Imperial Brands Backs Full-Year View; To Launch GBP1.1 Billion Buyback

October 05 2023 - 2:57AM

Dow Jones News

By Elena Vardon

Imperial Brands said it expects to meet its guidance for fiscal

2023 and that it will launch a bigger share buyback in fiscal

2024.

The tobacco group--which houses Davidoff, Gauloises and JPS

among its brands--said its trading for the year ended Sept. 30 is

seen in line with its guidance of low-single-digit growth in

tobacco and next-generation products net revenue. It had also

guided for group adjusted operating profit growth to accelerate to

the lower end of its mid-single-digit range.

It said it had seen improved tobacco net revenue growth over the

second half of the year on strong pricing, which offset higher

volume declines. Next-generation products--which include vape,

heated tobacco and oral nicotine--revenue growth also accelerated

in the period on strong growth in Europe, it added.

The FTSE 100-listed company said it is undertaking a 1.1 billion

pounds ($1.33 billion) share buyback for fiscal 2024, which will

start on Oct. 6 and end in September 2024 and represents a 10%

increase on the previous year's program. It added that it expects

total capital returns in the year to exceed GBP2.4 billion,

including dividends and buybacks.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

October 05, 2023 02:42 ET (06:42 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

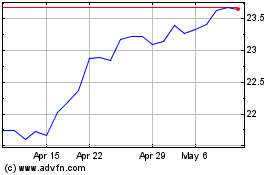

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Apr 2023 to Apr 2024