Current Report Filing (8-k)

March 18 2020 - 4:04PM

Edgar (US Regulatory)

false0000812011001-09614

0000812011

2020-03-18

2020-03-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 18, 2020

Vail Resorts, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

Delaware

|

|

51-0291762

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

390 Interlocken Crescent

|

|

|

|

Broomfield,

|

Colorado

|

|

80021

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

(303)

|

404-1800

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting materials pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

MTN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

As previously disclosed, Vail Holdings, Inc. (“VHI”), a wholly owned subsidiary of Vail Resorts, Inc. (the “Company”), is party to a $500 million revolving credit facility, dated as of August 15, 2018 and maturing on September 23, 2024 (as amended, the “Vail Holdings Credit Agreement”), with Bank of America, N.A., as administrative agent, and certain other lenders party thereto. Additionally, as previously disclosed, Whistler Mountain Resort Limited Partnership (“Whistler LP”) and Blackcomb Skiing Enterprises Limited Partnership (“Blackcomb LP”), together the “WB Partnerships,” are parties to a C$300 million revolving credit facility, dated as of November 12, 2013 and maturing December 15, 2024 (as amended, the “WB Credit Agreement”), with certain subsidiaries of Whistler LP and Blackcomb LP party thereto as guarantors, The Toronto-Dominion Bank, as administrative agent, and certain other lenders party thereto.

On March 18, 2020, VHI borrowed $400 million under the Vail Holdings Credit Agreement, and with certain letters of credit outstanding of approximately $81 million, there is approximately $19 million of remaining capacity under this facility. Also on March 18, 2020, the WB Partnerships borrowed C$175 million under the WB Credit Agreement for a total balance outstanding at this time of approximately C$183 million.

The Company borrowed under the Vail Holdings Credit Agreement and the WB Credit Agreement as a precautionary measure in order to increase its cash position and financial flexibility in light of the current financial market conditions resulting from the COVID-19 outbreak. The proceeds from the borrowing under the Vail Holdings Credit Agreement may be used for general corporate and other purposes permitted by the facility. The proceedings from the borrowing under the WB Credit Agreement may be used for general corporate purposes of the WB Partnerships and subsidiaries.

The foregoing descriptions of the Vail Holdings Credit Agreement and the WB Credit Agreement are only a summary and are qualified in their entirety by reference to the entire documents, copies of which are filed with the Securities and Exchange Commission.

Item 7.01. Regulation FD Disclosure.

On March 18, 2020, the Company issued a press release providing updated commentary on the evolving impact of COVID-19 on its business and results of operations. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

A list of exhibits furnished herewith is contained on the Exhibit Index which immediately precedes such exhibits and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Vail Resorts, Inc.

|

|

Date: March 18, 2020

|

By:

|

/s/ Michael Z. Barkin

|

|

|

|

Michael Z. Barkin

|

|

|

|

Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

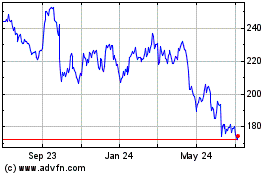

Vail Resorts (NYSE:MTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

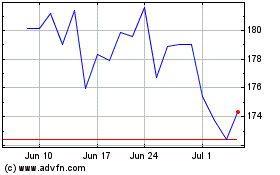

Vail Resorts (NYSE:MTN)

Historical Stock Chart

From Apr 2023 to Apr 2024