FALSE000180274900018027492023-08-292023-08-290001802749us-gaap:CommonStockMember2023-08-292023-08-290001802749us-gaap:WarrantsAndRightsSubjectToMandatoryRedemptionMember2023-08-292023-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2023

Lightning eMotors, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39283 | 84-4605714 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

815 14th Street SW, Suite A100

Loveland, Colorado 80537

(Address of principal executive offices, including zip code)

1-800-223-0740

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | ZEV | | New York Stock Exchange |

| Redeemable Warrants, each full warrant exercisable for one share of Common Stock at an exercise price of $230.00 per share | | ZEV.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On August 29, 2023, Lightning eMotors, Inc. (the “Company”) received written notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that the Company was not in compliance with the continued listing standard set forth in Section 802.01B of the NYSE’s Listed Company Manual because the average global market capitalization of the Company over a consecutive 30 trading-day period was less than $50 million and, at the same time, the Company’s last reported stockholders’ equity was less than $50 million.

In accordance with applicable NYSE procedures, the Company has 45 days from receipt of the Notice to submit a business plan advising the NYSE of the definitive action(s) the Company has taken, or is taking, that would bring it into compliance with continued listing standards within 18 months of receipt of the Notice. The NYSE will review the plan and, within 45 days of its receipt, determine whether the Company has made a reasonable demonstration of an ability to conform to the relevant standards in the 18-month period. If NYSE accepts the plan, the Company’s common stock will continue to be listed and traded on the NYSE during the 18-month period, subject to the Company’s compliance with the other continued listing standards of the NYSE and continued periodic review by the NYSE of the Company’s progress with respect to its plan.

The Notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during the applicable cure period, subject to the Company’s compliance with the other continued listing requirements of the NYSE.

Item 7.01 Regulation FD Disclosure.

As required by NYSE rules, the Company issued a press release on September 1, 2023, announcing that it had received the Notice from the NYSE described in Item 3.01. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in item 7.01 of this current report, including exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference into any registration statement or other filing pursuant to the securities act of 1933, as amended, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Lightning eMotors, Inc. |

| Dated: September 1, 2023 | | |

| By: | /s/ Timothy Reeser |

| Name: | Timothy Reeser |

| Title: | Chief Executive Officer and President |

Exhibit 99.1

Lightning eMotors Announces Receipt of Notice of Non-Compliance With NYSE Continued Listing Requirements

LOVELAND, Colo., September 1, 2023 — Lightning eMotors, Inc. (NYSE: ZEV) (the “Company”), announced today that it received a notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) on August 29, 2023 indicating that the Company is not in compliance with Section 802.01B of the NYSE listed company manual because the Company’s average global market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, the Company’s last reported stockholders’ equity was less than $50 million.

The Notice has no immediate effect on the listing of the Company’s common stock on the NYSE, subject to the Company’s compliance with the NYSE’s other continued listing requirements.

About Lightning eMotors

Lightning eMotors (NYSE: ZEV) has been providing specialized and sustainable fleet solutions since 2009, deploying complete zero-emission-vehicle (ZEV) solutions for commercial fleets since 2018. In that time, we have deployed a variety of vehicle classes and applications including but not limited to cargo and passenger vans, ambulances, transit and shuttle buses, school buses, specialty work trucks, and electric powertrains for school buses, transit buses and motor coaches. The Lightning eMotors team designs, engineers, customizes, and manufactures zero-emission vehicles to support the wide array of fleet customer needs with a full suite of control software, telematics, analytics, and charging solutions to simplify the buying and ownership experience and maximize uptime and energy efficiency. To learn more, visit our website at http://lightningemotors.com.

For more information, contact:

| | | | | |

Brian Smith investorrelations@lightningemotors.com | |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. federal securities laws, including the Company’s ability to regain compliance with the NYSE’s continued listing standards, and the Company’s ability to cure its global market capitalization deficiency. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all. We undertake no obligation to update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as may be required under applicable securities laws.

####

Lightning eMotors, Inc.

815 14th Street SW Suite A100 | Loveland, CO 80537 | USA | (800) 223-0740 | lightningemotors.com

Cover

|

Aug. 29, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 29, 2023

|

| Entity Registrant Name |

Lightning eMotors, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39283

|

| Entity Tax Identification Number |

84-4605714

|

| Entity Address, Address Line One |

815 14th Street SW

|

| Entity Address, Address Line Two |

Suite A100

|

| Entity Address, City or Town |

Loveland

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80537

|

| City Area Code |

800

|

| Local Phone Number |

223-0740

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001802749

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ZEV

|

| Security Exchange Name |

NYSE

|

| Warrants and Rights Subject to Mandatory Redemption |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable Warrants, each full warrant exercisable for one share of Common Stock at an exercise price of $230.00 per share

|

| Trading Symbol |

ZEV.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantsAndRightsSubjectToMandatoryRedemptionMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

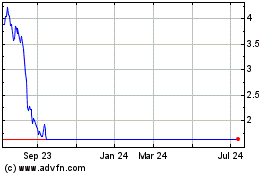

Lightning eMotors (NYSE:ZEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lightning eMotors (NYSE:ZEV)

Historical Stock Chart

From Apr 2023 to Apr 2024