By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

A global trade downturn doesn't appear to be slowing the drive

for bigger container ships, at least in one corner of the sector.

South Korea just launched the world's biggest boxship in turning a

vessel capable of carrying 24,000 20-foot boxes over to flag

carrier HMM, the WSJ Logistics Report's Costas Paris writes,

providing a mammoth demonstration of Seoul's aggressive support of

key national industries. It may be awhile before the ship termed a

megamax can test the limits of its capacity. The vessel is

launching into a depressed global trade market, with operators

canceling hundreds of sailings and idling droves of ships. Industry

observers say megaships are leaving Asian ports half full these as

coronavirus pandemic restrictions crush demand in Western

economies. South Korea is more focused on its domestic economy,

where shipbuilding is a major employer and a key target for $33

billion in rescue funds for major industrial sectors.

TRANSPORTATION

U.S. freight railroads are hunkering down to wait for better

days, whenever those come. CSX Corp. and Union Pacific Corp. have

taken hundreds of locomotives offline in recent weeks, reduced the

number of trains in their networks and sent workers home, the WSJ's

Paul Ziobro reports, as the declining shipping economy tests the

rail lines' ability to align their networks with freight demand.

Both carriers are using creative labor arrangements to keep workers

on staff without furloughs or layoffs, measures they say will allow

them to call back workers quickly as demand warrants. Both

railroads reported higher first-quarter profits as labor and fuel

costs dropped faster than the decline in shipments and revenue.

They'll be pressed to maintain that efficiency: Union Pacific

expects rail volumes to fall 25% in the near term, and

industry-wide figures show demand across a range of commodities is

already falling close to that rate.

QUOTABLE

E-COMMERCE

Amazon.com Inc. is getting closer to its third-party sellers'

business than the company is supposed to. Employees of the

e-commerce giant have used data about independent sellers on its

platform to develop competing products, the WSJ's Dana Mattioli

reports, a practice at odds with the Amazon's stated policies. In

one instance, Amazon employees tapped into documents and data about

a bestselling car-trunk organizer sold by a third-party vendor, and

the company's private-label arm later introduced its own car-trunk

organizers. The actions revealed in interviews and documents go to

the heart of a sometimes-troublesome relationship between Amazon

and the independent vendors on its marketplace. The online

retailing giant asserts it doesn't use information from the site's

individual third-party sellers in developing its private-label

products. But employees say Amazon's restrictions on access weren't

uniformly enforced and that using such data was a common

practice.

SUPPLY CHAIN STRATEGIES

China's supply chain for medical goods is turning into a

free-for-all. Agents for foreign governments, hospitals, businesses

and an army of middlemen are descending on the country to secure

ventilators and masks and other protective gear, the WSJ's Liza Lin

and Eva Xiao report, creating scenes of disarray marked by

million-dollar deals and little certainty that purchases will lead

to deliveries. Chinese factories are taking advantage, dictating

buying conditions and demanding advance payments in full, while

buyers must quickly vet newly-minted vendors. One healthcare

executive who's effectively leading a procurement team calls it

"very much a wild, Wild West" scene. The chaos underscores how

desperate U.S. and other buyers have become to secure medical gear.

Even when expensive deals can be made, shipping remains a problem.

Regulatory hurdles make the products' export difficult, and China

has limited foreign airlines' flights, reducing cargo capacity and

sharply driving up airfreight rates.

IN OTHER NEWS

Surveys show business activity across the U.S., Europe and Japan

collapsed in April. (WSJ)

American workers have filed more than 26 million unemployment

insurance claims in the past five weeks. (WSJ)

A sharp rise in oil prices extended a period of outsize moves in

global energy markets. (WSJ)

Mexico's inflation pulled back from March to April. (WSJ)

Daimler AG's first-quarter earnings fell 80% and operating

earnings at Daimler Trucks fell by nearly half to $266 million.

(WSJ)

Flatbed specialist Daseke Inc. named Jason Bates as its new

finance chief, hiring him away from truckload operator USA Truck

Inc. (WSJ)

Renault SA is negotiating for billions in state-backed loans as

the French automaker starts to reopen plants world-wide. (WSJ)

J.C. Penney Co. Inc. is in advanced talks for bankruptcy funding

with a group of lenders. (WSJ)

Gap Inc. says it has burned through half its cash savings after

drawing down its entire credit line and skipping April rent

payments. (WSJ)

Target Corp.'s sales from stores weakened significantly in late

March and early April, while online sales surged. (WSJ)

Instacart plans to add 250,000 workers over t he next two months

after hiring 300,000 since March. (WSJ)

Hershey Co. sales rose 11% in the four weeks ending April 4, far

behind the national average growth for food sales in stores.

(WSJ)

Borden Dairy Inc. and Dean Foods Inc. bondholders want to merge

the two bankrupt dairy companies. (WSJ)

Hormel Foods Inc. will pay new cash bonuses of more than $7

million to plant production workers in July. (Dow Jones)

U.S. consumers are buying more eco-friendly cleaning products as

traditional mass-market goods disappear in picked-over stores.

(WSJ

Amazon Chief Executive Jeff Bezos has reclaimed oversight of

much of the company's day-to-day operations. (New York Times)

Daimler Trucks resumed production at its heavy-duty truck plant

in Portland, Ore. (The Oregonian)

Truckload carrier Knight-Swift Transportation Holding's

first-quarter earnings fell 25.6% to $65.4 million on a 6.6% drop

in revenue to $1.12 billion. (Transport Dive)

Trucker Old Dominion Freight Line Inc.'s profit and revenue

ticked down slightly as stronger pricing helped offset lower

shipment volume. (Winston-Salem Journal)

Clipper Bulk is cutting landside office jobs on "historically

low" dry bulk shipping demand. (Lloyd's List)

Declining oil prices have left low-sulfur marine fuel in the

U.S. cheaper than high-sulfur fuel. (ShippingWatch)

Food distributor Sysco Inc. created a pop-up grocery store in a

parking lot in Florida. (Fort Myers News-Press)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

April 24, 2020 11:04 ET (15:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

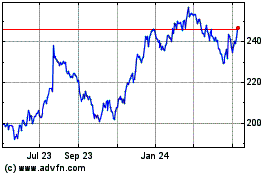

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

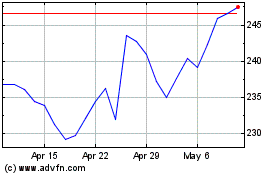

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024