Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-258506

Prospectus Supplement No. 13

(To Prospectus dated April 27, 2022)

OWLET, INC.

This prospectus supplement updates, amends and supplements the prospectus dated April 27, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-258506). Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement is being filed to update, amend and supplement the information included in the Prospectus with the information contained in our Current Report on Form 8-K (the “Current Report”) filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2023 (except for the portion of the Current Report furnished pursuant to Item 7.01 thereof and the corresponding exhibit 99.1 thereto not filed with the SEC), which is set forth below. Accordingly, we have attached the Current Report to this prospectus supplement.

This prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future reference.

Owlet, Inc.’s common stock and warrants are listed on the New York Stock Exchange under the symbols “OWLT” and “OWLT WS.” On February 17, 2023, the closing price of our common stock was $0.34, and the closing price of our warrants was $0.02.

We are an “emerging growth company” under federal securities laws and are

subject to reduced public company reporting requirements. Investing in our securities

involves certain risks. See “Risk Factors” beginning on page 6 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved

of these securities or determined if the Prospectus or this prospectus supplement is

truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 21, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 17, 2023

OWLET, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39516 | | 85-1615012 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

3300 North Ashton Boulevard, Suite 300, Lehi, Utah 84043

(Address of principal executive offices) (Zip Code)

(844) 334-5330

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | OWLT | | New York Stock Exchange |

| Warrants to purchase Common Stock | | OWLT WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Item 1.01 Entry Into a Material Definitive Agreement.

Investment Agreements

On February 17, 2023 (the “Closing Date”), Owlet, Inc. (the “Company”) entered into Investment Agreements (the “Investment Agreements”) with certain investors listed on Schedule 1 thereto (the “Investors”), pursuant to which the Company issued and sold to the Investors (i) an aggregate of 30,000 shares (the “Preferred Shares”) of the Company’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”), and (ii) warrants to purchase an aggregate of 110,204,066 shares of the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”), for an aggregate purchase price of $30.0 million (collectively, the “Private Placement”).

An entity affiliated with Eclipse Ventures LLC (“Eclipse”), which prior to the Private Placement beneficially owned approximately 25% of the Company’s outstanding Common Stock, and whose sole managing member is Lior Susan, chairman of the Company’s board of directors (the “Board”), purchased $20.2 million of the securities sold in the Private Placement. Other Investors include entities affiliated with Trilogy Equity Partners, LLC (“Trilogy”), an owner of more than 5% of the Company’s outstanding Common Stock and whose President and Managing Director is Amy McCullough, a member of the Board; Kurt Workman, the Company’s chief executive officer, president and member of the Board; and John Kim, a member of the Board. The Company’s material relationships with Eclipse and Trilogy are described under “Certain Relationships and Related Party Transactions” beginning on page 28 of the Company’s definitive proxy statement filed with the Securities and Exchange Commission on May 2, 2022, which description is incorporated herein by reference.

Series A Preferred Stock

In connection with the closing of the Private Placement, the Company also filed the Certificate of Designation of Series A Convertible Preferred Stock (the “Certificate of Designation”) with the Secretary of State of the State of Delaware on the Closing Date setting forth the terms, rights, obligations and preferences of the Series A Preferred Stock.

Ranking and Dividends

The Series A Preferred Stock ranks, with respect to dividend rights, rights of redemption and rights upon a liquidation event, (i) senior to the Common Stock and all other classes or series of equity securities of the Company established after the Closing Date, unless such shares or equity securities expressly provide that they rank in parity with or senior to the Series A Preferred Stock with respect to dividend rights, rights of redemption or rights upon a liquidation event, (ii) on parity with each class or series of equity securities of the Company established after the Closing Date, the terms of which expressly provide that it ranks on parity with the Series A Preferred Stock with respect to dividend rights, rights of redemption and rights upon a liquidation event and (iii) junior to each class or series of equity securities of the Company established after the Closing Date, the terms of which expressly provide that it ranks senior to the Series A Preferred Stock with respect to dividend rights, rights of redemption and rights upon a liquidation event.

The Series A Preferred Stock has a liquidation preference of $1,000.00 per share (the “Liquidation Preference”). The Company has agreed not to declare, pay or set aside any dividends on shares of Common Stock unless the holders of the Preferred Shares then outstanding first receive, or simultaneously receive, a dividend on each outstanding share of Series A Preferred Stock in an amount at least equal to the product of (i) the dividend payable on each share of Common Stock multiplied by (ii) the number of shares of Common Stock issuable upon conversion of a share of Series A Preferred Stock to Common Stock thereunder, in each case calculated on the record date for determination of holders entitled to receive such dividend.

Conversion and Redemption

The Series A Preferred Stock is convertible into Common Stock at the option of the holder at any time subsequent to the Closing Date. The number of shares issuable upon conversion is determined by the number of Preferred Shares so converted multiplied by 2,040.8163 (the “Conversion Rate”). Cash will be paid in lieu of any fractional shares based on the closing market price of the Common Stock on the conversion date. The Conversion Rate is subject to adjustment for customary anti-dilution protections, including for stock dividends, splits, and combinations, rights offerings, spin-offs, distributions of cash or other property (to the extent not participating on an as-converted basis) and above market self-tender or exchange offers.

At any time from and after the five-year anniversary of the Closing Date, the holders of at least a majority of the then-outstanding Preferred Shares may specify a date and time or the occurrence of an event by vote or written consent that all, and not less than all, outstanding Preferred Shares will automatically be: (i) converted into shares of Common Stock at the Conversion Rate, (ii) subject to certain exceptions and limitations, redeemed for an amount per share of Series A Preferred Stock equal to the Liquidation Preference plus all accrued or declared but unpaid dividends as of the redemption date and time or (iii) a combination of the foregoing.

Subject to certain exceptions, upon the occurrence of a fundamental change, voluntary or involuntary liquidation, dissolution or winding-up of the Company, the Company will be required to pay an amount per share of Series A Preferred Stock equal to the greater of (i) $1,000.00 per share or (ii) the consideration per share of Series A Preferred Stock as would have been payable had all Preferred Shares been converted to Common Stock immediately prior to the liquidation event, plus, in each case, the aggregate amount of all declared but unpaid dividends thereon to the date of final distribution to the holders of Series A Preferred Stock.

Voting and Consent Rights

Holders of Preferred Shares are entitled to vote with the holders of shares of Common Stock on an as-converted to common basis at any annual or special meeting of stockholders of the Company, and not as a separate class, except as required by Delaware law.

Additionally, for so long as any Preferred Shares remain outstanding, the Company will be prohibited, without the consent of the holders of at least a majority of the Preferred Shares, from taking various corporate actions, including:

•creating, authorizing or issuing any additional Preferred Shares or shares which rank senior to or on parity with the Preferred Shares;

•amending, waiving or repealing the rights, preferences or privileges of the Preferred Shares;

•increasing or decreasing the authorized number of Preferred Shares;

•exchanging, reclassifying or canceling the Preferred Shares (except as contemplated by the Certificate of Designations);

•declaring or paying any dividend on, or making any distribution to, or repurchasing any shares of Common Stock or other securities that rank junior to the Preferred Share, subject to certain exceptions;

•incurring any indebtedness other than Permitted Indebtedness (as defined in the Certificate of Designation); and

•creating, adopting, amending, terminating or repealing any equity (or equity-linked) compensation or incentive plan or increase the amount or number of equity securities reserved for issuance thereunder if the New York Stock Exchange (the “NYSE”) would require stockholder approval of such action; provided that the Company’s 2021 Incentive Award Plan (as it exists on the Closing Date) (the “2021 Plan”) and any automatic annual increases pursuant to the 2021 Plan shall not require approval.

Restrictions on Transfer

The holders of Series A Preferred Stock are permitted to transfer their Preferred Shares subject to any applicable legends or legal restrictions arising under applicable law, subject to completion of certain procedures.

Warrants

The Warrants are exercisable for a number of shares of Common Stock (the “Warrant Shares”) equal to 180% of the number of shares of Common Stock into which such investor’s Series A Preferred Stock is initially convertible. The Warrants have a five-year term and an exercise price that is equal to $0.333 per share. The Warrants also provide for an exercise on a cash or cashless net exercise basis at any time after the closing and will be automatically exercised on a cashless basis if not exercised prior to the expiration of the five-year term. Upon a fundamental change or other liquidation event, the Warrants will automatically net exercise if not exercised before the consummation of such event.

Registration Rights

As promptly as reasonably practicable after closing, but in any event within twenty (20) business days after the later of (i) the closing or (ii) the filing of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, the

Company will file and use commercially reasonable efforts to cause to be declared effective or otherwise become effective pursuant to the Securities Act of 1933, as amended (the “Securities Act”) a shelf registration statement to register the resale of all the shares of Common Stock issuable upon conversion or exercise of the Preferred Shares or Warrants (the “Resale Shelf”). Shares of Common Stock underlying the Preferred Shares and Warrants held by Eclipse, Trilogy, and Mr. Workman will be considered “Registrable Securities” for purposes of that certain Amended and Restated Registration Rights Agreement, dated as of July 15, 2021, by and among the Company and the holders party thereto, a copy of which was filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K, dated July 21, 2021, which is incorporated herein by reference, which will entitle such holders to the demand and piggyback registration rights set forth therein.

Participation Rights

The Investment Agreements provide each Investor that purchased 10,000 Preferred Shares, for so long as such Investor and its affiliates continues to hold or beneficially own at least 5,000 Preferred Shares, with a right to participate as investors in future financing transactions by the Company. The right is limited to financing transactions involving equity securities or securities exercisable or convertible for equity securities of the Company, and will provide such Investor the right to buy up to a number of new securities, on the same terms and conditions offered to other potential investors, necessary for such Investor to maintain its pro rata ownership percentage in the Company (calculated as the fraction equal to (a) the number of outstanding shares of Common Stock plus the number of shares of Common Stock underlying the Investor’s Preferred Shares on an as-converted basis divided by (b) the number of outstanding shares of Common Stock plus the number of shares of Common Stock underlying all outstanding Preferred Shares on an as-converted basis).

Stockholder Approval

The Certificate of Designation and Eclipse’s Warrant include certain provisions that prevent Eclipse, until Stockholder Approval (as defined below) is obtained, from converting its Preferred Shares, voting its Preferred Shares on an as-converted-to-Common Stock basis or exercising its Warrant, as applicable, to the extent such action would result in Eclipse beneficially owning in excess of 29.99% of the Company’s outstanding Common Stock (the “Individual Holder Share Cap”).

The Company has agreed in the Investment Agreements to include a proposal in the definitive proxy statement for its 2023 annual meeting of stockholders (the “2023 Annual Meeting”), soliciting approval by the Company’s stockholders to issue Common Stock to Eclipse such that the Individual Holder Share Cap shall no longer apply in accordance with applicable law and the rules and regulations of the NYSE (the “Stockholder Approval”). If the Stockholder Approval is not obtained at the 2023 Annual Meeting, the Company has agreed to use its commercially reasonable efforts to call a special stockholder meeting within four months of the 2023 Annual Meeting to obtain the Stockholder Approval as contemplated and if the Stockholder Approval is not obtained at such special meeting, the Company shall again include the Stockholder Approval for its annual stockholder meeting for 2024.

Stockholders Agreement

In connection with the Private Placement, the Company and Eclipse Ventures Fund I, L.P., Eclipse Continuity Fund I, L.P. and Eclipse Early Growth Fund I, L.P. entered into an Amended and Restated Stockholders Agreement (the “Stockholders Agreement”), which amends and restates that certain Stockholders Agreement, dated as of July 15, 2021, by and among the Company, Eclipse Ventures Fund I, L.P. and Eclipse Continuity Fund I, L.P. The Stockholders Agreement provides that (a) until such time as Eclipse beneficially owns less than 20.0% of the total voting power entitled to elect directors, Eclipse shall be entitled to nominate two individuals (the “Eclipse Directors” and each, an “Eclipse Director”) and (b) from such time that Eclipse beneficially owns less than 20.0% of the total voting power entitled to elect directors and until Eclipse beneficially owns less than 10.0% of the total voting power entitled to elect directors, Eclipse will be entitled to nominate one Eclipse Director.

The foregoing descriptions of the Certificate of Designation, Form of Warrant, the Investment Agreements, Stockholders Agreement and the transactions contemplated thereby are only summaries and do not purport to be complete, and are qualified in its entirety by reference to the full text of such instruments, copies of which are attached to this Current Report on Form 8-K as Exhibit 3.1, Exhibit 4.1, Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3, respectively, and incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The Private Placement was undertaken in reliance upon an exemption from the registration requirements of Section 4(a)(2) of the Securities Act. The Preferred Shares issued pursuant to the Investment Agreements and the Common Stock issuable upon conversion of the Series A Preferred Stock may not be re-offered or sold in the United States absent an effective registration statement or an exemption from the registration requirements under applicable federal and state securities laws. Any issuance of Common Stock upon exercise of the Warrants pursuant to a cashless exercise will be made pursuant to an exemption from registration under the Securities Act solely for the holder’s own account. The initial maximum number of shares of Common Stock issuable upon conversion of the Series A Preferred Stock and exercise of the Warrants is 171,428,550 shares, subject to customary anti-dilution adjustments.

Item 3.03 Material Modification to Rights of Security Holders.

Pursuant to the Investment Agreements, the Company issued the Preferred Shares as set forth in Item 1.01 above, which is incorporated herein by reference. The powers, designations, preferences, and other rights of the Series A Preferred Stock as are set forth in the Certificate of Designation, a copy of which is filed as Exhibit 3.1 hereto and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the Stockholders Agreement, the Company agreed to appoint one additional director designated by Eclipse to the Board, increasing the size of the Board to seven directors. The Company appointed Jayson Knafel, an Eclipse designee, to serve as a member of the Board as a Class II Director, for a term expiring at the Company’s annual meeting of stockholders to be held in 2023 and until his respective successor has been elected and qualified or until his earlier death, resignation or removal, effective following the execution of the Stockholders Agreement.

Mr. Knafel is a partner at Eclipse, a venture capital firm, where he leads the firm’s growth investment strategies and Eclipse Carbon Optimization. Mr. Knafel has worked at Eclipse since June 2021. In addition, Mr. Knafel served as the interim chief operating officer of Bright Machines, driving efficient and scalable processes across the global operations of the full-stack industrial automation company, from January 2022 to October 2022. Mr. Knafel was previously employed by Fidelity Investments as an Equity Research Associate and then as an Equity Research Analyst from 2015 to 2021, where he invested in global growth companies across sectors and stages of a company’s life cycle. Currently, Mr. Knafel also serves on the board of Axlehire, Inc. Mr. Knafel holds a Bachelor of Business Administration, Finance from University of Notre Dame.

Except as described in this Current Report on Form 8-K, there are no transactions between Mr. Knafel and the Company that would be reportable under Item 404(a) of Regulation S-K.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Pursuant to the Investment Agreements, the Company issued the Preferred Shares as set forth in Items 1.01 and 3.03 above, which are incorporated herein by reference. In connection with the closing of the Private Placement, the Company filed the Certificate of Designation with the Secretary of State of the State of Delaware on the Closing Date setting forth the terms, rights, obligations and preferences of the Series A Preferred Stock. A copy of the Certificate of Designation is filed as Exhibit 3.1 hereto and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On February 17, 2023, the Company issued a press release relating to the Private Placement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 furnished hereunder, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Furthermore, the information in this Item 7.01, including Exhibit 99.1 furnished hereunder, shall not be deemed incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 3.1 | | |

| | |

| 4.1 | | |

| | |

| 10.1 | | |

| | |

| 10.2 | | |

| | |

| 10.3 | | |

| | |

| 99.1 | | |

| |

| 104 | | Cover Page Interactive Data file (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| OWLET, INC. |

| |

| Date: February 21, 2023 | /s/ Kathryn R. Scolnick |

| Kathryn R. Scolnick |

| Chief Financial Officer |

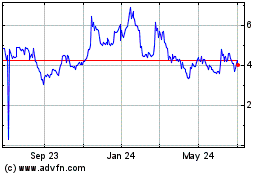

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Aug 2024 to Sep 2024

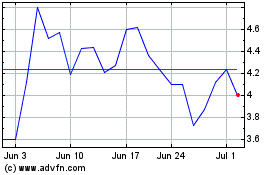

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Sep 2023 to Sep 2024