Current Report Filing (8-k)

March 02 2020 - 6:06AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 27, 2020

ROCKY

MOUNTAIN HIGH BRANDS, INC.

(Exact

name of the registrant as specified in its charter)

|

Nevada

|

000-55609

|

90-0895673

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File

Number)

|

(I.R.S. Employer

Identification No.)

|

|

9101

LBJ Freeway, Suite 200; Dallas, TX

|

75243

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 800-260-9062

______________________________________________________

(Former

name or address if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.below):

|

[ ]

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [ ]

SECTION 3 – Securities and Trading

Markets

Item 3.02 Unregistered Sales of Equity Securities

On February 27, 2020, we issued a total of

11,000 shares of our newly-designated Series H Preferred Stock to 1 subscribers at the stated value of $1,000 per share for a total

of $11,000 in subscription proceeds. The rights and features of our Series H Preferred Stock are described under Item 5.03, below.

This issuance was exempt under Rule 506(c) under Regulation D. All investors in the offering of Series H Preferred Stock have been

verified to be “accredited investors” as defined in Rule 501 under Regulation D.

SECTION 5 – Corporation Governance

and Management

Item 5.03 Amendments to Articles of Incorporation

or Bylaws

On February 27, 2020, our Board of Directors

approved the designation of a new class of Series H Preferred Stock consisting of 5,000 shares, stated value $1,000 per share.

Holder of Series H Preferred Stock are entitled to receive dividends at the rate of 14% of the stated value to be paid quarterly

in arrears. Dividends may be paid, at our option, in the form of cash or common stock valued at the conversion price for Series

H Preferred Stock. All shares of Series H Preferred Stock are convertible at the option of the holder to shares of common stock

at a price equal to 120% of the volume weighted average price for our common stock during the 5 trading days preceding the conversion

date. All conversions are limited such that no holder of Series H Preferred Stock may effect conversion that would result in the

holder owning more than 4.99% of our common stock.

At any time following one (1) year from issuance,

all shares of Series H Preferred Stock may, at our option, be redeemed by the payment of: (i) cash, (ii) common stock valued at

the conversion price then in effect, or (iii) a combination thereof. At two (2) years following the issue date, all shares of Series

H Preferred Stock then outstanding will automatically convert to shares of our common stock at the conversion price then in effect.

Shares of Series H Preferred Stock are entitled

to vote on an as-if-converted basis on all matters submitted to a vote of our shareholders. With respect to rights upon liquidation,

winding up, or dissolution, shares of Series H Preferred Stock rank junior to our Series F Convertible Preferred Stock and senior

to our common stock and any other previously issued classes of preferred stock.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf

of the undersigned hereunto duly authorized.

ROCKY

MOUNTAIN HIGH BRANDS, INC.

Date:

February 28, 2020

By:

/s/ Jens Mielke

Jens Mielke

Chief Financial Officer

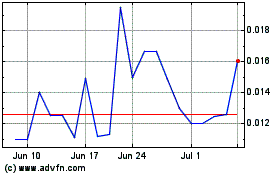

Rocky Mountain High Brands (PK) (USOTC:RMHB)

Historical Stock Chart

From Mar 2024 to Apr 2024

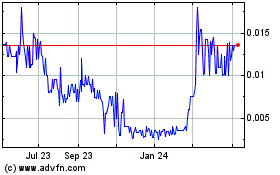

Rocky Mountain High Brands (PK) (USOTC:RMHB)

Historical Stock Chart

From Apr 2023 to Apr 2024