Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

x

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

This summary

highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that

you should consider before investing in the common stock of Axxess Pharma, Inc. (referred to herein as “we,” “our,”

“us,” “Axxess Pharma, Inc.” or the “Company”). You should carefully read the entire Prospectus,

including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and the accompanying financial statements and the related notes to the Financial Statements before making an investment decision.

Business Overview

Axxess Pharma, Inc., a Nevada Corporation,

has in-licensed rights to manufacture and distribute several Health Canada-approved pharmaceutical and natural health products.

The Company, through its subsidiaries Axxess Pharma Canada, Inc. and Allstar Health Brands Inc., intends to manufacture and distribute

the products described below in Canada, the United States, and other international markets:

Soropon Medicated Shampoo

Soropon Medicated Shampoo is a treatment

for both infants and adults for fungal infections of the scalp such as sebhorreic dermatitis and cradle cap in infants. There are

currently several shampoos that treat similar conditions offered in the $20-24.00 price range. The Company plans to employ an aggressive

pricing strategy in order to effectively compete with the other medicated shampoos currently offered in this market segment. The

Company expects to re-launch Soropon Medicated Shampoo into the Canadian market in early 2015.

TapouT- branded Products

In 2013 the Company acquired a World-Wide

Exclusive License (the “License”) from ABG-Authentic Brands for various TapouT branded products in return for a royalty

rate of 5%. The TapouT-branded products for which the Company received the License include: TapouT Spray Pain Relief, TapouT Pain

Relief Towelettes, TapouT Hot & Cold Reusable Packs, TapouT Instant Cold Packs, TapouT Extreme Muscle Growth Supplement and

TapouT Muscle Recovery Supplement. In addition, the Company will launch: an Omega-3 Fish oil supplement, an all-natural testosterone

boost, a line of RTD’s (Ready-to-Drink) Protein meal replacement products, and a protein powder in both a two-pound and one

pound package. The Company intends to manufacture the TapouT products in the United States and possibly in Australia where some

of its formulation work is being done, and distribute them in Canada, the United States, Australia, New Zealand, South Korea, Indonesia

and other international markets.

Transaction with Beaufort

Investment Agreement

On June 9, 2014, the Company entered into

an Investment Agreement with Beaufort. The Investor Agreement provides that the Company may, from time to time in its sole discretion

when it determines appropriate in accordance with the terms and conditions of the Investment Agreement, during the Commitment Period

(defined below), deliver an advance notice (the “Advance Notice”) to Beaufort, which states the dollar amount of securities

that the Company intends to sell to Beaufort on a date specified in the Advance Notice (the “Advance”). The Company

will be entitled to Advance to Beaufort (the “Advance Amount”) the number of shares of common stock equal to a maximum

of two hundred fifty percent (250%) of the average daily volume (U.S. market only) of our common stock for the ten (10) trading

days prior to the applicable Advance Notice. The purchase price per share to be paid by Beaufort for each Advance Amount will be

calculated at a 30% discount to the median price for the average of the ten (10) closing daily prices and the ten (10) closing

bid prices of the Company’s Common Stock immediately prior to Beaufort’s receipt of the Advance Notice. The “Commitment

Period” begins on the trading day after a registration statement is declared effective as to the common stock to be subject

to the Advance, and ends 36 months after such date, unless earlier terminated in accordance with the Investment Agreement.

The Company has the right, pursuant to

the terms of the Investment Agreement to Advance up to $2,000,000 of common stock to Beaufort. If the Company was to draw down

on the entire $2,000,000, then the Company would have to issue approximately 11,428,572 shares of common stock based upon an assumed

purchase price under the Investment Agreement of $0.175 (equal to 70% of the closing price of our common stock of $0.25 on July

23, 2014), representing 18.86% of the outstanding common stock of the Company at the time the Company advances the maximum investment

amount of $2 million of shares of common stock.

The current registration statement covers

11,428,572 shares of our Common Stock under the Investment Agreement that would raise $2,000,000 assuming our Common Stock’s

closing bid price remains unchanged from its price as of July 23, 2014. In the event our Common Stock’s price decreases,

we may receive substantially less than $2,000,000. In that case, the Company may have to prepare and file one or more additional

registration statements registering the resale of these shares if this registration statement is unable to cover the remaining

amount of shares. These subsequent registration statements may be subject to review and comment by the staff of the SEC, and will

require the consent of our independent registered public accounting firm.

In addition, Beaufort will not be obligated

to purchase shares if Beaufort’s total number of shares beneficially held at that time would exceed 4.99% of the number of

shares of the Company’s common stock as determined in accordance with Rule 13d-1 of the Securities Exchange Act of 1934,

as amended. In addition, the Company is not permitted to draw on the facility unless there is an effective Registration Statement

(as further explained below) to cover the resale of the shares.

The Investment Agreement further provides

that Beaufort and the Company are each entitled to customary indemnification from the other for any losses or liabilities they

may suffer as a result of any breach by the other of any provisions of the Investment Agreement or Registration Rights Agreement

(as defined below).

Registration Rights Agreement

In connection with the Investment Agreement,

the Company and Beaufort entered into a registration rights agreement, or the Registration Rights Agreement. Under the Registration

Rights Agreement, the Company will use its commercially reasonable efforts to file, within thirty (30) days of the date of the

Investment Agreement, a Registration Statement on Form S-1 covering the resale of the common stock subject to the Investment Agreement.

The Company has agreed to have the Registration Statement declared effective with the SEC. Beaufort has agreed to pay all legal

costs and expenses associated with the Registration Rights Agreement. Beaufort has also agreed to extend the filing deadline

to July 25, 2014.

Promissory Note

On June 9, 2014, the Company issued Beaufort

a secured promissory note (the “Note”) in the principal amount of Two Hundred Fifty Thousand Dollars ($250,000.00).

The Note is to be funded in two equal tranches of $125,000. The first tranche of $125,000 has been funded at closing. Beaufort

has 30 days to fund the second tranche. If the second tranche is not funded, then the principal of the Note shall become $125,000.

The Note matures six months from the date the Company receives the full amount of the Note (the “Maturity Date”).

As collateral for the Note, Mr. Peter Daniel

Bagi, President of the Company, has agreed to pledge 2,000,000 shares of common stock of the Company (subject to adjustment) to

Beaufort as security for the payment in full of principal and performance under the Note (“Stock Pledge Agreement”).

Depending on our cash position, we may

not be able to repay the note. While we have been able to manage our working capital needs with current credit facilities, additional

financing or commencement of revenue generating from operations will be required in order to repay the note. To date, we have not

generated any revenue, and we cannot make any assurances that we will be successful in generating any in the future. Also, we cannot

predict whether we will be able to obtain new financing, nor do we know if it will be in the form of equity or debt. We may not

be able to obtain the necessary additional capital on a timely basis, on acceptable terms, or at all. Additional investments are

being sought, but we cannot guarantee that we will be able to obtain such investments. Moreover, the amount of indebtedness may

not be reduced or relieved by the issuance of shares under the equity line agreement.

Transaction with Seaside

On May 19, 2014, the Company entered into

a Securities Purchase Agreement with Seaside 88, LP, a Florida limited partnership, or Seaside, pursuant to which the Company will

issue and sell to Seaside up to 5,000,000 shares of its common stock.

The per share purchase price shall be an

amount equal to the lower of (a) the average of the high and low trading prices (measured to two decimal places) of the common

stock for the ten (10) consecutive trading days immediately prior to a closing date, multiplied by 0.50 and (b) the average of

the high and low trading prices (measured to two decimal places) of the common stock for the trading day immediately prior to a

closing date, multiplied by 0.55. However, in no event the per share purchase price shall be less than the floor price equal to

$0.14 per share in any subsequent closing, unless both parties agree to waive it.

In addition, Seaside will not be obligated

to purchase shares if Seaside’s total number of shares beneficially held at that time would exceed 9.99% of the number of

shares of the Company’s common stock as determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934,

as amended.

Seaside is entitled to piggyback registration

rights for all the shares issued or issuable under the Securities Purchase Agreement.

The parties conducted the initial closing

on May 20, 2014 and the Company issued a total of 584,350 shares at $0.15 per share. Two subsequent closings were took place on

June 20, 2014 and July 21. The Company issued 917,300 shares at $0.15 per share and 840,520 shares at $0.1195 per share, respectively.

The Company received total proceeds of $323,609.90 from these three closings.

Acquisition

On September 13, 2013 the Company through

its wholly owned subsidiary Allstar Health Brands, enter into an assets purchase agreement with Revive Bioscience Inc. The Company

acquired assets related to the distribution of Tapout Products including DINS of TapouT pain relief products as well as trademarks,

website, remaining finished goods inventory of Tapout products as well customer lists and intellectual products associated with

the Tapout brand name. The purchase price included $52,000 cash used to pay-off outstanding accounts payable of Revive Bioscience

as of the closing date and 6,450,000 shares of common stock valued at $0.48 per share at the closing date of the transaction.

Where You Can Find Us

Our principal executive offices are located

at 3250 Bloor Street West, Suite 613, Toronto, ON, M8X 2X9. Our telephone number is (416) 410-6006. Unless the context provides

otherwise, when we refer to “we,” “our,” “us,” “Axxess Pharma, Inc.” or the “Company”

in this Prospectus, we are referring to Axxess Pharma, Inc.

THE OFFERING

|

Common stock offered by Selling Stockholder

|

|

16,573,752 shares of common stock.

|

|

|

|

|

|

Common stock outstanding before the offering

|

|

49,167,009 shares of common stock as of July 23, 2014.

|

|

|

|

|

|

Common stock outstanding after the offering

|

|

65,740,761 shares of common stock.

|

|

|

|

|

|

Use of proceeds

|

|

We will receive proceeds from the sale of securities pursuant to the Investment Agreement. The proceeds received under the Investment Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company.

|

|

|

|

|

|

OTC Pink Trading Symbol

|

|

AXXE

|

|

|

|

|

|

Risk Factors

|

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”.

|

RISK FACTORS

You should

carefully consider the risks described below together with all of the other information included in this Prospectus before making

an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are

not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to

differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs,

our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock

could decline, and you may lose all or part of your investment.

Risks Related to the Operations and

Business

We have a history of losses and expect

to incur additional losses in the future. We are unable to predict the extent of future losses or when we will become profitable

.

For the years ended December 31, 2012 and

2013, we experienced net losses of $606,964 and $11,221,801, respectively. We reported revenue of $2,400 and a gross

profit of $1,656 from continuing operations for the year ended December 31, 2013. Until one or more of the products under development

is successfully brought to market, we do not anticipate generating significant revenue or gross profit.

We expect to continue to incur operating

losses for the near future. Our ability in the future to achieve or sustain profitability is based on a number of factors, many

of which are beyond our control. Even if we achieve profitability in the future, we may not be able to sustain profitability in

subsequent periods.

Our financial statements indicate

conditions exist that raise substantial doubt as to whether we will continue as a going concern.

Our audited financial statements for the

year ended December 31, 2013 indicate conditions exist that raise substantial doubt as to whether we will continue as a going concern.

Our continuation as a going concern is dependent upon our ability to obtain financing to fund the continued development of products

and working capital requirements. If we cannot continue as a going concern, our stockholders may lose their entire investment.

Funding

from our Investment Agreement with Beaufort may be limited or be insufficient to fund our operations or to implement our strategy.

Under our Investment

Agreement with Beaufort, upon effectiveness of the registration statement of which this Prospectus is a part, and subject to other

conditions, we may direct Beaufort to purchase up to $2,000,000 of our shares of common stock over a 36-month period.

The current registration statement covers

11,428,572 shares of our Common Stock under the Investment Agreement that would raise $2,000,000 assuming our Common Stock’s

closing bid price remains unchanged from its price as of July 23, 2014. In the event our Common Stock’s price decreases,

we may receive substantially less than $2,000,000. In that case, the Company may have to prepare and file one or more additional

registration statements registering the resale of these shares if this registration statement is unable to cover the remaining

amount of shares. These subsequent registration statements may be subject to review and comment by the staff of the SEC, and will

require the consent of our independent registered public accounting firm.

There can be no

assurance that we will be able to receive all or any of the total commitment from Beaufort because the Investment Agreement contains

certain limitations, restrictions, requirements, conditions and other provisions that could limit our ability to cause Beaufort

to buy common stock from us. For instance, the Company is prohibited from issuing a drawdown notice if the amount requested

in such drawdown notice exceeds the maximum drawdown amount which shall be equal to 250% of average daily trading volume of the

common stock during the pricing period or the sale of shares pursuant to the drawdown notice would cause the Company to sell or

Beaufort to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership

by Beaufort of more than 4.99% of the Company’s common stock (as calculated pursuant to Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, and the rules and regulations thereunder). Also, as discussed above, there

must be an effective registration statement covering the resale of any shares to be issued pursuant to any drawdown under the Investment

Agreement, and the registration statement of which this Prospectus is a part covers the resale of only 11,428,572 shares that may

be issuable pursuant to drawdown under the Investment Agreement. These registration statements may be subject to review and

comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore,

the timing of effectiveness of these registration statements cannot be assured.

The extent to

which we rely on Beaufort as a source of funding will depend on a number of factors, including the amount of working capital needed,

the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources.

If obtaining sufficient funding from Beaufort were to prove unavailable or prohibitively dilutive, we would need to secure another

source of funding. Even if we sell all $2,000,000 of common stock under the Investment Agreement with Beaufort, we will still need

additional capital to fully implement our current business, operating and development plans.

Compliance with changing regulations

concerning corporate governance and public disclosure may result in additional expenses.

There have been changing laws, regulations

and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act, and new regulations promulgated

by the SEC. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their

lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory

and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by

ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and

standards are likely to continue to result in increased general and administrative expenses and a diversion of management time

and attention from revenue-generating activities to compliance activities. Our board members and executive officers could face

an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty

attracting and retaining qualified board members and executive officers, which could harm our business. If our efforts to comply

with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies, we could

be subject to liability under applicable laws or our reputation may be harmed.

We depend on key personnel to manage

our business effectively, and, if we are unable to hire, retain or motivate qualified personnel, our ability to design, develop,

market and sell our systems could be harmed.

Our future success depends, in part, on

certain key employees, including Peter Daniel Bagi, MD, our Director and President, and on our ability to attract and retain highly

skilled personnel. The loss of the services of any of our key personnel may seriously harm our business, financial condition and

results of operations. In addition, the inability to attract or retain qualified personnel, or delays in hiring required personnel,

particularly operations, finance, accounting, sales and marketing personnel, may also seriously harm our business, financial condition

and results of operations. Our ability to attract and retain highly skilled personnel will be a critical factor in determining

whether we will be successful in the future.

We will incur the expenses of complying

with public company reporting requirements.

After we become public, we will have an

obligation to comply with the applicable reporting requirements of the Exchange Act which includes the filing with the SEC of periodic

reports, proxy statements and other documents relating to our business, financial conditions and other matters, even though compliance

with such reporting requirements is economically burdensome.

Risks Related to Our Product Development

Efforts

We anticipate future losses and will

require additional financing, and our failure to obtain additional financing when needed could force us to delay, reduce or eliminate

our product development programs or commercialization efforts.

We anticipate future losses and therefore

may be dependent on additional financing to execute our business plan. In particular, we will require additional capital to continue

to conduct the research and development and obtain regulatory clearances and approvals necessary to bring any future products to

market and to establish effective marketing and sales capabilities for existing and future products. Our operating plan may change,

and we may need additional funds sooner than anticipated to meet our operational needs and capital requirements for product development,

clinical trials and commercialization. Additional funds may not be available when we need them on terms that are acceptable to

us, or at all. If adequate funds are not available on a timely basis, we may terminate or delay the development of one or more

of our products, or delay establishment of sales and marketing capabilities or other activities necessary to commercialize our

products.

Our future product development efforts

may not yield marketable products due to results of studies or trials, failure to achieve regulatory approvals or market acceptance,

proprietary rights of others or manufacturing issues.

Development of a product candidate requires

substantial technical, financial and human resources. Our potential product candidates may appear to be promising at various stages

of development yet fail to timely reach the market for a number of reasons, including: the lack of adequate quality or sufficient

prevention benefit; our or our collaborative development partners’ failure to receive necessary regulatory approvals on a

timely basis, or at all; the existence of proprietary rights of third parties; or the inability to develop manufacturing methods

that are efficient, cost-effective and capable of meeting stringent regulatory standards.

Our industry changes rapidly as a

result of technological and product developments, which may quickly render our product candidates less desirable or even obsolete.

If we are unable or unsuccessful in supplementing our product offerings, our revenue and operating results may be materially adversely

affected.

The industry in which we operate is subject

to rapid technological change. The introduction of new technologies in the market, including the delay in the adoption of these

technologies, as well as new alternatives for the delivery of products and services will continue to have a profound effect on

competitive conditions in this market. We may not be able to develop and introduce new products, services and enhancements that

respond to technological changes on a timely basis. If our product candidates are not accepted by the market as anticipated, if

at all, our business, operating results, and financial condition may be materially and adversely affected.

If we are unable to develop and later

market our products under development in a timely manner or at all, or if competitors develop or introduce similar products that

achieve commercialization before our products enter the market, the demand for our products may decrease or the products could

become obsolete.

Our products will operate in competitive

markets, where competitors may already be well established. We expect that competitors will continue to innovate and to develop

and introduce similar products that could be competitive in both price and performance. Competitors may succeed in developing or

introducing similar products earlier than, obtaining regulatory approvals and clearances for such products before our products

are approved and cleared, or developing more effective products. In addition, competitors may have products, which may achieve

commercialization before our products enter the market.

If a competitor’s products reach

the market before our products, they may gain a competitive advantage, impair the ability of us to commercialize the products,

or render the products obsolete. There can be no assurance that developments by competitors will not render our products obsolete

or noncompetitive. Our financial performance may be negatively impacted if a competitor’s successful product innovation reaches

the market before our products or gains broader market acceptance.

We believe that our products have certain

advantages, but maintaining these advantages will require continual investment in research and development, and later in sales

and marketing. There is no guarantee that we will be successful in maintaining these advantages. Nor is there any guarantee that

we will be successful in completing development of our products in any clinical trials or in achieving sales of our products, or

that future margins on such products will be acceptable.

We may never achieve market acceptance

or significant sales of our healthcare products or systems.

Through today, substantially all of our

healthcare products were under development and had generated only nominal revenue. We may never achieve market acceptance or more

than nominal or modest sales of these products and systems.

Risks Related to Our Common Stock

We do not anticipate declaring any

cash dividends on our common stock.

Any future determination with respect to

the payment of dividends will be at the discretion of the Board of Directors and will be dependent upon our financial condition,

results of operations, capital requirements, general business conditions, terms of financing arrangements and other factors that

our Board of Directors may deem relevant.

Our shares may be defined as "penny

stock," the rules imposed on the sale of the shares may affect your ability to resell any shares you may purchase, if at all.

Shares of our common stock may be defined

as a “penny stock” under the Exchange Act, and rules of the SEC. The Exchange Act and such penny stock rules

generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other

than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net

worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse, or in transactions not recommended

by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination

for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain

mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations,

the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by

the SEC. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock

and may also affect your ability to resell any shares you may purchase in this offering in the public markets.

Beaufort will pay less than the then-prevailing

market price for our common stock.

The common stock to be issued to Beaufort

pursuant to the Investment Agreement will be purchased at a 30% discount from the median price for the average of the ten (10)

closing daily prices and the ten (10) closing bid prices of the Company’s Common Stock immediately prior to Beaufort’s

receipt of the Advance Notice. Beaufort has a financial incentive to sell our common stock immediately upon receiving the shares

to realize the profit equal to the difference between the discounted price and the market price. If Beaufort sells the shares,

the price of our common stock could decrease. If our stock price decreases, Beaufort may have a further incentive to sell the shares

of our common stock that it holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted

and the value of our common stock may decline by exercising the drawdown right pursuant to the Investment Agreement.

Pursuant to the Investment Agreement, when

we deem it necessary, we may raise capital through the private sale of our common stock to Beaufort at a price equal to a 30% discount

from the median price for the average of the ten (10) closing daily prices and the ten (10) closing bid prices of the Company’s

Common Stock immediately prior to Beaufort’s receipt of the Advance Notice. Because the drawdown price is lower than the

prevailing market price of our common stock, to the extent that the drawdown right is exercised, your ownership interest may be

diluted.

We are registering an aggregate of

11,428,572 shares of common stock to be issued under the Investment Agreement. The sales of such shares could depress the market

price of our common stock.

We are registering an aggregate of 11,428,572

shares of common stock under this Prospectus, issuable to Beaufort pursuant to the drawdown notice under the Investment Agreement.

Notwithstanding Beaufort’s ownership limitation, the 11,428,572 shares would represent approximately 18.86% of our shares

of common stock outstanding immediately after our exercise of the drawdown right under the Investment Agreement. The sale of these

shares into the public market by Beaufort could depress the market price of our common stock.

The current registration statement covers

11,428,572 shares of our Common Stock under the Investment Agreement that would raise $2,000,000 assuming our Common Stock’s

closing bid price remains unchanged from its price as of July 23, 2014. Due to the floating offering price, we are not able to

determine the exact number of shares that we will issue under the Investment Agreement. In the event our Common Stock’s price

decreases, we may receive substantially less than $2,000,000. In that case, the Company may have to prepare and file one or more

additional registration statements registering the resale of these shares if this registration statement is unable to cover the

remaining amount of shares. These subsequent registration statements may be subject to review and comment by the staff of the SEC,

and will require the consent of our independent registered public accounting firm.

We may not have access to the full

amount available under the

Investment Agreement.

We have not drawn down funds and have not issued shares of our

common stock under the Investment Agreement. Our ability to drawdown funds and sell shares under the Investment Agreement requires

that the registration statement, of which this Prospectus is a part, be declared effective by the SEC, and that this registration

statement continue to be effective. In addition, the registration statement of which this Prospectus is a part registers 11,428,572

shares issuable under the Investment Agreement, and our ability to sell any remaining shares issuable under the Investment Agreement

is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares.

These registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our

independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be

assured. The effectiveness of these registration statements is a condition precedent to our ability to sell the shares of common

stock to Beaufort under the Investment Agreement. Even if we are successful in causing one or more registration statements registering

the resale of some or all of the shares issuable under the Investment Agreement to be declared effective by the SEC in a timely

manner, we may not be able to sell the shares unless certain other conditions are met. For instance, we are prohibited from issuing

a drawdown notice if the amount requested in such drawdown notice exceeds the maximum drawdown amount which shall be equal to 250%

of average daily trading volume of the common stock during the pricing period or the sale of shares pursuant to the drawdown notice

would cause us to sell or Beaufort to purchase an aggregate number of shares of our common stock which would result in beneficial

ownership by Beaufort of more than 4.99% of our common stock. Accordingly, because our ability to drawdown any amounts under the

Investment Agreement is subject to a number of conditions, there is no guarantee that we will be able to drawdown any portion or

all of the proceeds of $2,000,000 under the Investment Agreement.

Certain restrictions on the extent

of drawdowns and the delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares

in connection with the Investment Agreement, and as such, Beaufort

may sell a large number of shares, resulting in

substantial dilution to the value of shares held by existing stockholders.

Beaufort has agreed, subject to certain

exceptions listed in the Investment Agreement, to refrain from holding an amount of shares which would result in Beaufort or its

affiliates owning more than 4.99% of the then-outstanding shares of our common stock at any one time. These restrictions, however,

do not prevent Beaufort from selling shares of common stock received in connection with a drawdown, and then receiving additional

shares of common stock in connection with a subsequent drawdown. In this way, Beaufort could sell more than 4.99% of the outstanding

common stock in a relatively short time frame while never holding more than 4.99% at one time.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus contains forward looking

statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk

Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

All statements other than statements of historical fact contained in this prospectus, including statements regarding future events,

our future financial performance, business strategy, and plans and objectives of management for future operations, are forward-looking

statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,”

“can,” “continue,” “could,” “estimates,” “expects,” “intends,”

“may,” “plans,” “potential,” “predicts,” “should,” or “will”

or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe

we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve

known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere

in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive, and rapidly

changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we

address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual

results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements

largely on our current expectations and projections about future events and financial trends that we believe may affect our financial

condition, results of operations, business strategy, short term and long term business operations, and financial needs. These forward-looking

statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected

in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to,

those discussed in this prospectus, and in particular, the risks discussed below and under the heading “Risk Factors”

and those discussed in other documents we file with the Securities and Exchange Commission. The following discussion should be

read in conjunction with the consolidated financial statements and notes included herewith. We undertake no obligation to revise

or publicly release the results of any revision to these forward-looking statements. In light of these risks, uncertainties and

assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ

materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on

any forward-looking statement, each of which applies only as of the date of this prospectus. You should be aware that the occurrence

of the events described in the section entitled “Risk Factors” and elsewhere in this prospectus could negatively affect

our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to

update or revise publicly any of the forward-looking statements after the date of this prospectus to conform our statements to

actual results or changed expectations.

USE OF PROCEEDS

We will receive

proceeds from the sale of shares to Beaufort pursuant to the Investment Agreement. We intend to use the net proceeds received from

any such sales of shares to Beaufort under the Investment Agreement for general corporate and working capital purposes and acquisitions

or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best

interest of the Company.

SELLING STOCKHOLDER

We are registering for resale shares of

our common stock that are issued and outstanding held by the selling stockholder identified below. We are registering the shares

to permit the selling stockholder to resell the shares when and as it deems appropriate in the manner described in the “Plan

of Distribution.” As of July 23, 2014, there were 49,167,009 shares of common stock issued and outstanding.

The selling stockholder has never served

as our officer or director or any of its predecessors or affiliates within the last three years, nor has the selling stockholder

had a material relationship with us. The selling stockholder is neither a broker-dealer nor an affiliate of a broker-dealer. The

selling stockholder did not have any agreement or understanding, directly or indirectly, to distribute any of the shares being

registered at the time of purchase.

The selling stockholder may offer for sale

all or part of the shares from time to time. The table below assumes that the selling stockholder will sell all of the shares offered

for sale. The selling stockholder is under no obligation, however, to sell any shares pursuant to this Prospectus.

|

|

|

|

|

|

|

|

|

Number of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of

|

|

|

|

|

|

|

|

Shares of

|

|

|

Maximum

|

|

|

Common

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Number of

|

|

|

Stock

|

|

|

|

|

|

|

|

Beneficially

|

|

|

Shares of

|

|

|

Beneficially

|

|

|

Percent

|

|

|

|

|

Owned prior to

|

|

|

Common Stock

|

|

|

Owned after

|

|

|

Ownership

|

|

|

Name

|

|

Offering (1)

|

|

|

to be Offered

|

|

|

Offering

|

|

|

after Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beaufort Capital Partners LLC (2)

|

|

|

0

|

|

|

|

11,428,572

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Seaside 88, LP (3)

|

|

|

2,342,170

|

|

|

|

2,342,170

|

|

|

|

0

|

|

|

|

0

|

%

|

|

MGP Architects (4)

|

|

|

41,028

|

|

|

|

41,028

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Calvin Cameron (4)

|

|

|

115,806

|

|

|

|

115,806

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Realty Capital Management Ltd. (4)

|

|

|

22,459

|

|

|

|

22,459

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Strategic Equity Capital Holdings Inc. (4)

|

|

|

599,870

|

|

|

|

599,870

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Daniel Gooding (4)

|

|

|

46,953

|

|

|

|

46,953

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Ian Hasinoff (4)

|

|

|

115,800

|

|

|

|

115,800

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Anna Henson (4)

|

|

|

59,737

|

|

|

|

59,737

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Andrew Houlton (4)

|

|

|

45,396

|

|

|

|

45,396

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Kirarv Capital (4)

|

|

|

467,556

|

|

|

|

467,556

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Rob Klein (4)

|

|

|

56,147

|

|

|

|

56,147

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Zosia Lancaster (4)

|

|

|

11,738

|

|

|

|

11,738

|

|

|

|

0

|

|

|

|

0

|

%

|

|

E52 Financial Ltd. (4)

|

|

|

413,356

|

|

|

|

413,356

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Earl Marek (4)

|

|

|

10,357

|

|

|

|

10,357

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Justin Marek (4)

|

|

|

61,483

|

|

|

|

61,483

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Tom Mcdonnell (4)

|

|

|

309,000

|

|

|

|

309,000

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Gordon Mezzomo (4)

|

|

|

6,095

|

|

|

|

6,095

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Liam O’Neil (4)

|

|

|

33,688

|

|

|

|

33,688

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Jason Reid (4)

|

|

|

43,794

|

|

|

|

43,794

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Farrukh Sair (4)

|

|

|

10,979

|

|

|

|

10,979

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Igor Sevic (4)

|

|

|

12,429

|

|

|

|

12,429

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Paul Shook

(4)

|

|

|

10,357

|

|

|

|

10,357

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Gordon Stratford

(4)

|

|

|

10,357

|

|

|

|

10,357

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Owen Ward

(4)

|

|

|

12,500

|

|

|

|

12,500

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Geoff Dover

(4)

|

|

|

7,500

|

|

|

|

7,500

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Roman Levy

(4)

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Realty Capital Management Ltd.

(4)

|

|

|

125,000

|

|

|

|

125,000

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Jeff Walna

(4)

|

|

|

10,979

|

|

|

|

10,979

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Cheming Yang

(4)

|

|

|

113,571

|

|

|

|

113,571

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Chad Zinn

(4)

|

|

|

11,229

|

|

|

|

11,229

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Terrence Joyce

(4)

|

|

|

561

|

|

|

|

561

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Edward Leon

(4)

|

|

|

561

|

|

|

|

561

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Samuel Sayson

(4)

|

|

|

11,724

|

|

|

|

11,724

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Total

|

|

|

5,145,180

|

|

|

|

16,573,752

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In

computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities that are

currently convertible or exercisable into shares of our common stock, or convertible or exercisable into shares of our common stock

within 60 days of the date hereof are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of

computing the percentage ownership of any other person.

|

|

|

(2)

|

Includes 11,428,572 shares of our common stock that we will put to Beaufort Capital Partners LLC

pursuant to that certain investment agreement dated June 9, 2014. Leib Schaeffer is a Managing Member at Beaufort Capital Partners

LLC and has voting and dispositive power over the shares owned by Beaufort.

|

|

|

(3)

|

On May 19, 2014, the Company entered into a Securities Purchase Agreement with Seaside 88, LP,

a Florida limited partnership, or Seaside, pursuant to which the Company will issue and sell to Seaside up to 5,000,000 shares

of its common stock. The Company issued 584,350 shares at $0.15 per share on May 20, 2014, 917,300 shares at $0.15 per share on

June 20, 2014, and 840,520 shares at $0.1195 per share on July 21, respectively.

|

|

|

(4)

|

Includes 2,803,010 shares issued to the shareholders of Revive Bioscience Inc. pursuant to that

certain assets purchase agreement dated September 13, 2013.

|

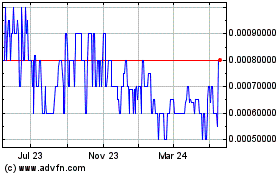

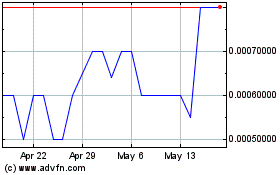

MARKET FOR COMMON EQUITY AND RELATED

STOCKHOLDER MATTERS

Our common stock is quoted on the OTC Pink

under the symbol “AXXE.” On July 23, 2014, the last reported bid price of our common stock was $0.25 per share. The

following table presents the high and low bid price for our common stock for the periods indicated:

|

Fiscal Year Ended December 31, 2014

|

|

High

|

|

|

Low

|

|

|

Quarter ended June 30, 2014

|

|

$

|

.27

|

|

|

$

|

.2505

|

|

|

Quarter ended March 31, 2014

|

|

$

|

.3861

|

|

|

$

|

.371

|

|

|

Fiscal Year Ended December 31, 2013

|

|

High

|

|

|

Low

|

|

|

Quarter ended December 31, 2013

|

|

$

|

.1709

|

|

|

$

|

.152

|

|

|

Quarter ended September 30, 2013

|

|

$

|

.278

|

|

|

$

|

.25

|

|

|

Quarter ended June 30, 2013

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Quarter ended March 31, 2013

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Fiscal Year Ended December 31, 2012

|

|

High

|

|

|

Low

|

|

|

Quarter ended December 31, 2012

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Quarter ended September 30, 2012

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Quarter ended June 30, 2012

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

|

Quarter ended March 31, 2012

|

|

$

|

N/A

|

|

|

$

|

N/A

|

|

Holders

As of July 23, 2014, there were approximately

657 holders of record of our common stock, which number does not reflect beneficial stockholders who hold their stock in nominee

or “street” name through various brokerage firms.

Dividend Policy

The Company has not paid any cash dividends

to date, and has no intention of paying any cash dividends on the common stock in the foreseeable future. The declaration and payment

of dividends is subject to the discretion of the Company’s Board of Directors and to certain limitations imposed under Nevada

law. The timing, amount and form of dividends, if any, will depend upon, among other things, the Company’s results of operations,

financial condition, cash requirements, and other factors deemed relevant by the Board of Directors. The Company intends to retain

any future earnings for use in its business.

DESCRIPTION OF BUSINESS

History and Corporate Structure

The Company was incorporated in the state of Delaware on April

7, 1997 as CGI Communications Services, Inc. On July 26, 2008, the Company amended its certificate of incorporation to change

its name to Axxess Pharma, Inc. On December 6, 2012, the Company reincorporated in Nevada by merging into a newly formed Nevada

entity with the same name. The Company now operates as Axxess Pharma, Inc. with Axxess Pharma Canada, Inc. and Allstar Health

Brands Inc.as its wholly owned subsidiaries.

Axxess Pharma Canada Inc. was incorporated under the Laws of

the Province of Ontario. The Company is engaged in the acquisition of Drug Identification Numbers and the eventual sale of the

related products. All Star Health Brands Inc. was incorporated on October 1, 2013 under the Laws of the Province of Ontario. The

Company is engaged in the acquisition of Drug Identification Numbers and the eventual sale of the related products.

Overview

Axxess Pharma, Inc., a Nevada Corporation,

has in-licensed rights to manufacture and distribute several Health Canada-approved pharmaceutical and natural health products.

The Company intends to manufacture and distribute the products described below in Canada, the United States, and other international

markets:

Soropon Medicated Shampoo

Soropon Medicated Shampoo is a treatment

for both infants and adults for fungal infections of the scalp such as sebhorreic dermatitis and cradle cap in infants. There

are currently several shampoos that treat similar conditions offered in the $20-24.00 price range. The Company plans to employ

an aggressive pricing strategy in order to effectively compete with the other medicated shampoos currently offered in this market

segment. The Company expects to re-launch Soropon Medicated Shampoo into the Canadian market in early 2015.

Other Health Canada-Approved Products:

The Company will assess the market for and timing of manufacture and re-launch of several or all of its pharmaceutical and natural

health products, once further financing is secured.

TapouT- branded Products

In 2013 the Company acquired a World-Wide

Exclusive License (the “License”) from ABG-Authentic Brands for various TapouT branded products in return for a royalty

rate of 5%. The TapouT-branded products for which the Company received the License include: TapouT Spray Pain Relief, TapouT Pain

Relief Towelettes, TapouT Hot & Cold Reusable Packs, TapouT Instant Cold Packs, TapouT Extreme Muscle Growth Supplement and

TapouT Muscle Recovery Supplement. In addition, the Company will launch: an Omega-3 Fish oil supplement, an all-natural testosterone

boost, a line of RTD’s (Ready-to-Drink) Protein meal replacement products, and a protein powder in both a two-pound and

one pound package. The Company intends to manufacture the TapouT products in the United States and possibly in Australia where

some of its formulation work is being done, and distribute them in Canada, the United States, Australia, New Zealand, South Korea,

Indonesia and other international markets.

Sales, Marketing and Distribution

We intend to utilize a multi-pronged sales,

marketing and distribution plan for our healthcare products. The Company has already signed several spokespersons/ ambassadors

including Brittney Palmer, Cole Whitt and Ryan Jimmo to help promote the TapouT brand. The Company intends to continue to pursue

recognizable names in sports and fitness to help promote the TapouT brand. The company also advertises in the several different

media channels, including print media and social media.

The Company has begun sales through several

online venues, including: go4itnutrition.com, amazon.com, ronniecolemannutrition.com and others. The Company has also begun retail

sales in the United States to US military personnel through the Army Air Force Exchange Service (“AAFES”) and has

recently received a second order for its products from AAFES. The Company expects retail relationship with AAFES to grow substantially

as the TapouT product line becomes more diverse and adds additional products to the AAFES sales orders.

The Company intends to expand its retail

distribution in the US through large chain retailers such as Bi-Lo, Winn Dixie, Vitamin World, and Walgreen’s. The Company

has had preliminary meetings with several of the aforementioned retail chains, and received extremely positive feedback. The Company

expects to finalize negotiations with several of these retail chains over the course of 2014.

In International markets, the Company

has a distribution agreement with Hard Core Beverages (HCB) of Australia for distribution of its products into the Australia/Asia

region, and has been working closely with HCB to begin sales. HCB has a history of aggressive marketing and the Company expects

the addition of HCB to add significantly to its revenues. Additionally, the Company plans to begin distribution of its TapouT

products in the Australia/Asia markets and believes that the popularity of the TapouT brand will help to increase sales and profitability

in the future.

Manufacturing

The Company currently has its supplements

and topical pain relief products (spray and wipes) manufactured by Private Label Nutraceuticals, of Norcross, Georgia, a fully

compliant Good Manufacturing Practices contract manufacturing facility. Private Label Nutraceuticals has a long track record of

high-quality manufacturing under FDA guidelines. In addition, Private Label Nutraceuticals will also manufacture the Omega-3 Fish

Oil and the all-natural testosterone boost products as soon as those products are ready to be placed into production.

The Company’s RTD protein meal-replacement

products planned for a late 2014 launch, have been formulated in Australia, and the Company has yet to decide where the final

commercial batches will be manufactured.

The Company’s line of Instant Cold

Pack and Reusable Hot & Cold Pack products are currently manufactured in China, and have allowances to be sold in the US and

Canada. The Company anticipates continuing the manufacture of these products in China.

Supply Arrangements

Currently the Company has supply agreements

with Private Label Nutraceuticals LLC, for all its supplements, topical pain relief and vitamis & Minerals; Goldrich Printpak

Inc. for its packaging; Quality Tape and Label Company for its labelling design and production; Great Lakes Fulfillment Services

for part of its fulfillment services; Planet Fulfillment, LLC for the remainder of the Company’s fulfillment requirements;

Environmental Regulation

As the Company does not directly manufacture

the Company relies on its suppliers policies pertaining to environmental regulation. In addition, the Company’s products

are made with all-natural ingredients.

Government Regulation

The Company’s products are regulated

under FDA Guidelines and Regulations. The ingredients used by the Company for the production of its products are classified as

GRAS (Generally Regarded As Safe). To the best of the Company’s knowledge all the new products under development conform

to the FDA guidelines for safety, and quality manufacturing.

Competitive Conditions

The market for the Company’s products

contains products in many cases similar to the Company’s own products. The Company believes its pain relief products are

unique in that they use a patented process which eliminates the need for chemical binders to deliver trans-dermally, and therefore

is a totally natural product formulated with essential oils known to provide pain relief. While the Company strives to provide

products, including its supplements and protein based products, with the latest ingredient formulations based on the needs listed

in the most current scientific literature, the Company understands other companies may be doing the same. Therefore the Company’s

strategy is to differentiate its products based on its use of all-natural, high-quality ingredients, and especially on brand recognition,

using the power of the TapouT brand as a major selling feature.

Research and Development

The Company currently works with Private

Label Nutraceuticals LLC to formulate new products, including the Omega-3 Fish Oil and all-natural Testosterone boost. In addition

the Company intends to introduce an expanded line of vitamins and minerals, the exact formulations of which will be a collaborative

research and development effort between the Company and Private Label Nutraceuticals LLC.

The Company has been working with HCB

to formulate a line a protein supplement with a unique blend of L-Carnitine, an Amino Acid believed to burn fat even at rest.

The Company anticipates that the formulation will have the major added benefit of being good-tasting, a trait which seems to be

elusive among the competition. The Company is also developing a protein powder with HCB expected to be launched in the fall of

2014.

Employees

As of July, 2014, we had four full-time employees. We consider

our relationship with our employees to be satisfactory and have not experienced any interruptions of our operations as a result

of labor disagreements. None of our employees are represented by labor unions or covered by collective bargaining agreements.

DESCIRPTION OF PROPERTY

Our corporate headquarters is located

in Toronto, Canada, where we occupy approximately 500 square feet of office space, under a lease that expires in May 2015. The

monthly lease payment is approximately $1,243. Our wholly owned subsidiary AllStar Health Brands Inc. leases an office in Aventura,

Florida, with a monthly payment of approximately $395 and the lease expires in March 2015.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion and analysis

should be read in conjunction with our financial statements and the related notes. Our discussion includes forward-looking statements

based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions.

Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a

result of a number of factors, including those set forth under the Risk Factors, Special Note Regarding Forward-Looking Statements

and Business sections in this Prospectus. We use words such as “anticipate,” “estimate,” “plan,”

“project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,”

“may,” “will,” “should,” “could,” and similar expressions to identify forward-looking

statements.

Overview

Axxess Pharma, Inc., a Nevada Corporation,

has in-licensed rights to manufacture and distribute several Health Canada-approved pharmaceutical and natural health products.

The Company, through its subsidiaries, intends to manufacture and distribute the products described below in Canada, the United

States, and other international markets:

Soropon Medicated Shampoo

Soropon Medicated Shampoo is a treatment

for both infants and adults for fungal infections of the scalp such as sebhorreic dermatitis and cradle cap in infants. There are

several shampoos meant to treat similar offered in the $20-24.00 price range. The Company plans to employ an aggressive pricing

strategy to compete effectively with the other competitors in this market segment. The Company expects to re-launch Soropon Medicated

Shampoo into the Canadian market in early 2015.

TapouT- branded Products

In 2013 the Company acquired a World-Wide

Exclusive License from ABG-Authentic Brands for various TapouT branded products in return for a royalty rate of 5%. The TapouT-branded

products include TapouT Spray Pain Relief, TapouT Pain Relief Towelettes, TapouT Hot & Cold Reusable Packs, TapouT Instant

Cold Packs, TapouT Extreme Muscle Growth Supplement and TapouT Muscle Recovery Supplement. The Company intends to manufacture the

TapouT products in the United States and distribute them in Canada, the United States, and other international markets.

Results of Operations

The following table summarizes changes

in selected operating indicators of the Company, illustrating the relationship of various income and expense items to net sales

for the respective periods presented (components may not add or subtract to totals due to rounding):

|

|

|

Three Months Ended

|

|

|

Fiscal

|

|

|

|

|

2014

|

|

|

2013

|

|

|

2013

|

|

|

2012

|

|

|

Revenue

|

|

|

$4,994

|

|

|

|

$0

|

|

|

|

2,400

|

|

|

|

--

|

|

|

Cost of Revenue

|

|

|

3,495

|

|

|

|

0

|

|

|

|

744

|

|

|

|

--

|

|

|

Gross Profit

|

|

|

1,499

|

|

|

|

0

|

|

|

|

1,656

|

|

|

|

--

|

|

|

General and Administrative Expenses

|

|

|

233,588

|

|

|

|

49,188

|

|

|

|

608

,620

|

|

|

|

11,221,801

|

|

|

Total Expenses

|

|

|

233,588

|

|

|

|

49,188

|

|

|

|

608,620

|

|

|

|

11,221,801

|

|

|

Loss from Operations

|

|

|

232,090

|

|

|

|

52,563

|

|

|

|

606,964

|

|

|

|

11,221,801

|

|

|

Other Expense

|

|

|

20,361

|

|

|

|

2,977

|

|

|

|

6,326,433

|

|

|

|

41,800

|

|

|

Net Loss

|

|

|

252,451

|

|

|

|

52,165

|

|

|

|

6,933,397

|

|

|

|

11,263,601

|

|

Three Months Ended March 31, 2014

Compared with three Months Ended March 31, 2013

Revenue:

Revenues in the first three months of 2014

were $4,944, compared with $- in the first three months of 2013. The increase in revenues in the first three months of 2014 was

primarily attributable to sales of the TapOut line of products, consisting of topical muscle relief, hot and cold therapy packs,

selling both online and to primary distributor AAFES (Army Air Force Exchange Service).

he significant components of revenues

are as follows:

|

|

1)

|

Hot and cold therapy packs

|

|

|

4)

|

All natural supplements

|

In the future management is expecting a

significant increase in revenues based on the following considerations:

|

|

1)

|

Currently a protein is in development that is all natural and is expected to be released in the

coming months, AAFES and other chain stores are waiting for this product. Stores believe this protein product will anchor the supplements

that are currently being sold, as customers will purchase both the protein and the supplements. This will result in an increase

in sales volume for all the natural supplements line. The protein powder is an all natural product that customers are currently

looking for, by releasing this product it will round out the product line for individuals that work out consistently.

|

|

|

2)

|

The supplements line is sold at a higher price than the muscle relaxant line, the higher price

point combined with larger sales volumes will result in revenue trending upwards.

|

|

|

3)

|

Currently management is waiting for regulatory approval in Australia for all their products and

it is expected within the next few months. Once approval is given, this will allow a major retailer to sell in Australia, Idonesia,

New Zealand, and South Korea.

|

|

|

4)

|

Management believes the TapOut exclusive license and the brand recognition it brings will dramatically

increase sales in the future as the products are introduced to various merchandisers.

|

Cost of Revenue:

Cost of revenues in the first three months

of 2014 was $3,495, compared with $- in the first three months of 2013. The increase in cost of sales in the first three months

of 2014 was primarily attributable to an increase in revenue. With the introduction of Allstar Health Brands, the company began

selling various products resulting in an increase in both revenue and cost of revenue.

In the future management expects cost of

revenue to trend upwards; this is directly attributed to an increase in sales. As the company sells more products, cost of revenue

per product will decrease due to utilization of economies of scale.

Gross Profit:

Gross profit in the first three months

of 2014 was $1,498, compared with $- in the first three months of 2013. The increase in gross profit in the first three months

of 2014 was primarily attributable to an increase in sales volume. With the introduction of Allstar Health Brands., the company

saw an increase in revenue and cost of revenue, which resulted in an increase in gross profit.

In the future management expects gross

profit to trend upwards for the following:

|

|

1)

|

Management is expecting revenue to increase with more products are being introduced and increased

distribution through retailers.

|

|

|

2)

|

With larger volumes of sales, the company will achieve more efficient economies of scale for cost

of revenue; this will result in an increase of gross profit.

|

SG&A Expenses:

SG&A in the first three months of 2014

was $233,588, compared with $49,188 in the first three months of 2013, reflecting an increase of 375%. The increase

in SG&A in the first three months of 2014 was primarily attributable to more general expenses required for operations.

During the current year the following expenses

have a material increase:

|

|

1)

|

Royalty Fees have increased; these expenses are related to licensing TapOut for the product. The

fee is 5% of whole sale and with an increase in whole sale the expense has increased.

|

|

|

2)

|

Professional fees have increased; expenses have increased with more legal fees related to stock

sales, fees to ensure all regulations have been followed, and accounting fees. As the company matured into operations professional

fees went up do the nature of the business requiring specific regulations to be followed and the company requiring financing.

|

|

|

3)

|

Office and general has increased; there was more expense required for printing and for shipping

items.

|

In the future management is expecting an

overall increase in all expenses, this is related to an increase business operations. With more sales and growth management is

expecting to increase all expenses to accommodate the increase in sales. Management is expecting more travel, more professional