As filed with the Securities and Exchange Commission on February 16, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | | | | | | | | | | | |

The Southern Company (Exact name of registrant as specified in its charter) | | Delaware (State or other jurisdiction of incorporation or organization) | | 58-0690070 (I.R.S. Employer Identification No.) |

30 Ivan Allen Jr. Blvd., N.W.

Atlanta, Georgia 30308

(404) 506-5000

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

_____________________________________________

MELISSA K. CAEN

Assistant Secretary

The Southern Company

30 Ivan Allen Jr. Blvd., N.W.

Atlanta, Georgia 30308

(404) 506-5000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________________________

The Commission is requested to mail signed copies of all orders, notices and communications to:

| | | | | | | | | | | | | | |

DANIEL S. TUCKER Executive Vice President and Chief Financial Officer THE SOUTHERN COMPANY 30 Ivan Allen Jr. Blvd., N.W. Atlanta, Georgia 30308 | | | | ERIC A. KOONTZ TROUTMAN PEPPER HAMILTON SANDERS LLP 600 Peachtree Street, N.E. Suite 3000 Atlanta, Georgia 30308-2216 |

_____________________________________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer x | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company o |

| | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

_____________________________________________

PROSPECTUS

The Southern Company

Common Stock

Senior Notes

Junior Subordinated Notes

Stock Purchase Contracts

Stock Purchase Units

________________________________________________________________

We will provide the specific terms of these securities in supplements to this Prospectus. You should read this Prospectus and the applicable Prospectus Supplement carefully before you invest.

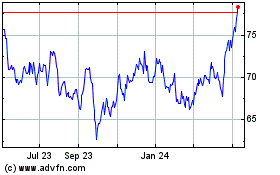

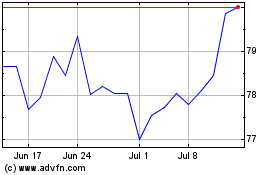

The Southern Company’s common stock is listed on the New York Stock Exchange under the symbol “SO.”

See “Risk Factors” on page 1 for information on certain risks related to the purchase of securities offered by this Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

________________________________________________________________

February 16, 2024

ABOUT THIS PROSPECTUS

This Prospectus is part of a registration statement filed with the Securities and Exchange Commission (the “Commission”) using a “shelf” registration process under the Securities Act of 1933, as amended (the “1933 Act”). Under the shelf process, The Southern Company (the “Company”) may sell, in one or more transactions,

| | | | | | | | |

| l | common stock (the “Common Stock”), |

| | |

| l | senior notes (the “Senior Notes”), |

| | |

| l | junior subordinated notes (the “Junior Subordinated Notes”), |

| | |

| l | stock purchase contracts (the “Stock Purchase Contracts”), or |

| | |

| l | stock purchase units (the “Stock Purchase Units”). |

This Prospectus provides a general description of those securities. Each time the Company sells securities, the Company will provide a prospectus supplement that will contain specific information about the terms of that offering (“Prospectus Supplement”). The Prospectus Supplement may also add, update or change information contained in this Prospectus. You should read this Prospectus and the applicable Prospectus Supplement together with the additional information under the heading “Available Information.”

RISK FACTORS

Investing in the Company’s securities involves risk. Please see the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”), which is incorporated by reference in this Prospectus. Before making an investment decision, you should carefully consider these risks as well as other information contained or incorporated by reference in this Prospectus. AVAILABLE INFORMATION

The Company has filed with the Commission a registration statement on Form S-3 (the “Registration Statement,” which term encompasses any amendments to the Registration Statement and exhibits to the Registration Statement) under the 1933 Act. As permitted by the rules and regulations of the Commission, this Prospectus does not contain all of the information set forth in the Registration Statement and the exhibits and schedules to the Registration Statement, to which reference is made.

The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and in accordance with the 1934 Act files reports, proxy statements and other information with the Commission. The Commission maintains a website that contains reports, proxy statements and other information regarding registrants including the Company that file electronically at http://www.sec.gov. Copies of certain information filed by the Company with the Commission are also available on the Company’s website at http://www.southerncompany.com. The information on the Company’s website is not incorporated by reference into this Prospectus and should not be considered to be a part of this Prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The following documents have been filed with the Commission pursuant to the 1934 Act and are incorporated by reference in this Prospectus and made a part of this Prospectus:

All documents filed by the Company with the Commission pursuant to Section 13(a), 13(c), 14 or 15(d) of the 1934 Act subsequent to the date of this Prospectus and prior to the termination of this offering shall be deemed to be incorporated by reference in this Prospectus and made a part of this Prospectus from the date of filing of such documents; provided, however, that the Company is not incorporating any information furnished under Item 2.02 or 7.01 of any Current Report on Form 8-K unless specifically stated otherwise. Any statement contained in a document incorporated or deemed to be incorporated by

reference in this Prospectus shall be deemed to be modified or superseded for purposes of this Prospectus to the extent that a statement contained in this Prospectus or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference in this Prospectus modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus.

The Company will provide without charge to each person, including any beneficial owner, to whom this Prospectus is delivered, on the written or oral request of any such person, a copy of any or all documents incorporated by reference in this Prospectus (other than the exhibits to such documents unless such exhibits are specifically incorporated by reference in this Prospectus). Such requests should be directed to Melissa K. Caen, Assistant Secretary, The Southern Company, 30 Ivan Allen Jr. Blvd., N.W., Atlanta, Georgia 30308, telephone (404) 506-5000.

THE SOUTHERN COMPANY

The Company was incorporated under the laws of Delaware on November 9, 1945. The principal executive offices of the Company are located at 30 Ivan Allen Jr. Blvd., N.W., Atlanta, Georgia 30308, and the telephone number is (404) 506-5000.

The Company is a holding company that owns all of the outstanding common stock of three traditional electric operating

companies, Southern Power Company (“Southern Power”) and Southern Company Gas. The traditional electric operating companies – Alabama Power Company, Georgia Power Company and Mississippi Power Company – are each operating public utility companies providing electric service to retail customers in three Southeastern states in addition to wholesale customers in the Southeast. Southern Power is also an operating public utility company. Southern Power develops, constructs, acquires, owns and manages power generation assets, including renewable energy projects, and sells electricity at market-based rates in the wholesale market. Southern Company Gas is an energy services holding company whose primary business is the distribution of natural gas in four states – Illinois, Georgia, Virginia and Tennessee – through its natural gas distribution utilities. Southern Company Gas is also involved in several other businesses that are complementary to the distribution of natural gas.

USE OF PROCEEDS

Except as may be otherwise described in an applicable Prospectus Supplement, the net proceeds received by the Company from the sale of the Common Stock, the Senior Notes, the Junior Subordinated Notes, the Stock Purchase Contracts or the Stock Purchase Units will be used to pay scheduled maturities and/or refundings of its securities, to repay short-term indebtedness to the extent outstanding and for other general corporate purposes, including the investment by the Company in its subsidiaries.

DESCRIPTION OF THE COMMON STOCK

The authorized capital stock of the Company currently consists of 1,500,000,000 shares of Common Stock, par value $5 per share. As of December 31, 2023, there were 1,090,814,507 shares of common stock issued and outstanding.

All shares of Common Stock of the Company participate equally with respect to dividends and rank equally upon liquidation. Each holder is entitled to one vote for each share held. The vote of two-thirds of the outstanding Common Stock is required to authorize or create preferred stock or to effect certain changes in the charter provisions affecting the Common Stock. No stockholder is entitled to preemptive rights.

The shares of Common Stock offered hereby will be fully paid and nonassessable by the Company and, therefore, will not be subject to further calls or assessment by the Company.

The transfer agent and registrar for the Common Stock is currently Equiniti Trust Company, LLC.

DESCRIPTION OF THE SENIOR NOTES

Set forth below is a description of the general terms of the Senior Notes. The following description does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the Senior Note Indenture dated as of January 1, 2007, between the Company and Computershare Trust Company, N.A., as successor trustee (the “Senior Note Indenture Trustee”), as heretofore supplemented and amended and as to be supplemented by a supplemental indenture to the Senior Note Indenture establishing the Senior Notes of each series (the Senior Note Indenture, as so supplemented, is referred to as the “Senior Note Indenture”). The terms of the Senior Notes will include those stated in the Senior Note Indenture and those made a part of the Senior Note Indenture by reference to the Trust Indenture Act of 1939, as amended (the “1939 Act”). Certain capitalized terms used and not defined in this section of the Prospectus are defined in the Senior Note Indenture.

General

The Senior Notes will be issued as unsecured senior debt securities under the Senior Note Indenture and will rank equally with all other unsecured and unsubordinated debt of the Company. The Senior Notes will be effectively subordinated to all existing and future secured debt of the Company. The Company had no secured debt outstanding at December 31, 2023. Since the Company is a holding company, the right of the Company and, hence, the right of creditors of the Company (including holders of Senior Notes) to participate in any distribution of the assets of any subsidiary of the Company, whether upon liquidation, reorganization or otherwise, is subject to prior claims of creditors and preferred stockholders of each subsidiary. As of December 31, 2023, on a consolidated basis, the Company had approximately $60.2 billion of outstanding long-term debt (including securities due within one year), of which approximately $40.3 billion was long-term debt (including securities due within one year) of the Company’s subsidiaries. In addition, the Company had approximately $2.3 billion of short-term notes payable, $1.9 billion of which was short-term notes payable of the Company’s subsidiaries.

The Senior Note Indenture does not limit the aggregate principal amount of Senior Notes that may be issued under the Senior Note Indenture and provides that Senior Notes may be issued from time to time in one or more series pursuant to an indenture supplemental to the Senior Note Indenture. The Senior Note Indenture gives the Company the ability to reopen a previous issue of Senior Notes and issue additional Senior Notes of such series, unless otherwise provided.

Reference is made to the Prospectus Supplement that will accompany this Prospectus for the following terms of the series of Senior Notes being offered by such Prospectus Supplement: (i) the title of such Senior Notes; (ii) any limit on the aggregate principal amount of such Senior Notes; (iii) the date or dates on which the principal of such Senior Notes is payable; (iv) the rate or rates at which such Senior Notes shall bear interest, if any, or any method by which such rate or rates will be determined, the date or dates from which such interest will accrue, the interest payment dates on which such interest shall be payable, and the regular record date for the interest payable on any interest payment date; (v) the place or places where the principal of, premium, if any, on and interest, if any, on such Senior Notes shall be payable; (vi) the period or periods within which, the price or prices at which and the terms and conditions on which such Senior Notes may be redeemed, in whole or in part, at the option of the Company or at the option of the holder prior to their maturity; (vii) the obligation, if any, of the Company to redeem or purchase such Senior Notes; (viii) the date or dates, if any, after which such Senior Notes may be converted or exchanged at the option of the holder into or for shares of Common Stock of the Company and the terms for any such conversion or exchange; (ix) the denominations in which such Senior Notes shall be issuable; (x) if other than the principal amount of such Senior Notes, the portion of the principal amount of such Senior Notes which shall be payable upon declaration of acceleration of the maturity of such Senior Notes; (xi) any deletions from, modifications of or additions to the Events of Default or covenants of the Company as provided in the Senior Note Indenture pertaining to such Senior Notes; (xii) whether such Senior Notes shall be issued in whole or in part in the form of a Global Security; and (xiii) any other terms of such Senior Notes.

The Senior Note Indenture does not contain provisions that afford holders of Senior Notes protection in the event of a highly leveraged transaction involving the Company or its subsidiaries.

Events of Default

Unless provided otherwise in the supplemental indenture relating to any series, the Senior Note Indenture provides that any one or more of the following described events with respect to the Senior Notes of any series, which has occurred and is continuing, constitutes an “Event of Default” with respect to the Senior Notes of such series:

(a) failure for 30 days to pay interest on the Senior Notes of such series, when due on an interest payment date other than at maturity or upon earlier redemption; or

(b) failure to pay principal of, premium, if any, on or interest on the Senior Notes of such series when due at maturity or upon earlier redemption; or

(c) failure for three Business Days to deposit any sinking fund payment when due by the terms of a Senior Note of such series; or

(d) failure to observe or perform any other covenant or warranty of the Company in the Senior Note Indenture (other than a covenant or warranty which has expressly been included in the Senior Note Indenture solely for the benefit of one or more series of Senior Notes other than such series) for 90 days after written notice to the Company from the Senior Note Indenture Trustee or the holders of at least 25% in principal amount of the outstanding Senior Notes of such series; or

(e) certain events of bankruptcy, insolvency or reorganization of the Company.

The holders of not less than a majority in aggregate outstanding principal amount of the Senior Notes of any series have the right to direct the time, method and place of conducting any proceeding for any remedy available to the Senior Note Indenture Trustee with respect to the Senior Notes of such series. If a Senior Note Indenture Event of Default occurs and is

continuing with respect to the Senior Notes of any series, then the Senior Note Indenture Trustee or the holders of not less than 25% in aggregate outstanding principal amount of the Senior Notes of such series may declare the principal amount of the Senior Notes due and payable immediately by notice in writing to the Company (and to the Senior Note Indenture Trustee if given by the holders), and upon any such declaration such principal amount shall become immediately due and payable. At any time after such a declaration of acceleration with respect to the Senior Notes of any series has been made and before a judgment or decree for payment of the money due has been obtained as provided in Article Five of the Senior Note Indenture, the holders of not less than a majority in aggregate outstanding principal amount of the Senior Notes of such series may, by written notice to the Company and the Senior Note Indenture Trustee, rescind and annul such declaration and its consequences if the default has been cured or waived and the Company has paid or deposited with the Senior Note Indenture Trustee a sum sufficient to pay all matured installments of interest and principal due otherwise than by acceleration and all sums paid or advanced by the Senior Note Indenture Trustee, including reasonable compensation and expenses of the Senior Note Indenture Trustee.

The holders of not less than a majority in aggregate outstanding principal amount of the Senior Notes of any series may, on behalf of the holders of all the Senior Notes of such series, waive any past default with respect to such series, except (i) a default in the payment of principal or interest or (ii) a default in respect of a covenant or provision which under Article Nine of the Senior Note Indenture cannot be modified or amended without the consent of the holder of each outstanding Senior Note of such series affected.

Registration and Transfer

The Company shall not be required to (i) issue, register the transfer of or exchange Senior Notes of any series during a period of 15 days immediately preceding the date notice is given identifying the Senior Notes of such series called for redemption or (ii) issue, register the transfer of or exchange any Senior Notes so selected for redemption, in whole or in part, except the unredeemed portion of any Senior Note being redeemed in part.

Payment and Paying Agent

Unless otherwise indicated in an applicable Prospectus Supplement, payment of principal of any Senior Notes will be made only against surrender to the Paying Agent of such Senior Notes. Principal of and interest on Senior Notes will be payable, subject to any applicable laws and regulations, at the office of such Paying Agent or Paying Agents as the Company may designate from time to time, except that, at the option of the Company, payment of any interest may be made by wire transfer or other electronic transfer or by check mailed to the address of the person entitled to an interest payment as such address shall appear in the Security Register with respect to the Senior Notes. Payment of interest on Senior Notes on any interest payment date will be made to the person in whose name the Senior Notes (or predecessor security) are registered at the close of business on the record date for such interest payment.

Unless otherwise indicated in an applicable Prospectus Supplement, the Senior Note Indenture Trustee will act as Paying Agent with respect to the Senior Notes. The Company may at any time designate additional Paying Agents or rescind the designation of any Paying Agents or approve a change in the office through which any Paying Agent acts.

All moneys paid by the Company to a Paying Agent for the payment of the principal of or interest on the Senior Notes of any series which remain unclaimed at the end of two years after such principal or interest shall have become due and payable will be repaid to the Company, and the holder of such Senior Notes will from that time forward look only to the Company for payment of such principal and interest.

Modification

The Senior Note Indenture contains provisions permitting the Company and the Senior Note Indenture Trustee, with the consent of the holders of not less than a majority in principal amount of the outstanding Senior Notes of each series affected, to modify the Senior Note Indenture or the rights of the holders of the Senior Notes of such series; provided that no such modification may, without the consent of the holder of each outstanding Senior Note affected, (i) change the stated maturity of the principal of, or any installment of principal of or interest on, any Senior Note, or reduce the principal amount of any Senior Note or the rate of interest on any Senior Note or any premium payable upon the redemption of any Senior Note, or change the method of calculating the rate of interest on any Senior Note, or impair the right to institute suit for the enforcement of any such payment on or after the stated maturity of any Senior Note (or, in the case of redemption, on or after the redemption date), or (ii) reduce the percentage of principal amount of the outstanding Senior Notes of any series, the consent of whose holders is required for any such supplemental indenture, or the consent of whose holders is required for any waiver (of compliance with certain provisions of the Senior Note Indenture or certain defaults under the Senior Note Indenture and their consequences) provided for in the Senior Note Indenture, or (iii) modify any of the provisions of the Senior Note Indenture relating to

supplemental indentures, waiver of past defaults or waiver of certain covenants, except to increase any such percentage or to provide that certain other provisions of the Senior Note Indenture cannot be modified or waived without the consent of the holder of each outstanding Senior Note affected thereby.

In addition, the Company and the Senior Note Indenture Trustee may execute, without the consent of any holders of Senior Notes, any supplemental indenture for certain other usual purposes, including the creation of any new series of Senior Notes.

Consolidation, Merger and Sale

The Company shall not consolidate with or merge into any other corporation or convey, transfer or lease its properties and assets substantially as an entirety to any person, unless (1) such other corporation or person is a corporation organized and existing under the laws of the United States, any state in the United States or the District of Columbia and such other corporation or person expressly assumes, by supplemental indenture executed and delivered to the Senior Note Indenture Trustee, the payment of the principal of, premium, if any, on and interest on all the Senior Notes and the performance of every covenant of the Senior Note Indenture on the part of the Company to be performed or observed; (2) immediately after giving effect to such transactions, no Senior Note Indenture Event of Default, and no event which, after notice or lapse of time or both, would become a Senior Note Indenture Event of Default, shall have happened and be continuing; and (3) the Company has delivered to the Senior Note Indenture Trustee an officers’ certificate and an opinion of counsel, each stating that such transaction complies with the provisions of the Senior Note Indenture governing consolidation, merger, conveyance, transfer or lease and that all conditions precedent to the transaction have been complied with.

Information Concerning the Senior Note Indenture Trustee

The Senior Note Indenture Trustee, prior to a Senior Note Indenture Event of Default with respect to Senior Notes of any series, undertakes to perform, with respect to Senior Notes of such series, only such duties as are specifically set forth in the Senior Note Indenture and, in case a Senior Note Indenture Event of Default with respect to Senior Notes of any series has occurred and is continuing, shall exercise, with respect to Senior Notes of such series, the same degree of care as a prudent individual would exercise in the conduct of his or her own affairs. Subject to such provision, the Senior Note Indenture Trustee is under no obligation to exercise any of the powers vested in it by the Senior Note Indenture at the request of any holder of Senior Notes of any series, unless offered reasonable indemnity by such holder against the costs, expenses and liabilities which might be incurred by the Senior Note Indenture Trustee. The Senior Note Indenture Trustee is not required to expend or risk its own funds or otherwise incur any financial liability in the performance of its duties if the Senior Note Indenture Trustee reasonably believes that repayment or adequate indemnity is not reasonably assured to it.

The Senior Note Indenture Trustee also serves as Subordinated Note Indenture Trustee. The Senior Note Indenture Trustee and certain of its affiliates may also serve as trustee under other indentures pursuant to which securities of the Company and certain subsidiaries of the Company are outstanding.

Governing Law

The Senior Note Indenture and the Senior Notes will be governed by, and construed in accordance with, the internal laws of the State of New York.

Miscellaneous

The Company will have the right at all times to assign any of its rights or obligations under the Senior Note Indenture to a direct or indirect wholly-owned subsidiary of the Company; provided, that, in the event of any such assignment, the Company will remain primarily liable for all such obligations. Subject to the foregoing, the Senior Note Indenture will be binding upon and inure to the benefit of the parties to the Senior Note Indenture and their respective successors and assigns.

DESCRIPTION OF THE JUNIOR SUBORDINATED NOTES

Set forth below is a description of the general terms of the Junior Subordinated Notes. The following description does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the Subordinated Note Indenture dated as of October 1, 2015, between the Company and Computershare Trust Company, N.A., as successor trustee (the “Subordinated Note Indenture Trustee”), as heretofore supplemented and amended and as to be supplemented by a supplemental indenture to the Subordinated Note Indenture establishing the Junior Subordinated Notes of each series (the Subordinated Note Indenture, as so supplemented, is referred to as the “Subordinated Note Indenture”). The terms of the Junior Subordinated Notes will include

those stated in the Subordinated Note Indenture and those made a part of the Subordinated Note Indenture by reference to the 1939 Act. Certain capitalized terms used and not defined in this section of the Prospectus are defined in the Subordinated Note Indenture.

General

The Junior Subordinated Notes will be issued as unsecured junior subordinated debt securities under the Subordinated Note Indenture. The Subordinated Note Indenture does not limit the aggregate principal amount of Junior Subordinated Notes that may be issued under the Subordinated Note Indenture and provides that Junior Subordinated Notes may be issued from time to time in one or more series pursuant to an indenture supplemental to the Subordinated Note Indenture. The Subordinated Note Indenture gives the Company the ability to reopen a previous issue of Junior Subordinated Notes and issue additional Junior Subordinated Notes of such series, unless otherwise provided.

Reference is made to the Prospectus Supplement that will accompany this Prospectus for the following terms of the series of Junior Subordinated Notes being offered by such Prospectus Supplement: (i) the title of such Junior Subordinated Notes; (ii) any limit on the aggregate principal amount of such Junior Subordinated Notes; (iii) the date or dates on which the principal of such Junior Subordinated Notes is payable; (iv) the rate or rates at which such Junior Subordinated Notes shall bear interest, if any, or any method by which such rate or rates will be determined, the date or dates from which such interest will accrue, the interest payment dates on which such interest shall be payable, and the regular record date for the interest payable on any interest payment date; (v) the place or places where the principal of, premium, if any, on and interest, if any, on such Junior Subordinated Notes shall be payable; (vi) the period or periods within which, the price or prices at which and the terms and conditions on which such Junior Subordinated Notes may be redeemed, in whole or in part, at the option of the Company or at the option of the holder prior to their maturity; (vii) the obligation, if any, of the Company to redeem or purchase such Junior Subordinated Notes; (viii) the date or dates, if any, after which such Junior Subordinated Notes may be converted or exchanged at the option of the holder into or for shares of Common Stock of the Company and the terms for any such conversion or exchange; (ix) the denominations in which such Junior Subordinated Notes shall be issuable; (x) if other than the principal amount of the Junior Subordinated Notes, the portion of the principal amount of such Junior Subordinated Notes which shall be payable upon declaration of acceleration of the maturity of such Junior Subordinated Notes; (xi) any deletions from, modifications of or additions to the Events of Default or covenants of the Company as provided in the Subordinated Note Indenture pertaining to such Junior Subordinated Notes; (xii) whether such Junior Subordinated Notes shall be issued in whole or in part in the form of a Global Security; (xiii) the right, if any, of the Company to extend the interest payment periods of such Junior Subordinated Notes; and (xiv) any other terms of such Junior Subordinated Notes.

The Subordinated Note Indenture does not contain provisions that afford holders of Junior Subordinated Notes protection in the event of a highly leveraged transaction involving the Company or its subsidiaries.

Subordination

The Junior Subordinated Notes are subordinated and junior in right of payment to all Senior Indebtedness (as defined below) of the Company. No payment of principal of (including redemption payments, if any), premium, if any, on or interest on (including Additional Interest (as defined below)) the Junior Subordinated Notes may be made if (a) any Senior Indebtedness is not paid when due and any applicable grace period with respect to such default has ended with such default not being cured or waived or otherwise ceasing to exist, or (b) the maturity of any Senior Indebtedness has been accelerated because of a default, or (c) notice has been given of the exercise of an option to require repayment, mandatory payment or prepayment or otherwise of the Senior Indebtedness. Upon any payment or distribution of assets of the Company to creditors upon any liquidation, dissolution, winding-up, reorganization, assignment for the benefit of creditors, marshalling of assets or liabilities, or any bankruptcy, insolvency or similar proceedings of the Company, the holders of Senior Indebtedness shall be entitled to receive payment in full of all amounts due or to become due on or in respect of all Senior Indebtedness before the holders of the Junior Subordinated Notes are entitled to receive or retain any payment or distribution. Subject to the prior payment of all Senior Indebtedness, the rights of the holders of the Junior Subordinated Notes will be subrogated to the rights of the holders of Senior Indebtedness to receive payments and distributions applicable to such Senior Indebtedness until all amounts owing on the Junior Subordinated Notes are paid in full.

The term “Senior Indebtedness” means, with respect to the Company, (i) any payment due in respect of indebtedness of the Company, whether outstanding at the date of execution of the Subordinated Note Indenture or incurred, created or assumed after such date, (a) in respect of money borrowed (including any financial derivative, hedging or futures contract or similar instrument) and (b) evidenced by securities, debentures, bonds, notes or other similar instruments issued by the Company that, by their terms, are senior or senior subordinated debt securities including, without limitation, all such obligations under its indentures with various trustees; (ii) all capital lease obligations; (iii) all obligations issued or assumed as the deferred purchase price of property, all conditional sale obligations and all obligations of the Company under any title retention agreement (but

excluding trade accounts payable arising in the ordinary course of business and long-term purchase obligations); (iv) all obligations for the reimbursement of any letter of credit, banker’s acceptance, security purchase facility or similar credit transaction; (v) all obligations of the type referred to in clauses (i) through (iv) above of other persons the payment of which the Company is responsible or liable as obligor, guarantor or otherwise; and (vi) all obligations of the type referred to in clauses (i) through (v) above of other persons secured by any lien on any property or asset of the Company (whether or not such obligation is assumed by the Company), except for (1) any such indebtedness that is by its terms subordinated to or that ranks equally with the Junior Subordinated Notes and (2) any unsecured indebtedness between or among the Company or its affiliates. Such Senior Indebtedness shall continue to be Senior Indebtedness and be entitled to the benefits of the subordination provisions contained in the Subordinated Note Indenture irrespective of any amendment, modification or waiver of any term of such Senior Indebtedness.

The Subordinated Note Indenture does not limit the aggregate amount of Senior Indebtedness that may be issued by the Company. As of December 31, 2023, the Senior Indebtedness of the Company, on an unconsolidated basis, aggregated approximately $12.2 billion. Since the Company is a holding company, the right of the Company and, hence, the right of creditors of the Company (including holders of Senior Notes and Junior Subordinated Notes) to participate in any distribution of the assets of any subsidiary of the Company, whether upon liquidation, reorganization or otherwise, is subject to prior claims of creditors and preferred stockholders of each subsidiary. As of December 31, 2023, on a consolidated basis, the Company had approximately $60.2 billion of outstanding long-term debt (including securities due within one year), of which approximately $40.3 billion was long-term debt (including securities due within one year) of the Company’s subsidiaries. In addition, the Company had approximately $2.3 billion of short-term notes payable, $1.9 billion of which was short-term notes payable of the Company’s subsidiaries.

Additional Interest

“Additional Interest” is defined in the Subordinated Note Indenture as any interest due and not paid on an interest payment date, together with interest on such interest due from such interest payment date to the date of payment, compounded quarterly, on each interest payment date.

Certain Covenants

The Company covenants in the Subordinated Note Indenture, for the benefit of the holders of each series of Junior Subordinated Notes, that, (i) if at such time the Company shall have given notice of its election to extend an interest payment period for such series of Junior Subordinated Notes and such extension shall be continuing, or (ii) if at such time an Event of Default under the Subordinated Note Indenture with respect to such series of Junior Subordinated Notes shall have occurred and be continuing, (a) the Company shall not declare or pay any dividend or make any distributions with respect to, or redeem, purchase, acquire or make a liquidation payment with respect to, any of its capital stock and (b) the Company shall not make any payment of interest on, principal of or premium, if any, on or repay, repurchase or redeem any debt securities (including guarantees) issued by the Company which rank equally with or junior to the Junior Subordinated Notes. None of the foregoing, however, shall restrict (i) any of the actions described in the preceding sentence resulting from any reclassification of the Company’s capital stock or the exchange or conversion of one class or series of the Company’s capital stock for another class or series of the Company’s capital stock, (ii) the purchase of fractional interests in shares of the Company’s capital stock pursuant to the conversion or exchange provisions of such capital stock or the security being converted or exchanged, (iii) dividends, payments or distributions payable in shares of capital stock, (iv) redemptions, purchases or other acquisitions of shares of capital stock in connection with any employment contract, incentive plan, benefit plan or other similar arrangement of the Company or any of its subsidiaries or in connection with a dividend reinvestment or stock purchase plan, or (v) any declaration of a dividend in connection with implementation of any stockholders’ rights plan, or the issuance of rights, stock or other property under any such plan, or the redemption, repurchase or other acquisition of any such rights pursuant thereto.

Events of Default

Unless provided otherwise in the supplemental indenture relating to any series, the Subordinated Note Indenture provides that any one or more of the following described events with respect to the Junior Subordinated Notes of any series, which has occurred and is continuing, constitutes an “Event of Default” with respect to the Junior Subordinated Notes of such series:

(a) failure for 30 days to pay interest on the Junior Subordinated Notes of such series, including any Additional Interest in respect of the Junior Subordinated Notes of such series, when due on an interest payment date other than at maturity or upon earlier redemption; provided, however, that a valid extension of the interest payment period by the Company shall not constitute a default in the payment of interest for this purpose; or

(b) failure to pay principal of, or premium, if any, on or interest, including Additional Interest, on the Junior Subordinated Notes of such series when due at maturity or upon earlier redemption; or

(c) failure for three Business Days to deposit any sinking fund payment when due by the terms of a Junior Subordinated Note of such series; or

(d) failure to observe or perform any other covenant or warranty of the Company in the Subordinated Note Indenture (other than a covenant or warranty which has expressly been included in the Subordinated Note Indenture solely for the benefit of one or more series of Junior Subordinated Notes other than such series) for 90 days after written notice to the Company from the Subordinated Note Indenture Trustee or the holders of at least 25% in principal amount of the outstanding Junior Subordinated Notes of such series; or

(e) certain events of bankruptcy, insolvency or reorganization of the Company.

The holders of not less than a majority in aggregate outstanding principal amount of the Junior Subordinated Notes of any series have the right to direct the time, method and place of conducting any proceeding for any remedy available to the Subordinated Note Indenture Trustee with respect to the Junior Subordinated Notes of such series. If a Subordinated Note Indenture Event of Default occurs and is continuing with respect to the Junior Subordinated Notes of any series, then the Subordinated Note Indenture Trustee or the holders of not less than 25% in aggregate outstanding principal amount of the Junior Subordinated Notes of such series may declare the principal amount of the Junior Subordinated Notes due and payable immediately by notice in writing to the Company (and to the Subordinated Note Indenture Trustee if given by the holders), and upon any such declaration such principal amount shall become immediately due and payable. At any time after such a declaration of acceleration with respect to the Junior Subordinated Notes of any series has been made and before a judgment or decree for payment of the money due has been obtained as provided in Article Five of the Subordinated Note Indenture, the holders of not less than a majority in aggregate outstanding principal amount of the Junior Subordinated Notes of such series may, by written notice to the Company and the Subordinated Note Indenture Trustee, rescind and annul such declaration and its consequences if the default has been cured or waived and the Company has paid or deposited with the Subordinated Note Indenture Trustee a sum sufficient to pay all matured installments of interest (including any Additional Interest) and principal due otherwise than by acceleration and all sums paid or advanced by the Subordinated Note Indenture Trustee, including reasonable compensation and expenses of the Subordinated Note Indenture Trustee.

The holders of not less than a majority in aggregate outstanding principal amount of the Junior Subordinated Notes of any series may, on behalf of the holders of all the Junior Subordinated Notes of such series, waive any past default with respect to such series, except (i) a default in the payment of principal or interest (including Additional Interest) or (ii) a default in respect of a covenant or provision which under Article Nine of the Subordinated Note Indenture cannot be modified or amended without the consent of the holder of each outstanding Junior Subordinated Note of such series affected.

Registration and Transfer

The Company shall not be required to (i) issue, register the transfer of or exchange Junior Subordinated Notes of any series during a period of 15 days immediately preceding the date notice is given identifying the Junior Subordinated Notes of such series called for redemption or (ii) issue, register the transfer of or exchange any Junior Subordinated Notes so selected for redemption, in whole or in part, except the unredeemed portion of any Junior Subordinated Note being redeemed in part.

Payment and Paying Agent

Unless otherwise indicated in an applicable Prospectus Supplement, payment of principal of any Junior Subordinated Notes will be made only against surrender to the Paying Agent of such Junior Subordinated Notes. Principal of and interest on Junior Subordinated Notes will be payable, subject to any applicable laws and regulations, at the office of such Paying Agent or Paying Agents as the Company may designate from time to time, except that, at the option of the Company, payment of any interest may be made by wire transfer or other electronic transfer or by check mailed to the address of the person entitled to an interest payment as such address shall appear in the Security Register with respect to the Junior Subordinated Notes. Payment of interest on Junior Subordinated Notes on any interest payment date will be made to the person in whose name the Junior Subordinated Notes (or predecessor security) are registered at the close of business on the record date for such interest payment.

Unless otherwise indicated in an applicable Prospectus Supplement, the Subordinated Note Indenture Trustee will act as Paying Agent with respect to the Junior Subordinated Notes. The Company may at any time designate additional Paying Agents or rescind the designation of any Paying Agents or approve a change in the office through which any Paying Agent acts.

All moneys paid by the Company to a Paying Agent for the payment of the principal of or interest on the Junior Subordinated Notes of any series which remain unclaimed at the end of two years after such principal or interest shall have

become due and payable will be repaid to the Company, and the holder of such Junior Subordinated Notes will from that time forward look only to the Company for payment of such principal and interest.

Modification

The Subordinated Note Indenture contains provisions permitting the Company and the Subordinated Note Indenture Trustee, with the consent of the holders of not less than a majority in principal amount of the outstanding Junior Subordinated Notes of each series affected, to modify the Subordinated Note Indenture or the rights of the holders of the Junior Subordinated Notes of such series; provided that no such modification may, without the consent of the holder of each outstanding Junior Subordinated Note affected, (i) change the stated maturity of the principal of, or any installment of principal of or interest on, any Junior Subordinated Note, or reduce the principal amount of any Junior Subordinated Note or the rate of interest (including Additional Interest) on any Junior Subordinated Note or any premium payable upon the redemption of any Junior Subordinated Note, or change the method of calculating the rate of interest on any Junior Subordinated Note, or impair the right to institute suit for the enforcement of any such payment on or after the stated maturity of any Junior Subordinated Note (or, in the case of redemption, on or after the redemption date), or (ii) reduce the percentage of principal amount of the outstanding Junior Subordinated Notes of any series, the consent of whose holders is required for any such supplemental indenture, or the consent of whose holders is required for any waiver (of compliance with certain provisions of the Subordinated Note Indenture or certain defaults under the Subordinated Note Indenture and their consequences) provided for in the Subordinated Note Indenture, or (iii) modify any of the provisions of the Subordinated Note Indenture relating to supplemental indentures, waiver of past defaults or waiver of certain covenants, except to increase any such percentage or to provide that certain other provisions of the Subordinated Note Indenture cannot be modified or waived without the consent of the holder of each outstanding Junior Subordinated Note affected thereby, or (iv) modify the provisions of the Subordinated Note Indenture with respect to the subordination of the Junior Subordinated Notes in a manner adverse to such holder.

In addition, the Company and the Subordinated Note Indenture Trustee may execute, without the consent of any holders of Junior Subordinated Notes, any supplemental indenture for certain other usual purposes, including the creation of any new series of Junior Subordinated Notes.

Consolidation, Merger and Sale

The Company shall not consolidate with or merge into any other corporation or convey, transfer or lease its properties and assets substantially as an entirety to any person, unless (1) such other corporation or person is a corporation organized and existing under the laws of the United States, any state of the United States or the District of Columbia and such other corporation or person expressly assumes, by supplemental indenture executed and delivered to the Subordinated Note Indenture Trustee, the payment of the principal of and premium, if any, on and interest (including Additional Interest) on all the Junior Subordinated Notes and the performance of every covenant of the Subordinated Note Indenture on the part of the Company to be performed or observed; (2) immediately after giving effect to such transactions, no Subordinated Note Indenture Event of Default, and no event which, after notice or lapse of time or both, would become a Subordinated Note Indenture Event of Default, shall have happened and be continuing; and (3) the Company has delivered to the Subordinated Note Indenture Trustee an officers’ certificate and an opinion of counsel, each stating that such transaction complies with the provisions of the Subordinated Note Indenture governing consolidation, merger, conveyance, transfer or lease and that all conditions precedent to the transaction have been complied with.

Information Concerning the Subordinated Note Indenture Trustee

The Subordinated Note Indenture Trustee, prior to a Subordinated Note Indenture Event of Default with respect to Junior Subordinated Notes of any series, undertakes to perform, with respect to Junior Subordinated Notes of such series, only such duties as are specifically set forth in the Subordinated Note Indenture and, in case a Subordinated Note Indenture Event of Default with respect to Junior Subordinated Notes of any series has occurred and is continuing, shall exercise, with respect to Junior Subordinated Notes of such series, the same degree of care as a prudent individual would exercise in the conduct of his or her own affairs. Subject to such provision, the Subordinated Note Indenture Trustee is under no obligation to exercise any of the powers vested in it by the Subordinated Note Indenture at the request of any holder of Junior Subordinated Notes of any series, unless offered reasonable indemnity by such holder against the costs, expenses and liabilities which might be incurred by the Subordinated Note Indenture Trustee. The Subordinated Note Indenture Trustee is not required to expend or risk its own funds or otherwise incur any financial liability in the performance of its duties if the Subordinated Note Indenture Trustee reasonably believes that repayment or adequate indemnity is not reasonably assured to it.

The Subordinated Note Indenture Trustee also serves as Senior Note Indenture Trustee. The Subordinated Note Indenture Trustee and certain of its affiliates may also serve as trustee under other indentures pursuant to which securities of the Company and certain subsidiaries of the Company are outstanding.

Governing Law

The Subordinated Note Indenture and the Junior Subordinated Notes will be governed by, and construed in accordance with, the internal laws of the State of New York.

Miscellaneous

The Company will have the right at all times to assign any of its rights or obligations under the Subordinated Note Indenture to a direct or indirect wholly-owned subsidiary of the Company; provided, that, in the event of any such assignment, the Company will remain primarily liable for all such obligations. Subject to the foregoing, the Subordinated Note Indenture will be binding upon and inure to the benefit of the parties to the Subordinated Note Indenture and their respective successors and assigns.

DESCRIPTION OF THE STOCK PURCHASE CONTRACTS AND THE STOCK PURCHASE UNITS

The Company may issue Stock Purchase Contracts, including contracts that obligate holders to purchase from the Company, and the Company to sell to these holders, a specified or varying number of shares of Common Stock at a future date or dates. The consideration per share of Common Stock may be fixed at the time the Stock Purchase Contracts are issued or may be determined by reference to a specific formula set forth in the Stock Purchase Contracts. The Stock Purchase Contracts may be issued separately or as a part of Stock Purchase Units consisting of a Stock Purchase Contract and beneficial interests in either debt securities of the Company or debt securities of third parties including, but not limited to, U.S. Treasury securities, that would secure the holders’ obligations to purchase the Common Stock under the Stock Purchase Contracts. The Stock Purchase Contracts may require the Company to make periodic payments to the holders of some or all of the Stock Purchase Units or vice versa, and such payments may be unsecured or prefunded on some basis and may be paid on a current or deferred basis. The Stock Purchase Contracts may require holders to secure their obligations under these Stock Purchase Contracts in a specified manner. The terms of any Stock Purchase Contracts or Stock Purchase Units being offered will be described in a Prospectus Supplement.

PLAN OF DISTRIBUTION

The Company may sell the Common Stock, the Senior Notes, the Junior Subordinated Notes, the Stock Purchase Contracts and the Stock Purchase Units in one or more of the following ways from time to time: (i) to underwriters for resale to the public or to institutional investors; (ii) directly to institutional investors; or (iii) through agents to the public or to institutional investors. The Prospectus Supplement with respect to Common Stock and each series of Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units will set forth the terms of the offering of such Common Stock, Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units, including the name or names of any underwriters or agents, the purchase price of such Common Stock, Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units and the proceeds to the Company from such sale, any underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation, any initial public offering price, any discounts or concessions allowed or reallowed or paid to dealers and any securities exchange on which such Common Stock, Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units may be listed.

If underwriters participate in the sale, such Common Stock, Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units will be acquired by the underwriters for their own accounts and may be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale.

Unless otherwise set forth in the Prospectus Supplement, the obligations of the underwriters to purchase any Common Stock, Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units will be subject to certain conditions precedent and the underwriters will be obligated to purchase all of such Common Stock, Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units, if any are purchased.

Underwriters and agents may be entitled under agreements entered into with the Company to indemnification against certain civil liabilities, including liabilities under the 1933 Act. Underwriters and agents and their affiliates may engage in

transactions with, or perform services for, the Company in the ordinary course of business, for which they may receive customary compensation.

The Company’s common stock is listed on the New York Stock Exchange. Each series of Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units will be a new issue of securities and will have no established trading market. Any underwriters to whom Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units are sold for public offering and sale may make a market in such Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice. The Senior Notes, Junior Subordinated Notes, Stock Purchase Contracts or Stock Purchase Units may or may not be listed on a national securities exchange.

LEGAL MATTERS

The validity of the Common Stock, the Senior Notes, the Junior Subordinated Notes, the Stock Purchase Contracts and the Stock Purchase Units and certain matters relating to such securities will be passed upon on behalf of the Company by Troutman Pepper Hamilton Sanders LLP, Atlanta, Georgia. Certain legal matters will be passed upon for the underwriters by Hunton Andrews Kurth LLP, New York, New York. From time to time, Hunton Andrews Kurth LLP acts as counsel to affiliates of the Company for some matters.

EXPERTS

The consolidated financial statements, and the related financial statement schedule, incorporated in this Prospectus by reference from the Form 10-K, and the effectiveness of the Company’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated financial statements and financial statement schedule have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| | | | | |

| Item 14. | Other Expenses of Issuance and Distribution. |

The estimated expenses of issuance and distribution, other than underwriting discounts and commissions, to be borne by the Company are as follows:

| | | | | |

| Securities and Exchange Commission registration fee | * |

| Fees and expenses of trustees and/or Transfer Agent and Registrar | ** |

| Listing fees of New York Stock Exchange | ** |

| Rating Agency fees | ** |

| Services of Southern Company Services, Inc. | ** |

| Fees and expenses of counsel | ** |

| Blue sky fees and expenses | ** |

| Fees of accountants | ** |

| Miscellaneous expenses | ** |

| Total | ** |

___________________________

| | | | | |

| * | Under Rules 456(b) and 457(r) under the 1933 Act, the Commission registration fee will be paid at the time of any particular offering of securities under this Registration Statement and is therefore not currently determinable. |

| |

| ** | These fees are calculated based on the amount of securities offered and/or the number of offerings and accordingly are not presently known and cannot be estimated at this time. |

| | | | | |

| Item 15. | Indemnification of Directors and Officers. |

Delaware General Corporation Law

Section 145 of Title 8 of the Delaware Code gives a corporation power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. The same section also gives a corporation power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification will be made in respect of any claim, issue or matter as to which such person is adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court deems proper. Also, the section states that, to the extent that a present or former director or officer of a corporation has been successful on the merits or otherwise in defense of any such action, suit or proceeding, or in defense of any claim, issue or matter therein, the person will be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection therewith.

Provisions of the By-Laws

Action in Reliance upon Orders of Regulatory Bodies

No present or future director or officer of the Company will be liable for any act, omission, step or conduct taken or had in good faith which is required, authorized or approved by order issued pursuant to the Public Utility Holding Company Act of 1935, the Federal Power Act, or any state statute regulating the Company or its subsidiaries by reason of their being public utility companies or public utility holding companies, or any amendment to any thereof. In the event that such provisions are found by a court not to constitute a valid defense, each such director and officer will be reimbursed for, or indemnified against, all expenses and liabilities incurred by him or her or imposed on him or her, in connection with, or arising out of, any such action, suit or proceeding based on any act, omission, step or conduct taken or had in good faith as described above.

Right to Indemnification

Each person who was or is made a party or is threatened to be made a party to or is otherwise subject to or involved in any claim, demand, action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”), by reason of the fact that he or she is or was a director or an officer of the Company or is or was serving at the request of the Company as a director, officer, employee or agent of another company or of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan (an “Indemnitee”), whether the basis of such Proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, will be indemnified by the Company to the fullest extent permitted or required by the General Corporation Law of State of Delaware (the “DGCL”) and any other applicable law, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Company to provide broader indemnification rights than such law permitted the Company to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, Employee Retirement Income Security Act excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such Indemnitee in connection therewith (“Indemnifiable Losses”); provided, however, that, except with respect to Proceedings to enforce rights to indemnification as described below, the Company will indemnify any such Indemnitee in connection with a Proceeding (or part thereof) initiated by such Indemnitee only if such Proceeding (or part thereof) was authorized by the Board of Directors of the Company. An Indemnitee’s right to indemnification as described in this paragraph does not include and is separate from an Indemnitee’s right to Advancement of Expenses (as defined below) as described in the immediately subsequent paragraph.

Right to Advancement of Expenses

Each Indemnitee has a right to advancement by the Company of any and all expenses (including, without limitation, attorneys’ fees and expenses) incurred in defending any Proceeding in advance of its final disposition (an “Advancement of Expenses”); provided, however, that, if the DGCL so requires, an Advancement of Expenses incurred by an Indemnitee in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such Indemnitee, including without limitation service to an employee benefit plan) will be made only upon delivery to the Company of an undertaking (an “Undertaking”), by or on behalf of such Indemnitee, to repay, without interest, all amounts so advanced if it is ultimately determined by final judicial decision from which there is no further right to appeal (a “Final Adjudication”) that such Indemnitee is not entitled to an Advancement of Expenses. An Indemnitee’s right to an Advancement of Expenses is not subject to the satisfaction of any standard of conduct and is not conditioned upon any prior determination that Indemnitee is entitled to indemnification with respect to the related Proceeding or the absence of any prior determination to the contrary.

Right of Indemnitee to Bring Suit

If a claim for indemnification described above is not paid in full by the Company within 60 calendar days after a written claim has been received by the Company (following the final disposition of such proceeding) or if a claim for Advancement of Expenses is not paid in full by the Company within 20 calendar days after a written claim has been received by the Company, the Indemnitee may at any time thereafter bring suit against the Company to recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Company to recover an Advancement of Expenses pursuant to the terms of an Undertaking, the Indemnitee will be entitled to the fullest extent permitted or required by the DGCL, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Company to provide broader reimbursements of prosecution or defense expenses than such law permitted the Company to provide prior to such amendment), to be paid also the expense of prosecuting or defending such suit. In (i) any suit brought by the Indemnitee to enforce a right to indemnification (but not in a suit brought by the Indemnitee to enforce a right to an Advancement of Expenses) it will be a defense that, and (ii) any suit brought by the Company to recover an Advancement of Expenses pursuant to the terms of an Undertaking, the Company will be entitled to recover such expenses, without interest, upon a Final Adjudication that, the Indemnitee has not met any applicable standard for indemnification set forth in the DGCL. Neither the failure of the Company (including its Board of Directors or a committee thereof, its stockholders or independent legal counsel) to have made a determination prior to the commencement of such suit that indemnification of the Indemnitee is proper in the circumstances because the Indemnitee has met the applicable standard of conduct set forth in the

DGCL, nor an actual determination by the Company (including its Board of Directors or a committee thereof, its stockholders or independent legal counsel) that the Indemnitee has not met such applicable standard of conduct, will create a presumption that the Indemnitee has not met the applicable standard of conduct or, in the case of such a suit brought by the Indemnitee, be a defense to such suit. In any suit brought by an Indemnitee to enforce a right to indemnification or to an Advancement of Expenses, or brought by the Company to recover an Advancement of Expenses pursuant to the terms of an Undertaking, the burden of proving that the Indemnitee is not entitled to be indemnified, or to such Advancement of Expenses, will be on the Company.

Miscellaneous

The rights to indemnification and to the Advancement of Expenses described above (i) are deemed to be separate contract rights and such rights will continue as to an Indemnitee who has ceased to be a director, officer, employee or agent and will inure to the benefit of the Indemnitee’s heirs, executors and administrators and (ii) are not exclusive of any other right that any person may have under any statute, the Company’s Certificate of Incorporation, the Company’s By-Laws, any agreement or any vote of stockholders or disinterested directors or otherwise. The Company will not be liable to make any payment to an Indemnitee in respect of any Indemnifiable Losses to the extent that the Indemnitee has otherwise actually received payment (net of any expenses incurred in connection therewith and any repayment by the Indemnitee made with respect thereto) under any insurance policy or from any other source in respect of such Indemnifiable Losses.

Insurance

The Company has an insurance policy covering its liabilities and expenses which might arise in connection with its lawful indemnification of its directors and officers for certain of their liabilities and expenses and also covering its officers and directors against certain other liabilities and expenses.

| | | | | | | | |

Exhibit

Number | | |

| 1.1 | — | Form of Underwriting Agreement relating to Common Stock.* |

| |

| 1.2 | — | Form of Underwriting Agreement relating to Senior Notes.* |

| |

| 1.3 | — | Form of Underwriting Agreement relating to Junior Subordinated Notes.* |

| |

| 1.4 | — | Form of Sales Agency Agreement relating to Common Stock.* |

| | |

| 1.5 | — | Form of Underwriting Agreement relating to Stock Purchase Contracts.* |

| | |

| 1.6 | — | Form of Underwriting Agreement relating to Stock Purchase Units.* |

| | |

| 1.7 | — | Form of Remarketing Agreement for Junior Subordinated Notes.* |

| | |

| 4.1 | — | Senior Note Indenture dated as of January 1, 2007, between The Southern Company and Computershare Trust Company, N.A., as successor Trustee, and certain indentures supplemental thereto through September 8, 2023. (Designated in Form 8-K dated January 11, 2007, File No. 1-3526, as Exhibit 4.1, in Form 8-K dated May 19, 2016, File No. 1-3526, as Exhibit 4.2(e), in Form 8-K dated May 19, 2016, File No. 1-3526, as Exhibit 4.2(f), in Form 8-K dated May 19, 2016, File No. 1-3526, as Exhibit 4.2(g), in Form 8-K dated April 1, 2020, File No. 1-3526, as Exhibit 4.2), in Form 8-K dated February 23, 2021, File No. 1-3526, as Exhibit 4.4(a), in Form 8-K dated February 23, 2021, File No. 1-3526, as Exhibit 4.4(b), in Form 8-K dated October 3, 2022, File No. 1-3526, as Exhibit 4.4(a), in Form 8-K dated October 3, 2022, File No. 1-3526, as Exhibit 4.4(b), in Form 8-K dated February 28, 2023, File No. 1-3526, as Exhibit 4.2, in Form 8-K dated May 15, 2023, File No. 1-3526, as Exhibit 4.4(a), in Form 8-K dated May 15, 2023, File No. 1-3526, as Exhibit 4.4(b), in Form 8-K dated September 5, 2023, File No. 1-3526, as Exhibit 4.4(a) and in Form 8-K dated September 5, 2023, File No. 1-3526, as Exhibit 4.4(b).) |

| |

| 4.2 | — | Form of Supplemental Indenture to Senior Note Indenture to be used in connection with the issuance of Senior Notes.* |

| | | | | | | | |

| |

| 4.3 | — | Subordinated Note Indenture dated as of October 1, 2015, between The Southern Company and Computershare Trust Company, N.A., as successor Trustee, and certain indentures supplemental thereto through May 9, 2022. (Designated in Form 8-K dated October 1, 2015, File No. 1-3526, as Exhibit 4.3, in Form 10-Q for the quarter ended June 30, 2017, File No. 1-3526 as Exhibit 4(a)1, in Form 8-K dated November 17, 2017, File No. 1-3526, as Exhibit 4.4, in Form 8-K dated August 13, 2019, File No. 1-3526, as Exhibit 4.4(a), in Form 8-K dated August 13, 2019, File No. 1-3526, as Exhibit 4.4(b), in Form 8-K dated January 6, 2020, File No. 1-3526 as Exhibit 4.4, in Form 8-K dated September 15, 2020, File No. 1-3526, as Exhibit 4.4(a), in Form 8-K dated September 15, 2020, File No. 1-3526, as Exhibit 4.4(b), in Form 8-K dated May 3, 2021, File No. 1-3526, as Exhibit 4.4, in Form 8-K dated September 13, 2021, File No. 1-3526, as Exhibit 4.4, in Form 8-K dated May 9, 2022, File No. 1-3526, as Exhibit 4.4(a) and in Form 8-K dated May 9, 2022, File No. 1-3526, as Exhibit 4.4(b).) |

| |

| 4.4 | — | Form of Supplemental Indenture to Subordinated Note Indenture to be used in connection with the issuance of Junior Subordinated Notes.* |

| |

| 4.5 | — | |

| |

| 4.6 | — | |

| |

| 4.7 | — | Form of Senior Note (included in Exhibit 4.2 above). |

| |

| 4.8 | — | Form of Junior Subordinated Note (included in Exhibit 4.4 above). |

| |

| 4.9 | — | Form of Stock Purchase Contract.* |

| | |

| 4.10 | — | Form of Stock Purchase Unit Certificate.* |

| | |

| 5.1 | — | |

| |

| 23.1 | — | |

| |

| 23.2 | — | Consent of Troutman Pepper Hamilton Sanders LLP (included in Exhibit 5.1 above). |

| |

| 24.1 | — | |

| |

| 25.1 | — | |

| |

| 25.2 | — | |

| | |

| 107.1 | — | |

Exhibits listed above which have heretofore been filed with the Commission and which were designated as noted above are hereby incorporated herein by reference and made a part hereof with the same effect as if filed herewith.

_______________

| | | | | |

| * | To be subsequently filed or incorporated by reference. |

(a) Undertaking related to Rule 415 offering:

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the registration statement is on Form S-1, Form S-3, Form SF-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or, as to a registration statement on Form S-3, Form SF-3 or Form F-3, is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.