China's Uber Rival Didi Scores $7 Billion in Fundraising -- 2nd Update

June 16 2016 - 12:13AM

Dow Jones News

By Juro Osawa and Rick Carew

HONG KONG -- China's homegrown competitor to Uber Technologies

Inc. has raised $7.3 billion in its latest fundraising effort,

giving it a host of powerful allies including Apple Inc. to fend

off the global ride-hailing champion locally.

Didi Chuxing Technology Co., the country's biggest ride-sharing

company, said Thursday that it closed a $4.5 billion fundraising

round that attracted new investors such as Apple, China Life

Insurance Co. and the financial affiliate of online shopping firm

Alibaba Group Holding Ltd. The round valued the company at nearly

$28 billion, people familiar with the matter said.

In addition, Didi said it has secured a $2.5 billion syndicated

loan arranged by China Merchants Bank Co. Didi also raised roughly

$300 million in debt from China Life, the country's biggest

insurer.

The fundraising will leave Didi flush with cash to help it

battle Uber in China's competitive ride-hailing market. Didi said

it now has about $10.5 billion in disposable funds following the

new fundraising round through equity and debt.

Uber and Didi are duking it out for China's potentially

lucrative ride-sharing market by spending huge sums to attract

drivers and passengers to their competing services.

The battle between Uber and Didi for global investment allies

has only intensified in recent months. Uber raised $3.5 billion

from the investment arm of Saudi Arabia earlier this month as part

of a financing round totaling more than $5 billion, the largest to

date raised by a private, venture-backed company.

Uber is separately turning to the so-called leveraged-loan

market for the first time to raise as much as $2 billion, The Wall

Street Journal reported this week.

Uber has hired Morgan Stanley and Barclays PLC to sell a

leveraged loan of $1 billion to $2 billion to institutional

investors in the coming weeks, according to people familiar with

the matter.

While Uber's business in China has expanded rapidly during the

past year, the company still faces an uphill battle against Didi,

which not only has a larger share of the private car-hailing market

where Uber competes, but also dominates the country's taxi-hailing

segment.

Didi, which was formed last year by the merger of two rival

Chinese taxi-hailing apps, is backed by influential domestic and

foreign investors. Its growing list of investors includes two of

China's biggest internet companies -- e-commerce company Alibaba

and social-network company Tencent Holdings Ltd., as well as Apple.

Didi said Tencent and Alibaba both put additional money into the

latest fundraising round, without disclosing the exact amount.

Other big investors in the round included several Chinese banks

and insurance companies that made investments of more than $100

million each, according to a person familiar with the matter.

As the two biggest ride-hailing companies scour the globe for

capital, a few of the same investors are putting money into both

companies.

China Life, the state-owned insurer that this month invested in

Didi, had already invested in San Francisco-based Uber last year.

Hillhouse Capital Group, a China-based investment firm, was an

early investor in Didi but also led a convertible-bond deal to

invest in Uber's global operations. Similarly, Tiger Global

Management LLC has backed Didi in China and has invested in Uber's

global operations.

Competing startups dislike overlapping shareholder bases because

the companies often share confidential strategy and financial

results with investors. It's unclear whether Didi and Uber have

made any special arrangements for those investors.

Write to Juro Osawa at juro.osawa@wsj.com and Rick Carew at

rick.carew@wsj.com

(END) Dow Jones Newswires

June 15, 2016 23:58 ET (03:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

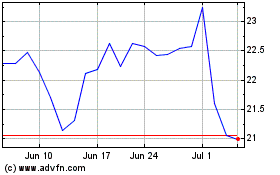

China Merchants Bank (PK) (USOTC:CIHKY)

Historical Stock Chart

From May 2024 to Jun 2024

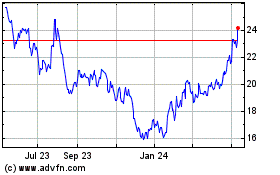

China Merchants Bank (PK) (USOTC:CIHKY)

Historical Stock Chart

From Jun 2023 to Jun 2024