VW Stalled Bond Probe, SEC Says

July 08 2019 - 7:32PM

Dow Jones News

By Dave Michaels

WASHINGTON -- Volkswagen AG dragged out a federal investigation

into whether it defrauded U.S. bond investors by omitting details

about its efforts to cheat on diesel-emissions tests, according to

the government.

The Securities and Exchange Commission, in a Monday federal

court filing, explained why it took so long to sue Volkswagen and

its former chief executive officer after the auto maker pleaded

guilty in 2017 to criminal charges over the diesel-cheating

scandal. In May, a federal judge in San Francisco questioned the

SEC over the delay and said he was "totally mystified" by the

regulator's move.

Representatives for VW didn't immediately respond to requests

for comment.

The SEC said its probe began in September 2015 and struggled

with "long delays by VW in producing documents and other

information, uncooperative witnesses who were reluctant or

altogether refused to speak to the staff and efforts (with mixed

success) to navigate cumbersome procedures for collecting evidence

located abroad."

The agency's filing provides a rare, detailed timeline of one of

its enforcement investigations, which examined Volkswagen's sale of

$13 billion in bonds in the U.S. from April 2014 to May 2015. The

SEC claims senior executives knew more than 500,000 vehicles in the

U.S. grossly exceeded legal emissions limits during that

period.

The SEC said Volkswagen's costs of funding would have been

higher if the company had disclosed the burgeoning legal risks to

purchasers of its debt.

In its March civil lawsuit, the SEC said former CEO Martin

Winterkorn heard about a emissions-cheating device from two

engineers in November 2007.

The SEC said it first sought a settlement with Volkswagen in

mid-2016, but the company excluded it from settlement talks with

the Justice Department and other agencies.

"VW's counsel informed DOJ and the [SEC] staff that VW viewed

the SEC's securities investigation differently than the other

government investigations," the SEC wrote.

The SEC said it encountered obstacles abroad too. The German

financial regulator, the Federal Financial Supervisory Authority,

rejected the SEC's request for help obtaining documents and

interviews of key witnesses. The SEC wrote that it then asked the

Justice Department for its assistance in arranging interviews but

that it also turned the agency down.

Volkswagen was slow to produce documents that identified

employees and officers involved in its bond offerings, the SEC

said. The company sent the SEC millions of pages of requested

documents but didn't include a spreadsheet that listed the names of

employees involved in preparing its bond disclosures, according to

the SEC.

U.S. District Judge Charles Breyer ordered the SEC in May to

make the filings it produced Monday.

The material includes a 113-page statement from an SEC

supervisor in Chicago, Jeffrey Shank, that explains when the SEC

discovered each factual claim in its lawsuit.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

July 08, 2019 19:17 ET (23:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

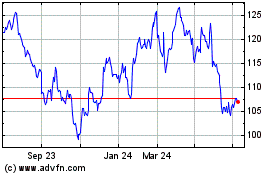

Volkswagen (TG:VOW3)

Historical Stock Chart

From Aug 2024 to Sep 2024

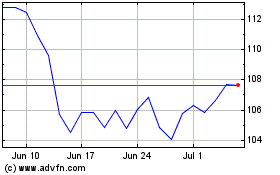

Volkswagen (TG:VOW3)

Historical Stock Chart

From Sep 2023 to Sep 2024