CB

Scientific, Inc, Stock Symbol - CBSC

March 4, 2021 -- InvestorsHub NewsWire -- via Derek McCarthy

-- COVID

was officially declared a national emergency on March 13, 2020.

Immediately, according to OnlineDoctor, Google search interest for

"telehealth" rose by 317%. Simultaneously, Google searches for the

term "doctor near me" dropped by 28% in the U.S. Now that it's

clear Americans are open to at home healthcare services it's up to

us as investors to find great companies in this space for our

portfolios. I have identified two such companies and this article

will introduce them as well as support my opinion that investing in

At Home Healthcare companies should result in a huge profit

potential.

A new wave of

enthusiasm for 'no contact' medicine has taken hold in the United

States and it's in the form of telemedicine and at home remote

monitoring. For patients that are at high risk of Covid-19, going

to the doctor's office can be mixed with fear and concern of

contracting the illness due to the high likelihood of human

contact. Telemedicine and at home remote monitoring are both

solutions to deal with that anxiety. Telemedicine and at home

remote monitoring both significantly reduces the risk of Covid-19

exposure. As a result, many Americans are adopting a positive

attitude toward new technology for being treated and diagnosed at

home.

Telehealth is the distribution of health-related services and

information via electronic information and telecommunication

technologies. It allows long-distance patient and clinician

contact, care, advice, reminders, education, intervention,

monitoring, and remote admissions according to

Wikipedia.

Two companies that

are clearly taking a firm position in the space are 'Face 2 Face

Health', a private childcentric digital health company and CB

Scientific Inc, a public company trading under the stock

ticker CBSC

that is focused on

at home remote monitoring. These two featured companies will

reiterate the foundational argument of this article which is that

medicine in the future is going to be strongly footed in

Telemedicine and at home remote monitoring. Companies that are on

the forefront today are sure to be leaders in the industry tomorrow

and to that end, I as the writer and as an investor feel there is a

tremendous opportunity to make money with developing companies that

personify why at home medical services are an essential part of any

portfolio containing healthcare related

investments.

Face 2 Face Health

is my first featured company and is being used to fortify the point

that this growing trend of Telemedicine is here to stay.

"Children's Health and wellness at your fingertips."

According to the company website (https://f2fhealth.com/),

they seek to improve the health and development and well-being of

every child. Face2Face Health is the first easy to use digital

holistic care coordination and education platform focused primarily

on children and families. Through digital connectivity, they

provide help for a child's physical, developmental, emotional and

behavioral challenges and offer such tools and resources like

screening, remote monitoring, supplements and support

communities.

QUOTE

FROM AMI SHAH, MD, FACP ABAARM:

CB Scientific Inc,

Stock Symbol CBSC,

provides innovative

products and services in the ambulatory non-invasive cardiac remote

monitoring space. Their FDA and CE cleared EKG devices, interactive

cloud-based acquisition software, and smartphone apps for both iOS

and Android platforms, provide improvements in compliance for

patients at risk of abnormal heart rhythms as well as more

scientifically accurate information for physicians. (*) in customer

trials awaiting final CFDA approval. Recently the company announced

they are closing an acquisition (https://cbscientificinc.com/cb-scientific-inc-announces-definitive-agreement-to-acquire-cardiolink-corporation-an-independent-diagnostic-testing-facility-idtf/)

which will streamline their diagnostics by offering both a

diagnosis and treatment recommendations. CBSC

has also announced

that they have new Asian distributors for their My-Cam product, an

auto trigger loop EKG recording device. With that development, the

company then appointed a new director of Asia Pacific named XXX and

Chip Martin as the CEO for CBSC.

This is discussed in a recent podcast (https://audioboom.com/posts/7807543-cb-scientific-inc-discusses-the-potential-of-their-proprietary-cardiac-event-monitor-my-cam-w)

including future revenue projections by June 2021.

Finding the right

investments comes down to understanding the benefits of at home

healthcare and certainly finding the most undervalued opportunities

in the market. I truly believe that CB Scientific Inc. Stock

Symbol CBSC

is, of course,

undervalued and when they start delivering product(s) to their new

Asian distributors later this month, we will see just how impactful

their non invasive cardiac monitor is for people all over the

world. Asia, in particular, has a particularly high rate of heart

disease and globally it already effects 31% of the world's

population. CBSC

is positioned

perfectly to help change early detection and diagnosis which will

save lives and costs due to heart disease.

We have heard from

Doctors like Ami Shah, a board certified and fellowship trained

internal medicine physician who has practiced telemedicine for over

15 years, who believes whole heartily that Telemedicine is the

future and at home remote monitoring is absolutely an integral part

of the overall picture for optimal health and well-being. CB

Scientific, Inc. is a great investment opportunity in my opinion,

and one company that we think you should look at as a potential

investment opportunity. Please read our full disclaimer and

remember to always do your own research of all new investments.

Good luck trading CBSC

and thank you for

reading.

Disclaimer;

INS has been

compensated $50,000 by CB Scientific Inc for digital marketing

services. INS Digital Media is engaged in the business of marketing

and advertising public companies, investment funds and trading

software for companies in return for monetary compensation. Never

invest in any stock featured on this page unless you can afford to

lose your entire investment. INS Digital Media/INS/ Investor News

Source and its employees are not a Registered Investment Advisers,

Broker Dealers, financial analysts or variation of any of these

listed professions or a member of any association. INS is

compensated by third party shareholders from time to time to

feature certain companies, in that even we encourage the company to

issue a press release highlighting such activities on their behalf.

These third parties may have shares and are assumed to liquidate

the company's shares which may very well negatively affect the

stock price. This compensation constitutes a conflict of interest

as to our ability to remain objective in our communication

regarding the profiled company. INS may, from time to time,

purchase shares of public companies that we have been compensated

to feature or profile in the open market and INS does this at fair

market value. Through the use of this advertisement , additional

marketing material, landing pages, social media post or other

affiliated platform marketing presented by Investor News Source

viewing you are using, you agree to hold INS its operators owners

and employees harmless to any and all loss (monetary or otherwise),

damage (monetary or otherwise), or injury (monetary or otherwise)

that you may incur. Trading stock is very risky and you should

never invest unless you are willing to loose your entire

investment. The information contained in publications,

advertisements and published opinions are always based on publicly

available information provided by the featured company and based on

sources which INS and it's members believe to be reliable but that

information is not guaranteed by INS as being accurate and does not

purport to be a complete statement or summary of the Information.

Publications, ads and opinion posts should NOT be considered

financial advice or a solicitation to buy or to stock.

SOURCE: by:

Derek McCarthy

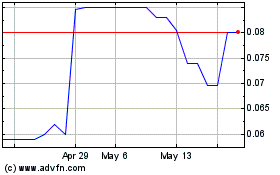

CB Scientific (QB) (USOTC:CBSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

CB Scientific (QB) (USOTC:CBSC)

Historical Stock Chart

From Apr 2023 to Apr 2024