UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-39703

Yatsen Holding Limited

Building 35, No. 2519 East Xingang Road

Haizhu District, Guangzhou 510330

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

YATSEN HOLDING LIMITED |

|

|

|

|

|

|

By: |

|

/s/ Donghao Yang |

Name: |

|

Donghao Yang |

Title: |

|

Chief Financial Officer |

Date: November 21, 2023

Exhibit 99.1

Yatsen Announces Third Quarter 2023 Financial Results and Upsizing and Extension of Share Repurchase Program

Conference Call to Be Held at 7:30 A.M. U.S. Eastern Time on November 21, 2023

GUANGZHOU, China, November 21, 2023 – Yatsen Holding Limited (“Yatsen” or the “Company”) (NYSE: YSG), a leading China-based beauty group, today announced its unaudited financial results for the third quarter ended September 30, 2023, and upsizing and extension of the share repurchase program.

Third Quarter 2023 Highlights

•Total net revenues for the third quarter of 2023 decreased by 16.3% to RMB718.1 million (US$98.4 million) from RMB857.9 million for the prior year period.

•Total net revenues from Skincare Brands1 for the third quarter of 2023 decreased by 4.1% to RMB258.5 million (US$35.4 million) from RMB269.4 million for the prior year period. As a percentage of total net revenues, total net revenues from Skincare Brands for the third quarter of 2023 increased to 36.0% from 31.4% for the prior year period.

•Gross margin for the third quarter of 2023 was 71.4%, as compared with 68.9% for the prior year period.

•Net loss for the third quarter of 2023 decreased by 6.1% to RMB197.9 million (US$27.1 million) from RMB210.7 million for the prior year period. Non-GAAP net loss2 for the third quarter of 2023 increased by 3.0% to RMB130.2 million (US$17.9 million) from RMB126.5 million for the prior year period.

1 Include net revenues from Galénic, DR.WU (its mainland China business), Eve Lom, Abby’s Choice and other skincare brands of the Company.

2 Non-GAAP net loss is a non-GAAP financial measure. Non-GAAP net loss is defined as net loss excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, and (iv) tax effects on non-GAAP adjustments.

Mr. Jinfeng Huang, Founder, Chairman and Chief Executive Officer of Yatsen, stated, “China’s beauty industry continued to recover modestly in the third quarter. Amid uncertainties in consumer demand, we remained focused on building strong brand equity based on superior product performance and consumer satisfaction. Our clinical and premium skincare brands, including Galénic, DR.WU and Eve Lom, recorded growth in combined net revenues for another quarter. Meanwhile, we upgraded Perfect Diary through a series of campaigns to reposition the brand with a refreshed visual identity and new product launches. Looking ahead, we will continue to adapt flexibly and proceed with our strategic transformation.”

Mr. Donghao Yang, Director and Chief Financial Officer of Yatsen, commented, “Our third-quarter total net revenues are in line with our previous guidance, indicating that our strategic transformation is largely on track. Our three major skincare brands recorded year-over-year growth of 7.4% in combined net revenues, while net revenues from our skincare brands overall declined year-over-year mostly due to our strategic decision to phase out the Abby’s Choice brand. Furthermore, our gross margin improved to 71.4% in the third quarter from 68.9% in the prior year period. Net loss margin in the third quarter expanded to 27.6% mainly due to increased investments in the Perfect

Diary brand upgrade and preparations for the Double 11 Shopping Festival. With cash, restricted cash and short-term investments of RMB2.24 billion, we are confident in our resources and ability to advance our strategic plan going forward.”

Third Quarter 2023 Financial Results

Net Revenues

Total net revenues for the third quarter of 2023 decreased by 16.3% to RMB718.1 million (US$98.4 million) from RMB857.9 million for the prior year period. The decrease was primarily attributable to a 21.5% year-over-year decrease in net revenues from Color Cosmetics Brands3, combined with a 4.1% year-over-year decrease in net revenues from Skincare Brands.

3 Include Perfect Diary, Little Ondine, Pink Bear and other color cosmetics brands of the Company.

Gross Profit and Gross Margin

Gross profit for the third quarter of 2023 decreased by 13.3% to RMB512.8 million (US$70.3 million) from RMB591.3 million for the prior year period. Gross margin for the third quarter of 2023 increased to 71.4% from 68.9% for the prior year period. The increase was driven by (i) increasing sales of higher-gross margin products from Skincare Brands, (ii) more disciplined pricing and discount policies and (iii) cost optimization across all of the Company’s brand portfolios.

Operating Expenses

Total operating expenses for the third quarter of 2023 decreased by 13.1% to RMB744.3 million (US$102.0 million) from RMB857.0 million for the prior year period. As a percentage of total net revenues, total operating expenses for the third quarter of 2023 were 103.6%, as compared with 99.9% for the prior year period.

•Fulfillment Expenses. Fulfillment expenses for the third quarter of 2023 were RMB56.0 million (US$7.7 million), as compared with RMB63.8 million for the prior year period. As a percentage of total net revenues, fulfillment expenses for the third quarter of 2023 increased to 7.8% from 7.4% for the prior year period. The increase was primarily attributable to the deleveraging effect of lower net revenues in the third quarter of 2023.

•Selling and Marketing Expenses. Selling and marketing expenses for the third quarter of 2023 were RMB511.7 million (US$70.1 million), as compared with RMB564.8 million for the prior year period. As a percentage of total net revenues, selling and marketing expenses for the third quarter of 2023 increased to 71.3% from 65.8% for the prior year period. The increase was primarily attributable to increased investments in the Perfect Diary brand upgrade and preparations for the Double 11 Shopping Festival.

•General and Administrative Expenses. General and administrative expenses for the third quarter of 2023 were RMB151.8 million (US$20.8 million), as compared with RMB194.5 million for the prior year period. As a percentage of total net revenues, general and administrative expenses for the third quarter of 2023 decreased to 21.1%

from 22.7% for the prior year period. The decrease was primarily attributable to a reduction in compensation corresponding to a decrease in general and administrative headcount.

•Research and Development Expenses. Research and development expenses for the third quarter of 2023 were RMB24.7 million (US$3.4 million), as compared with RMB33.9 million for the prior year period. As a percentage of total net revenues, research and development expenses for the third quarter of 2023 decreased to 3.4% from 3.9% for the prior year period. The decrease was primarily attributable to the Company’s efforts to maintain research and development expenses at a reasonable level relative to total net revenues.

Loss from Operations

Loss from operations for the third quarter of 2023 decreased by 12.9% to RMB231.5 million (US$31.7 million) from RMB265.7 million for the prior year period. Operating loss margin was 32.2%, as compared with 31.0% for the prior year period.

Non-GAAP loss from operations4 for the third quarter of 2023 increased by 1.2% to RMB164.6 million (US$22.6 million) from RMB162.6 million for the prior year period. Non-GAAP operating loss margin was 22.9%, as compared with 19.0% for the prior year period.

Net Loss

Net loss for the third quarter of 2023 decreased by 6.1% to RMB197.9 million (US$27.1 million) from RMB210.7 million for the prior year period. Net loss margin was 27.6%, as compared with 24.6% for the prior year period. Net loss attributable to Yatsen’s ordinary shareholders per diluted ADS5 for the third quarter of 2023 was RMB0.36 (US$0.05), as compared with RMB0.37 for the prior year period.

Non-GAAP net loss for the third quarter of 2023 increased by 3.0% to RMB130.2 million (US$17.9 million) from RMB126.5 million for the prior year period. Non-GAAP net loss margin was 18.1%, as compared with 14.7% for the prior year period. Non-GAAP net loss attributable to Yatsen’s ordinary shareholders per diluted ADS6 for the third quarter of 2023 was RMB0.24 (US$0.03), as compared with RMB0.22 for the prior year period.

4 Non-GAAP loss from operations is a non-GAAP financial measure. Non-GAAP loss from operations is defined as loss from operations excluding share-based compensation expenses and amortization of intangible assets resulting from assets and business acquisitions.

5 ADS refers to American depositary shares, each of which represents four Class A ordinary shares.

6 Non-GAAP net loss attributable to ordinary shareholders per diluted ADS is a non-GAAP financial measure. Non-GAAP net loss attributable to ordinary shareholders per diluted ADS is defined as non-GAAP net loss attributable to ordinary shareholders divided by the weighted average number of diluted ADS outstanding for computing diluted earnings per ADS. Effective from the second quarter of 2023, non-GAAP net loss attributable to ordinary shareholders is defined as net loss attributable to ordinary shareholders excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) tax effects on non-GAAP adjustments and (v) accretion to redeemable non-controlling interests, and non-GAAP net loss attributable to ordinary shareholders per diluted ADS for the prior year period presented in this document is also calculated in the same manner.

Balance Sheet and Cash Flow

As of September 30, 2023, the Company had cash, restricted cash and short-term investments of RMB2.24 billion (US$307.0 million), as compared with RMB2.63 billion as of December 31, 2022.

Net cash used in operating activities for the third quarter of 2023 was RMB163.4 million (US$22.4 million), compared with net cash generated from operating activities of RMB21.8 million for the prior year period.

Business Outlook

For the fourth quarter of 2023, the Company expects its total net revenues to be between RMB1.01 billion and RMB1.06 billion, representing a 0% to 5% increase year-over-year. These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to change.

Upsizing and Extension of Share Repurchase Program

As previously announced in November 2021 and August 2022, the Company established and modified a share repurchase program under which the Company may repurchase up to US$150.0 million worth of its ordinary shares (including in the form of ADSs) through August 25, 2024 (the “Share Repurchase Program”). From the launch of the Share Repurchase Program on November 17, 2021 to November 19, 2023, the Company in aggregate purchased approximately 100.0 million ADSs for an aggregate consideration of approximately US$126.5 million (inclusive of broker commissions) under the Share Repurchase Program.

On November 20, 2023, the Company’s board of directors approved and authorized a change to the size and term of the Share Repurchase Program, increasing the aggregate value of shares that may be repurchased under the Share Repurchase Program from US$150.0 million to US$200.0 million and extending the effective term of the Share Repurchase Program through November 19, 2025. The Company’s proposed repurchases may be made from time to time through open market transactions at prevailing market prices, in privately negotiated transactions, in block trades and/or through other legally permissible means, depending on the market conditions and in accordance with applicable rules and regulations. The Company’s board of directors will review the Share Repurchase Program periodically, and may authorize further adjustment of its terms and size. The Company expects to fund the repurchases with its existing cash balance.

Exchange Rate

This announcement contains translations of certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to US$ were made at a rate of RMB7.2960 to US$1.00, the exchange rate in effect as of September 29, 2023, as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. The Company makes no representation that any RMB or US$ amounts could have been, or could be, converted into US$ or RMB, as the case may be, at any particular rate, or at all.

Conference Call Information

The Company’s management will hold a conference call on Tuesday, November 21, 2023, at 7:30 A.M. U.S. Eastern Time or 8:30 P.M. Beijing Time to discuss its financial results and operating performance for the third quarter 2023.

|

|

United States (toll free): |

+1-888-346-8982 |

International: |

+1-412-902-4272 |

Mainland China (toll free): |

400-120-1203 |

Hong Kong, SAR (toll free): |

800-905-945 |

Hong Kong, SAR: |

+852-3018-4992 |

Conference ID: |

4252658 |

The replay will be accessible through November 28, 2023, by dialing the following numbers:

|

|

United States: |

+1-877-344-7529 |

International: |

+1-412-317-0088 |

Replay Access Code: |

4252658 |

A live and archived webcast of the conference call will also be available on the Company’s investor relations website at http://ir.yatsenglobal.com/.

About Yatsen Holding Limited

Yatsen Holding Limited (NYSE: YSG) is a leading China-based beauty group with the mission of creating an exciting new journey of beauty discovery for consumers around the world. Founded in 2016, the Company has launched and acquired numerous color cosmetics and skincare brands including Perfect Diary, Little Ondine, Abby's Choice, Galénic, DR.WU (its mainland China business), Eve Lom, Pink Bear and EANTiM. The Company's flagship brand, Perfect Diary, is one of the leading color cosmetics brands in China in terms of retail sales value. The Company primarily reaches and engages with customers directly both online and offline, with expansive presence across all major e-commerce, social and content platforms in China.

For more information, please visit http://ir.yatsenglobal.com/.

Use of Non-GAAP Financial Measures

The Company uses non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders and non-GAAP net income (loss) attributable to ordinary shareholders per diluted ADS, each a non-GAAP financial measure, in reviewing and assessing its operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company presents these non-GAAP financial measures because they are used by the management to evaluate operating performance and formulate business plans. Non-GAAP financial measures help identify underlying trends in its business, provide further information about its results of operations, and enhance the overall understanding of its past performance and future prospects. The Company defines non-GAAP income (loss) from operations as income (loss) from operations excluding share-based compensation expenses and amortization of intangible assets resulting from assets and business acquisitions. The Company defines non-GAAP net income (loss) as net income (loss) excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, and (iv) tax effects on non-GAAP adjustments. The Company defines non-GAAP net income (loss) attributable to ordinary shareholders as net income (loss) attributable to ordinary shareholders excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) tax effects on non-GAAP adjustments and (v) accretion to redeemable non-controlling interests. Non-GAAP net income (loss) attributable to ordinary shareholders per diluted ADS is computed using non-GAAP net income (loss) attributable to ordinary shareholders divided by weighted average number of diluted ADS outstanding for computing diluted earnings per ADS.

However, the non-GAAP financial measures have limitations as analytical tools as the non-GAAP financial measures are not presented in accordance with U.S. GAAP and may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating performance. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure. Reconciliations of Yatsen’s non-GAAP financial measure to the most comparable U.S. GAAP measure are included at the end of this press release.

Safe Harbor Statement

This announcement contains statements that may constitute “forward-looking” statements which are made pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to,” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the Securities and Exchange Commission (“SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs, plans, outlook and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, which include but not limited to the following: the Company’s growth strategies; its future business development, results of operations and financial condition; its ability to continue to roll out popular products and maintain popularity of existing products; its ability to anticipate and respond to changes in industry trends and consumer preferences and behavior in a timely manner; its ability to attract and retain new customers and to increase revenues generated from repeat customers; its expectations regarding demand for and market acceptance of its products and services; its ability to integrate newly-acquired businesses and brands; trends and competition in and relevant government policies and regulations relating to China’s beauty market; changes in its revenues and certain cost or expense items; and general economic conditions globally and in China. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Yatsen Holding Limited

Investor Relations

E-mail: ir@yatsenglobal.com

Piacente Financial Communications

Hui Fan

Tel: +86-10-6508-0677

E-mail: yatsen@thepiacentegroup.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: yatsen@thepiacentegroup.com

YATSEN HOLDING LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(All amounts in thousands, except for share, per share data or otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

1,512,945 |

|

|

|

796,857 |

|

|

|

109,218 |

|

Short-term investments |

|

|

1,072,867 |

|

|

|

1,420,841 |

|

|

|

194,742 |

|

Accounts receivable, net |

|

|

200,843 |

|

|

|

182,703 |

|

|

|

25,042 |

|

Inventories, net |

|

|

423,287 |

|

|

|

393,109 |

|

|

|

53,880 |

|

Prepayments and other current assets |

|

|

292,825 |

|

|

|

338,223 |

|

|

|

46,357 |

|

Amounts due from related parties |

|

|

5,654 |

|

|

|

32,215 |

|

|

|

4,415 |

|

Total current assets |

|

|

3,508,421 |

|

|

|

3,163,948 |

|

|

|

433,654 |

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

41,383 |

|

|

|

21,888 |

|

|

|

3,000 |

|

Investments |

|

|

502,579 |

|

|

|

610,936 |

|

|

|

83,736 |

|

Property and equipment, net |

|

|

75,619 |

|

|

|

67,085 |

|

|

|

9,195 |

|

Goodwill |

|

|

857,145 |

|

|

|

887,932 |

|

|

|

121,701 |

|

Intangible assets, net |

|

|

689,669 |

|

|

|

668,896 |

|

|

|

91,680 |

|

Deferred tax assets |

|

|

1,951 |

|

|

|

1,333 |

|

|

|

183 |

|

Right-of-use assets, net |

|

|

133,004 |

|

|

|

105,392 |

|

|

|

14,445 |

|

Other non-current assets |

|

|

52,885 |

|

|

|

39,445 |

|

|

|

5,406 |

|

Total non-current assets |

|

|

2,354,235 |

|

|

|

2,402,907 |

|

|

|

329,346 |

|

Total assets |

|

|

5,862,656 |

|

|

|

5,566,855 |

|

|

|

763,000 |

|

Liabilities, redeemable non-controlling interests and shareholders' equity |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

119,847 |

|

|

|

105,630 |

|

|

|

14,478 |

|

Advances from customers |

|

|

16,652 |

|

|

|

13,184 |

|

|

|

1,807 |

|

Accrued expenses and other liabilities |

|

|

323,259 |

|

|

|

347,359 |

|

|

|

47,610 |

|

Amounts due to related parties |

|

|

27,242 |

|

|

|

6,753 |

|

|

|

926 |

|

Income tax payables |

|

|

21,826 |

|

|

|

19,084 |

|

|

|

2,616 |

|

Lease liabilities due within one year |

|

|

79,586 |

|

|

|

54,615 |

|

|

|

7,486 |

|

Total current liabilities |

|

|

588,412 |

|

|

|

546,625 |

|

|

|

74,923 |

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Deferred tax liabilities |

|

|

113,441 |

|

|

|

111,090 |

|

|

|

15,226 |

|

Deferred income-non current |

|

|

45,280 |

|

|

|

35,582 |

|

|

|

4,877 |

|

Lease liabilities |

|

|

52,997 |

|

|

|

49,675 |

|

|

|

6,809 |

|

Total non-current liabilities |

|

|

211,718 |

|

|

|

196,347 |

|

|

|

26,912 |

|

Total liabilities |

|

|

800,130 |

|

|

|

742,972 |

|

|

|

101,835 |

|

Redeemable non-controlling interests |

|

|

339,924 |

|

|

|

370,830 |

|

|

|

50,826 |

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

|

Ordinary Shares (US$0.00001 par value; 10,000,000,000 ordinary shares authorized, comprising of 6,000,000,000 Class A ordinary shares, 960,852,606 Class B ordinary shares and 3,039,147,394 shares each of such classes to be designated as of December 31, 2022 and September 30, 2023; 2,030,600,883 Class A shares and 666,572,880 Class B ordinary shares issued as of December 31, 2022 and September 30, 2023; 1,569,677,384 Class A ordinary shares and 666,572,880 Class B ordinary shares outstanding as of December 31, 2022, 1,479,141,164 Class A ordinary shares and 666,572,880 Class B ordinary shares outstanding as of September 30, 2023) |

|

|

173 |

|

|

|

173 |

|

|

|

24 |

|

Treasury shares |

|

|

(669,150 |

) |

|

|

(839,113 |

) |

|

|

(115,010 |

) |

Additional paid-in capital |

|

|

12,038,802 |

|

|

|

12,040,365 |

|

|

|

1,650,269 |

|

Statutory reserve |

|

|

24,177 |

|

|

|

24,177 |

|

|

|

3,314 |

|

Accumulated deficit |

|

|

(6,600,365 |

) |

|

|

(6,854,638 |

) |

|

|

(939,506 |

) |

Accumulated other comprehensive (loss) income |

|

|

(74,195 |

) |

|

|

79,808 |

|

|

|

10,935 |

|

Total Yatsen Holding Limited shareholders' equity |

|

|

4,719,442 |

|

|

|

4,450,772 |

|

|

|

610,026 |

|

Non-controlling interests |

|

|

3,160 |

|

|

|

2,281 |

|

|

|

313 |

|

Total shareholders' equity |

|

|

4,722,602 |

|

|

|

4,453,053 |

|

|

|

610,339 |

|

Total liabilities, redeemable non-controlling interests and shareholders' equity |

|

|

5,862,656 |

|

|

|

5,566,855 |

|

|

|

763,000 |

|

YATSEN HOLDING LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(All amounts in thousands, except for share, per share data or otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

Total net revenues |

|

|

857,904 |

|

|

|

718,125 |

|

|

|

98,427 |

|

Total cost of revenues |

|

|

(266,626 |

) |

|

|

(205,325 |

) |

|

|

(28,142 |

) |

Gross profit |

|

|

591,278 |

|

|

|

512,800 |

|

|

|

70,285 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Fulfilment expenses |

|

|

(63,757 |

) |

|

|

(56,025 |

) |

|

|

(7,679 |

) |

Selling and marketing expenses |

|

|

(564,815 |

) |

|

|

(511,706 |

) |

|

|

(70,135 |

) |

General and administrative expenses |

|

|

(194,541 |

) |

|

|

(151,830 |

) |

|

|

(20,810 |

) |

Research and development expenses |

|

|

(33,881 |

) |

|

|

(24,739 |

) |

|

|

(3,391 |

) |

Total operating expenses |

|

|

(856,994 |

) |

|

|

(744,300 |

) |

|

|

(102,015 |

) |

Loss from operations |

|

|

(265,716 |

) |

|

|

(231,500 |

) |

|

|

(31,730 |

) |

Financial income |

|

|

10,834 |

|

|

|

30,319 |

|

|

|

4,156 |

|

Foreign currency exchange (loss) gain |

|

|

(19,309 |

) |

|

|

1,800 |

|

|

|

247 |

|

Income (loss) from equity method investments, net |

|

|

16,919 |

|

|

|

(6,655 |

) |

|

|

(912 |

) |

Other income, net |

|

|

50,198 |

|

|

|

8,780 |

|

|

|

1,203 |

|

Loss before income tax expenses |

|

|

(207,074 |

) |

|

|

(197,256 |

) |

|

|

(27,036 |

) |

Income tax expenses |

|

|

(3,656 |

) |

|

|

(654 |

) |

|

|

(90 |

) |

Net loss |

|

|

(210,730 |

) |

|

|

(197,910 |

) |

|

|

(27,126 |

) |

Net loss attributable to non-controlling interests and redeemable non-controlling interests |

|

|

4,452 |

|

|

|

1,371 |

|

|

|

188 |

|

Net loss attributable to Yatsen's shareholders |

|

|

(206,278 |

) |

|

|

(196,539 |

) |

|

|

(26,938 |

) |

Shares used in calculating loss per share (1): |

|

|

|

|

|

|

|

|

|

Weighted average number of Class A and Class B ordinary shares: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,257,211,263 |

|

|

|

2,173,360,208 |

|

|

|

2,173,360,208 |

|

Diluted |

|

|

2,257,211,263 |

|

|

|

2,173,360,208 |

|

|

|

2,173,360,208 |

|

Net loss per Class A and Class B ordinary share |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.09 |

) |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

Diluted |

|

|

(0.09 |

) |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

Net loss per ADS (4 ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.37 |

) |

|

|

(0.36 |

) |

|

|

(0.05 |

) |

Diluted |

|

|

(0.37 |

) |

|

|

(0.36 |

) |

|

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

Share-based compensation expenses are included in the operating expenses as follows: |

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

Fulfilment expenses |

|

|

837 |

|

|

|

767 |

|

|

|

105 |

|

Selling and marketing expenses |

|

|

14,801 |

|

|

|

9,485 |

|

|

|

1,300 |

|

General and administrative expenses |

|

|

68,241 |

|

|

|

42,635 |

|

|

|

5,844 |

|

Research and development expenses |

|

|

7,498 |

|

|

|

24 |

|

|

|

3 |

|

Total |

|

|

91,377 |

|

|

|

52,911 |

|

|

|

7,252 |

|

|

|

|

|

|

|

|

|

|

|

(1) Authorized share capital is re-classified and re-designated into Class A ordinary shares and Class B ordinary shares, with each Class A ordinary share being entitled to one vote and each Class B ordinary share being entitled to twenty votes on all matters that are subject to shareholder vote.

YATSEN HOLDING LIMITED

UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(All amounts in thousands, except for share, per share data or otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

Loss from operations |

|

|

(265,716 |

) |

|

|

(231,500 |

) |

|

|

(31,730 |

) |

Share-based compensation expenses |

|

|

91,377 |

|

|

|

52,911 |

|

|

|

7,252 |

|

Amortization of intangible assets resulting from assets and business acquisitions |

|

|

11,692 |

|

|

|

13,956 |

|

|

|

1,913 |

|

Non-GAAP loss from operations |

|

|

(162,647 |

) |

|

|

(164,633 |

) |

|

|

(22,565 |

) |

Net loss |

|

|

(210,730 |

) |

|

|

(197,910 |

) |

|

|

(27,126 |

) |

Share-based compensation expenses |

|

|

91,377 |

|

|

|

52,911 |

|

|

|

7,252 |

|

Amortization of intangible assets resulting from assets and business acquisitions |

|

|

11,692 |

|

|

|

13,956 |

|

|

|

1,913 |

|

Revaluation of investments on the share of equity method investments |

|

|

(16,836 |

) |

|

|

3,227 |

|

|

|

442 |

|

Tax effects on non-GAAP adjustments |

|

|

(2,005 |

) |

|

|

(2,430 |

) |

|

|

(333 |

) |

Non-GAAP net loss |

|

|

(126,502 |

) |

|

|

(130,246 |

) |

|

|

(17,852 |

) |

Net loss attributable to Yatsen's shareholders |

|

|

(206,278 |

) |

|

|

(196,539 |

) |

|

|

(26,938 |

) |

Share-based compensation expenses |

|

|

91,377 |

|

|

|

52,911 |

|

|

|

7,252 |

|

Amortization of intangible assets resulting from assets and business acquisitions |

|

|

12,107 |

|

|

|

13,701 |

|

|

|

1,878 |

|

Revaluation of investments on the share of equity method investments |

|

|

(16,836 |

) |

|

|

3,227 |

|

|

|

442 |

|

Tax effects on non-GAAP adjustments |

|

|

(2,171 |

) |

|

|

(2,430 |

) |

|

|

(333 |

) |

Non-GAAP net loss attributable to Yatsen's shareholders |

|

|

(121,801 |

) |

|

|

(129,130 |

) |

|

|

(17,699 |

) |

Shares used in calculating loss per share: |

|

|

|

|

|

|

|

|

|

Weighted average number of Class A and Class B ordinary shares: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,257,211,263 |

|

|

|

2,173,360,208 |

|

|

|

2,173,360,208 |

|

Diluted |

|

|

2,257,211,263 |

|

|

|

2,173,360,208 |

|

|

|

2,173,360,208 |

|

Non-GAAP net loss attributable to ordinary shareholders per Class A and Class B ordinary share |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.05 |

) |

|

|

(0.06 |

) |

|

|

(0.01 |

) |

Diluted |

|

|

(0.05 |

) |

|

|

(0.06 |

) |

|

|

(0.01 |

) |

Non-GAAP net loss attributable to ordinary shareholders per ADS (4 ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.22 |

) |

|

|

(0.24 |

) |

|

|

(0.03 |

) |

Diluted |

|

|

(0.22 |

) |

|

|

(0.24 |

) |

|

|

(0.03 |

) |

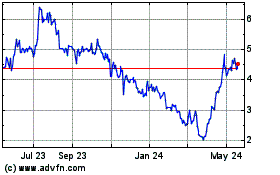

Yatsen (NYSE:YSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

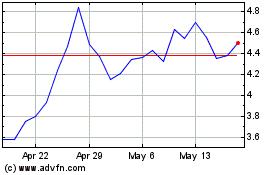

Yatsen (NYSE:YSG)

Historical Stock Chart

From Apr 2023 to Apr 2024