Dundee Corporation Reports Second Quarter 2013 Financial Results

August 12 2013 - 5:06PM

Marketwired

Dundee Corporation (TSX:DC.A)(TSX:DC.PR.B)(TSX:DC.PR.C) (the

"Corporation") is reporting its financial results as at and for the

three and six months ended June 30, 2013. The Corporation's

unaudited condensed interim consolidated financial statements,

along with the accompanying management's discussion and analysis

have been filed on the System for Electronic Document Analysis and

Retrieval ("SEDAR") and may be viewed under the Corporation's

profile at www.sedar.com or the Corporation's website at

www.dundeecorp.com.

COMPLETION OF DISTRIBUTION OF DUNDEE REALTY CORPORATION

On May 30, 2013, the Corporation completed a restructuring,

through a tax efficient plan of arrangement (the "Arrangement")

that effectively distributed the majority of its ownership in

Dundee Realty Corporation ("Dundee Realty") to its shareholders,

through the creation of a new public entity, DREAM Unlimited Corp.

("DREAM"). The Arrangement was accounted for as a distribution of

all of the underlying assets of Dundee Realty, resulting in the

inclusion in current period net earnings of a $599.4 million gain.

In addition to the gain, the Corporation has classified the

operating results of Dundee Realty prior to completion of the

Arrangement as discontinued operations. As part of the Arrangement,

the Corporation retained a 29% interest in DREAM, which leaves it

with a 20% effective interest in Dundee Realty, compared with the

70% it owned prior to the Arrangement.

CHANGES IN ACCOUNTING GUIDELINES - EARLY IMPLEMENTATION OF IFRS

9

In concert with the completion of the Arrangement, the

Corporation early adopted International Financial Reporting

Standard ("IFRS") 9. Under this standard, the Corporation's

portfolio of investments and other financial instruments will

generally be measured at fair value, with changes in fair value

being recognized in net earnings. Under the application of previous

accounting guidelines, changes in fair value were recorded in other

comprehensive income, other than decreases in value of financial

assets that were deemed to be other-than temporary. The

implementation of IFRS 9 will cause significant volatility to the

Corporation's earnings on a period-over-period basis.

FINANCIAL HIGHLIGHTS

-- Net earnings attributable to owners of the Corporation during the second

quarter of 2013, inclusive of the gain on the distribution of Dundee

Realty and less the loss from continuing operations as outlined below,

were $541.6 million or $9.97 per share.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Three months ended

June 30, 2013 June 30, 2012

(in millions of dollars, other

than per share amounts) Amounts Per Share Amounts Per Share

----------------------------------------------------------------------------

Earnings from discontinued

operations $ 610.9 $ 11.29 $ 21.9 $ 0.40

Loss from continuing operations $ (69.3) $ (1.32) $ (133.6) $ (2.47)

----------------------------------------------------------------------------

Net earnings attributable to

owners of Dundee Corporation $ 541.6 $ 9.97 $ (111.7) $ (2.07)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

-- Net Earnings from Continuing Operations - During the three months ended

June 30, 2013, the Corporation incurred a loss from continuing

operations attributable to owners of Dundee Corporation of $69.3

million, or a loss of $1.32 per share. This compares with a loss from

continuing operations attributable to owners of Dundee Corporation of

$133.6 million, or $2.47 per share incurred in the second quarter of the

prior year. Net earnings include unrealized losses in the Corporation's

investment portfolio, reflecting changes in value as determined by

equity and credit markets. The Corporation believes that equity and

credit markets do not necessarily correctly reflect the underlying value

of certain assets, and therefore provide little analytical or predictive

value. The Corporation's investment decisions are not motivated by the

short-term impact that resulting gains or losses may have on reported

earnings in any particular reporting period.

-- Market Value of Investments - The market value of the Corporation's

portfolio of investments was $1.5 billion at June 30, 2013, including

$0.7 billion accounted for on an equity basis.

-- Fee Earning Assets under Management and Administration - Fee earning

assets under management and administration decreased to $4.1 billion at

June 30, 2013, compared with $4.9 billion at December 31, 2012.

-- Corporate Debt at June 30, 2013 was $261.7 million, of which $94.5

million was borrowed by the Corporation's operating subsidiaries,

including Dundee Energy Corporation and Blue Goose Capital Corp. This

compares with corporate debt of $99.5 million at December 31, 2012,

before debt associated with Dundee Realty.

ABOUT THE CORPORATION

Dundee Corporation is a public Canadian independent holding

company listed on the Toronto Stock Exchange ("TSX") under the

symbol "DC.A". Through its operating subsidiaries, Dundee

Corporation is engaged in diverse business activities in the areas

of its core competencies including investment advisory and

corporate finance, energy, resources, agriculture, real estate and

infrastructure. Dundee Corporation also holds, directly and

indirectly, a portfolio of investments mostly in these core focus

areas, as well as other select investments in both publicly listed

and private companies.

Contacts: Dundee Corporation Ned Goodman President and Chief

Executive Officer (416) 365-5665 Dundee Corporation Lucie Presot

Vice President and Chief Financial Officer (416) 365-5157

www.dundeecorp.com

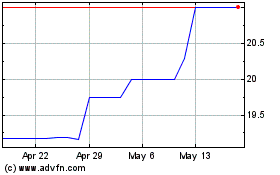

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

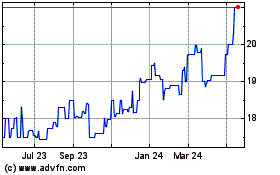

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Apr 2023 to Apr 2024