Brunner Investment Trust PLC Net Asset Value(s) (8227T)

January 10 2017 - 9:07AM

UK Regulatory

TIDMBUT

RNS Number : 8227T

Brunner Investment Trust PLC

10 January 2017

The Brunner Investment Trust PLC

As recommended by the AIC, net asset values are calculated on

both a capital and a cum-income basis.

The Brunner Investment Trust PLC announces that at close of

business on 9 January 2017:

1) based on the par value of the company's long term debt and

preference shares, the capital net asset value per ordinary share

was 780.38p.

2) based on the market value of the company's long term debt and

preference shares, the capital net asset value per ordinary share

was 754.58p.

3) based on the par value of the company's long term debt and

preference shares, the cum-income net asset value per ordinary

share was 787.29p.

4) based on the market value of the company's long term debt and

preference shares, the cum-income net asset value per ordinary

share was 761.49p.

In the valuation of the company's long term debt at market

value, the margin added to the yield of the relevant reference gilt

is derived from the spread of BBB UK corporate bond yields over

gilt yields.

Enquiries:

Kirsten Salt

Tel: 020 3246 7513

10 January 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVBSGDBLGBBGRG

(END) Dow Jones Newswires

January 10, 2017 09:07 ET (14:07 GMT)

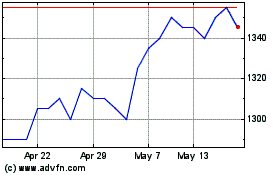

Brunner Investment (LSE:BUT)

Historical Stock Chart

From Mar 2024 to Apr 2024

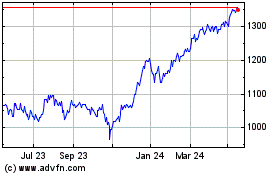

Brunner Investment (LSE:BUT)

Historical Stock Chart

From Apr 2023 to Apr 2024