Placing of 9,648,000 new Ordinary Shares at the Issue Price

to Placees to raise gross proceeds of GBP7.24 million. The Placing

is conditional, inter alia, upon Shareholders approving the

Resolutions at the General Meeting and on the Placing Agreement not

having been terminated in accordance with its terms. The

Conditional Placing is also dependent on the occurrence of

Admission; and

-- an Open Offer of up to 1,345,169 new Ordinary Shares at the

Issue Price to Qualifying Shareholders to raise net proceeds of up

to approximately GBP1 million on the basis of 1 Open Offer Share

for every 38 Existing Ordinary Shares held on the Record Date, at

the Issue Price, payable in full at the time of acceptance of the

Open Offer. Shareholders subscribing for their full entitlement

under the Open Offer may also request additional Open Offer Shares

through the Excess Application Facility.

The Issue Price represents a discount of 3.8 per cent. to the

closing price of 78 pence per Existing Ordinary Share on 27

September 2019 (being the last business day prior to the

announcement of the Acquisition and Fundraising).

The purpose of this announcement is to set out the background to

and the reasons for the Fundraising and to give details of the

Acquisition, to explain why the Board considers the Fundraising and

Acquisition to be in the best interests of the Company and its

Shareholders as a whole and why the Directors recommend that you

vote in favour of the Resolutions required to be passed to

implement them.

The Placing and the Open Offer are conditional, amongst other

matters, on the passing of the Resolutions respectively at the

General Meeting. Notice of the General Meeting to be held at 11.00

a.m. on 18 October 2019 at the offices of Directa Plus plc, 3rd

floor, 11-12 St. James's Square, London, SW1Y 4LB at which the

resolutions required to give effect to the Placing and Open Offer

will be proposed.

2. Background to and reasons for the Acquisition and Fundraising

Introduction

Directa Plus is one of the largest producers and suppliers of

graphene-based products for use in consumer and industrial markets.

The Company's graphene manufacturing capability uses proprietary

patented technology based on a plasma super expansion process.

Starting from natural graphite, each step of Directa Plus'

production process - expansion, exfoliation and drying - creates

graphene-based materials and hybrid graphene materials ready for a

variety of uses and available in various forms such as powder,

liquid and paste.

This proprietary production process uses a physical process,

rather than a chemical process, to process graphite into pristine

graphene nanoplatelets, which enables Directa Plus to offer a

sustainable, non-toxic product, without unwanted by-products.

Directa Plus' products are made of hybrid graphene materials and

graphene nano-platelets. The products (marketed as G+) have

multiple applications due to its properties. These G+ products can

be categorised into various families, with different products being

suitable for specific practical applications.

Strategy

The Company is principally focused on the two key verticals in

which the Board believes it has a strong commercial advantage

through developed and launched products and a technological

lead:

-- Environmental, based on our Grafysorber(R) product; and

-- Textiles, based on our G+ products.

In addition, the Board remains selective in building out the

pipeline of opportunities in the Elastomers and Composite Material

sectors.

The Board believes that the Company continues to make very good

progress towards commercialising its products, particularly in the

two key vertical markets that have the potential to generate

significant revenues and value for our Shareholders.

The ability to demonstrate strong cash resources to fund the

Company until it achieves positive cash flows will materially

assist Directa Plus to attract and retain blue chip customers and

partners. It will also allow Directa Plus to negotiate commercial

agreements from a position of strength in order to capture more

value for Shareholders from the product launches the Company's

technology enables.

Integrating Directa Plus' intellectual property into new

products allows customers to gain significant competitive

advantage. The Board is committed to seeking to benefit from the

proceeds of customer growth attributed to the Company's products,

rather than merely supplying an essential ingredient. As such,

Directa Plus has adopted a commercialisation model based on

capturing a proportion of these additional revenues and profits, in

order to drive value for our Shareholders. This could take the form

of royalty payments, upfront enabling licence payments,

joint-ventures to get closer to end-users or a combination of all

three.

Setcar S.A.

Privately owned Setcar, established in 1994, is a highly

regarded environmental remediation services company based in

Braila, Romania, and operating in the Black Sea region. The company

offers a full range of services related to the treatment and

disposal of hazardous waste, with a focus on decontamination of

industrial equipment and sites, decontamination of soil and

integrated waste management services.

Setcar is fully authorised and accredited to carry out its

activities. Clients include Arcelormittal, Ford, E ON, Enel,

Lukoil, and OMV Petrom. Setcar is also endorsed by international

bodies such as the United Nations Industrial Development

Organisation.

Setcar has been a commercial partner of Directa Plus since 2014

and has contributed to the industrial development of Grafysorber

mobile decontamination units.

For the year ended 31 December 2018, in accordance with Romanian

GAAP, Setcar reported audited revenues of EUR3.96 million (2017:

EUR2.41 million), EBITDA of EUR0.25 million (2017: EUR0.17

million). Net assets as at 31 December 2018 were EUR3.28 million

(2017: EUR3.26 million).

The Acquisition

The Company has conditionally agreed to acquire 51 per cent. of

Setcar. Setcar is being jointly acquired with GVC, a company owned

by the ultimate beneficial owner of the GSP group, a leading

provider of offshore integrated services for the oil and gas

industry with rigs in operation in Romania, Turkey, Greece and

Mexico, who have conditionally agreed to acquire 47.03% of Setcar.

The total consideration payable by the Company and GVC, in

proportion to their shareholdings in Setcar, is EUR4.1 million. An

existing shareholder in Setcar will remain a minority shareholder

and immediately following Completion will hold 1.97%.

Of the total consideration, EUR2.1 million will be paid in cash

to the owners of Setcar as follows:

-- EUR0.6 million upon Completion

-- EUR0.4 million on 30 April 2020

-- EUR0.85 million on the first anniversary of Completion

-- EUR0.25 million on the second anniversary of Completion.

Immediately following Completion, the Company and GVC will

provide a EUR2 million loan to Setcar, in proportion to their

respective shareholdings in the company, in order to facilitate the

payment of a EUR2 million dividend to the vendors of Setcar. The

loan will then be converted into ordinary shares in Setcar in

proportion to the shareholdings of each of the Company and GVC.

Following Completion, Setcar will be renamed Directa

Environmental Solutions.

The Board believes that the Acquisition will:

-- create a business case in a European country with a real need

for environmental clean-up, which could be replicated in other

countries;

-- provide a significant business opportunity within captive

off-shore applications generated through partnership with GVC. The

combined company is entitled to participate in international

tenders;

-- present the opportunity to control a direct commercial

channel capable of significantly improving the Grafysorber

commercial ramp-up on the market and to fulfil the market

expectations in one of the main company verticals;

-- further the development of technologies and equipment that

use Grafysorber as a base material, combined with the opportunity

to deal directly with the end-user will give Directa Plus the

possibility to increase revenues and margins, protecting the

know-how); and

-- facilitate development of (with the possibility to patent)

other Grafysorber applications in the environmental field

(pollutants other than hydrocarbons or in synergy with other

materials / technologies, other applications such as soil or air

treatment etc.) leveraging on the competence of the personnel and

the Setcar laboratory equipment.

Following Completion, Directa Environmental Solutions will enter

into several commercial contracts, already signed by the Company's

acquisition partner, GVC, or an entity in the GSP group, for the

provision of environmental services to a number of multinational

oil and gas companies. These contracts will extend across several

years starting between October 2019 and late 2020 and represent a

revenue opportunity of at least EUR8 million.

3. Use of proceeds from the Placing and Open Offer

The Company intends to use the proceeds of the Placing as

follows:

-- EUR2.1 million for the acquisition of 51 per cent. of Setcar;

-- EUR1.3 million to invest in revenue growth in the

environmental sector and applications development;

-- EUR1.0 million to improve the G+ production facility in order

to deliver the on-going reduction of production cost, increased

production capacity and automation;

-- EUR1.4 million to fund research and development activities on

the improvement of G+ applications in key markets, to develop new

IP and to maintain the Company's existing patents portfolio;

and

-- EUR2.44 million for general working capital.

In addition, any further monies received under the Open Offer

will be used to further support the Company's strategy as well as

for general working capital purposes.

Interim results for the six months ended 30 June 2019

The Company has today announced interim results for the six

months ended 30 June 2019.

Revenue for the six months to 30 June 2019 increased by 56 per

cent to EUR894,693 (2018: EUR573,822), whilst the loss before tax

was similar to last year at EUR1,778,890 (2018: loss of

EUR1,753,053). Cash at the period end was EUR4,760,951

(EUR4,947,457 at the end of the comparable period and EUR5,503,884

as at 31 December 2018).

4. The Placing

Subject to the satisfaction of the conditions under the Placing,

including inter alia, the passing of the Resolutions, the Company

will place a total of 9,648,000 new Ordinary Shares raising in

aggregate approximately GBP7.24 million (before expenses). The

Placing Shares have been placed by Cantor Fitzgerald and N+1

Singer, as agent for the Company with institutional and other

investors. The Placing Shares will be allotted at the Issue

Price.

The Issue Price represents a discount of 3.8 per cent. to the

closing price of 78 pence per Existing Ordinary Share on 27

September 2019 (being the last business day prior to the

announcement of the Acquisition and Fundraising).

The Placing of the New Ordinary Shares will be conducted in two

separate tranches over two Business Days to assist EIS and VCT

investors to claim certain tax reliefs.

It is intended that the Company will issue the First Tranche

Placing Shares to the persons nominated by the Company in

accordance with the Placing Agreement no later than 3.00 p.m. on 18

October 2019, being one Business Day prior to Admission. The issue

of the First Tranche Placing Shares will not be conditional on

Admission. It is intended that the Company will issue the Second

Tranche Placing Shares in accordance with the Placing Agreement no

later than 8.00 a.m. on 21 October 2019. The issue of the Second

Tranche Placing Shares will be conditional on Admission. Investors

should be aware of the possibility that only the First Tranche

Placing Shares might be issued and that none of the remaining

Second Tranche Placing Shares are issued.

The Placing (other than in respect of the First Tranche Placing

Shares) is conditional upon, inter alia, Admission occurring no

later than 8.00 a.m. on 21 October 2019 (or such later date as the

Company, Cantor Fitzgerald and N+1 Singer shall agree, being no

later than 31 October 2019.

The Fundraising is not underwritten by Cantor Fitzgerald or N+1

Singer or any other person.

If the conditions relating to the issue of the Placing Shares

are not satisfied, the Placing Shares will not be issued and the

Company will not receive the related placing monies. In this

situation, the Company would not have sufficient resources to fully

implement the strategy outlined above.

The Placing Agreement

Pursuant to the terms of the Placing Agreement, Cantor

Fitzgerald and N+1 Singer have conditionally agreed to use

reasonable endeavours, as agents of the Company, to procure

subscribers for the Placing Shares at the Issue Price. The

Fundraising has not been underwritten by Cantor Fitzgerald, N+1

Singer or any other person.

The EIS/VCT Placing is conditional, inter alia, upon the

Resolutions being duly passed at the General Meeting. The

Conditional Placing is conditional, inter alia, upon the

Resolutions being duly passed at the General Meeting and Admission

becoming effective on or before 8.00 a.m. on 21 October 2019 (or

such later time and/or date as the Company, Cantor Fitzgerald and

N+1 Singer may agree, but in any event by no later than 8.00 a.m.

on 31 October 2019. If any of the conditions in relation to the

Placing are not satisfied, the Placing Shares (other than possibly

the First Tranche Placing Shares) will not be issued and all monies

received from the investors in respect of the Placing Shares will

be returned to them (at the investors' risk and without interest)

as soon as possible thereafter.

The Placing Agreement contains warranties from the Company in

favour of Cantor Fitzgerald and N+1 Singer in relation to, inter

alia, the accuracy of certain information in this announcement, the

circular and other matters relating to the Company and its

business. In addition, the Company has agreed to indemnify Cantor

Fitzgerald and N+1 Singer in relation to certain liabilities it may

incur in respect of the Fundraising. Cantor Fitzgerald and N+1

Singer have the right to terminate the Placing Agreement or Placing

prior to Admission in certain circumstances that are customary for

an agreement of this nature, in particular in the event of any

breach of the warranties given to Cantor Fitzgerald and N+1 Singer

in the Placing Agreement which either of Cantor Fitzgerald or N+1

Singer considers to be material in the context of the Fundraising,

the failure of the Company to comply, in any material respect, with

any of its obligations under the Placing Agreement, the occurrence

of a change in (amongst other things) national or international

financial or political conditions which in the reasonable opinion

of either Cantor Fitzgerald or N+1 Singer is likely to affect the

Placing in a material way, or a material adverse change in the

condition (financial, operational, legal or otherwise), earnings,

business, management, property, assets, rights, results of

operations or prospects of the Company which is material in the

context of the Fundraising.

Settlement and dealings

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM. It is

expected that Admission will occur and that dealings will commence

at 8.00 a.m. on 21 October 2019 on which date it is also expected

that the Placing Shares will be enabled for settlement in

CREST.

The New Ordinary Shares will, when issued, rank pari passu in

all respects with the Existing Ordinary Shares including the right

to receive dividends and other distributions declared following

Admission.

5. Related Party Transactions

Certain Directors and Substantial Shareholders (as defined in

the AIM Rules) in the Company have subscribed for Placing Shares in

connection with the Placing. The number of Placing Shares

conditionally subscribed for by each such Director and Substantial

Shareholder pursuant to the Placing, and their resulting

shareholdings on Admission, are set out below:

Shareholder Existing Number of Number of Ordinary Percentage

Ordinary Existing Placing Shares held of Enlarged

Shares Ordinary Shares post Admission* Share Capital

held Shares held subscribed held*

as a percentage for

of all Existing

Ordinary

Shares

Nant Capital,

LLC / Patrick

Soon-Shiong 11,343,440 22.19% 6,280,000 17,623,440 28.37%

Dompe Holdings

S.r.l. 6,926,666 13.55% 593,333 7,519,999 12.11%

Galbiga Immobiliare

S.r.l.** 3,448,791 6.75% 356,000 3,804,791 6.13%

* assuming the Open Offer is fully subscribed

** Giulio Cesareo, CEO of the Company, and his family are the

sole beneficiaries of the Ordinary Shares held by Galbiga

Immobiliare S.r.l.

Nant Capital, LLC and Dompe Holdings S.r.l. are "Substantial

Shareholders" in the Company for the purposes of the AIM Rules.

Their conditional subscription for Placing Shares pursuant to the

Placing (as described above) and the participation of certain

Directors as stated above will be related party transactions for

the purposes of the AIM Rules. The Directors who are independent of

the related party transaction, having consulted with Cantor

Fitzgerald Europe, the Company's nominated adviser for the purposes

of the AIM Rules, consider the terms of the participations of each

of Giulio Cesareo, Nant Capital, LLC and Dompe Holdings S.r.l. in

the Placing to be fair and reasonable insofar as Shareholders are

concerned.

6. Details of the Open Offer

In order to provide Shareholders with an opportunity to

participate, the Company is providing all Qualifying Shareholders

with the opportunity to subscribe at the Issue Price for an

aggregate of up to 1,345,169 Open Offer Shares. This allows

Shareholders to participate on a pre-emptive basis whilst providing

the Company with the flexibility to raise additional equity capital

to further improve its financial position.

Shareholders are being offered the opportunity to apply for

additional Open Offer Shares in excess of their pro rata

entitlements to the extent that other Shareholders do not take up

their entitlements in full. In the event of applications in excess

of the maximum number of Open Offer Shares available, the Company

will decide on the basis for allocation. The Open Offer Shares have

not been placed subject to clawback nor have they been

underwritten. Consequently, there may be fewer than 1,345,169 Open

Offer Shares issued pursuant to the Open Offer.

A Qualifying Non-CREST Shareholder who has sold or transferred

all or part of their holding of Existing Ordinary Shares prior to

the Ex-entitlement Date, should consult their broker or other

professional adviser as soon as possible, as the invitation to

acquire Open Offer Shares under the Open Offer may be a benefit

which may be claimed by the transferee. Qualifying Non-CREST

Shareholders who have sold all or part of their registered holdings

should, if the market claim is to be settled outside CREST,

complete Box 11 on the Application Form and immediately send it to

the stockbroker, bank or other agent through whom the sale or

transfer was effected for transmission to the purchaser or

transferee. The Application Form should not, however, subject to

certain exceptions, be forwarded to or transmitted in or into a

Restricted Jurisdiction.

The Directors intend to participate in the Open Offer.

Basic Entitlement

Qualifying Shareholders are invited, on and subject to the terms

and conditions of the Open Offer, to apply for any number of Open

Offer Shares (subject to the limit on the number of Excess Shares

that can be applied for using the Excess Application Facility) at

the Issue Price. Qualifying Shareholders have a Basic Entitlement

of:

1 Open Offer Share for every 38 Existing Ordinary Shares

registered in the name of the relevant Qualifying Shareholder on

the Record Date.

Basic Entitlements under the Open Offer will be rounded down to

the nearest whole number and any fractional entitlements to Open

Offer Shares will be disregarded in calculating Basic Entitlements

and will be aggregated and made available to Qualifying

Shareholders under the Excess Application Facility.

The aggregate number of Open Offer Shares available for

subscription pursuant to the Open Offer will not exceed 1,345,169

Open Offer Shares.

Allocations under the Open Offer

In the event that valid acceptances are not received in respect

of all of the Open Offer Shares under the Open Offer, unallocated

Open Offer Shares will be allotted to Qualifying Shareholders to

meet any valid applications under the Excess Application Facility.

The Company may satisfy valid applications for Excess Shares of

applicants in whole or in part but reserves the right not to

satisfy any excess above any Open Offer Entitlements. The Board may

scale back applications made in excess of Open Offer Entitlements

on such basis as it reasonably considers to be appropriate.

Excess Application Facility

The Open Offer is structured to allow Qualifying Shareholders to

subscribe for Open Offer Shares at the Issue Price pro rata to

their holdings of Existing Ordinary Shares. Qualifying Shareholders

may also make applications in excess of their pro rata initial

entitlement. Any such applications will be granted at the absolute

discretion of the Company. If applications under the Excess

Application Facility are received for more than the total number of

Open Offer Shares available following take-up of Open Offer

Entitlements, such applications will be scaled according to the

Directors' discretion to the number of excess Open Offer Shares

applied for by Qualifying Shareholders under the Excess Application

Facility. Applications under the Excess Application Facility may be

allocated in such manner as the Directors may determine, in their

absolute discretion, and no assurance can be given that any

applications under the Excess Application Facility by Qualifying

Shareholders will be met in full or in part or at all.

Not all Shareholders will be Qualifying Shareholders.

Shareholders who are located in, or are citizens of, or have a

registered address in Restricted Jurisdictions will not qualify to

participate in the Open Offer. The attention of Overseas

Shareholders is drawn to paragraph 5 of Part III of the

circular.

Qualifying Shareholders should note that the Open Offer is not a

rights issue. Qualifying Non-CREST Shareholders should be aware

that the Application Form is not a negotiable document and cannot

be traded. Qualifying Shareholders should also be aware that in the

Open Offer, unlike in a rights issue, any Open Offer Shares not

applied for will not be sold in the market nor will they be placed

for the benefit of Qualifying Shareholders who do not apply under

the Open Offer.

Conditions

The Open Offer is conditional upon, inter alia, the passing of

the Resolutions and Admission.

If the conditions are not satisfied, the Open Offer will not

proceed and any Open Offer Entitlements admitted to CREST will

thereafter be disabled and application monies under the Open Offer

will be refunded to the applicants, at the applicant's risk either

as a cheque by first class post to the address set out on the

Application Form or returned direct to the account of the bank or

building society on which the relevant cheque or banker's draft was

drawn in the case of Qualifying Non-CREST Shareholders and by way

of a CREST payment in the case of Qualifying CREST Shareholders,

without interest, as soon as practicable thereafter.

7. Resolutions and General Meeting

The Placing and Open Offer are both conditional upon, amongst

other things, the Directors obtaining appropriate Shareholder

authorities at the General Meeting to allot the Placing Shares and

the Open Offer Shares and to disapply statutory pre-emption rights

which would otherwise apply to such allotment.

A notice convening the General Meeting to be held at the offices

of Directa Plus plc, 3rd floor, 11-12 St. James's Square, London,

SW1Y 4LB at 11 a.m. on 18 October 2019. An explanation of each of

the Resolutions is set out below.

Resolution 1: Authority to allot shares

If passed by Shareholders, this resolution would give the

Directors the authority to allot (a) the Placing Shares; (b) the

Open Offer Shares; and (c) Ordinary Shares up to an aggregate

nominal amount of GBP51,758 (representing 20,703,201 Ordinary

Shares). The amount in (c) represents approximately one-third of

the Enlarged Share Capital (assuming all Open Offer Shares are

subscribed for in full). Unless revoked, varied or extended, the

authority sought under this resolution will expire at the

conclusion of the annual general meeting in 2020 or the close of

business on 30 June 2020, whichever is sooner.

If passed, this resolution would give the Directors authority to

allot the same percentage of Ordinary Shares that they would have

been authorised to allot had the Fundraising not taken place. Other

than in respect of the Fundraising, the Directors have no present

intention to exercise the authority sought under this resolution.

However, it is considered prudent to maintain the flexibility that

this authority provides so that the Company can more readily take

advantage of possible opportunities. These authorities are without

prejudice to previous allotments or rights to receive allotments

made under existing authorities.

Resolution 1 will be proposed as an ordinary resolution and

requires a simple majority of Shareholders present, in person or by

proxy, to vote in favour in order to be passed. This authority will

replace the authority under section 551 of the Act given to the

Directors at the 2019 AGM.

As at the date of this announcement, the Company did not hold

any shares in treasury.

Resolution 2: Disapplication of pre-emption rights

This resolution would, if passed, allow the Directors to allot

equity securities or sell treasury shares for cash (other than in

connection with an employee share scheme), without having to offer

such shares to existing shareholders in proportion to their own

holdings (known as pre-emption rights).

The Act requires that, if the Company issues new shares, or

grants rights to subscribe for or to convert any security into

shares for cash or sells any treasury shares, it must first offer

them to existing shareholders in proportion to their current

holdings. It is proposed that the Directors be authorised to issue

shares for cash without first offering them to existing

shareholders in proportion to their existing shareholdings in the

following circumstances: (a) in connection with the Placing; (b) in

connection with the Open Offer; and (c) a rights issue or other

pre-emptive offer or an offer to holders of other equity securities

if required by the right of those securities or if the Directors

otherwise consider necessary. The resolution also enables the

Directors to modify the statutory pre-emption rights to deal with

legal, regulatory or practical problems that may arise on a rights

or other pre-emptive offer or issue.

Resolution 2 will be proposed as a special resolution and

requires a majority of at least 75 per cent. of those present, in

person or by proxy, to vote in favour to be passed. If passed, this

authority will expire, unless revoked, varied or extended, at the

same time as the authority to allot shares given pursuant to

Resolution 1. These authorities are without prejudice to previous

allotments or rights to receive allotments made under existing

authorities.

The Directors consider the authority in this resolution to be

appropriate in order to allow the Company flexibility to finance

business opportunities or to conduct a pre-emptive offer or rights

issue.

8. EIS/VCT

The Company received advance assurance on 1 April 2016 from HMRC

that it is a qualifying company for the purposes of the Enterprise

Investment Scheme ("EIS Advance Assurance"). On 5 July 2019 and 8

August 2019, the Company applied to HMRC to receive advance

assurance that it continues, and will continue following completion

of the Acquisition, to be a qualifying company for EIS Advance

Assurance and is a qualifying company for the purposes of the

Venture Capital Trust rules ("VCT Advance Assurance").

The Company has not yet received a letter from HMRC in response

to its applications dated 5 July 2019 and 8 August 2019 authorising

the Company to issue compliance certificates under Section 204(1)

Income Tax Act 2007 in respect of the ordinary shares to be issued,

following receipt of a form EIS1 satisfactorily completed. As a

result of the consultation document on advance assurance HMRC's

policy has changed and as of 2 January 2018, HMRC can no longer

consider VCT Advance Assurance applications where the details of

the potential qualifying holding are not given.

Even if assurance is received, it does not guarantee the

availability of any form of relief under the Enterprise Investment

Scheme to any particular subscriber or that the Company will

constitute a qualifying holding for VCT purposes.

Investors considering taking advantage of EIS relief or making a

qualifying VCT investment are recommended to seek their own

professional advice in order that they may fully understand how the

relief legislation may apply in their individual circumstances. Any

Shareholder who is in any doubt as to his taxation position under

the EIS and VCT legislation, or who is subject to tax in a

jurisdiction other than the UK, should consult an appropriate

professional adviser.

9. Action to be taken by Shareholders

If a hard copy of the Form of Proxy is requested this should be

completed and returned in accordance with the instructions printed

on it so as to arrive at the Company's registrars, Link Asset

Services, The Registry, 34 Beckenham Road, Beckenham, Kent, BR3 4TU

as soon as possible and in any event not later than 11.00 a.m. on

16 October 2019. Completion and return of the Form of Proxy will

not prevent Shareholders from attending the General Meeting and

voting in person should they so wish.

The action to be taken by Qualifying Shareholders in order to

apply for Open Offer Shares under the Open Offer is set out under

"Procedure for Application and Payment" in Part III of the circular

and in the accompanying Application Form.

The articles of association of the Company permit the Company to

issue shares in uncertificated form. CREST is a computerised

paperless share transfer and settlement system which allows shares

and other securities to be held in electronic rather than paper

form. CREST is a voluntary system and Shareholders who wish to

retain certificates will be able to do so.

10. Recommendation

The Board believe that the Placing and Open Offer are in the

best interests of the Company and its Shareholders as a whole and

recommend Shareholders to vote in favour of the Resolutions, as

they intend to do in respect of their own beneficial holdings of

3,673,836 Ordinary Shares, representing approximately 7.2 per cent.

of the current issued share capital of the Company.

Appendix 1: Expected timetable of principal events

Record Date for the Open Offer 6.00 p.m. on 26 September

2019

Announcement of the Firm Placing, 30 September 2019

Conditional Placing and Open Offer

Publication of Circular and Application 30 September 2019

Form

Ex-entitlement date for the Open Offer 8.00 a.m. on 1 October

2019

Open Offer Entitlements and Excess as soon as possible after

CREST Open Offer Entitlements credited 8.00 a.m. on 2 October

to stock accounts of Qualifying CREST 2019

Shareholders

Latest recommended time for requesting 4.30 p.m. on 10 October

withdrawal of Open Offer Entitlements 2019

and Excess CREST Open Offer Entitlements

from CREST

Latest time and date for depositing 3.00 p.m. on 11 October

Open Offer Entitlements and Excess 2019

CREST Open Offer Entitlements in to

CREST

Latest time and date for splitting 3.00 p.m. on 15 October

of Application Forms (to satisfy bona 2019

fide market claims only)

Latest time and date for receipt of 11.00 a.m. on 16 October

Forms of Proxy and CREST voting instructions 2019

for use at the General Meeting

Latest time and date for receipt of 11.00 a.m. on 17 October

completed Application Forms and payment 2019

in full under the Open Offer and settlement

of relevant CREST instructions (as

appropriate)

General Meeting 11.00 a.m. on 18 October

2019

Announce result of Open Offer 18 October 2019

Admission and commencement of dealings 8.00 a.m. on 21 October

in Conditional Placing Shares and 2019

Open Offer Shares commence

CREST members' accounts credited in as soon as possible after

respect of the First Tranche and Second 8.00 a.m. on 21 October

Tranche in uncertificated form 2019

Dispatch of definitive share certificates 4 November 2019

for the Conditional Placing Shares

Open Offer Shares in certificated

form

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCURVURKWAKOAR

(END) Dow Jones Newswires

September 30, 2019 09:21 ET (13:21 GMT)

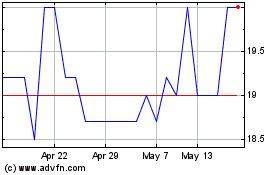

Directa Plus (LSE:DCTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Directa Plus (LSE:DCTA)

Historical Stock Chart

From Apr 2023 to Apr 2024