AER Energy (AERN) Seeing Sales Rise Through February

March 08 2012 - 7:30AM

Marketwired

AER Energy Resources, Inc. (PINKSHEETS: AERN), a diversified

holding company with an emphasis on oil and gas exploration,

drilling, well completion and fuel distribution, announced that

sales from their Copeland, Allie Wade and South Wade leases have

improved oil sales by 25% from February to January.

"At today's price of oil exceeding $105 (per barrel), AER

Petroleum continues its exceptional position to take advantage of

continued higher oil prices," states Al Karmali, President of AER

Petroleum, Inc. In an Associated Press article released yesterday,

it states, "Retail gas prices are at their highest levels ever for

this time of year despite ample supplies and declining demand.

That's because tension in the Persian Gulf has kept crude oil

prices around $100 per barrel for most of the month.

Analysts say oil prices are likely to remain at those levels

until there is more clarity about what will happen in the Gulf,

where Iran has threatened to close the Strait of Hormuz if the U.S.

and other countries impose more sanctions on its nuclear

program.

These factors could help all companies that are involved in US

production similar to AER Energy like, Imperial Oil (NYSE: IMO),

Dynergy, Inc (NYSE: DYN) and Suncor Energy, Inc (NYSE: SU).

Information, opinions and analysis contained herein are based on

sources believed to be reliable, but no representation, expressed

or implied, is made as to its accuracy, completeness or

correctness. The opinions contained herein reflect our current

judgment and are subject to change without notice. We accept no

liability for any losses arising from an investor's reliance on or

use of this report. This report is for information purposes only,

and is neither a solicitation to buy nor an offer to sell

securities. A third party has hired and paid IO News Wire twelve

hundred and ninety five dollars for the publication and circulation

of this news release. Certain information included herein is

forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995, including, but not limited to,

statements concerning manufacturing, marketing, growth, and

expansion. Such forward-looking information involves important

risks and uncertainties that could affect actual results and cause

them to differ materially from expectations expressed herein. We

have no ownership of equity, no representation; do no trading of

any kind and send no faxes or emails.

Contact: Eric Jensen www.ionewswire.com 516.942.4910

AER Energy Resources (CE) (USOTC:AERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

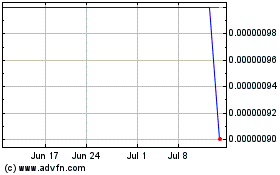

AER Energy Resources (CE) (USOTC:AERN)

Historical Stock Chart

From Apr 2023 to Apr 2024