Table of Contents

Registration No. 333-267039

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

AMENDMENT NO. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cannabis Bioscience

International Holdings, Inc.

(formerly named China Infrastructure Construction

Corp.)

(Exact name of Registrant

as specified in its charter)

____________________

| Colorado |

8999; 8099 |

84-4901229 |

| (State or other jurisdiction of |

Primary Standard |

(I.R.S. Employer Identification No.) |

| Incorporation or organization) |

Industrial Classification |

|

| |

Code Numbers |

|

____________________

6201 Bonhomme Road, Suite 466S,

Houston, TX 77036

Telephone: (817) 528-2475

(Address, including zip

code and telephone number,

including area code, of Registrant’s principal executive offices)

____________________

Dante Picazo

Chief Executive Officer

Cannabis Bioscience International Holdings,

Inc.

6201 Bonhomme Road, Suite 466S

Houston, TX 91789

Telephone: (817) 528-2475

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

____________________

Copy to:

Barry J. Miller, Esq.

Barry J. Miller PLLC

7146 Pebble Park Drive

West Bloomfield, MI 48322

Telephone: (248) 232-8039

Fax: (248) 246-9524

____________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable following the effective

date of this registration statement is declared effective by the Registrant and from time to time thereafter, as determined by the Selling

Stockholders.

If any of the securities being registered on

this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box: ☒

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

___________________

Indicate by check mark whether the Registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (check one)

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check

mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

___________________

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated

October __, 2023.

PROSPECTUS

Cannabis

Bioscience International Holdings, Inc.

10,087,154,885 SHARES OF COMMON

STOCK

This

Prospectus relates to the offer and sale of up to 10,087,154,885 shares of the common

stock, without par value (“Common Stock”), of Cannabis Bioscience International

Holdings, Inc., a Colorado corporation (the “Shares”), of which 6,250,000,000

shares are offered by the Company and 3,837,154,885 shares are offered by the Selling

Stockholders. The Company will receive the proceeds of sales of the shares that it sells,

but none of the proceeds of the sales of the shares that are sold by the Selling Stockholders.

The Company is offering the shares to be sold by it at an aggregate offering price of $5,000,000.

An investment

in Common Stock is speculative and involves a high degree of risk. Therefore, before purchasing Common Stock, investors should carefully

consider the risk factors and other uncertainties described in this Prospectus. See “Risk Factors.”

We are

an “emerging growth company” as defined under the U.S. federal securities laws and, as such, may elect to comply with reduced

public company reporting requirements for this Prospectus and future filings. See “Prospectus Summary – Implications

of Being an Emerging Growth Company.”

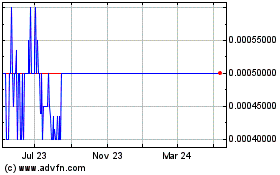

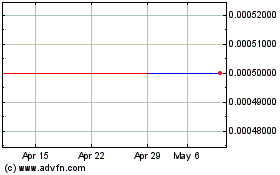

The Common Stock is quoted on the OTC Pink tier

of the alternate trading system operated by OTC Markets Group Inc. (“OTC”) under the trading symbol CBIH.

The Company and the Selling Stockholders will

offer their shares at $0.0008 per share (the “Fixed Offering Price”). See “Plan of Distribution”

for further information. The Selling Stockholders may sell any, all or none of their shares and the Company does not know when, in what

amounts or in what manner they may sell their shares.

Any investment in the shares offered herein

involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent

registered public accounting firm has issued an audit opinion for the Company’s consolidated financial statements for the

year ended May 31, 2022, that includes a statement expressing substantial doubt as to our ability to continue as a going concern.

On December 6, 2022, the Company changed its

corporate name from China Infrastructure Construction Corp. to Cannabis Bioscience International Holdings, Inc. On August 16, 2023,

the Financial Industry Regulatory Authority published the name change and a new trading symbol, CBIH.

Dante Picazo, the Company’s chief executive

officer and one of its directors, has voting control of the Company, with power to elect and remove its directors, and will continue

to have such control after the offering.

The Selling Stockholders and any broker-dealers

or agents involved in selling the Shares may be deemed to be underwriters within the meaning of the Securities Act of 1933, as amended

(the “Securities Act”), in connection with such sales. In such event, any commissions received by such broker-dealers or

agents and any profit on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts under the

Securities Act.

The Selling

Stockholders and any other person participating in the sale of the Shares will be subject to the provisions of the Securities Exchange

Act of 1934 (the “Exchange Act”) and the rules and regulations promulgated thereunder. These rules include, without limitation,

Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling Stockholders and any other person.

In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Shares to engage in market-making

activities with respect to the particular shares being distributed, which may affect the marketability of the Shares and the ability

of any person or entity to engage in market-making activities with respect to the Shares.

Once sold

under the registration statement of which this Prospectus forms a part, the Shares will be freely tradeable in the hands of persons other

than our affiliates.

We have

paid and will pay all expenses incurred in registering the shares, whether offered by the Company or the Selling Stockholders, including

legal and accounting fees. See “Plan of Distribution.” For information regarding expenses of registration,

see “Use of Proceeds and Business Plan”

The Jumpstart

Our Business Startups Act, or the JOBS Act, was enacted in April 2012 to encourage capital formation in the United States and reduce

the regulatory burden on new-public companies that qualify as “emerging growth companies.” We are an “emerging growth

company” within the meaning of the JOBS Act. As an “emerging growth company,” we intend to take advantage of certain

exemptions from various public reporting requirements, including the requirement that our internal control over financial reporting be

audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley

Act, certain requirements related to the disclosure of executive compensation in this Prospectus and our periodic reports and proxy statements,

and the requirement that we hold a non-binding advisory vote on executive compensation and any golden parachute payments. We may take

advantage of these exemptions until we are no longer an “emerging growth company.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is October __,

2023.

TABLE OF CONTENTS

Through and including October __, 2023

(the 25th day after the date of this Prospectus), all dealers effecting transactions in these securities, whether or not participating

in this offering, may be required to deliver a prospectus, in addition to a dealer’s obligation to deliver a prospectus when acting

as an underwriter and with respect to an unsold allotment or subscription.

This Prospectus forms a part of a registration

statement on Form S-1 that we filed with the SEC. Under this registration statement, the Selling Stockholders may, from time to time,

sell their shares, as described in this Prospectus. We will not receive any proceeds from the sale of the Shares by any such Selling

Stockholders. See “Use of Proceeds and Business Plan.”

Neither we nor the Selling Stockholders have

authorized anyone to provide any information or make any representations other than those contained in this Prospectus or any free writing

prospectuses we have prepared. Neither we nor the Selling Stockholders take responsibility for and cannot assure as to the reliability

of any information that others may give you, other than the information contained in this Prospectus. This Prospectus is an offer

to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful. The information contained

in this Prospectus is current only as of its date, regardless of the time of delivery of this Prospectus or any sale of Common Stock.

For investors outside the United States: Neither

we nor the Selling Stockholders have taken any action that would permit this offering or possession or distribution of this Prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this Prospectus must inform themselves about and observe any restrictions relating to the offering of the shares

of Common Stock and the distribution of this Prospectus outside the United States.

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this Prospectus. Because this is only a summary, it does not contain all information that may be important to you. You should

read the entire Prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes

thereto appearing elsewhere in this Prospectus before making an investment decision. This Prospectus contains forward-looking statements

and information relating to the Company. See “Cautionary Notes.”

The Company is based in Houston, Texas, and was

established in 2003. For more detailed information respecting its corporate history, see “Description of Business

– History.” The address of our principal executive office is 6201 Bonhomme Road, Suite 466S, Houston, TX 77036, and our

telephone number is (832) 606-7500. Its website is www.chnc-hdh.com. The information contained thereon is not intended to be incorporated

into this Prospectus or the registration statement of which it is a part.

We provide educational and other services to

the cannabis industry (the “Pharmacology University Business”) (see “Description of Business –

Business – Pharmacology University Business”) and clinical trial services to Sponsors and CROs and clinical trials

that we conduct as a Sponsor (the “Alpha Research Business”) (see “Description of Business –

Business – Alpha Research Business”) “Sponsor” means a person who takes responsibility for and initiates

a clinical investigation of a drug or medical device, including an individual or pharmaceutical company, governmental agency,

academic institution, private organization, or other organization. “CRO” means a person that assumes, as an independent

contractor with a Sponsor, one or more of the obligations of a Sponsor, such as the design of a protocol, selection or monitoring of

investigations, evaluation of reports, and preparation of materials to be submitted to the U.S. Food and Drug Administration (the

“FDA”).

Implications of Being an Emerging Growth Company

We are an “emerging growth company”

as defined in the Jumpstart Our Business Startups Act (known as the “JOBS Act”). Under the JOBS Act, we may utilize reduced

reporting requirements that are otherwise applicable to public companies, including delaying auditor attestation of internal control

over financial reporting, providing only two years of audited financial statements and related Management’s Discussion and Analysis

of Financial Condition and Results of Operations in this Prospectus and the reports that we will file with the U.S. Securities and Exchange

Commission (the “SEC”), including reduced executive compensation disclosures.

We are permitted to remain an emerging growth

company for up to five years from the date of the first sale in this offering. However, if certain events occur before the end of that

period, including our becoming a “large accelerated filer,” our annual gross revenue’s exceeding $1.07 billion or our

issuance of more than $1.0 billion of nonconvertible debt in any three-year period, we will cease to be an emerging growth company.

We have elected to take advantage of certain

of the reduced disclosure obligations in this Prospectus and the registration statement of which it is a part and may elect to take advantage

of other reduced reporting requirements in future filings. In particular, in this Prospectus, we have provided only two years of audited

financial statements and have not included all of the information relating to executive compensation that would be required if we were

not an emerging growth company. As a result, the information that we provide to our stockholders may be different from that which might

be received from public reporting companies that are not emerging growth companies. We have irrevocably elected to avail ourselves of

the extended transition period for complying with new or revised accounting standards and therefore, we will be subject to the same new

or revised accounting standards as private companies.

Recent Developments

The COVID-19 pandemic has harmed the Company.

Early in 2020, the COVID-19 pandemic resulted

in decreased business activity and restrictions on the conduct of businesses, including mandatory lockdowns. Because of these restrictions,

all our classrooms and public venues were closed and other Pharmacology University Business activities that required face-to-face contact,

such as its consulting services and franchising and marketing efforts, were sharply reduced or terminated. Among other things, the Pharmacology

University Business closed its seminars in Ecuador and the Dominican Republic; ceased holding classes at the University of Tadeo in Bogota,

Cartagena and Santa Marta, Colombia; and ceased all travel. The business conducted by the Alpha Research Business has also been adversely

affected because several of the clinical studies in which it was participating were deferred, shortened or canceled. These restrictions

have been reduced or eliminated in many jurisdictions, but if the pandemic resurges, they could be reimposed. We have not been able to

resume classroom teaching and seminars, consulting services, franchising and marketing efforts and the Alpha Research Business has continued

to be adversely impacted.

As a result of the pandemic, we experienced substantial

reductions in our revenues and our losses increased in our educational and clinical trial businesses. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Impact of the COVID-19 Pandemic.” To protect

our business from disruption caused by the COVID-19 pandemic and to enable our students to continue to be educated, we created online

courses. We currently have over 100 online videos in English, Spanish, Portuguese, Italian and Arabic. We also commenced the use of Zoom

meetings to hold virtual classes to teach students and be able to respond to their questions in real time. We believe that these measures

have helped us to manage our business prudently during the pandemic; nevertheless, much of our business depends on personal contacts,

and we have not been able to reduce the adverse effects of the pandemic’s reducing or eliminating personal contact.

Risk Factors Summary

Our business is subject to many risks and uncertainties

of which you should be aware before deciding whether to invest in Common Stock, in addition to general business risks. These risks are

more fully described in the section titled “Risk Factors” immediately following this Prospectus Summary. These risks include,

among others, the following:

| |

· |

The COVID-19 pandemic and the impact of actions to mitigate the COVID-19 pandemic have materially and adversely impacted and will continue materially and adversely to impact our business, results of operations and financial condition. In particular, our revenues have decreased and our losses have increased, in each case materially, since the onset of the pandemic. |

| |

|

|

| |

· |

The Company expects to encounter significant challenges in recovering from the adverse effects of the COVID-19 pandemic and can give no assurances respecting its success in meeting them. |

| |

|

|

| |

· |

The Company has incurred net losses each year since its inception

and may not be able to achieve profitability. It has incurred net losses of 1,032,579, $885,171 and $159,308 for the fiscal years ended

May 31, 2023, May 31, 2022, and May 31, 2021, respectively. Its accumulated deficit for the fiscal years ended May 31, 2023, May 31,

2022, and May 31, 2021, were 4,682,736, $3,650,156 and $2,764,985, respectively. |

| |

|

|

| |

· |

The Alpha Research Business is conducted in a highly competitive industry and may not be able to compete successfully with its current or future competitors. |

| |

|

|

| |

· |

Both the Pharmacology University Business and the Alpha Research Business are subject to a wide variety of complex, evolving, and, with respect to the Pharmacology University Business, sometimes inconsistent and ambiguous laws and regulations that may adversely impact their operations and could cause the Company to incur significant liabilities including fines and criminal penalties, which could have a material adverse effect on its business, results of operations, and financial condition. |

| |

|

|

| |

· |

The Alpha Research Business is conducted in a highly competitive industry and may not be able to compete successfully with its current or future competitors. |

| |

|

|

| |

· |

Following the Offering, there will be a large number of shares of Common Stock that may be sold in the public markets, which may substantially and adversely affect their market price. For further information, see “Risk Factors – Risks Related to the Common Stock and the Offering – There will be a larger number of shares of Common Stock that will be eligible to be sold in the public markets” and “Shares Eligible for Future Sale.” |

| |

|

|

| |

· |

The Company may not be able to sell all of the Shares at the Fixed Offering Price. See “Risk Factors – Risks Related to the Common Stock and the Offering – We may change the Fixed Offering Price. |

THE

OFFERING

| Amount of Offering by the Company: |

|

$5,000,000 |

| |

|

|

| Offering Price per Share: |

|

The shares offered by the Company will be sold at the Fixed Offering Price of $0.0008

per share for the duration of the offering (the “Fixed Offering Price”). The Selling Stockholders may offer their shares in different ways and at varying prices. See “Plan of Distribution.” |

| |

|

|

| Shares of Common Stock offered by the Company: |

|

6,250,000,000 shares |

| |

|

|

Shares

of Common Stock offered by the Selling Stockholders:

|

|

3,837,154,885 shares |

| |

|

|

Shares

of Common Stock outstanding prior to the Offering:

|

|

10,331,749,347 shares |

| |

|

|

Shares

of Common Stock outstanding after the Offering:

|

|

16,581,749,347 shares |

| |

|

|

| |

|

The number of shares of Common Stock to be outstanding after the Offering is based on 10,331,749,347

shares of Common Stock outstanding as of the date of this Prospectus. |

| |

|

|

| Voting rights: |

|

Each share of Common Stock and Series A Preferred is entitled to one vote per share. The Series B

Preferred has 60% of the voting power in the Company and all of the outstanding shares are held by the Company’s chief

executive officer, who is also a director. By virtue of his holdings of Series B Preferred, he has the power to control the outcome

of all matters submitted to stockholders for approval, including the election of directors and the approval of any change-of-control

transaction. See “Description of Capital Stock.” |

| |

|

|

| Use of Proceeds: |

|

The proceeds that we receive from sales of the shares offered by the Company will be used for the

purposes set forth under “Use of Proceeds and Business Plan.”. We will not receive any proceeds from the

sale of the Shares offered by the Selling Stockholders. |

| |

|

|

| Trading symbol: |

|

CBIH |

| |

|

|

| Risk Factors: |

|

An investment in Common Stock is highly speculative and involves a high degree of risk for the reasons

set forth in “Risk Factors” and elsewhere in this Prospectus. |

| |

|

|

| Fees and Expenses: |

|

We will pay all expenses incident to the registration of the shares offered by this Prospectus, except

for sales commissions and other expenses of the Selling Stockholders. |

RISK FACTORS

An investment in

Common Stock involves a high degree of risk. Prospective investors should carefully consider the risks described below and all of the

other information contained in this Prospectus, including the Company’s consolidated financial statements and the related notes

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” before deciding whether

to invest in Common Stock. If any of the events described below occur, the Company’s business, business prospects, cash flow, results

of operations or financial condition could be materially and adversely harmed. In these events, the trading price of the Common Stock

could decline, and investors might lose all or part of their investments. Investors should read the section entitled “Forward-Looking Statements” for a discussion of what types of statements are forward-looking, as well as the significance of such statements

in the context of this Prospectus.

The following is a discussion of the risk

factors that the Company believes are currently material. These risks and uncertainties are not the only ones facing the Company,

and in addition to general business risks, there may be other matters of which the Company is not aware or that it currently considers

immaterial. All of these could adversely affect the Company’s business, business prospects, cash flow, results of operations

or financial condition.

Business-Related Risks

The COVID-19 pandemic

and the efforts to mitigate its impact may have an adverse effect on the Company’s business, liquidity, results of operations,

financial condition and price of its securities.

The COVID-19 pandemic has materially and adversely

impacted the Company and its results of operations, particularly as a result of limitations on the ability of the Pharmacology University

Business to conduct classes and other face-to-face activities due to lockdowns. Public health authorities and governments at local, national

and international levels have from time to time announced various measures of varying intensity to respond to this pandemic. Some measures

that have directly or indirectly impacted the Company’s business include voluntary or mandatory quarantines and business closures,

restrictions on travel and limiting gatherings of people in public places.

For detailed information respecting the impact

of the pandemic on the Company’s financial results, see “Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Impact of the COVID-19 Pandemic.”

Although many of the measures introduced to combat

the COVID-19 pandemic have been relaxed and in some cases terminated, the Company does not know when it will be able to resume its normal

operations, particularly in the classroom, franchising and consulting activities of the Pharmacology University Business. However, we

expect that returning to normal operations will require time, will involve substantial costs and will involve uncertainties, including

(i) whether the pandemic will continue to abate, (ii) what measures governments will take if the pandemic intensifies and (iii) the ability

of our customers and suppliers to recover from the effects of the pandemic.

To the extent the pandemic has and may continue

to affect the Company’s business and financial results adversely, it may also have the effect of heightening many of the other

risks to which the Company is subject, whether or not described under “Risk Factors.” If the pandemic does

not continue to abate or it intensifies, the Company’s ability to execute its business plan on a timely basis or at all may be

materially impeded.

We have a limited operating history, making

it difficult to forecast our revenue and evaluate our business and prospects.

We have a limited operating history and as a

result, our ability to forecast our future results of operations and plan for growth is limited and subject to many uncertainties. We

have encountered and expect to continue to encounter risks and uncertainties frequently experienced by growing companies in rapidly evolving

industries, such as the risks and uncertainties described herein. Accordingly, we may be unable to prepare accurate internal financial

forecasts or replace anticipated revenue that we do not receive as a result of delays arising from these factors, and our results of

operations in future reporting periods may be below the expectations of investors. If we do not address these risks successfully, our

results of operations could differ materially from our estimates and forecasts or the expectations of investors, causing our business

to suffer and the market price of the Common Stock to decline.

We

have a history of net losses, we anticipate increasing operating expenses in the future, and we may not be able to achieve and, if achieved,

maintain profitability.

We have incurred significant net losses each

year since our inception (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

We expect to continue to incur net losses for the foreseeable future and we may not achieve or maintain profitability in the future.

It is difficult for us to predict our future results of operations or the limits of our market opportunity. We expect our operating expenses

to significantly increase over the next several years as we hire additional personnel, particularly in sales and marketing, and expand

our operations, both domestically and internationally. We may also selectively pursue acquisitions. In addition, because we will become

subject to the reporting and other requirements of the Exchange Act as a result of the effectiveness of the registration statement of

which this Prospectus is a part, we will incur additional significant legal, accounting, and other expenses that we did not incur previously.

If our revenue does not increase to offset the expected increases in our operating expenses, we will not become profitable. Our growth

could be impeded for many reasons, including, but not limited to, those set forth under “Risk Factors.” Our failure to sustain

consistent profitability could cause the market price of the Common Stock to decline.

The Company requires substantial additional

capital. If the Company cannot raise capital, it may have to curtail its operations or it could fail.

The Company requires substantial additional capital through public

or private debt or equity financings to continue operating, as well as to fund its operating losses, increase its sales and marketing

capacity, take advantage of opportunities for internal expansion or acquisitions, hire, train and retain employees, develop and complete

existing services and new services and products and respond to economic and competitive pressures. The Company needs $5,000,000 to execute

its business plan and meet its other corporate expenses, some or all of which may be provided from the sale of the Shares. If it cannot

raise such capital, it may have to alter its business plan or curtail its operations, or it could fail. The financial condition of the

Company presents a material risk to investors and may make it difficult to attract additional capital or adversely affect the terms on

which the Company can obtain it. For further information, see “Management’s

Discussion and Analysis of Financial Condition and Results of Operations – General Statement of Business – Going Concern”

and “– Liquidity and Capital Resources.”

The Company has received no commitment for financing

from investors or banks and no assurance can be given that any such commitment will be forthcoming or, if so, in what amount and on what

terms.

The preceding risk factors raise substantial

doubt about our ability to continue as a going concern and our independent registered public accounting firm has included an explanatory

paragraph relating to our ability to continue as a going concern in its report on our audited consolidated financial statements contained

in this Prospectus.

The consolidated financial statements contained

in the Prospectus were prepared on the assumption that we will continue as a going concern. Accordingly, the accompanying financial statements

do not include any adjustments that might be necessary should we be unable to continue as a going concern. We do not have adequate funds

available, and the Offering may not provide sufficient proceeds to fund our anticipated expenses without obtaining significant additional

financing. This raises substantial doubt about our ability to continue as a going concern. The perception that we may not be able to

continue as a going concern may materially limit our ability to raise additional funds through the issuance of new debt or equity securities

or otherwise and no assurance can be given that sufficient funding will be available when needed to allow us to continue as a going concern.

This perception may also make it more difficult to operate our business due to concerns about our ability to meet our contractual obligations.

Our ability to continue as a going concern is contingent upon, among other factors, our ability to sell shares of Common Stock, including

those that we are offering by this Prospectus, and obtaining additional capital. We cannot provide any assurance that we will be able

to raise additional capital. If we cannot secure additional capital, we may be required to curtail our operations and take measures to

reduce costs to conserve cash in amounts sufficient to sustain operations and meet our obligations. These measures could cause significant

delays in the realization of our business plan. It is not presently possible for us to predict the potential success of our business

plan. We cannot predict the revenue or the income potential of our proposed businesses and operations. If we cannot operate as a viable

entity, you may lose some or all of your investment.

In

addition, the report of our independent registered public accounting firm with respect to our consolidated financial statements appearing

elsewhere in this Prospectus contains an explanatory paragraph stating that the Company had negative working capital at May 31, 2021,

had incurred recurring losses and recurring negative cash flow from operating activities, and had an accumulated deficit, raising substantial

doubt about its ability to continue as a going concern. For information about Management’s evaluation of and plans regarding these

matters, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” and Note 3 to its consolidated financial statements.

Delays in payments by Sponsors and CROs

have affected and may continue to affect the Company’s cash flows.

The Company has from time to time been affected

by delays in payments by Sponsors and CROs. More specifically, at May 31, 2023, and May 31, 2022, the Company had accounts receivable

from Sponsors and CROs of $10,549 and $5,614, respectively, of which $2,500 and $470, respectively, were not paid timely; all of these

accounts payable have been collected. At May 31, 2023, the balance of accounts receivable was 3.3% of the revenue of $316,825 for that

fiscal year and at May 31, 2022, the balance of accounts receivable was 2.6% of the revenue of $214,980 for that fiscal year. However,

at August 31, 2022, accounts receivable were $43,307, which was 31.3% of the revenue of $51,251 for the three months then ended due to

delays in payment; the Company has collected all of these receivables.

Although the Company was able to cope with

this delay, it may not be able to do so in the case of future delays. If such a delay were to recur, the proceeds of the Offering were

insufficient and other available resources were insufficient to pay its obligations, the Company would have to sell shares of Common

Stock, probably at below-market prices and/or borrow money at rates of interest that could be high. If the Company were unable to sell

shares or borrow money, it might have to alter its business plan or curtail its operations, or it could fail.

We May be Affected by Inflation.

Inflation rates have increased and may

continue to rise. Companies from which we purchase goods and services may raise their prices and we may be unable to pass these

increases on to our customers. Although we have not yet been affected, inflation could adversely affect our business,

including our competitive position, market share, revenues and operating income.

We May be Affected by Increasing

Interest Rates.

Interest rates have recently risen, but we

have not been materially affected. However, we cannot assure that rising interest rates will not affect us in the future, thereby reducing

our ability to borrow or increasing our expenses if we were to borrow, either of which would adversely affect our business plans and

growth, increase the cost of our borrowings and reduce our earnings.

Because the Pharmacology University Business

deals with persons that operate in the cannabis industry, it faces unique, unpredictable and evolving risks.

The Company does not grow or sell cannabis

or manufacture or sell cannabis-related paraphernalia and believes that it is not directly subject to the risks that may arise from violation

of the federal, state and foreign laws relating thereto. However, some of the Company’s customers and potential customers engage

in one or more of these activities, and are subject to these risks, the eventuation of which may adversely affect demand for the services

and products offered by the Pharmacology University Business and the Company’s ability to collect receivables from its customers.

Specific risks faced by these customers and potential customers include the following:

Cannabis is illegal

under federal law, the laws of certain states and certain foreign countries.

Cannabis is illegal under

federal law, as is growing, cultivating, selling or possessing it for any purpose or assisting or conspiring with those who do so. Additionally,

it is unlawful to knowingly open, lease, rent, use, or maintain any place, whether permanently or temporarily, for the purpose of manufacturing,

distributing, or using cannabis. The laws of some states and foreign countries in which the Company operates prohibit one or more of

these activities. Even in states in which the use of cannabis has been legalized, its use, growth, cultivation, sale and possession remain

violations of federal law, because federal law preempts state laws. Strict enforcement of these federal, state or foreign laws would

likely result in the inability of some or all of the Company’s U.S. customers and potential customers to operate, which could adversely

affect demand for the services offered by the Pharmacology University Business and the Company’s ability to collect receivables.

In particular, some of

the Company’s customers may be directly affected by these laws and as a result, the Company may be indirectly affected by the cannabis-related

laws of other jurisdictions in which it operates. These jurisdictions and summaries of the relevant laws are as follows:

| |

· |

Texas. Possession of (i) up to two ounces of cannabis

is a Class B misdemeanor, punishable by up to 180 days in jail and a fine of up to $2,000, (ii) from two up to four ounces is a Class

A misdemeanor, punishable by imprisonment of up to one year and a fine of up to $4,000, (iii) from four ounces up to five pounds

is a felony, punishable by imprisonment of up to two years and a fine of up to $10,000; (iv) from five pounds up to 50 pounds is

a felony, punishable by imprisonment of up to 10 years and a fine of up to $10,000; (v) from 50 pounds up to 2,000 pounds is a felony,

punishable by imprisonment of up to 20 years and a fine of up to $10,000; and more than 2,000 pounds is a felony, punishable by imprisonment

of up to 99 years and a fine of up to $50,000. The Texas Compassionate Use Act (TBCUA), passed in 2015, permits the use of low-THC

cannabis oil, containing no more than 0.5% THC and at least 10% CBD, for individuals diagnosed with intractable epilepsy but this

legislation limits access to a small number of patients and requires physicians to register with the Texas Department of Public Safety

to prescribe the oil. |

| |

|

|

| |

· |

Colombia. In 2015, the Colombian Constitutional Court

ruled that personal possession and consumption of drugs, including cannabis, could not be criminal offenses. In 2016, legalized medical

cannabis and established a framework for its cultivation, production and export. In 2017, Colombia decriminalized the possession

of up to 20 grams of cannabis for personal use. Possession of more than 20 grams and any activity regarded as commercial cultivation,

sale, or export is punishable by imprisonment. |

| |

|

|

| |

· |

Mexico. The production, sale, and use of cannabis

for recreational and medical purposes is lawful. Possession of more than 28 grams up to 200 grams is subject to a fine of $500 and

possession of more than 200 grams is subject to imprisonment of up to six years. |

| |

|

|

| |

· |

Jordan. Recreational and medical use of cannabis is illegal.

Possession of cannabis is punishable by imprisonment, except that first-time offenders are placed in rehabilitation. The growth and

sale of cannabis are punishable by imprisonment or, in the case of the latter, death. |

| |

|

|

| |

· |

Ecuador. Cannabis is illegal in Ecuador for both medical

and recreational use. Possession, cultivation, sale, and trafficking are strictly prohibited, and persons violating these laws are

subject to imprisonment, except that the possession of up to 10 grams for personal use is legal, as is medical use. Cultivation and

sale are illegal. |

| |

|

|

| |

· |

Venezuela. The cultivation, sale, and possession of

cannabis for recreational purposes are illegal in Venezuela. However, the possession for personal use of up to 20 grams of cannabis

and 5 grams of genetically modified cannabis have been decriminalized. |

| |

|

|

| |

· |

Argentina. The cultivation, sale, and possession of

cannabis for recreational purposes are illegal and are punishable by imprisonment ranging from 4 to 15 years; personal recreational

use is lawful, as is medical use. |

| |

|

|

| |

· |

Brazil. Cannabis is illegal, except for possession

and cultivation of personal amounts and for private use and use of cannabis medications is allowed for terminally ill patients or

those who have exhausted other treatment options. |

| |

|

|

| |

· |

Canada. Canada permits the possession of cannabis

and the growth of cannabis in limited amounts. Medical cannabis is lawful for persons who have received authorization from their

healthcare providers. Penalties for possession over the legal limit, illegal distribution or sale, illegal production of cannabis,

illegal exportation and other cannabis-related offenses can be as high as imprisonment for 14 years. |

The Company does not

believe that it and its personnel are subject to direct risk under these laws, inasmuch as its operations in these jurisdictions involve

teaching, writing, editing, translating and other activities that do not involve the production, sale, use, cultivation or export of

cannabis. However, customers of the Company to whom it extends credit or who are required to make periodic payments, such as persons

to whom the Company provides consulting services or the Company’s franchises, could be directly affected by these laws, with the

result that their ability to pay amounts that they owe to the Company timely or all could be impaired or negated.

The Company may face

risks in the above foreign jurisdictions and others in which it may in the future have operations because of its lack of familiarity

and burdens of complying with foreign laws, legal standards and regulatory requirements relating to cannabis. See “Risk Factors

– Because our success depends in part on our ability to expand our operations outside the United States, our business will be susceptible

to risks associated with international operations” for information as to general risks that that the Company may encounter in conducting

foreign operations.

Uncertainties exist

respecting enforcement.

The enforcement of federal

laws relating to cannabis has varied and may continue to vary in intensity. Some administrations have indicated that they intend to enforce

such laws vigorously, while others have deprioritized enforcement to varying degrees, based, for example, on whether the laws of a state

in which an offense occurred have legalized cannabis or whether the offense relates to the recreational of medical use of cannabis. The

Company believes that the Department of Justice (the “DOJ”) under the Biden administration is not prioritizing enforcement

of the CSA, but the extent to which the DOJ will seek to enforce the CSA under a future administration and against whom enforcement will

be sought is unclear.

Since 2014, it has been

the policy of the Department of the Treasury to deprioritize enforcement of the Bank Secrecy Act against financial institutions and marijuana-related

businesses which utilize them. If the Department of the Treasury were to change this policy, it would be more difficult for our clients

and potential clients to access the U.S. banking systems and conduct financial transactions, which could in turn adversely affect our

operations.

Since 2014, in annual bills,

Congress has prohibited federal funds from being used to prevent states from implementing their own medical marijuana laws, but has not

codified federal protections for medical marijuana patients and producers. Despite this prohibition, the DOJ maintains that it can prosecute

violations of the federal marijuana ban. No assurance can be given that Congress will continue to pass such bills. If it does not do so,

the risk of federal enforcement that overrides such state laws could increase.

The Company cannot predict

the vigor with which state and foreign laws relating to cannabis are or may be enforced, but to the degree that they are enforced, its

customers and potential customers could be adversely affected, which in turn, could adversely affect demand for the Company’s services

and its ability to collect receivables.

On December 2, 2022,

the Medical Marijuana and Cannabidiol Research Expansion Act, which established a new, separate registration process to facilitate research

on marijuana, became law.

Recently, Congress has

considered several bills relating to cannabis:

| · | The

Marijuana Opportunity Reinvestment and Expungement Act (known as the “MORE Act”)

would among other things decriminalize cannabis by removing it from the list of scheduled

substances under the Controlled Substances Act, was passed by the House of Representatives

on in 2021 and 2022, , but was not taken up by the Senate. |

| | | |

| · | The

Cannabis Administration and Opportunity Act, which would decriminalize cannabis at the federal

level and expunge federal cannabis-related criminal records, was introduced in the Senate

in 2021 and 2022, but has not been acted on. |

| | | |

| · | The

Secure and Fair Enforcement (SAFE) Banking Act, which generally prohibits a federal banking

regulator from penalizing a depository institution for providing banking services to a legitimate

cannabis-related business, was passed by the House of Representatives on several occasions,

most recently in 2023, but has never been not acted upon by the Senate. |

The Company believes that

these bills or similar legislation will be reintroduced in the Congress in the near future, but cannot predict whether any of

them will become law.

The Company cannot foresee

developments relating to the above matters and cannot predict how and the extent to which we could be affected by them; however, these

effects could be sudden and adverse.

The Company could

become subject to racketeering laws.

While the Company does not

grow, handle, process or sell cannabis or products derived from it, its receipt of money from clients that do so exposes it to risks

related to the Racketeer Influenced Corrupt Organizations Act (“RICO”). RICO is a federal statute providing civil and criminal

penalties for acts performed as part of an ongoing criminal organization. Under RICO, it is unlawful for any person who has received

income derived from a pattern of racketeering activity (which includes most felonious violations of the federal laws relating to cannabis)

to use or invest any of that income in the acquisition of any interest, or the establishment or operation of, any enterprise which is

engaged in interstate commerce. RICO also authorizes private parties whose properties or businesses are harmed by such patterns of racketeering

activity to initiate civil actions. A violation of RICO could result in fines, penalties, administrative sanctions, convictions or settlements

arising from civil or criminal proceedings, seizure of assets, disgorgement of profits, cessation of business activities or divestiture.

Banking regulations

could limit access to banking services and expose the Company to risk.

Receipt of payments from

clients engaged in the cannabis business could subject the Company to the consequences of federal laws and regulations relating to money

laundering, financial record keeping and proceeds of crime, including the Bank Secrecy Act, as amended by the “Patriot Act.”

Since the Company may receive money from persons whose activities are illegal, many banks and other financial institutions could be concerned

that their receipt of these funds from the Company could violate federal statutes such as those relating to money laundering, unlicensed

money remittances and the Bank Secrecy Act. As a result, banks may refuse to provide services to the Company. Such refusal could make

it difficult for the Company to operate. Additionally, some courts have denied cannabis-related businesses bankruptcy protection, thus

making it difficult for lenders to recoup their investments, which may make it more difficult for the Company to raise capital through

loans. While the Company has not encountered difficulty in obtaining banking services, no assurance can be given that it will be able

to do so.

Since

2014, the DOJ has de-prioritized enforcement of the Bank Secrecy Act against financial institutions and cannabis-related businesses that

utilize them. If such enforcement were to increase, it might become more difficult for the Company and its clients and potential

clients to access the U.S. banking systems and conduct financial transactions, which could adversely affect the Company’s operations.

Dividends and distributions

could be prevented if receipt of payments from clients is deemed to be proceeds of crime.

While the Company has no

intention to declare or pay dividends in the foreseeable future, if any of its revenues were found to have resulted from violations of

money laundering laws or otherwise the proceeds of crime, the Company might determine to or be required to suspend the declaration declaring

or payment of dividends.

Further legislative

developments beneficial to the Company’s operations are not assured.

The Pharmacology University

Business involves providing services to persons who may be directly or indirectly engaged in the cultivation, distribution, manufacture,

storage, transportation or sale of cannabis and cannabis products. Its success depends on the continued development of the cannabis industry.

Such development depends upon continued legislative and regulatory legalization of cannabis at the state level and either legalization

at the federal level or a continued “hands-off” approach by federal enforcement agencies. However, regulatory developments

beneficial to the industry cannot be assured. While there may be ample public support for legislative action, other factors, such as the

willingness of legislative bodies to act, election results, scientific findings or intangible events, could slow or halt progressive legislation

relating to cannabis and or reduce the current tolerance for the use of cannabis, which could adversely affect the demand for the Company’s

services.

The House of Representatives,

in its most recent term, passed bills that would decriminalize cannabis, remove it from the list of scheduled substances under the Controlled

Substances Act, eliminate criminal penalties for individuals who manufacture, distribute, or possess cannabis, and prohibit a federal

banking regulator from penalizing a depository institution for providing banking services to legitimate cannabis- or hemp-related businesses

or ordering a depository institution to terminate a customer account unless (i) the agency has a valid reason for doing so, and (ii) that

reason is not based solely on reputation risk. Neither of these bills became law because the Senate did not pass them. None of these bills

was adopted by Congress. No assurance can be given that any similar bill will be adopted by the present or any future Congress.

We may be subject

to risks relating to bankruptcy laws.

Some courts have denied

marijuana-related businesses bankruptcy protection, thus making it very difficult for lenders to recoup their investments, which may

limit the willingness of banks to lend to our clients and us. The lack of banking and financial services presents unique and significant

challenges to businesses in the cannabis industry. We could experience difficulties obtaining and maintaining regular banking and financial

services because of the activities of our clients.

Changes in legislation

or clients’ violations of law could adversely affect the Company.

The voters or legislatures

of states in which cannabis has been legalized could repeal or amend these laws, which could adversely affect the demand for the Company’s

services. In addition, changes to and interpretations of laws and regulations could detrimentally affect its clients and, in turn, result

in a material adverse effect on its operations. Violations of these laws, or allegations of such violations, could disrupt our clients’

business, thereby adversely affecting the Company.

Changes

in government regulation could affect the Alpha Research Business.

Governmental

agencies worldwide, including in the United States, strictly regulate the drug development process. The Alpha Research Business is subject

to regulation and its activities involve providing services helping pharmaceutical and biotechnology companies and CROs that are subject

to regulation. Changes in regulations, especially those that affect clinical trials, could adversely affect demand for our services.

Also, if government efforts to contain drug costs or changes in the practices of health insurers impact pharmaceutical and biotechnology

companies’ profits from new drugs, they may spend less or reduce their growth in spending on research and development, thereby

reducing the market for clinical trials.

Failure

to comply with existing regulations or contractual obligations could result in a loss of revenue or earnings or increased costs.

Failure

on the part of the Alpha Research Business to comply with applicable regulations, whether imposed directly or required to be complied

with by contract, could have adverse effects. If this were to happen, we could be contractually required to repeat the trial at no further

cost to our customer, but at substantial cost to us, or the contract could be terminated; in either case, we could be exposed to a lawsuit

seeking substantial monetary damages.

We may

bear financial losses because most of our clinical trial contracts are fixed price and may be delayed or terminated or reduced in scope

for reasons beyond our control.

Many of

our clinical trial contracts provide for services on a fixed-price or capped fee-for-service basis and they may be terminated or reduced

in scope either immediately or upon notice. Cancellations may occur for a variety of reasons, including the inefficacy of a drug or device;

its failure to meet safety requirements; unexpected or undesired results; insufficient patient enrollment; insufficient investigator

recruitment; a client’s decision to terminate the development of a product or to end a particular study; and our failure to perform

our duties under the contract properly.

The loss,

reduction in scope or delay of a contract or the loss, delay or conclusion of multiple contracts could materially adversely affect our

business, although our contracts often entitle us to receive the costs of winding down terminated projects, as well as all fees earned

by us up to the time of termination.

We may

suffer losses if we underprice our contracts or incur overrun costs.

Since

Alpha Research Institute’s contracts are often structured based on a fixed price or a fee for service with a cap, we would bear

the loss if we were to misestimate costs. Underpricing or cost overruns could have a material adverse effect on our business, results

of operations, financial condition, and cash flows.

The

potential loss or delay of a contract or multiple contracts could adversely affect our results.

Most of our contracts for clinical trials can

be terminated by our customers upon 30 to 90 days’ notice or immediately in certain circumstances. Our clients may delay, terminate

or reduce the scope of our contracts for a variety of reasons beyond our control, including but not limited to decisions to forego or

terminate a particular clinical trial; lack of available financing, budgetary limits or changing priorities; actions by regulatory authorities;

production problems resulting in shortages of the drug being tested; failure of products being tested to satisfy safety requirements

or efficacy criteria; unexpected or undesired clinical results for products; insufficient patient enrollment in a clinical trial; insufficient

investigator recruitment; shift of business to a competitor or internal resources; product withdrawal following market launch; shut down

of manufacturing facilities; or our failure to comply with the provisions of a contract.

In the event of termination, our contracts often

provide for fees for winding down the project, but these fees may not be sufficient for us to realize the full amount of revenues or

profits anticipated thereunder.

If the Alpha Research Business fails to

perform services in accordance with contractual requirements, regulatory standards and ethical considerations, we could be subject to

significant costs or liability and our reputation could be harmed.

We contract

with Sponsors and CROs in performing clinical trials to assist them in bringing new drugs to market. Clinical trials are complex and

subject to contractual requirements, regulatory standards and ethical considerations. If we fail to perform in accordance with these

requirements, regulatory agencies may take action against us or customers may terminate contracts. Customers may also bring claims against

us for breach of our contractual obligations and patients in the clinical trials and patients taking drugs approved on the basis of those

clinical trials may bring personal injury claims against us for negligence. Any such action could have a material adverse effect on our

results of operations, financial condition and reputation. The occurrence of any of the foregoing could impact our ability to provide

the same level of service to our clients, require us to modify our services or increase our costs, which could materially and adversely

affect our operating results and financial condition.

We are subject to federal and state health

privacy laws and regulations. If we cannot comply or have not fully complied with such laws and regulations, we could face government

enforcement actions, civil penalties, criminal sanctions, or damages, which could harm our reputation and adversely affect our business.

The Health Insurance Portability and Accountability

Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act and their respective implementing regulations

(“collectively, HIPAA”), establishes federal privacy and security standards for the protection of individually identifiable

health information that applies to health plans, healthcare clearinghouses, and healthcare providers that submit certain covered transactions,

or “covered entities.” A subset of these standards also applies to “business associates,” which are persons or

entities that perform certain services for, or on behalf of, a covered entity that involve creating, receiving, maintaining, or transmitting

protected health information.

Some of our customers may be HIPAA-covered entities

and service providers, and in that context, we may function as a business associate under HIPAA. Among other things, this status means

that, for certain activities, we must comply with applicable administrative, technical, and physical safeguards as required by HIPAA,

including stringent data security obligations. Failure to comply with HIPAA can result in significant civil monetary penalties and, in

certain circumstances, criminal penalties with fines or imprisonment.

The HIPAA-covered entities and service providers

that we serve as business associates may require us to enter into HIPAA-compliant business associate agreements with them. If

we were unable to comply with our obligations as a HIPAA business associate, we could face contractual liability under the applicable

business associate agreement.

In addition, many state laws govern the privacy

and security of health information in certain circumstances, many of which differ from HIPAA. There may also be costs associated with

responding to government investigations regarding alleged violations of these and other laws and regulations, even if there are ultimately

no findings of violations or no penalties imposed. These costs could consume our resources and impact our business. Publicity from alleged

violations could harm our reputation.

If we are unable to meet the requirements of

HIPAA, our business associate agreements or state health privacy laws, we could face contractual liability or civil and criminal liability

under HIPAA, all of which could have an adverse impact on our business and generate negative publicity, which, in turn, could have an

adverse effect on our ability to attract new customers and adversely affect our business condition and prospects.

We may be adversely affected by client

concentration.

We derive the majority of our revenues from a

few customers. If any of them decreases or terminates its relationship with us, our business, results of operations or financial condition

could be materially adversely affected. For further information, see “Description of Business – Concentration of Revenues.”

Our business could incur liability if

a drug causes harm to a patient. While we are generally indemnified and insured against such risks, we may still suffer financial losses.

We could suffer liability for harm allegedly

caused by a drug or device for which we conduct a clinical trial, either as a result of a lawsuit against the Sponsor or CRO to which

we are joined or an action launched by a regulatory body. While we are generally indemnified for such harm under our agreements with

Sponsors and CROs, we could nonetheless incur financial losses, regulatory penalties or both. Further, the indemnification obligations

of Sponsors and CROS are enforceable by us only if specific facts, which may be difficult to prove or may be subject to dispute, exist.

Any claim could result in potential liability for us if the claim is outside the scope of such indemnification, the Sponsor or CRO does

not comply with its indemnification obligations or our liability exceeds applicable indemnification limits or available insurance coverage.

Further, we do not carry insurance to cover damages for which we are liable. Such a claim could have an adverse impact on our financial

condition and results of operations. Furthermore, the associated negative publicity could have an adverse effect on our business and

reputation.

If we fail to maintain an effective

system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements

or comply with applicable regulations could be impaired.

The Sarbanes-Oxley Act of 2002 (“SOX”)

requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting.

However, our independent registered public accounting has advised management that we have the following material weaknesses in internal

control: lack of in-house personnel with insufficient technical knowledge to identify and address certain accounting matters; insufficient

accounting personnel to perform duties over financial transaction processing, key account reconciliations and reporting; insufficient

written policies and procedures over accounting transaction processing such that routine transactions are recorded on an accrual basis

in a timely manner; and insufficient in-house knowledge on monitoring accounting standards for the impact of complex accounting standards.

Accordingly, we need to develop and refine

our disclosure controls and other procedures to ensure that information required to be disclosed by us in the reports that we will file

under the Exchange Act is accumulated and communicated to our principal executive and financial officers. We are also continuing to improve

our internal control over financial reporting. To maintain and improve effective disclosure controls and procedures and internal control

over financial reporting, we will need to expend significant resources, including accounting-related costs and significant management

oversight.

Our current controls and any new controls

that we develop may become inadequate because of changes in conditions in our business. Further, weaknesses in our disclosure controls

and internal control over financial reporting may be discovered. Any failure to develop or maintain effective controls or any difficulties

encountered in their implementation or improvement could adversely affect our results of operations or cause us to fail to meet our reporting

obligations and result in a restatement of our consolidated financial statements. Failure to implement and maintain effective internal

control over financial reporting could also adversely affect the results of periodic management evaluations and annual independent registered

public accounting firm attestation reports regarding the effectiveness of our internal control over financial reporting that we will

eventually be required to include in our periodic reports filed with the SEC. Ineffective disclosure controls and procedures and internal

control over financial reporting could also cause investors to lose confidence in our reported financial and other information, which

could have a negative effect on the trading price of Common Stock. We are not currently required to comply with the SEC rules that implement

Section 404 of SOX and are therefore not required to make a formal assessment of the effectiveness of our internal control over financial

reporting for that purpose. After the registration statement of which this Prospectus forms a part is made effective, we will be required

to provide an annual management report on the effectiveness of our internal control over financial reporting commencing with our second

annual report on Form 10-K.

Our independent registered public accounting

firm will not be required to attest formally to the effectiveness of our internal control over financial reporting until after we cease

to be an “emerging growth company” as defined in the JOBS Act. At that time, our independent registered public accounting

firm may issue an adverse report if it is not satisfied with the level at which our internal control over financial reporting is documented,

designed or operating. Any failure to maintain effective disclosure controls and internal control over financial reporting could harm

our business, results of operations, and financial condition and could cause a decline in the price of Common Stock.

Our business and operations would suffer

in the event of computer system failures, cyber-attacks or deficiencies in our or related parties’ cyber security.

Our internal computer systems and those of

current and future third parties on which we rely may fail and are vulnerable to damage from computer viruses and unauthorized access.

Our information technology and other internal infrastructure systems, including corporate firewalls, servers, leased lines and connection

to the Internet, face the risk of systemic failure that could disrupt our operations. If such an event were to occur and cause interruptions

in our operations, it could result in a material disruption of our operations. Likewise, the failure, cyber-attack or deficiencies of

or on the computer systems of third parties on which we rely various products and services and similar events relating to their computer

systems could also have a material adverse effect on our business. To the extent that any disruption or security breach were to result

in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could

incur liability, our competitive position could be harmed and the further development and commercialization of our products could be

hindered or delayed.

Risk Factors Related to CBD

Products

We have no experience conducting clinical

trials as a Sponsor.

Clinical trials as

a Sponsor (“Sponsored Trials”) and are subject to the risks inherent in the initial organization, financing, expenditures,

complications and delays in a new business. Further, cannabinoid research, clinical trials and product development is highly speculative,

involves a high degree of risk. Accordingly, investors should consider our prospects in light of the costs, uncertainties, delays and

difficulties frequently encountered by companies in the early stages of development, especially those relating engaging in Sponsored

Trials. Potential investors should carefully consider the risks and uncertainties that a company with a limited operating history will

face. In particular, potential investors should consider that we may be unable to:

| |

• |

successfully implement or execute our current business plan as it relates

to Sponsored Trials, or develop a business plan that is sound; |

| |

• |

successfully complete clinical trials and obtain regulatory approval for the marketing of our

product candidates; |

| |

• |

successfully contract for the manufacture of our clinical products and establish a commercial

supply; |

| |

• |

secure market exclusivity or adequate intellectual property protection for our product candidates; |

| |

• |

attract and retain an experienced management and advisory team; or |

| |

• |

raise sufficient funds in the capital markets to effectuate our

business plan, including clinical development, regulatory approval and commercialization for our product candidates. |

We have no CBD products sale and do not expect to have any

for a considerable period.

Our ability to obtain revenue and profits

from CBD products depends on identifying safe and effective products through clinical trials and commercializing them by selling or licensing

them. We presently have no such products and do not expect to have any for at least two years. We do not expect to generate significant

revenue unless and until we begin to sell one or more such products. Our ability to generate revenue depends on a number of factors,

including, but not limited to, our ability to:

| |

• |

successfully complete preclinical studies; |

| |

• |

successfully enroll subjects in and complete clinical trials;

|

| |

• |

receive regulatory approvals, if required, from applicable regulatory

authorities; |

| |

• |

initiate and successfully complete all safety studies, if required,

to obtain marketing approval for our CBD products; |

| |

• |

establish commercial manufacturing capabilities

or make arrangements with third-party manufacturers for clinical supply and commercial manufacturing; |

| |

• |

obtain and maintain patent and trade secret

protection or regulatory exclusivity for our product candidates; |

| |

• |

launch commercial sales of our CBD products,

whether alone or in collaboration with others; |

| |

• |

obtain and maintain acceptance of the product

candidates, if and when approved, by patients, the medical community and third-party payors; |

| |

• |

effectively compete with other therapies; |

| |

• |

obtain and maintain healthcare coverage and

adequate reimbursement; |

| |

• |

enforce and defend intellectual property rights

and claims; |

| |

• |

maintain a continued acceptable safety profile

of the product candidates following approval. |

If we do not achieve one or more of these

factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize our product

candidates, which would materially harm our business. If regulatory approvals is required for any of our CBD products candidates, our

operations could be adversely affected.

We face competition from other companies

engaged in the development and commercial exploitation of CBD products and our operating results will suffer if we fail to compete effectively.

The CBD industry

is intensely competitive and subject to rapid and significant changes in technology and regulation. We have existing competitors and

potential new competitors in a number of jurisdictions, many of which have or will have substantially greater name recognition, commercial

infrastructures and financial, technical and personnel resources than we have. Established competitors may invest heavily to quickly

discover and develop novel compounds that could make any of our products obsolete or uneconomical. In addition, mergers and acquisitions

in the biotechnology and pharmaceutical industries may result in even more resources being concentrated among a smaller number of our

competitors, potentially reducing or eliminating our commercial opportunities. Further, such potential competitors may enter the market

before us, and their products may be designed to circumvent our granted patents and pending patent applications. They may also challenge,

narrow or invalidate our granted patents or our patent applications, and such patents and patent applications may fail to provide adequate