Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 29 2024 - 7:38AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F ◻

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ◻

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ◻

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 29, 2024

| | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

3

Exhibit 99.1

| Earnings

Conference

Call 4Q23 |

| Disclaimer

2

This presentation contains what are considered “forward-looking statements,” as defined in Section 27A of the 1933

Securities Act and Section 21E of the 1934 Securities Exchange Act, as amended. Some of these forward-looking

statements are identified with words such as “believe,” “may,” “could,” “would,” “possible,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” as well as the negative forms of these words,

other terms of similar meaning or the use of future dates.

The forward-looking statements include, without limitation, statements related to the declaration or payment of

dividends, implementation of the key operational and financial strategies and investment plans, guidance about future

operations and factors or trends that influence the financial situation, liquidity or operational results. Such statements

reflect the current view of the management and are subject to diverse risks and uncertainties. These are qualified in

accordance with the inherent risks and uncertainties involving future expectations in general, and actual results could

differ materially from those currently anticipated due to various risks and uncertainties. There is no guarantee that the

expected events, trends or results will actually occur. The statements are based on diverse assumptions and factors,

including general economic and market conditions, industry conditions and operating factors. Any changes in such

assumptions or factors could cause actual results to differ materially from current expectations. Suzano does not

undertake any obligation to update any such forward-looking statements as a result of new information, future events or

otherwise, except as expressly required by law. All forward-looking statements in this presentation are covered in their

entirety by this disclaimer.

In addition, this presentation contains some financial indicators that are not recognized by the BR GAAP or IFRS. These

indicators do not have a standard meaning and may not be comparable to indicators with a similar description used by

other companies. We provide these indicators because we use them as measurements of Suzano's performance; they

should not be considered separately or as a replacement for other financial metrics that have been disclosed in accordance

with BR GAAP or IFRS. |

| Main strategic achievements in 2023

3

Addressable markets

⚫ Fiber to fiber: expanding fluff business

(340kt)

⚫ Expanding tissue business organically and

inorganically in Brazil

Structural competitiveness

and growth

⚫ Modernization of Aracruz and Jacareí

mills

⚫ Highest ever land bank and forest base

expansion

⚫ Cerrado Project: preparing for start-up

Shareholder compensation

⚫ 3

rd share buyback program

concluded

⚫ Approval of Interest on Equity

payment (R$1.5 billion)

1 To be disclosed in the 2023 Sustainability Report in March. |

| 2023: all-time-high investment cycle with no leverage

pressure

4

HIGHLIGHTS

1 Excluding Consumer Goods. | 2 Operating Cash Generation = Adjusted EBITDA less Sustaining Capex. | 3 Considers Finnvera and IFC credit line. | 4 Net Debt / Adjusted EBITDA in the last twelve months.

Adjusted EBITDA: Liquidity3

:

Sales

Volume

Financial

Management

Operating

Performance

10.2 million tons

(vs. 10.6 million tons

in 2022)

Pulp:

1.1 million tons

(vs. 1.2 million tons

in 2022)

Paper1

Pulp Inventory:

Lowest historical level

Operating Cash Generation2

:

Cash cost ex-downtimes:

R$18.3 bn

(vs. R$28.2 billion in 2022)

R$11.6 bn

(vs. R$22.6 billion in 2022)

R$882/ton

(vs. R$885/ton in 2022)

US$11.5 bn

(vs. US$10.9 billion in 2022)

Leverage4

:

US$6.8 bn

(vs. US$6.0 billion in 2022)

Net debt:

3.1x in US$

(vs. 2.0x in 2022) |

| 1,186 1,239 1,608

2,410 2,327

6,220 6,377 6,827

6,215

5,793

820 736

353 368

1,173 1,103

2,669

2,394

1,806

Paper Sales¹ (‘000 tons) Average Net Price (R$/ton)

5

4Q22 3Q23 4Q23 2022

224 176 202

80

96

117

304

272

320

810

651 577

4Q22 3Q23

4Q22 3Q23 4Q23 2023

Paper Adjusted EBITDA and EBITDA Margin²

R$ MM

R$/ton

Margin %

PAPER AND PACKAGING BUSINESS

Despite a more challenging scenario, EBITDA in 2023

outperformed pre-pandemic levels

1 Excluding Consumer Goods. | ² Excluding impact of Management LTI: 4Q22: - R$17/ton; 3Q23: - R$64/ton ; 4Q23: - R$16/ton; 2019: - R$6/ton; 2020: - R$37/ton; 2021: - R$9/ton; 2022: R$6/ton; 2023: - R$27/ton

2022 2023

1,381 1,307

1,885

2,827 2,568

39% 39% 31%

4Q23 2022 2023

39% 36%

2019 2020 2021

31% 32% 35%

Exports Domestic |

| 831

547 572

3,931

2,999

Average FX

7,274

2,912

3,756

761

600

2,759

2,486

2,761

PULP BUSINESS

Sales Volume (‘000 tons)

4Q22 3Q23 4Q23

10,600 10,215

2022

Average Net Price – Export Market ($/tons) Adjusted EBITDA and EBITDA Margin (%)

25,099

15,195

4Q22 3Q23 4Q23 2022

R$ 5.26 R$ 4.88 R$ 4.96 R$ 5.17

Demand exceeding operational availability led to the lowest

inventory level ever

6

2,636

1,172 1,360

R$ MM R$/ton Margin %

4Q22 3Q23 4Q23 2023

4,366

2,671 2,835

US$ BRL

61% 44% 48% 61%

2023 2022 2023

R$ 5.00

50%

2,368

1,487 |

| 164 176

366

339

337

449

(42)

4Q22

(29)

Wood

(101)

Input

12

Fixed Cost

6

Energy

(9)

FX

(36)

4Q23

937

816

-13%

180

351 339

364 337

(34)

3Q23

(27)

Wood

(14)

Input

(4)

Fixed Cost

(2)

Energy

2

FX

176

(36)

4Q23

861 816

-5%

PULP BUSINESS

Pulp Cash Cost – 4Q23 vs. 3Q23 (ex-downtime – R$/ton)

Pulp Cash Cost – 4Q23 vs. 4Q22 (ex-downtime – R$/ton)

7

Continuous improvement throughout 2023

Commodity price

effect:

-R$3/ton

Commodity price

effect:

-R$73/ton

Δ Δ Δ Δ

Δ Δ Δ Δ

Wood

Input

Fixed Cost

Energy

FX |

| Total capex timeline (R$ billion)

CERRADO PROJECT

On time and on budget: getting ready for start-up

8

1 Inside the fence includes investments in industrial and infrastructure.

Physical Progress

(inside-the-fence¹)

78%

Financial Progress

(inside-the-fence¹)

86%

8.5

4.6

0.1 0.7

7.4

0.9

2020 2021 2022 2023 2024 2025

Actual Expected |

| 4.5

0.7

1.7 2.0 1.6 1.5

8.6

1.3

Net Debt (US$ billion)

9

2.0

2.6

3.0

2.0

2.7

3.1

Dec/22 Sep/23 Dec/23

In R$

In US$

¹ Considers capex ex-maintenance and KC deal. | ² Proforma as of 02/28/2024. Figures as of 12/31/2023 adjusted by EPP rollover and IFC transactions. | ³ Finnvera and IFC credit line. | 4 Considers the portion of debt with currency swaps for foreign

currency.

Amortization Schedule² (US$ billion)

Cash on hand

(65% in US$)

Stand-by

facilities

Leverage (Net debt/EBITDA LTM)

Average Cost (in US$): 5.0% p.a.

Average Term: 75 months

Liquidity 2024 2025 2026 2027 2029

onwards

2028

6.8

% of debt in

fixed rate (US$)4

79% 96% 96% 97% 89% 80%

Finnvera and IFC³ 1.0

FINANCIAL MANAGEMENT

Strong balance sheet maximizes post-Cerrado value creation

10.4 11.5

4.6

Net Debt

Dec. 2021

(4.2)

Capital for

Allocation

Modernization

and Growth¹

1.4

Dividends/

Share Buyback

(0.8)

Derivative cash

adjustments

0.1

Others Net Debt

Dec. 2023

13.4

Net Debt

Dec. 2019

Deleveraging

Cycle |

| Flattish 2027 guidance, offsetting 2023 inflation

10

708 685

573

30

(27)

584

470 484

1,750 1,753

2027

Previous

Inflation² FX 2027

Current

Cash cost

SG&A + Freight

Sustaining Capex

TOD¹ 2027 current vs. TOD 2027 previous (R$/t)

1 Total operational disbursement at full capacity, including integrated pulp volumes. Real terms at 2024 currency. | 2 Deviation from inflation forecast for 2023 + inflation rates forecast for 2024.

Inflation 2023 -> IPCA: 4.6%, INPC: 3.7%, IGPM: -3.2% | 2024 -> IPCA: 4.0%, INPC: 3.8%, IGPM: 0.9%.

Total Operational Disbursement – TOD (R$/t) |

| A 100 years startup |

| Q&A

4Q23

Investor Relations

www.suzano.com.br/ir

ri@suzano.com.br |

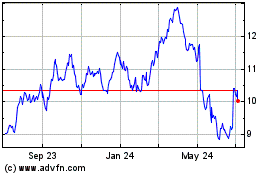

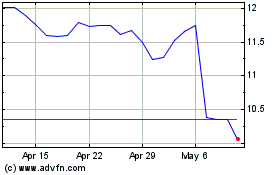

Suzano (NYSE:SUZ)

Historical Stock Chart

From Apr 2024 to May 2024

Suzano (NYSE:SUZ)

Historical Stock Chart

From May 2023 to May 2024