Current Report Filing (8-k)

December 05 2022 - 6:43AM

Edgar (US Regulatory)

0001549922FALSE00015499222022-11-292022-11-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 29, 2022

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35666 | | 45-5200503 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrant’s telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units | SMLP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 29, 2022, the Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of Summit Midstream GP, LLC, the general partner (the “General Partner”) of Summit Midstream Partners, LP (“SMLP” or the “Partnership”), approved a compensation program pursuant to which each member of the Partnership’s senior management, including the Partnership’s executive officers, shall have the opportunity to elect to forfeit none, 50% or 100% of each vesting tranche of his or her previously disclosed outstanding retention cash component awards granted in each of 2020, 2021 and 2022 under the Summit Midstream Partners, LP 2012 Long-Term Incentive Plan in exchange for phantom units to be granted under the Summit Midstream Partners, LP 2022 Long-Term Incentive Plan (the “Plan”). The forfeiture of the vesting tranches of the cash retention component awards elected to be forfeited and the corresponding grant of phantom units will occur on December 9, 2022. The number of phantom units to be granted pursuant to the Plan will be determined by dividing the cash value of the applicable vesting tranche of the cash retention component award forfeited by such participant by the volume weighted average price of a common unit of SMLP during the three trading days ending on and including the date of grant. Such phantom units will generally be subject to the same terms and conditions, including vesting, that applied to the original vesting tranche of the cash retention component award that was forfeited and have been previously disclosed. The maximum number of phantom units that can be granted pursuant to the program is 300,000. Elections shall be proportionally reduced to the extent such phantom unit allotment would be exceeded based on the aggregate value of the elections made.

The Compensation Committee had made the 2020, 2021, and 2022 dollar-denominated awards to balance the need to attract and retain employees while managing the use of common units in limited supply under the Summit Midstream Partners, LP 2012 Long-Term Incentive Plan, as amended and restated on March 19, 2020. When approving the election plan described above, the Compensation Committee considered (i) its philosophy that the management team should be aligned with our unitholders and focused on increasing long-term unitholder value, (ii) creating additional opportunities for the management team to achieve our equity holding guidelines, and (iii) prudent use of the additional units available for grant under the Summit Midstream Partners, LP 2022 Long-Term Incentive Plan following its approval by our unitholders this year.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Summit Midstream Partners, LP |

| | (Registrant) |

| | |

| | By: | Summit Midstream GP, LLC (its general partner) |

| | |

| Dated: | December 5, 2022 | /s/ William J. Mault |

| | William J. Mault, Executive Vice President and Chief Financial Officer |

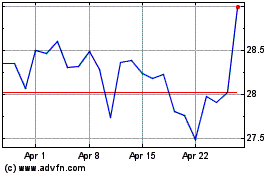

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024