Current Report Filing (8-k)

June 02 2020 - 8:32AM

Edgar (US Regulatory)

false 0001393311 false 0001393311 2020-06-02 2020-06-02 0001393311 us-gaap:CommonStockMember 2020-06-02 2020-06-02 0001393311 psa:SeriesVPreferredStockMember 2020-06-02 2020-06-02 0001393311 psa:SeriesWPreferredStockMember 2020-06-02 2020-06-02 0001393311 psa:SeriesXPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesBPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesCPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesDPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesEPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesFPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesGPreferredStockMember 2020-06-02 2020-06-02 0001393311 us-gaap:SeriesHPreferredStockMember 2020-06-02 2020-06-02 0001393311 psa:SeriesIPreferredStockMember 2020-06-02 2020-06-02 0001393311 psa:SeriesJPreferredStockMember 2020-06-02 2020-06-02 0001393311 psa:SeriesKPreferredStockMember 2020-06-02 2020-06-02 0001393311 psa:NotesDue2032Member 2020-06-02 2020-06-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 2, 2020

PUBLIC STORAGE

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

001-33519

|

|

95-3551121

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS. Employer

Identification No.)

|

|

|

|

|

|

701 Western Avenue,

Glendale, California

|

|

91201-2349

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(818) 244-8080

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

Common Shares, $0.10 par value

|

|

PSA

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.375% Cum Pref Share, Series V, $0.01 par value

|

|

PSAPrV

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.200% Cum Pref Share, Series W, $0.01 par value

|

|

PSAPrW

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.200% Cum Pref Share, Series X, $0.01 par value

|

|

PSAPrX

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.400% Cum Pref Share, Series B, $0.01 par value

|

|

PSAPrB

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.125% Cum Pref Share, Series C, $0.01 par value

|

|

PSAPrC

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.950% Cum Pref Share, Series D, $0.01 par value

|

|

PSAPrD

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.900% Cum Pref Share, Series E, $0.01 par value

|

|

PSAPrE

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.150% Cum Pref Share, Series F, $0.01 par value

|

|

PSAPrF

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.050% Cum Pref Share, Series G, $0.01 par value

|

|

PSAPrG

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.600% Cum Pref Share, Series H, $0.01 par value

|

|

PSAPrH

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.875% Cum Pref Share, Series I, $0.01 par value

|

|

PSAPrI

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.700% Cum Pref Share, Series J, $0.01 par value

|

|

PSAPrJ

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.750% Cum Pref Share, Series K, $0.01 par value

|

|

PSAPrK

|

|

New York Stock Exchange

|

|

0.875% Senior Notes due 2032

|

|

PSA32

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01.

|

Regulation FD Disclosure.

|

Public Storage announced today the following operating update for the two months ended May 31, 2020. The Company’s nearly 2,500 self-storage facilities qualify as “essential” businesses under applicable business closure orders, and thus remain open to serve customers.

Same Store Facilities Operating Update (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Two months ended May 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Percentage

Change

|

|

|

Move-In Customers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Square feet moved in (millions)

|

|

|

17.6

|

|

|

|

18.9

|

|

|

|

(6.9

|

%)

|

|

Annual contract rent per square foot moved in (b)

|

|

$

|

11.18

|

|

|

$

|

13.79

|

|

|

|

(18.9

|

%)

|

|

Move-Out Customers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Square feet moved out (millions)

|

|

|

15.7

|

|

|

|

16.8

|

|

|

|

(6.5

|

%)

|

|

Annual contract rent per square foot moved out (b)

|

|

$

|

15.32

|

|

|

$

|

15.93

|

|

|

|

(3.8

|

%)

|

|

At May 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Square foot occupancy (c)

|

|

|

94.0

|

%

|

|

|

93.6

|

%

|

|

|

0.4

|

%

|

|

Annual contract rent per occupied square foot (b)

|

|

$

|

17.52

|

|

|

$

|

17.86

|

|

|

|

(1.9

|

%)

|

We have observed no material degradation in rent collections in the two months ended May 31, 2020.

Please see “Analysis of Same Store Revenue” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our March 31, 2020 Form 10-Q for further information with respect to the various factors we see affecting our revenues in the year ended December 31, 2020.

|

|

(a)

|

The Same Store Facilities consist of 2,224 facilities (143.9 million net rentable square feet) that have been owned and operated on a stabilized basis since January 1, 2018. These facilities represented approximately 85% of the aggregate net rentable square feet of our U.S. consolidated self-storage portfolio at March 31, 2020.

|

|

|

(b)

|

Annual contract rent represents the agreed upon monthly rate that is paid by our tenants in place at the time of measurement. Contract rates are initially set in the lease agreement upon move-in and we adjust them from time to time with notice. Contract rent excludes other fees that are charged on a per-item basis, such as late charges and administrative fees, does not reflect the impact of promotional discounts, and does not reflect the impact of rents that are written off as uncollectible.

|

|

|

(c)

|

Occupancy levels include delinquent tenants for whom auctions have been delayed, with occupancies at May 31, 2020 reflecting a similar level of such tenants as at March 31, 2020.

|

Forward-Looking Statements

This Form 8-K, including the sections of our most recent Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on April 30, 2020 that are referenced herein, contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this Form 8-K, other than statements of historical fact, are forward-looking statements which may be identified by the use of the words “expects,” “believes,” “intends,” “anticipates,” “should,” “estimates” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause actual events to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to, those described in Part 1, Item 1A, “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC on February 25, 2020, our most recent Form 10-Q filed with the SEC on April 30, 2020, and in our other filings with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PUBLIC STORAGE

|

|

|

|

|

|

|

|

|

|

Date: June 2, 2020

|

|

|

|

By:

|

|

/s/ H. Thomas Boyle

|

|

|

|

|

|

|

|

H. Thomas Boyle

|

|

|

|

|

|

|

|

Chief Financial Officer

|

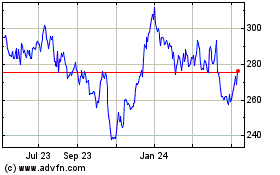

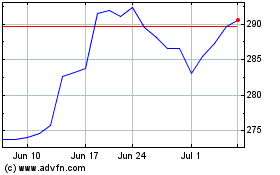

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024