UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material Pursuant to § 240.14a-12 |

MIX TELEMATICS LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Q3FY24

Earnings Call Script for February 1, 2024, 8:00 a.m. ET Page 1 of 9

MiX Telematics – Q3FY24

Earnings Call Script

Speakers

Stefan “Joss” Joselowitz,

MiX Telematics – President & CEO

Paul Dell, MiX Telematics –

CFO

PRESENTATION

Good morning, everyone,

and thank you for participating in today’s conference call to discuss MiX Telematics’ financial results for the third quarter

of fiscal 2024, ended December 31, 2023.

Joining us today

are MiX Telematics’ President and CEO, Stefan Joselowitz and the Company’s CFO, Paul Dell. Following their remarks, we’ll

open the call for any questions you may have.

I’d now like

to turn the conference over to MiX Telematics’ Chief Financial Officer, Paul Dell, as he reads the Company’s Safe Harbor

Statement regarding forward looking statements. Paul, please go ahead.

Paul

Dell – MiX Telematics - CFO

Thank you, and

good morning, everyone.

Q3FY24

Earnings Call Script for February 1, 2024, 8:00 a.m. ET Page 2 of 9

Before we continue,

I’d like to remind all participants that during today’s call we will make forward-looking statements related to our business,

which are subject to material risks and uncertainties that could cause our actual results to differ materially. For discussion of the

material risks and other important factors that could affect our results, please refer to those contained in our Form 10-K and other

SEC filings, all of which are available on the Investor Relations section of our website. We will also be referring to certain non-GAAP

financial measures. There is a reconciliation schedule detailing these results currently available in our press release, which is located

on our website and filed with the SEC.

With that, I would

like to turn the call over to MiX Telematics’ President and CEO, Stefan Joselowitz. Joss?

Stefan

“Joss” Joselowitz – MiX Telematics – President & CEO

Thank you, Paul,

and good morning, everyone.

Before turning

to our third quarter performance, I would like to update you on the progress we have made towards completing our transformative business

combination with Powerfleet. I am pleased to report that we have made significant headway in navigating the complex regulatory processes

that govern the transaction in both the United States and South Africa. We have crossed a number of important administrative hurdles,

including receiving most of the pre-requisite approvals needed to proceed.

One of the final

hurdles is for both companies to obtain the approval of their respective shareholders, and to this end, we have set the date of the formal

vote for February 28th, 2024. Earlier this week, we mailed copies of the Powerfleet prospectus and our scheme circular to

shareholders. While there are no guarantees, I am confident we will receive the green-light from our investors, and we expect the transaction

to formally close in early April.

Q3FY24

Earnings Call Script for February 1, 2024, 8:00 a.m. ET Page 3 of 9

I reaffirm that

we have dedicated transaction teams at both MiX and Powerfleet, focused on completing the merger deal. As a result, we have managed to

keep our regional leaders and business units somewhat protected from the day-to-day complexities around the transaction. That said, since

the announcement of the combination, we have been hard at work laying the foundation for integration between the organizations whilst

also focusing on operational execution. We have developed a robust integration plan to ensure the transition will go smoothly, and the

work we’ve already been able to complete has exceeded my expectations. Internally, together with the Powerfleet executive team,

we have communicated our go forward operating structure and established integration workstreams, with well-defined objectives and appropriate

executive sponsorship.

So, whilst deal

related distractions have not been completely avoidable, our team has remained focused and delivered a strong operational performance.

In the third quarter,

we had a record number of net subscriber additions, bringing our total base to well over 1.1 million. Subscription revenue, which represented

86% of total revenues, came in ahead of expectations at $33.7 million - up 6% year-over-year in constant currency. We also maintained

our strict cost discipline practices, resulting in the continued year-over-year expansion of our adjusted EBITDA margin by 220 basis

points, to 24.4%.

Paul will provide

more detail, but increased subscriber acquisition costs combined with a significant increase in our accounts receivable balances resulted

in disappointing free cash performance. Corrective measures have been put in place to ensure that we deliver a strong free cash flow

result this coming quarter.

Q3FY24 Earnings

Call Script for February 1, 2024, 8:00 a.m. ET Page 4 of 9

Our Africa segment

continues to be our core growth driver, generating meaningful net subscriber growth. Globally, our AI-enabled camera solution is playing

a significant part in winning and acquiring a broad base of new business, and we are also making sustained progress with other initiatives

across all geographies. In North America, we acquired new customer logos and subscribers, successfully upsold several existing customers

with expansion deals and, and continued to add more MiX Vision AI subscribers. Across Europe, we secured two major contracts with a combined

subscriber commitment close to 5,000 vehicles. In Australia and LATAM, we continued to see progress with both new customer acquisition

and existing fleet expansion across a variety of verticals, including public transport, energy, mining, construction and agriculture.

On the technology

front, we delivered several new features and enhancements to support our expansion into the construction vertical. This included OEM

integration into the construction equipment standard, as well as new insights and dashboards for asset utilization and fault code reporting.

Our MiX Vision AI solution has been further enhanced to support additional privacy features and can now also be sold to our MiX OEM Connect

subscribers. This means customers using our service with telematics data feeds from vehicle manufacturers, such as Ford, can now get

the same video experience as customers using proprietary MiX in-vehicle technology.

Overall, I’m

pleased with most elements of our operational execution as we move one step closer to completing our transformative business combination

with Powerfleet. This is a very exciting time for both companies, and our entire organization is eager to hit the ground running and

begin executing our combined strategic growth initiatives.

It is opportune

to remind our MiX Telematics shareholders that the direct Nasdaq listing, afforded by the proposed merger, should provide significantly

increased market exposure and an expanded investor base.

Q3FY24 Earnings

Call Script for February 1, 2024, 8:00 a.m. ET Page 5 of 9

As a large shareholder,

I strongly believe that the combined leadership group under Steve Towe’s future stewardship, combined with Powerfleet’s Unity

strategy, and our collective scale will undoubtedly accelerate the achievement of our shared strategic and financial goals.

On the expectation

that the merger proceeds as planned, this will likely be my last earnings call for MiX Telematics. I would like to take the opportunity

to thank my team who helped build such an awesome business. I am also particularly pleased that, with the exception of Steve Blackhart

and myself, the entire MiX leadership team will have important roles in the new Powerfleet executive structure. I want to especially

thank Charles Tasker, our Chief Operating Officer, Catherine Lewis, our EVP of technology, Gert Pretorius who runs our Africa business,

Jonathan Bates our head of Marketing, Brendan Horan on special projects and Steve Blackhart - the most recent addition to our team who

currently heads up M&A. My relationship with almost all of these individuals pre-dates our U.S. IPO in 2013 and I am extremely grateful

for their support and commitment over the years. And lastly, I want to thank Paul Dell, our CFO, who will be moving into the role of

Chief Accounting Officer at Powerfleet. And with that, Paul, over to you!

Paul

Dell – MiX Telematics - CFO

Thanks, Joss. We will now turn to the

financial results for our third fiscal quarter ended December 31, 2023. Our total revenue of $39.1 million grew 5.8% on a constant currency

basis. Subscription revenue increased 6.4% on a constant currency basis to $33.7 million, representing 86.1% of total revenue. Most of

our revenues are derived from currencies other than the U.S. dollar like the South African Rand and British Pound. The change in foreign

currency exchange rates resulted in a 2.7% decline in our reported subscription revenues this quarter.

Q3FY24 Earnings Call Script for February

1, 2024, 8:00 a.m. ET Page 6 of 9

We added a record 52,400 subscribers

during the quarter, with the trailing twelve months subscriber base increasing by nearly 183,000 subscribers, primarily driven by our

Africa segment.

In addition to

the subscription revenue growth, we were also pleased to maintain our hardware and other revenues at $5.4 million in the quarter with

strong contributions from Africa, Brazil as well as our Middle East and Australasia segments.

Our gross margin

in the third quarter decreased 430 basis points to 60.1% compared to 64.4% in the same year-ago quarter due primarily to lower subscription

margins. Our subscription revenue margin decreased 510 basis points to 64.5% compared to 69.6% in the same year-ago period and, similar

to last quarter, was impacted by accelerated depreciation of in-vehicle devices following the non-renewal of an energy sector customer.

We expect our subscription margin to normalize in the coming quarters.

Adjusted EBITDA

increased 13% to $9.5 million compared to $8.4 million in the year-ago period. As a percentage of total revenue, adjusted EBITDA margin

increased by 220 basis points year-over-year to 24.4%.

After investing

$5.7 million in capital expenditures, which included investments in-vehicle devices of $4.2 million, we reported negative free cashflow

of $4.0 million. We ended the quarter with $25.4 million in cash and cash equivalents. Our management team is focused on significantly

reducing our accounts receivable balance which was inflated by lower than expected collections in South Africa during the holiday period

as well as delayed payments from large Energy customers looking enhance their year-end cash positions. Looking at our revised cash forecasts

we anticipate significant free cash will be generated as we close out the 2024 fiscal year.

Q3FY24

Earnings Call Script for February 1, 2024, 8:00 a.m. ET Page 7 of 9

Now I wanted to

provide an update on some of the details of our proposed business combination with Powerfleet.

In connection with

the transaction, Powerfleet and MiX have signed a commitment letter with Rand Merchant Bank, a leading South African corporate bank,

to provide an $85 million senior debt facility concurrent with the closing date. Powerfleet also plans to draw an additional $14 million

on its current facility with Bank Hapoalim. The proceeds from the refinancing of the combined company’s balance sheet will be used

to redeem in full the outstanding Powerfleet convertible preferred stock held by affiliates of Abry Partners, as well as satisfying outstanding

MiX facilities. Transaction-related expenses will be paid from cash on the balance sheet. Given the combined company’s current

sources of cash generation, we have structured the transaction so that the go forward Powerfleet balance sheet includes Israeli shekel

and South African rand-denominated debt, providing a natural FX hedge for USD-denominated investors.

As Joss said earlier,

we are now expecting that the transaction will close in early April 2024. The transaction close is contingent upon shareholder approvals

as well as other customary closing conditions. This week, we issued our scheme circular and the Powerfleet prospectus with instructions

on the voting process, which will take place on Wednesday, February 28th.

Q3FY24

Earnings Call Script for February 1, 2024, 8:00 a.m. ET Page 8 of 9

Finally, I wanted to discuss our outlook

for fiscal 24. We continue to anticipate that both constant currency organic subscription revenue and ARR growth will be in the mid-single

digits with the full year adjusted EBITDA margin approaching the mid-20s. Overall MiX Telematics expects to continue to maintain a disciplined

approach to growth with a focus on delivering strong profitability and cashflows, while progressing towards Rule of 40 performance in

the medium term.

This concludes our prepared remarks,

and I’ll now turn the call back over to the Operator for Q&A.

Cautionary Note Regarding Forward-Looking

Statements

This communication

contains forward-looking statements within the meaning of federal securities laws. The Company’s, Powerfleet’s and the combined

business’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on

these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” anticipate,” “intend,” “plan,” “may,” “will,”

“could,” “should,” “believes,” “predicts,” “potential,” “continue,”

and similar expressions are intended to identify such forward-looking statements. All statements other than statements of historical

fact are statements that could be forward-looking statements. Most of these factors are outside the parties’ control and are difficult

to predict. The risks and uncertainties referred to above include, but are not limited to, risks related to: (i) the completion of the

Transactions in the anticipated timeframe or at all; (ii) the satisfaction of the closing conditions to the Transactions including, but

not limited to the ability to obtain approval of the shareholders of the Company and stockholders of Powerfleet and the ability to obtain

the Financing; (iii) the failure to obtain necessary regulatory approvals; (iv) the ability to realize the anticipated benefits of the

Transactions; (v) the ability to successfully integrate the businesses; (vi) disruption from the Transactions making it more difficult

to maintain business and operational relationships; (vii) the negative effects of the announcement of the Transactions or the consummation

of the Transactions on the market price of Powerfleet’s or the Company’s securities; (viii) significant transaction costs

and unknown liabilities; (ix) litigation or regulatory actions related to the Transactions; and (x) such other factors as are set forth

in the periodic reports filed by Powerfleet and the Company with the SEC, including but not limited to those described under the heading

“Risk Factors” in their annual reports on Form 10-K, quarterly reports on Form 10-Q and any other filings made with the SEC

from time to time, which are available via the SEC’s website at http://www.sec.gov. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated

by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward looking

statements included in this communication are made only as of the date of this report, and except as otherwise required by applicable

securities law, neither Powerfleet nor the Company assume any obligation nor do they intend to publicly update or revise any forward-looking

statements to reflect subsequent events or circumstances.

Q3FY24

Earnings Call Script for February 1, 2024, 8:00 a.m. ET Page 9 of 9

Additional Information and Where

to Find It

In connection with

the proposed transaction, Powerfleet has filed, and the SEC declared effective on January 24, 2024, a registration statement on Form

S-4 (the “Registration Statement”), which includes a joint proxy statement of the Company and Powerfleet and a prospectus

of Powerfleet. The Company and Powerfleet commenced the mailing of the joint proxy statement/prospectus on January 29, 2024. Each of

the Company and Powerfleet may also file other relevant documents with the SEC regarding the proposed transaction. Any holder of the

MiX ordinary shares through an intermediary such as a broker/dealer or clearing agency or the MiX ADSs should consult with their intermediary

or The Bank of New York Mellon, the depositary for the MiX ADSs, as applicable, about how to obtain information on the Company’s

shareholder meeting. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING

ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER DOCUMENTS THAT MAY BE FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS.

Investors and shareholders will be able to obtain free copies of these documents (if and when available) and other documents containing

important information about the Company and Powerfleet once such documents are filed with the SEC through the website maintained by the

SEC at www.sec.gov. The Company and Powerfleet may file other relevant materials with the SEC in connection with the Transactions. The

Company and Powerfleet will make available copies of materials they file with, or furnish to, the SEC free of charge at http://investor.mixtelematics.com

and https://ir.powerfleet.com, respectively.

No Offer or Solicitation

This communication

shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act.

Participants

in the Solicitation

The Company, Powerfleet

and their respective directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation

of proxies from the Company’s shareholders and Powerfleet’s stockholders in connection with the Transactions. Securityholders

may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the

joint proxy statement/prospectus, its Annual Report on Form 10-K for the year ended March 31, 2023, which was filed with the SEC on June

22, 2023, and its definitive proxy statement for its 2023 annual general meeting of shareholders, which was filed with the SEC on July

28, 2023. Securityholders may obtain information regarding the names, affiliations and interests of the Powerfleet’s directors

and executive officers in the joint proxy statement/prospectus, its Annual Report on Form 10-K for the fiscal year ended December 31,

2022, which was filed with the SEC on March 31, 2023, its amended Annual Report on Form 10-K/A for the year ended December 31, 2022,

which was filed with the SEC on May 1, 2023, and its definitive proxy statement for its 2023 annual meeting of stockholders, which was

filed with the SEC on June 21, 2023. Other information regarding the participants in the proxy solicitations and a description of their

direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other

relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should

read the joint proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these

documents from the Company or Powerfleet using the sources indicated above.

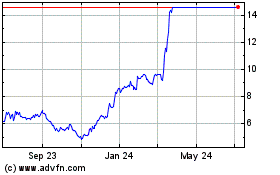

MiX Telematics (NYSE:MIXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

MiX Telematics (NYSE:MIXT)

Historical Stock Chart

From Apr 2023 to Apr 2024