Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

March 05 2024 - 2:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

MEDMEN ENTERPRISES INC.

(Name of Issuer)

CLASS B SUBORDINATE VOTING SHARES

(Title of Class of Securities)

58507M107

(CUSIP Number)

David Rosenthal

Chief Compliance Officer

Gotham Green Partners, LLC

1437 4th Street

Santa Monica, California 90401

(212) 659-3838

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 1, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions of the Exchange Act (however, see the Notes).

| CUSIP No. 58507M107 | Page 1 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

750,960,544 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

750,960,544 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

750,960,544 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

33.4% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IA |

|

(1) |

Includes (a) an aggregate of 699,113,845 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 51,846,699 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 2 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green GP 1, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

76,950,396 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

76,950,396 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

76,950,396 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

4.9% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 69,899,769 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 7,050,627 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 3 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green GP II, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

221,346,679 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

221,346,679 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

221,346,679 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

12.9% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 216,094,903 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate 5,251,776 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 4 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners SPV IV GP, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

334,429,367 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

334,429,367 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

334,429,367 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

18.3% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 332,557,811 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 1,871,556 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 5 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners SPV VI GP, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

118,234,102 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

118,234,102 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

118,234,102 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

7.3% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 80,561,362 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 37,672,740 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 6 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund 1 HoldCo, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

15,388,156 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

15,388,156 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

15,388,156 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

1.0% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 13,978,207 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 1,409,949 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 7 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund 1 (Q) HoldCo, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

61,562,240 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

61,562,240 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

61,562,240 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

4.0% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 55,921,562 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 5,640,678 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 8 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund II HoldCo, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

32,453,849 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

32,453,849 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

32,453,849 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

2.1% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 31,683,833 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 770,016 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 9 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund II (Q) HoldCo, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

188,892,830 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

188,892,830 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

188,892,830 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

11.2% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 184,411,070 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 4,481,760 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 10 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners SPV IV HoldCo, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

334,429,367 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

334,429,367 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

334,429,367 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

18.3% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 332,557,811 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 1,871,556 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 11 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners SPV VI HoldCo, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

118,234,102 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

118,234,102 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

118,234,102 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

7.3% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 80,561,362 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 37,672,740 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 12 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund 1, L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

15,388,156 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

15,388,156 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

15,388,156 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

1.0% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN |

|

(1) |

Includes (a) an aggregate of 13,978,207 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 1,409,949 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 13 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund 1 (Q), L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

61,562,240 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

61,562,240 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

61,562,240 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

4.0% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN |

|

(1) |

Includes (a) an aggregate of 55,921,562 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 5,640,678 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 14 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund II, L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

32,453,849 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

32,453,849 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

32,453,849 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

2.1% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN |

|

(1) |

Includes (a) an aggregate of 31,683,833 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 770,016 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 15 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Fund II (Q), L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

188,892,830 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

188,892,830 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

188,892,830 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

11.2% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN |

|

(1) |

Includes (a) an aggregate of 184,411,070 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 4,481,760 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 16 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners SPV IV, L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

334,429,367 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

334,429,367 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

334,429,367 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

18.3% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN |

|

(1) |

Includes (a) an aggregate of 332,557,811 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 1,871,556 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 17 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Gotham Green Partners SPV VI, L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

118,234,102 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

118,234,102 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

118,234,102 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

7.3% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

|

(1) |

Includes (a) an aggregate of 80,561,362 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 37,672,740 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 18 of 19 |

| 1 |

NAMES OF REPORTING PERSONS

Jason Adler |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

|

(a) ☐

(b) ☐ |

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

750,960,544 shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

750,960,544 shares (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

750,960,544 shares (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

| |

Not applicable. |

☐ |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

9

33.4% (2) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

|

(1) |

Includes (a) an aggregate of 699,113,845 Shares issuable upon conversion of the outstanding principal and accrued interest of Convertible Notes as of February 29, 2024, and (b) an aggregate of 51,846,699 Shares issuable upon exercise of Warrants. |

|

(2) |

Calculated based on 1,497,778,734 Shares outstanding as of December 27, 2023, as provided by the issuer. |

| CUSIP No. 58507M107 | Page 19 of 19 |

Explanatory Note

This Amendment No. 5 (the “Amendment”) amends the Schedule

13D filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 10, 2022, as amended by Amendment No. 1,

Amendment No. 2, Amendment No. 3, and Amendment No. 4 filed with the SEC on February 8, 2023, May 10, 2023, August 10, 2023, and November

13, 2023, respectively (collectively, the “Schedule 13D”), which amended a Schedule 13G initially filed on February 16, 2021

and amended on June 10, 2021 and August 27, 2021. This Amendment is being filed to reflect accrued payment-in-kind interest on the Convertible

Notes as of February 29, 2024.

Unless set forth below, all previous Items set forth

in the Schedule 13D remain unchanged. All capitalized terms used herein but not defined shall have the same meanings as set forth in

the Schedule 13D.

| Item 5. |

Interest in Securities of the Issuer |

Item 5 of the Schedule 13D is hereby amended and restated

in its entirety as follows:

(a) and (b). Items 7 through 11 and 13 of each of

the cover pages of this Schedule 13D are incorporated herein by reference n this Item 5.

The information set forth in Item 4 is hereby

incorporated by reference into this Item 5.

Each Reporting Person expressly disclaims, to the

extent permitted by applicable law, beneficial ownership of any Shares held by the other Reporting Persons. In addition, the filing of

this Schedule 13D by Jason Adler and Gotham Green Partners, LLC should not be construed as an admission that either is, and each

disclaims that they are, a beneficial owner, as defined in Rule 13d-3 under the Securities Act, of any of the Shares covered by this

Schedule 13D.

(c) During the past 60 days, the Reporting Persons

did not conduct any transactions in the Shares.

(d) To the knowledge of the Reporting Persons, no

one other than the Reporting Persons, or the partners, members, affiliates or shareholders of the Reporting Persons has the right to receive

or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities of the Issuer reported as beneficially

owned by the Reporting Persons herein.

(e) Not applicable.

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated: March 5, 2024

GOTHAM GREEN PARTNERS, LLC

|

|

GOTHAM GREEN FUND 1 HOLDCO, LLC

|

| |

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

Gotham Green GP 1, LLC |

|

Name: |

Jason Adler |

|

|

|

|

Title: |

Managing Member |

|

By:

|

/s/ Jason Adler |

| |

|

|

Name: |

Jason Adler |

| |

|

|

Title: |

Managing Member |

| GOTHAM GREEN GP 1, LLC |

|

GOTHAM GREEN FUND 1 (Q) HOLDCO, LLC

|

| |

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

Gotham Green GP 1, LLC |

|

Name: |

Jason Adler |

|

|

|

|

Title: |

Managing Member |

|

By:

|

/s/ Jason Adler |

| |

|

|

Name: |

Jason Adler |

| |

|

|

Title: |

Managing Member |

| GOTHAM GREEN GP II, LLC |

|

GOTHAM GREEN FUND II HOLDCO, LLC

|

| |

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

Gotham Green GP II, LLC |

|

Name: |

Jason Adler |

|

|

|

|

Title: |

Managing Member |

|

By:

|

/s/ Jason Adler |

| |

|

|

Name: |

Jason Adler |

| |

|

|

Title: |

Managing Member |

| GOTHAM GREEN PARTNERS SPV IV GP, LLC |

|

GOTHAM GREEN FUND II (Q) HOLDCO, LLC

|

| |

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

Gotham Green GP II, LLC |

|

Name: |

Jason Adler |

|

|

|

|

Title: |

Managing Member |

|

By:

|

/s/ Jason Adler |

| |

|

|

Name: |

Jason Adler |

| |

|

|

Title: |

Managing Member |

| GOTHAM GREEN PARTNERS SPV VI GP, LLC |

|

GOTHAM GREEN PARTNERS SPV IV HOLDCO, LLC

|

| |

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

Gotham Green Partners SPV IV GP, LLC |

|

Name: |

Jason Adler |

|

|

|

|

Title: |

Managing Member |

|

By:

|

/s/ Jason Adler |

| |

|

|

Name: |

Jason Adler |

| |

|

|

Title: |

Managing Member |

| GOTHAM GREEN PARTNERS SPV VI HOLDCO, LLC |

|

GOTHAM GREEN FUND II (Q), L.P.

|

| |

|

|

|

|

|

By: |

Gotham Green Partners SPV VI GP, LLC |

|

By:

|

Gotham Green GP II, LLC |

|

|

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

/s/ Jason Adler |

| Name: |

Jason Adler |

|

Name: |

Jason Adler |

| Title: |

Managing Member |

|

Title: |

Managing Member |

| GOTHAM GREEN FUND 1, L.P. |

|

GOTHAM GREEN PARTNERS SPV IV, L.P.

|

| |

|

|

|

|

|

By: |

Gotham Green GP 1, LLC |

|

By:

|

Gotham Green Partners SPV IV GP, LLC |

|

|

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

/s/ Jason Adler |

| Name: |

Jason Adler |

|

Name: |

Jason Adler |

| Title: |

Managing Member |

|

Title: |

Managing Member |

| GOTHAM GREEN FUND 1 (Q), L.P. |

|

GOTHAM GREEN PARTNERS SPV VI, L.P.

|

| |

|

|

|

|

|

By: |

Gotham Green GP 1, LLC |

|

By:

|

Gotham Green Partners SPV VI GP, LLC |

|

|

|

|

|

|

|

By: |

/s/ Jason Adler |

|

By:

|

/s/ Jason Adler |

| Name: |

Jason Adler |

|

Name: |

Jason Adler |

| Title: |

Managing Member |

|

Title: |

Managing Member |

| GOTHAM GREEN FUND II, L.P. |

|

/s/ Jason Adler

|

| |

|

|

JASON ADLER |

|

By: |

Gotham Green GP II, LLC |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Jason Adler |

|

|

|

| Name: |

Jason Adler |

|

|

|

| Title: |

Managing Member |

|

|

|

| Attention: | Intentional

misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001) |

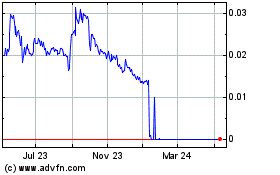

Medmen Enterprises (CE) (USOTC:MMNFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

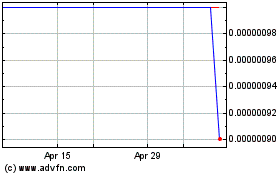

Medmen Enterprises (CE) (USOTC:MMNFF)

Historical Stock Chart

From Apr 2023 to Apr 2024