UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

FOR THE MONTH OF DECEMBER 2023

COMMISSION FILE NUMBER: 001-33863

XINYUAN REAL ESTATE CO., LTD.

27/F, China Central Place, Tower II

79 Jianguo Road, Chaoyang District

Beijing 100025

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

On

December 18, 2023, Xinyuan Real Estate Co., Ltd. (the “Company”) entered into a subscription agreement (the

“Subscription Agreement”) with Central Plains Ltd. (the “Purchaser”), pursuant to which the Purchaser agreed

to purchase from the Company, and the Company agreed to issue to the Purchaser, an aggregate of 11,398,784 common shares of the

Company, par value $0.0001 per share (the “Common Shares”), at a purchase price of $0.14 per Common Share (the

“Transaction”). A Supplemental Listing Application was filed with the NYSE on the same day. Closing of the Transaction is pending on approval of such

filing.

The Common Shares have

not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any State,

and will be issued in reliance on exemptions from registration under the Securities Act, afforded by Regulation S promulgated under the Securities Act.

The foregoing descriptions

of the Subscription Agreement and the Transaction are not complete and are qualified in their entirety by reference to the full text of

the Subscription Agreement, a copy of which is attached as Exhibit 10.1 to this report and incorporated by reference herein.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

XINYUAN REAL ESTATE CO., LTD. |

| |

(Registrant) |

| |

|

|

| Date: December 22, 2023 |

By: |

/s/ Yong Zhang |

| |

|

Name: |

Yong Zhang |

| |

|

Title: |

Chief Executive Officer |

Exhibit 10.1

THIS SUBSCRIPTION AGREEMENT (THIS "AGREEMENT")

RELATES TO AN OFFER AND SALE OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT

TO REGULATION S (AS DEFINED HEREIN) UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT").

NONE OF THE SECURITIES TO WHICH THIS SUBSCRIPTION

AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE SECURITIES ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE

OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE

PROVISIONS OF REGULATION S UNDER THE SECURITIES ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, OR PURSUANT

TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN EACH CASE

ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

SUBSCRIPTION AGREEMENT

This Agreement is dated as of December 18,

2023 (the “Execution Date”) by and between Xinyuan Real Estate Co., Ltd., a Cayman Islands company (the “Company”),

and Central Plains Ltd. (the “Purchaser”).

W I T N E S S E T H:

WHEREAS, subject to the terms and conditions

set forth in this Agreement and pursuant to the provisions of Regulation S (“Regulation S”) promulgated by the U.S. Securities

and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), the Company

desires to issue and sell to the Purchaser, and the Purchaser desires to purchase from the Company, securities of the Company as more

fully described in this Agreement (collectively, the “Offering”).

NOW, THEREFORE, in consideration of and

subject to the mutual agreements, terms and conditions herein contained, the receipt and sufficiency of which are hereby acknowledged,

the Company and the Purchaser agree as follows:

| 1. | PURCHASE AND SALE OF COMMON SHARES, AND RELEVANT RIGHTS |

| 1.1 | Purchase and Sale of Common Shares. Subject to the terms and conditions set forth herein, the Company

is offering to the Purchaser the number of common shares of the Company, par value US$0.0001 each (the “Common Shares”),

set forth on the signature page herein at a price of US$0.14 per share (collectively, the “Purchase Price”). The

Common Shares are sometimes collectively referred to herein as the “Shares”. |

| 1.2 | Closing. The closing of the transactions contemplated hereby (the “Closing”)

shall take place on December 22, 2023 or such other date the Company and the Purchaser may agree upon in writing (such date and time

being called the “Closing Date”). |

| (a) | At the Closing, subject to Section 2 below, the Purchase Price will become payable by the Purchaser

to the Company. The Purchaser shall pay the Purchase Price upon the Company’s written notice, such notice should be delivered to

the Purchaser pursuant to the Section 5.8 below no less than 30 business days in advance to the payment, by wire transfer of immediately

available funds to a bank account of Xinyuan Real Estate Co., Ltd. as specified by the Company. All such wire transfer remitted to

the Company shall be accompanied by information identifying the Purchaser, subscription, the Purchaser’s corporate identification

number and address; and |

| (b) | At the Closing, the Company shall deliver to the Purchaser a copy of the Company's Register of Members

or an extract thereof, representing the ownership of the common shares by the Purchaser. |

| 2. | REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

The Company represents and warrants to the Purchaser

as of the date hereof and the Closing that:

| 2.1 | The Company is duly incorporated in the Cayman Islands and is validly existing in good standing under

the laws of the Cayman Islands. The Company and each of its direct and indirect subsidiaries that have been consolidated with the Company

in its audited financial statements for the year ended December 31, 2022 or any such entity subsequently acquired (each, a “Subsidiary”)

are not in violation of any of the provisions of their respective articles of incorporation, by-laws or other organizational or charter

documents, each as may be amended (the “Internal Documents”). The Company and each Subsidiary are qualified to transact

business as a foreign corporation and are in good standing under the laws of each jurisdiction where the location of their respective

properties or the conduct of their respective business makes such qualification necessary, except where the failure to be so qualified

would not have a material adverse effect on the business, assets, liabilities, results of operations, condition (financial or otherwise),

properties or prospects of the Company on a consolidated basis. |

| 2.2 | Each of the Company and each Subsidiary has all power and authority to conduct its business as presently

conducted and as may proposed to be conducted as described in the SEC Reports (as defined herein). The Company has all power and authority

to (i) enter into and perform its obligations under this Agreement and (ii) issue, sell and deliver the Shares. The execution

and delivery of this Agreement and the issuance, sale and delivery of the Shares have been duly authorized by all necessary corporate

action. Once executed and delivered and countersigned by the Purchaser, this Agreement will constitute valid and binding obligations of

the Company, enforceable against the Company in accordance with its terms except as enforceability may be limited by applicable bankruptcy,

insolvency, reorganization, moratorium or other similar laws now or hereafter in effect relating to or affecting creditors’ rights

generally, including the effect of statutory and other laws regarding fraudulent conveyances and preferential transfers, and except that

no representation is made herein regarding the enforceability of the Company’s obligations to provide indemnification and contribution

remedies under the securities laws and subject to the limitations imposed by general equitable principles (regardless of whether such

enforceability is considered in a proceeding at law or in equity). |

| 2.3 | The Shares, when issued in accordance with the terms of this Agreement against payment therefor, will

be duly and validly issued, and free from all taxes or liens with respect to the issue thereof (except for restrictions under applicable

state and Federal securities laws or as provided under this Agreement) and shall not be subject to preemptive rights, rights of first

refusal and/or other similar rights of shareholders of the Company and/or any other person. |

| 2.4 | No action, suit or proceeding by or before any court or governmental agency, authority or body or any

arbitrator involving the Company or its property is pending or, to the best knowledge of the Company, threatened in writing that (i) could

reasonably be expected to have a material adverse effect on the performance of this Agreement by the Company or the consummation of any

of the transactions contemplated hereby or thereby, and/or (ii) could reasonably be expected to have a material adverse effect on

the Company’s operations. |

| 2.5 | The Company is not in (i) violation or default of any provision of its Internal Documents; and/or

(ii) default or material violation of any statute, law, rule, regulation, judgment, order or decree applicable to the Company of

any court, regulatory body, administrative agency, governmental body, arbitrator or other authority having jurisdiction over the Company

or any of its properties, as applicable except to the extent such default or material violation would not result in a material adverse

effect of the Company. |

| 2.6 | Assuming the accuracy of the Purchaser’s representations and warranties set forth in this Agreement,

the Company is not required to (i) register under the Securities Act the offer and sale of the Shares to the Purchaser in the manner

contemplated herein and (ii) to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or

registration with, any court or other federal, state, local or other governmental authority, self-regulatory organization (including The

New York Stock Exchange, or the “NYSE”) or other person in connection with the execution, delivery and performance of this

Agreement, except for filings required by the SEC and except that, if required by the NYSE Listing Rules, the Company will submit a Listing

of Additional Shares Notification Form to NYSE in connection with the transactions contemplated hereby. |

| 2.7 | The execution and delivery of this Agreement does not, and the consummation of the transactions contemplated

hereby will not, conflict with, or result in any violation of, or default under (with or without notice or lapse of time, or both), or

give rise to a right of termination, cancellation or acceleration of any obligation or to a loss of a material benefit under any provision

of any mortgage, indenture, lease or other agreement or instrument, permit, concession, franchise, license, judgment, order, decree, statute,

law, ordinance, rule or regulation applicable to the Company or its properties or assets except to the extent any of the foregoing

would not result in a material adverse effect on the Company. Neither the execution and delivery of this Agreement by the Company, nor

the consummation of the transaction contemplated hereby, will result in the imposition of any security interest upon the Shares other

than those imposed by the Purchaser. |

| 2.8 | Securities Compliance and Restricted Shares. All Shares are restricted securities as defined in

Rule 144 promulgated under the Securities Act. |

| 2.9 | No General Solicitation. Neither the Company nor any person acting on behalf of the Company has

offered or sold any of the Shares by any form of general solicitation or general advertising (within the meaning of Regulation D). |

| 2.10 | Certain Fees. Brokers fees, finder’s fees or financial advisory fees or commissions may be

payable by the Company with respect to the transactions contemplated by this Agreement. The Purchaser shall have no obligation with respect

to any fees or with respect to any claims made by or on behalf of other persons for fees of a type contemplated in this section that may

be due in connection with the transactions contemplated by this Agreement except as otherwise agreed to or incurred by the Purchaser. |

| 2.11 | As of their respective dates, all reports and registration statements (the “SEC Reports”)

filed or furnished by the Company with the SEC complied as to form in all material respects with the requirements of the Securities Act

and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations of the SEC promulgated

thereunder, and none of the SEC Reports, when filed, contained any untrue statement of a material fact or omitted to state a material

fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which

they were made, not misleading. The financial statements of the Company included in the SEC Reports comply in all material respects with

applicable accounting requirements and the rules and regulations of the SEC with respect thereto as in effect at the time of filing

and fairly present in all material respects the financial position of the Company as of and for the dates thereof and the results of operations

and cash flows for the periods then ended, subject, in the case of unaudited statements, to normal, year-end audit adjustments. To the

knowledge of the Company, there are no material outstanding or unresolved comments in comment letters from the staff of the Division of

Corporation Finance of the SEC with respect to any of the SEC Reports as of the date hereof. |

| 2.12 | The Company’s issued and outstanding common shares are registered pursuant to Section 12(b) of

the Exchange Act, and are listed for trading on the NYSE under the symbol “XIN”. There is no suit, action, proceeding or,

to the knowledge of the Company, investigation pending or, to the knowledge of the Company, threatened in writing against the Company

by the NYSE or the SEC with respect to any intention by such entity to deregister the common shares or prohibit or terminate the listing

of the common shares on the NYSE. The Company has taken no action that is designed to terminate the registration of the common shares

under the Exchange Act. |

| 2.13 | The Company is not, and immediately after receipt of payment for the Shares, will not be, (i) an

“investment company” within the meaning of the Investment Company Act of 1940, as amended or (ii) a Passive Foreign Investment

Company, as defined in Section 1297(a) of the U.S. Internal Revenue Code. |

| 3. | REPRESENTATIONS AND WARRANTIES OF THE PURCHASER |

The Purchaser hereby represents and warrants to

the Company as of the date hereof and as of the Closing as follows:

| 3.1 | Organization. The Purchaser is a business company with limited liability duly formed, validly existing

and in good standing under the laws of its jurisdiction with full right, or similar power and authority to enter into and to consummate

the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder and thereunder. |

| 3.2 | Authority. The Purchaser has the requisite power and authority to enter into and perform this Agreement

and to purchase the Shares being sold to it hereunder. The execution, delivery and performance of this Agreement by the Purchaser and

the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary corporate action,

and no further consent or authorization of the Purchaser or members, or managers, as the case may be, is required. This Agreement has

been duly authorized, executed and delivered by the Purchaser and constitutes, or shall constitute when executed and delivered, a valid

and binding obligation of the Purchaser enforceable against the Purchaser in accordance with the terms hereof. |

| 3.3 | Purchase Entirely for Own Account. This Agreement is made with the Purchaser in reliance upon the

Purchaser’s representations to the Company, which by the Purchaser’s execution of this Agreement, the Purchaser hereby confirms,

as provided in this Section 3 including that the Shares being acquired by Purchaser hereunder are being acquired for investment purposes

only for the Purchaser’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof,

and that the Purchaser has no present intention of selling, granting any participation or interest in, or otherwise distributing the same.

By executing this Agreement, the Purchaser further represents that the Purchaser does not presently have any contract, undertaking, agreement

or arrangement with any Person to sell, transfer or grant participations or any interest to such Person or to any third Person, with respect

to any of the Shares. |

| 3.4 | Experience of the Purchaser. The Purchaser, either alone or together with its representatives,

has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks

of the prospective investment in the Shares, and has so evaluated the merits and risks of such investment. |

| 3.5 | Ability to Bear Risk. The Purchaser understands and agrees that purchase of the Shares is a high-risk

investment and the Purchaser is able to afford and bear an investment in a speculative venture having the risks and objectives of the

Company, including a risk of total loss of such investment. The Purchaser must bear the substantial economic risks of the investment in

the Shares indefinitely because none of the Shares may be sold, hypothecated or otherwise disposed of unless subsequently registered under

the Securities Act and applicable state securities laws or an exemption from such registration(s) are available. The Purchaser represents

that it is able to bear the economic risk of an investment in the Shares and is able to afford a complete loss of such investment. The

Company has no obligation to effect any such registration, secure any exemption therefrom or take any other action to facilitate any transfer

of the Shares or any interest or participation therein or thereto. |

| 3.6 | Disclosure of Information. The Purchaser has been given access to full and complete information

regarding the Company and has utilized such access to the Purchaser’s satisfaction for the purpose of obtaining such information

regarding the Company as the Purchaser has reasonably requested. In particular, the Purchaser: (i) has received and thoroughly read

and evaluated all the disclosures contained in this Agreement; and (ii) has been given a reasonable opportunity to review such documents

as the Purchaser has requested and to ask questions of, and to receive answers from, representatives of the Company concerning the terms

and conditions of the Shares and the business and affairs of the Company and to obtain any additional information concerning the Company’s

business to the extent reasonably available so as to understand more fully the nature of this investment and to verify the accuracy of

the information supplied. The Purchaser is satisfied that it has received adequate information with respect to all matters which he/she/it

considers material to its decision to make this investment. |

| 3.7 | No other documents. In evaluating the suitability of an investment in the Company, the Purchaser

has not relied upon any representation or other information (oral or written) other than the SEC Reports or as stated in this Agreement. |

| 3.8 | Use of Purchase Price. The Purchaser understands, acknowledges and agrees that management of the

Company shall have sole and absolute discretion concerning the use of the Purchase Price as well as the timing of its expenditures. |

| 3.9 | Restricted Securities. The Purchaser understands that the Shares have not been registered under

the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act, which depends upon, among

other things, the bona fide nature of the investment intent and the accuracy of the Purchaser’s representations as expressed herein.

The Purchaser understands that the Shares are “restricted securities” under applicable U.S. federal and state securities laws

and that, pursuant to these laws, the Purchaser must hold the Shares indefinitely unless they are registered with the SEC and qualified

by state authorities, or an exemption from such registration and qualification requirements is available. The Purchaser acknowledges that

the Company has no obligation to register or qualify the Shares. The Purchaser further acknowledges that if an exemption from registration

or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale,

the holding period for the Shares, and on requirements relating to the Company that are outside of the Purchaser’s control, and

which the Company is under no obligation and may not be able to satisfy. |

| 3.10 | No General Solicitation. The Purchaser is not purchasing the Shares as a result of any advertisement,

article, notice or other communication regarding the Shares published in any newspaper, magazine or similar media or broadcast over television

or radio or presented at any seminar or any other general solicitation or general advertisement. |

| 3.11 | Residence. The Purchaser is presently a bona fide resident of the country represented on the signature

page hereof and has no present intention of becoming a resident of any other state, country, or jurisdiction, and the address and

Social Security Number/National Insurance Number (or other applicable number) or Employer Identification Number/Corporate Tax Reference

Number (or other applicable number) set forth on the signature page hereof are the Purchaser’s true and correct residential

or business address and Social Security Number/National Insurance Number (or other applicable number) or Employer Identification Number/Corporate

Tax Reference Number (or other applicable number). |

| 3.12 | The Purchaser has been independently advised as to the restrictions with respect to trading the Shares

and with respect to the resale restrictions imposed by applicable securities laws, confirms that no representation has been made to it

by or on behalf of the Company with respect thereto, acknowledges the risks relating to an investment therein and of the fact that it

may not be able to resell the Shares except in accordance with limited exemptions under applicable securities legislation and regulatory

policy until expiry of the applicable restriction period and compliance with the other requirements of applicable law, or that the Shares

are registered under the Securities Act and in compliance with the other requirements of applicable laws, that the Purchaser (or others

for whom it is contracting hereunder) is solely responsible to find out what these restrictions are and the Purchaser is solely responsible

(and neither the Company nor any of its officers, directors or affiliates, is in any way responsible) for compliance with applicable resale

restrictions and the Purchaser is aware that it may not be able to resell the Shares except in accordance with limited exemptions under

applicable securities laws, or that the Shares are registered under the Securities Act, and it agrees that any certificates representing

the Shares may bear a legend indicating that the resale of such securities is restricted; |

| 3.13 | The Company may complete additional financings, including project financing, in the future in order to

develop the business of the Company and to fund its ongoing development; there is no assurance that such financings or project financings

will be available and, if available, on reasonable terms; failure to obtain sufficient additional funds by way of debt or equity financings

or through joint ventures will prevent the continued development of the business of the Company and any such future financings may have

a dilutive effect on current security holders, including the Purchaser; |

| 3.14 | The Purchaser is solely responsible (and the Company is not responsible in any way) for compliance with

all applicable hold periods and resale restrictions under which the Shares are subject; |

| 3.15 | The Purchaser understands that the purchase of the Shares is a highly speculative investment and that

an investment in the Shares is suitable only for sophisticated investors and requires the financial ability and willingness to accept

the possibility of the loss of all or substantially all of such investment as well as the risks and lack of liquidity inherent in an investment

in the Company; |

| 3.16 | Confidential Information. The Purchaser agrees that the Purchaser, its affiliates, and their respective

officers, directors, managers, members, employees, agents and representatives will keep confidential and will not disclose, divulge or

use (other than for purposes of monitoring its investment in the Company) any confidential information which the Purchaser may obtain

from the Company pursuant to financial statements, reports and other materials submitted by the Company to the Purchaser pursuant to this

Agreement, unless such information is (i) known to the public through no fault of the Purchaser; (ii) becomes part of the public

domain other than by a breach of this Agreement; (iii) becomes known by the action of a third party not in breach of a duty of confidence;

or (iv) is required to be disclosed to a third party pursuant to any applicable law, government resolution, or decision of any court

or tribunal of competent jurisdiction; provided, however, that the Purchaser may disclose such information (i) to its attorneys,

accountants and other professionals in connection with their representation of the Purchaser in connection with the Purchaser’s

investment in the Company, (ii) to any prospective permitted transferee of the Securities, or (iii) to any general partner or

affiliate of the Purchaser, so long as the prospective transferee agrees to be bound by the provisions of this Section. |

| 3.17 | Regulation S Exemption. The Purchaser acknowledges and agrees that none of the Shares have been

registered under the Securities Act, or under any state securities or "blue sky" laws of any state of the United States, and

are being offered only in a transaction not involving any public offering within the meaning of the Securities Act, and, unless so registered,

may not be offered or sold in the United States or to U.S. Persons (as defined herein), except pursuant to an effective registration statement

under the Securities Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities

Act, and in each case only in accordance with applicable state and provincial securities laws. The Purchaser understands that the Shares

are being offered and sold to him, her or it in reliance on an exemption from the registration requirements of United States federal and

state securities laws under Regulation S promulgated under the Securities Act and that the Company is relying upon the truth and accuracy

of the representations, warranties, agreements, acknowledgments and understandings of the Purchaser set forth herein in order to determine

the applicability of such exemptions and the suitability of the Purchaser to acquire the Shares. In this regard, the Purchaser represents,

warrants and agrees that: |

| (i) | The Purchaser is not a U.S. Person and is not an affiliate (as defined in Rule 501(b) under

the Securities Act) of the Company and is not acquiring the Shares for the account or benefit of a U.S. Person. A “U.S. Person”

means any one of the following: |

| (A) | any natural person resident in the United States of America; |

| (B) | any partnership, corporation or other entity organized or incorporated under the laws of the United States

of America; |

| (C) | any estate of which any executor or administrator is a U.S. Person; |

| (D) | any trust of which any trustee is a U.S. Person; |

| (E) | any agency or branch of a foreign entity located in the United States of America; |

| (F) | any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other

fiduciary for the benefit or account of a U.S. person; |

| (G) | any discretionary account or similar account (other than an estate or trust) held by a dealer or other

fiduciary organized, incorporated or (if an individual) resident in the United States of America; and |

| (H) | any partnership or corporation if: |

| (1) | organized or incorporated under the laws of any foreign jurisdiction; and |

| (2) | formed by a U.S. person principally for the purpose of investing in securities not registered under the

Securities Act, unless it is organized or incorporated, and owned, by accredited investors (as defined in Rule 501(a) under

the Securities Act) who are not natural persons, estates or trusts. |

| (ii) | At the time of the origination of contact concerning this Agreement and the date of the execution and

delivery of this Agreement, the Purchaser was outside of the United States. |

| (iii) | The Purchaser realizes that the basis for the exemption may not be present if, notwithstanding such representations,

the Purchaser has in mind merely acquiring the Shares for a fixed or determinable period in the future, or for a market rise, or for sale

if the market does not rise. The Purchaser does not have any such intention. |

| (iv) | The Purchaser will not, during the period commencing on the date of issuance of the Shares and ending

six months after such date (the “Restricted Period”), offer, sell, pledge or otherwise transfer the Shares in the United

States, or to a U.S. Person for the account or for the benefit of a U.S. Person, unless such Shares have been registered for resale pursuant

to the Securities Act, or otherwise in a manner that is not in compliance with Regulation S. |

| (v) | The Purchaser will, after expiration of the Restricted Period, offer, sell, pledge or otherwise transfer

the Shares only pursuant to registration under the Securities Act or an available exemption therefrom and, in accordance with all applicable

state and foreign securities laws. |

| (vi) | The Purchaser was not in the United States engaged in, and prior to the expiration of the Restricted Period

will not engage in, any short selling of or any hedging transaction with respect to the Shares, including without limitation, any put,

call or other option transaction, option writing or equity swap. |

| (vii) | Neither the Purchaser nor or any person acting on his or its behalf has engaged, nor will engage, in any

directed selling efforts to a U.S. Person with respect to the Shares and the Purchaser and any person acting on his or its behalf have

complied and will comply with the “offering restrictions” requirements of Regulation S under the Securities Act. |

| (viii) | The transactions contemplated by this Agreement have not been pre-arranged with a buyer located in the

United States or with a U.S. Person, and are not part of a plan or scheme to evade the registration requirements of the Securities Act. |

| (ix) | Neither the Purchaser nor any person acting on his or its behalf has undertaken or carried out any activity

for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States, its territories

or possessions, for any of the Shares. The Purchaser agrees not to cause any advertisement of the Shares to be published in any newspaper

or periodical or posted in any public place and not to issue any circular relating to the Shares, except such advertisements that include

the statements required by Regulation S under the Securities Act, and only offshore and not in the U.S. or its territories, and only in

compliance with any local applicable securities laws. |

| (x) | The Purchaser has carefully reviewed and completed the investor questionnaire annexed hereto as Exhibit A. |

| 3.18 | No Advertisements or Direct Selling Effort. The Purchaser is not subscribing for the Shares as

a result of or subsequent to any advertisement, article, notice or other communication published in any newspaper, magazine, or similar

media or broadcast over television or radio or via the Internet, or presented at any seminar or meeting. The Purchaser has not acquired

the Shares as a result of, and will not itself engage in, any "directed selling efforts" (as defined in Regulation S) in the

United States in respect of any of the Shares which would include any activities undertaken for the purpose of, or that could reasonably

be expected to have the effect of, conditioning the market in the United States for the resale of any of the Shares; provided, however,

that the Purchaser may sell or otherwise dispose of any of the Shares pursuant to registration of any of the Shares pursuant to the Securities

Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise provided herein. |

| 3.19 | Economic Considerations. The Purchaser is not relying on the Company, or its affiliates or agents

with respect to economic considerations involved in this investment. The Purchaser has relied solely on his or her own advisors. |

| 3.20 | Compliance with Laws. Any resale of the Shares during the “distribution compliance period”

as defined in Rule 902(f) to Regulation S shall only be made in compliance with exemptions from registration afforded by Regulation

S. Further, any such sale of the Shares in any jurisdiction outside of the United States will be made in compliance with the securities

laws of such jurisdiction. The Purchaser will not offer to sell or sell the Shares in any jurisdiction unless the Purchaser obtains all

required consents, if any. |

| 4.1 | Legends. Each certificate representing the Shares shall be endorsed with the following legends,

in addition to any other legend required to be placed thereon by applicable federal or state securities laws: |

“THESE SECURITIES ARE BEING OFFERED TO INVESTORS

WHO ARE NOT U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“THE SECURITIES ACT”))

AND WITHOUT REGISTRATION WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT IN RELIANCE UPON REGULATION

S PROMULGATED UNDER THE SECURITIES ACT.”

“TRANSFER OF THESE SECURITIES IS PROHIBITED,

EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S PROMULGATED UNDER THE SECURITIES ACT, PURSUANT TO REGISTRATION UNDER THE SECURITIES

ACT, OR PURSUANT TO AVAILABLE EXEMPTION FROM REGISTRATION. HEDGING TRANSACTIONS MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE

SECURITIES ACT.”

| 4.2 | Company’s Refusal to Register Transfer of Shares. The Company shall refuse to register any

transfer of the Shares not made in accordance with (i) the provisions of Regulation S, (ii) pursuant to an effective registration

statement filed under the Securities Act, or (iii) pursuant to an available exemption from the registration requirements of the Securities

Act. |

| 5.1 | Fees and Expenses. Except as expressly set forth in this Agreement to the contrary, each party

shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such

party incident to the negotiation, preparation, execution, delivery and performance of this Agreement. |

| 5.2 | Representations and Warranties. The representations and warranties of the Company and the Purchaser

shall survive the Closing and delivery of the Shares. |

| 5.3 | Indemnification. The Purchaser agrees to indemnify and hold harmless the Company and each director,

officer or agent thereof from and against any and all losses, damages, liabilities and expenses arising out of or in connection with any

breach of, or inaccuracy in, any representation, warranty or covenant of the undersigned, whether contained in this Agreement or otherwise. |

| 5.4 | Waiver, Amendment. Neither this Agreement nor any provisions hereof shall be waived, modified,

changed, discharged or terminated except by an instrument in writing signed by the party against whom any waiver, modification, change,

discharge or termination is sought. |

| 5.5 | Section and Other Headings. The section headings contained in this Agreement are for reference

purposes only and shall not affect in any way the meaning or interpretation of this Agreement. |

| 5.6 | Governing Law; Arbitration. This Agreement shall be governed by, and construed in accordance with,

the internal laws of the State of New York without regard to the choice of law principles thereof. The parties hereby irrevocably and

unconditionally consent to submit to the exclusive jurisdiction of Beijing International Arbitration Center for any disputes arising out

of or relating to this Agreement and the transactions contemplated hereby. The number of arbitrators shall be three, each party shall

appoint one arbitrator. If either party fails to select an arbitrator within the time limit specified in the arbitration rules, the arbitrator

shall be appointed by the Director of the Beijing International Arbitration Center. The third arbitrator shall be the chief arbitrator

and shall be mutually appointed by both parties. If an agreement on the appointment cannot be reached, the third arbitrator shall be jointly

appointed by the two arbitrators who have been selected or appointed. If the two arbitrators cannot reach an agreement on the appointment,

the third arbitrator shall be appointed by the Director of the Beijing International Arbitration Center. The language of arbitration (including

documents) will be English. The decision of the Arbitral Tribunal shall be final and binding. |

| 5.7 | Counterparts. This Agreement may be executed in any number of counterparts, each of which when

so executed and delivered shall be deemed to be an original and all of which together shall be deemed to be one and the same agreement. |

| 5.8 | Notices. All notices and other communications provided for herein shall be in writing and shall

be deemed to have been duly given if delivered personally or sent by registered or certified mail, return receipt requested, postage prepaid

or if delivered by electronic transmission, on the business day of such delivery if sent by 6:00 p.m. in the time zone of the recipient,

or if sent after that time, on the next succeeding business day: |

The address included on the signature

page.

Xinyuan Real Estate Co., Ltd.

27/F, China Central Place, Tower II

79 Jianguo Road, Chaoyang District

Beijing 100025

People’s Republic of China

Attn: Yong ZHANG

Email: yong.zhang@xyre.com; copy bo.tang@xyre.com;

irteam@xyre.com

| 5.9 | Binding Effect. The provisions of this Agreement shall be binding upon and accrue to the benefit

of the parties hereto and their respective heirs, legal representatives, permitted successors and assigns. |

| 5.10 | Entire Agreement. This Agreement (including the Exhibit hereto) constitute the full and entire

understanding and agreement between the parties with respect to the subject matter hereof, and any other written or oral agreement relating

to the subject matter hereof existing between the parties are expressly canceled. |

| 5.11 | Severability. If any term, provision, covenant or restriction of this Agreement is held by a court

of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions

set forth herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto

shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same

result as that contemplated by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention

of the parties that they would have executed the remaining terms, provisions, covenants and restrictions without including any of such

that may be hereafter declared invalid, illegal, void or unenforceable. |

| 5.12 | Remedies. In addition to being entitled to exercise all rights provided herein or granted by law,

including recovery of damages, the Purchaser and the Company will be entitled to specific performance under this Agreement. The parties

agree that monetary damages may not be adequate compensation for any loss incurred by reason of any breach of obligations contained in

this Agreement and hereby agree to waive and not to assert in any action for specific performance of any such obligation the defense that

a remedy at law would be adequate. |

| 5.13 | Construction. The parties agree that each of them and/or their respective counsel have reviewed

and had an opportunity to revise this Agreement and, therefore, the normal rule of construction to the effect that any ambiguities

are to be resolved against the drafting party shall not be employed in the interpretation of this Agreement or any amendments thereto. |

| 5.14 | Further Assurances. Each party hereto shall from time to time at the request of the other party

hereto do such further acts and execute and deliver such further instruments, deeds and documents as shall be reasonably required in order

to fully perform and carry out the provisions of this Agreement. The parties hereto agree to act honestly and in good faith in the performance

of their respective obligations hereunder. |

| 5.15 | Waivers. No waiver by any party of any default with respect to any provision, condition or requirement

of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any other provisions, condition or requirement

hereof and thereof, nor shall any delay or omission of any party to exercise any right hereunder and thereunder in any manner impair the

exercise of any such right accruing to it thereafter. |

| 5.16 | Successors and Assigns. This Agreement may not be assigned by a party hereto without the prior

written consent of the Company or the Purchaser, as applicable, provided, however, that, subject to federal and state securities laws

and as otherwise provided in this Agreement, the Purchaser may assign its rights and delegate its duties hereunder in whole or in part

(i) to a third party acquiring all or substantially all of its Shares in a private transaction or (ii) to an affiliate, in each

case, without the prior written consent of the Company, after notice duly given by the Purchaser to the Company provided, that no such

assignment or obligation shall affect the obligations of the Purchaser hereunder and that such assignee agrees in writing to be bound,

with respect to the transferred securities, by the provisions hereof that apply to the Purchaser. The provisions of this Agreement shall

inure to the benefit of and be binding upon the respective permitted successors and assigns of the parties. Nothing in this Agreement,

express or implied, is intended to confer upon any party other than the parties hereto or their respective successors and assigns any

rights, remedies, obligations or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement. |

| 5.17 | Choice of Language. This Agreement is written in English and Chinese. If there is any inconsistency

between the Chinese and English version, the English version shall prevail. |

[Signature Pages Follow]

IN WITNESS WHEREOF, the undersigned have executed

this Agreement as of the date first written above and agree to be bound by the terms and conditions hereof.

| |

Company: |

| |

|

| |

Xinyuan Real Estate Co., Ltd. |

| |

|

| |

|

| |

/s/ Yong ZHANG |

| |

Name: |

Yong ZHANG |

| |

Title: |

Chief Executive Officer |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK;

SIGNATURE PAGE FOR THE PURCHASER FOLLOWS]

XINYUAN REAL ESTATE CO., LTD.

PURCHASER SIGNATURE PAGE TO

SUBSCRIPTION AGREEMENT

The Purchaser hereby elects to purchase 11,398,784

Common Shares for a total purchase price of $1,595,830.

Date (NOTE: To be completed by the Purchaser):December 18,

2023

| Central Plains Ltd. |

|

| Name of Purchaser |

|

| |

|

| |

|

|

ILS FIDUCIARY (BVI) LIMITED

Mill Mall, Suite 6, Wickhams Cay 1,

P.O.Box 3085

Road Town, Tortola, British Virgin Islands |

|

| Address |

|

| |

|

| |

|

| /s/ Jinghong HUO |

|

| Name: Jinghong HUO |

|

| Title: Director |

|

| |

|

| |

|

| December 18, 2023 |

|

| Date |

|

Exhibit A

INVESTOR SUITABILITY QUESTIONNAIRE

FOR NON-U.S. INVESTORS AS DEFINED IN RULE 902 OF REGULATION S

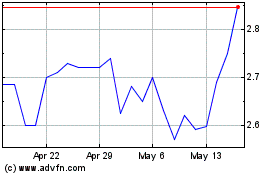

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

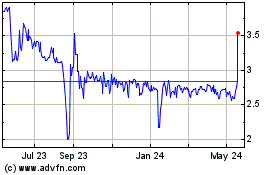

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Apr 2023 to Apr 2024