KKR-Backed PHC Holdings Plans $740.6 Million Initial Public Offering

October 06 2021 - 6:39AM

Dow Jones News

By Kosaku Narioka

KKR & Co.-backed PHC Holdings Corp. said it plans to sell

shares worth 82.55 billion yen ($740.6 million) in an initial

public offering.

The Japanese healthcare-device maker, formerly known as

Panasonic Healthcare, said Wednesday it plans to offer 6.6 million

new shares and 18.8 million shares held by existing shareholders,

including KKR, Japanese trading house Mitsui & Co. and

Panasonic Corp.

The IPO price of Y3,250 apiece was at the lower end of the

Y3,250-Y3,500 range used in a book building process and would value

the company around Y400 billion, given about 123.0 million shares

outstanding at the time of listing.

The shares are scheduled to be listed on the Tokyo Stock

Exchange on Oct. 14.

KKR, which bought the healthcare business from Panasonic in

2014, held a 46% stake in the company as of Sept. 7, while Mitsui

owned a 20% interest and Panasonic had 11% ownership.

Write to Kosaku Narioka at kosaku.narioka@wsj.com

(END) Dow Jones Newswires

October 06, 2021 06:24 ET (10:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

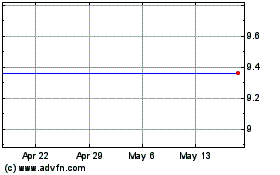

Panasonic (PK) (USOTC:PCRFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

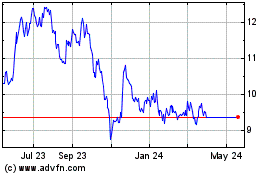

Panasonic (PK) (USOTC:PCRFY)

Historical Stock Chart

From Apr 2023 to Apr 2024