Regions Financial Corporation Declares Quarterly Common and Preferred Stock Dividends

April 22 2020 - 4:30PM

Business Wire

The Regions Financial Corporation (NYSE:RF) Board of Directors

today declared the following cash dividends on its common shares,

Series A preferred shares, Series B preferred shares, and Series C

preferred shares:

- A cash dividend of $0.155 on each share of outstanding common

stock, payable on July 1, 2020, to stockholders of record at the

close of business on June 5, 2020.

- A cash dividend of $15.9375 per share of Series A Preferred

Stock outstanding (equivalent to approximately $0.398438 per

depositary share), payable on June 15, 2020, to stockholders of

record at the close of business on June 1, 2020.

- A cash dividend of $15.9375 per share of Series B Preferred

Stock outstanding (equivalent to approximately $0.398438 per

depositary share), payable on June 15, 2020, to stockholders of

record at the close of business on June 1, 2020.

- A cash dividend of $14.25 per share of Series C Preferred Stock

(equivalent to approximately $0.35625 per depositary share),

payable on May 15, 2020, to stockholders of record at the close of

business on May 4, 2020.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $133 billion in

assets, is a member of the S&P 500 Index and is one of the

nation’s largest full-service providers of consumer and commercial

banking, wealth management, and mortgage products and services.

Regions serves customers across the South, Midwest and Texas, and

through its subsidiary, Regions Bank, operates approximately 1,400

banking offices and 2,000 ATMs. Regions Bank is an Equal Housing

Lender and Member FDIC. Additional information about Regions and

its full line of products and services can be found at

www.regions.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200422005824/en/

Media Contact: Evelyn Mitchell (205) 264-4551

Investor Relations Contact: Dana Nolan (205) 264-7040

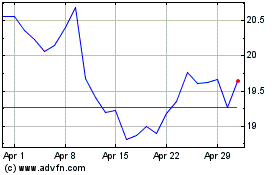

Regions Financial (NYSE:RF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Regions Financial (NYSE:RF)

Historical Stock Chart

From Apr 2023 to Apr 2024