UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2021

Commission File Number 001-38896

Luckin Coffee Inc.

(Exact Name of Registrant as Specified in Its Charter)

28th Floor, Building T3, Haixi Jingu Plaza

1-3 Taibei Road

Siming District, Xiamen City, Fujian

People’s Republic of China, 361008

+86-592-3386666

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Entry into Rights Agreement

On October 14, 2021, the Board of Directors (the

“Board”) of Luckin Coffee Inc. (in Provisional Liquidation), a company incorporated under the laws of the Cayman

Islands (the “Company” or “Luckin Coffee”), unanimously adopted a shareholder rights plan (the “Rights

Plan”) to protect the interests of the Company’s shareholders. The Rights Plan, if triggered, will significantly dilute the ownership of any Acquiring Person (defined below). However, the Board may,

in its sole and absolute discretion, determine that a shareholder or potential shareholder is exempt from the Rights Plan at any time

before such person becomes an Acquiring Person. The Board believes the Rights Plan is an effective course of action for the Board to fulfill its

fiduciary duties to the Company and its shareholders and to enable shareholders to realize the long-term value of their investment.

The Rights Plan was adopted following a careful evaluation and consultation with the Company’s external legal advisors and is

supported by the Joint Provisional Liquidators of the Company.

Luckin Coffee has made significant progress in its restructuring,

which included enhancing its internal controls and corporate governance. At the same time, Luckin Coffee has delivered strong revenue

growth and improvements in results of operation, and the Board and management team remain highly committed to driving growth and value

creation for the benefit of its stakeholders.

Summary of the Rights Agreement

The

Company granted (i) one right (collectively, the “Class A Rights”) with respect to each outstanding

Class A Ordinary Share, par value $0.000002 each (the “Class A Ordinary Shares”) and one right (collectively, the “Class

B Rights” and, together with the Class A Rights, the “Rights”) for each Class B Ordinary Share, par value $0.000002

each (the “Class B Ordinary Shares”, and, together with the Class A Ordinary Shares, the “Ordinary Shares”),

in each case, of the Company held of record at the close of business on October 25, 2021 (the “Record Time”), and (ii) one

Class A Right for each Class A Ordinary Share and each convertible preferred shares of the Company (collectively, the “Preferred

Shares” and, together with the Ordinary Shares, the “Shares”) and one Class B Right for each Class B Ordinary Share,

in each case, (x) issued after the Record Time and prior to the Separation Time (as defined below) and (y) issued after the Separation

Time and prior to the Expiration Time (as defined below) pursuant to the terms of securities convertible or redeemable into the Shares

or rights, in each case, issued or granted prior to, and outstanding, at the Separation Time, subject to certain exceptions. The Rights

will be issued pursuant to a Rights Agreement, dated as of October 14, 2021 (the “Rights Agreement”), between the Company

and American Stock Transfer & Trust Company, LLC, as Rights Agent (the “Rights Agent”). Each Class A Right entitles its

registered holder to purchase from the Company, at or after the Separation Time and prior to the Expiration Time, one Class A Ordinary

Share (or in certain circumstances, securities of another entity), for $5.50 (the “Class A Exercise Price”), subject to

adjustment. Each Class B Right entitles its registered holder to purchase from the Company, at or after the Separation Time and prior

to the Expiration Time, one Class B Ordinary Share (or in certain circumstances, securities of another entity), for $5.50 (the “Class

B Exercise Price,” and, together with the Class A Exercise Price, the “Exercise Price”), subject to adjustment. Capitalized

terms used in this report on Form 6-K but not otherwise defined herein have the meanings

given to them in the Rights Agreement.

Rights Certificates; Exercise Period

The

Rights will be evidenced by the certificates for the associated Share (or, if the Shares shall be uncertificated, by the registration

of the associated Share in the register of members of the Company and any confirmation thereof as provided for in the Rights Agreement)

until the Separation Time, being the next business day following the earlier of (i) the tenth business day (or such later date as the

Board may from time to time fix by resolution in accordance with the Rights Agreement) after the date on which any Person commences

a tender or exchange offer that, if consummated, would result in such Person’s becoming an Acquiring Person (as defined below) and

(ii) the tenth day after the date of the first event causing a Flip-in Date (as defined below) to occur; provided, that if the foregoing

results in the Separation Time being prior to the Record Time, the Separation Time shall be the Record Time and provided further, that

if any offer referenced in clause (i) is cancelled, terminated or otherwise withdrawn prior to the Separation Time without the purchase

of any Shares pursuant thereto, such offer shall be deemed never to have been made.

The

Rights Agreement provides that, until the Separation Time, the Rights will be transferred with and only with the associated Shares.

Share certificates issued on or after the Record Time but prior to the Separation Time (or the registration of the Shares in the Company’s

register of members with respect to uncertificated shares) shall evidence one Right for each Share represented thereby and such certificates

(or confirmation of registration with respect to uncertificated shares) shall contain a legend incorporating by reference the terms of

the Rights Agreement (as such may be amended from time to time). Notwithstanding the absence of the aforementioned legend, certificates

evidencing the Shares outstanding at the Record Time (or registration) shall also evidence one Right for each Ordinary Share evidenced

thereby. At or after the Separation Time, if requested by the Company, separate certificates evidencing the Rights (“Rights Certificates”)

will be delivered to holders of record of the Shares at the Separation Time. The Rights will not be exercisable until the Separation Time.

Flip-in Trigger

A

Flip-in Date will occur on any Share Acquisition Date (as defined below) or such later date and time as the Board may from time to time

fix by resolution adopted prior to the Flip-in Date that would otherwise have occurred. A Share Acquisition Date means the earlier of (a) the date of the first

public announcement by the Company or an Acquiring Person that an Acquiring Person has become such or (b) the date on which any Acquiring

Person becomes the Beneficial Owner of more than 50% of the outstanding Shares or more than 50% of Voting Power of the Company, excluding

for this purpose any shares determined to be constructively owned pursuant to the Rights Agreement.

An

Acquiring Person is any Person who, together with all Affiliates and Associates of such Person, is or becomes the Beneficial Owner

of 10% or more of the outstanding Shares or 10% or more of the Voting Power of the Company at any time after the first public

announcement of the Rights Agreement, including where such Person holds the controlling equity interests in an entity which is in

liquidation or similar winding-up proceedings (a “Liquidating Subsidiary”) and becomes a Beneficial Owner of 10% or more of the

outstanding Shares or acquires 10% or more of the Voting Power of the Company as a result of the Liquidation Termination Event or

the Liquidation Amendment Event, which causes all or part of the voting, disposition or other rights previously granted to the

officer appointed in respect of the Liquidating Subsidiary to revert to that Person thereupon; provided, however, such term

shall not include (i) the Company or any Subsidiary of the Company (in each case including, without limitation, in any fiduciary

capacity), any employee benefit plan of the Company or of any Subsidiary of the Company or any entity or trustee holding Shares for

or pursuant to the terms of any such plan or for the purpose of funding any such plan or other benefits for employees of the Company

or of any Subsidiary of the Company, (ii) any Person who is the Beneficial Owner of 10% or more of the outstanding Shares or 10% or

more of the Voting Power of the Company at the time of the first public announcement of the adoption of the Rights Agreement (a

“Grandfathered Person”), provided, that if a Grandfathered Person becomes the Beneficial Owner (other than by means of a

share dividend, share split or reclassification, or pursuant to additional grants of any such equity awards to a member of the

Board) of any additional Share or Voting Power of the Company, such Grandfathered Person will be deemed to be an Acquiring Person

unless, upon such acquisition of Beneficial Ownership of the Shares or Voting Power of the Company, such Person is not the

Beneficial Ownership of 10% or more of the outstanding Shares and 10% or more of the Voting Power of the Company, (iii) any Person

who becomes the Beneficial Owner of 10% or more of the outstanding Shares or 10% or more of the Voting Power of the Company after

the time of the first public announcement of the Rights Agreement solely as a result of (A) an acquisition by the Company of Shares

that, by reducing the number of the Shares outstanding, increases the proportionate number of the Shares Beneficially Owned by such

Person, until such time after the public announcement by the Company of such repurchases as such Person becomes the Beneficial Owner

(other than by means of a share dividend, share split or reclassification) of any additional Shares or Voting Power of the Company

while such Person is or as a result of which such Person becomes the Beneficial Owner of 10% or more of the outstanding Shares or

10% or more of the Voting Power of the Company or (B) the occurrence of a Flip-in Date which has not resulted from the acquisition

of Beneficial Ownership of the Shares or Voting Power of the Company by such Person or any of such Person’s Affiliates or

Associates, (iv) any Person who becomes the Beneficial Owner of 10% or more of the outstanding Shares or 10% or more of the Voting

Power of the Company but who acquired Beneficial Ownership of the Shares or Voting Power of the Company without any plan or

intention to seek or affect control of the Company, if such Person promptly divests, or promptly enters into an agreement with, and

satisfactory to, the Board, in the Board’s sole discretion, to divest, and subsequently divests in accordance with the terms

of such agreement (without exercising or retaining any power, including voting power, with respect to such shares), sufficient

Shares (or securities convertible into, exchangeable into or exercisable for the Shares or otherwise deemed to be Beneficially Owned

by such Person) so that such Person ceases to be the Beneficial Owner of 10% or more of the outstanding Shares and/or 10% or more of

the Voting Power of the Company, as applicable, (v) any Person who becomes an Acquiring Person solely as a result of any unilateral

grant of any security by the Company or through the exercise of any options, warrants, rights or similar interests (including

restricted stock) granted by the Company to its directors, officers and employees, until such time thereafter as such Person becomes

the Beneficial Owner (other than by means of a share dividend, share split or reclassification) of any additional Shares or Voting

Power of the Company; or (vi) any Person who the Board determines, prior to the time such Person would otherwise be an Acquiring

Person, should be exempted from the definition of Acquiring Person.

In the event that prior to the Expiration Time a Flip-in Date occurs,

the Company shall take such action as shall be necessary to ensure and provide that (i) each Class A Right (other than Class A Rights

Beneficially Owned by the Acquiring Person or any affiliate or associate thereof, which Rights shall become void) shall constitute the

right to purchase from the Company, upon the exercise thereof in accordance with the terms of the Rights Agreement, that number of Class

A Ordinary Shares having an aggregate Market Price on the Share Acquisition Date that gave rise to the Flip-in Date equal to twice the

Exercise Price for such Class A Right for an amount in cash equal to such Exercise Price and (ii) each Class B Right (other than Class

B Rights Beneficially Owned by the Acquiring Person or any affiliate or associate thereof, which Rights shall become void) shall constitute

the right to purchase from the Company, upon the exercise thereof in accordance with the terms of the Rights Agreement, that number of

Class B Ordinary Shares having an aggregate Market Price on the Share Acquisition Date that gave rise to the Flip-in Date equal to twice

the Exercise Price for such Class Right for an amount in cash equal to such Exercise Price.

Exchange

The Board may, at its option, at any time after a Flip-in Date and

prior to the time that an Acquiring Person becomes the Beneficial Owner of more than 50% of the outstanding Shares or more than 50% of

the Voting Power of the Company (excluding for this purpose any shares determined to be constructively owned), elect to exchange all (but

not less than all) the then outstanding Rights (other than Rights Beneficially Owned by the Acquiring Person or any affiliate or associate

thereof, which Rights become null and void) for the Shares at an exchange ratio of one Class A Ordinary Share per Class A Right and one

Class B Ordinary Share per Class B Right, appropriately adjusted to protect the interests of holders of Rights generally in the event

that after the Separation Time any of the events described above, or any analogous event, shall have occurred with respect to the Shares

(such exchange ratio, as adjusted from time to time, hereinafter referred to as the “Exchange Ratio”). Immediately upon such

action by the Board (the “Exchange Time”), the right to exercise such Rights will terminate and each such Right will thereafter

represent only the right to receive a number of Class A Ordinary Shares or Class B Ordinary Shares, respectively, equal to the number

of such Rights held by such holder multiplied by the Exchange Ratio.

Flip-over Trigger

In

the event that prior to the Expiration Time the Company enters into an agreement with respect to, consummates or permits to occur a transaction

or series of transactions on or after a Flip-in Date in which, directly or indirectly, (i) the Company shall consolidate or merge

or participate in a scheme of arrangement or statutory share exchange with any other Person or (ii) the Company shall sell or otherwise

transfer (or one or more of its Subsidiaries shall sell or otherwise transfer) assets (A) aggregating more than 50% of the assets (measured

by either book value or fair market value) or (B) generating more than 50% of the operating income or cash flow, of the Company and its

Subsidiaries (taken as a whole) to any Person (other than the Company or one or more of its wholly owned Subsidiaries) or to two or more

such Persons that are Affiliates or Associates or otherwise acting, directly or indirectly, in cooperation or collaboration with each

other (a “Flip-over Transaction or Event”), the Company shall not enter into any agreement with respect to, consummate

or permit to occur any such Flip-over Transaction or Event unless and until it shall have entered into a supplemental agreement with the

Person engaging in such Flip-over Transaction or Event or the parent corporation thereof (“Flip-over Entity”), for the benefit

of the holders of the Rights (the terms of which shall be reflected in an amendment to the Rights Agreement entered into with the Rights

Agent), providing that, upon consummation or occurrence of the Flip-over Transaction or Event (i) each Right shall thereafter constitute

the right to purchase from the Flip-over Entity, upon exercise thereof in accordance with the terms hereof, that number of shares of the

capital stock (or similar equity interest) with the greatest voting power in respect of the election of directors (or other Persons similarly

responsible for the direction of the business and affairs) of the Flip-over Entity (the “Flip-over Stock”) having an aggregate

Market Price on the date of consummation or occurrence of such Flip-over Transaction or Event equal to twice the applicable Exercise Price

for an amount in cash equal to the applicable Exercise Price (such right to be appropriately adjusted in order to protect the interests

of the holders of Rights generally in the event that after such date of consummation or occurrence any of the events described in the

Rights Agreement, or any analogous event, shall have occurred with respect to the Flip-over Stock) and (ii) the Flip-over Entity shall

thereafter be liable for, and shall assume, by virtue of such Flip-over Transaction or Event and such supplemental agreement, all the

obligations and duties of the Company pursuant to the Rights Agreement. For purposes of the foregoing description, the term “Acquiring

Person” shall include any Acquiring Person and its Affiliates and Associates, counted together as a single Person.

Anti-Dilution

The Exercise Price and the number of Rights outstanding, or in

certain circumstances the securities purchasable upon exercise of the Rights, are subject to adjustment from time to time to prevent

dilution in the event of a share dividend on, or a subdivision or a combination into a smaller number of shares of, the Shares, or

the issuance or distribution of any securities or assets in respect of, in lieu of or in exchange for the Shares.

Redemption

The Board may redeem all of the Rights at a price of $0.001 per Right

(rounded up to the nearest whole US$0.01 in the case of any holder whose holding are not in a multiple of ten) at any time prior to the

Flip-in Date. If the Board redeems any Rights, it must redeem all of the Rights. Once the Rights are redeemed, the only right of the holders

of Rights will be to receive the redemption price per Right. The redemption price will be subject to adjustment.

Expiration

The Rights will expire on the earliest of (i) the Exchange Time, (ii)

the date on which the Rights are redeemed as described herein, (iii) the close of business on the third anniversary of the date of the

Rights Agreement, unless, for purposes of this clause (iii), extended by action of the Board (in which case the applicable time shall

be the time to which it has been so extended) and (iv) the closing of a consolidation, merger, scheme of arrangement or statutory share

exchange involving the Company which does not constitute a Flip-over Transaction or Event in which the Shares are cancelled or converted

into, or into the right to receive, another security, cash or other consideration, and which shall be pursuant to a merger or other acquisition

agreement between the Company and any Person that has been approved by the Board prior to any Person becoming an Acquiring Person (such

earliest time, the “Expiration Time”).

The holders of Rights will, solely by reason of their ownership of

Rights, have no rights as shareholders of the Company, including, without limitation, the right to vote or to receive dividends.

The

Rights will not prevent a takeover of the Company. However, the Rights may cause substantial dilution to a person or group that acquires

10% or more of the Shares or 10% or more of the Voting Power of the Company or any existing holder of 10% or more of the Shares

or 10% or more of the Voting Power of the Company who shall acquire any additional Shares, unless the Rights are first redeemed by the

Board. Nevertheless, the Rights should not interfere with a transaction that is in the best interests of the Company and its shareholders

given that the Rights can be redeemed, or the Rights Agreement can be terminated, on or prior to the Flip-in Date, before the consummation

of such transaction.

As of October 14, 2021, there were 1,880,396,244 Class A Ordinary

Shares issued and outstanding and 144,778,552 Class B Ordinary Shares issued and outstanding. As long as the Rights are attached to the Shares, the

Company will issue one Right with each new Share so that all such shares will have Rights attached.

The Rights Agreement (which includes as Exhibit A the forms of Rights

Certificate and Election to Exercise) is attached hereto as an exhibit and is incorporated herein by reference. The foregoing description

of the Rights is qualified in its entirety by reference to the Rights Agreement and the exhibit thereto.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Luckin Coffee Inc.

|

|

|

|

|

|

Date:

|

October 14, 2021

|

|

By:

|

/s/ Reinout Hendrik Schakel

|

|

|

|

|

Name: Reinout Hendrik Schakel

|

|

|

|

|

Title: Chief Financial Officer and Chief Strategy Officer

|

EXHIBIT INDEX

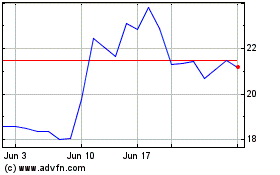

Luckin Coffee (PK) (USOTC:LKNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Luckin Coffee (PK) (USOTC:LKNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024