The Payoneer Digital Purchasing Mastercard

streamlines the way SMBs use their earnings to invest back into

growing their businesses, bringing value to digital marketplaces

and platforms too

Payoneer Inc., the global payment and commerce-enabling platform

which powers growth for millions of digital businesses worldwide,

today announced a multifaceted relationship with Mastercard.

Beginning with the Payoneer Digital Purchasing Mastercard,

tailor-made for SMBs, eCommerce sellers and freelancers worldwide,

Payoneer and Mastercard will work closely to better meet the needs

of the B2B market.

This partnership comes soon after Payoneer announced that it

will be going public through a SPAC transaction, which assigns

Payoneer a pro-forma implied enterprise value of approximately

$3.3B upon consummation. Mastercard will provide Payoneer with

access to innovative new products and benefits to better meet the

needs of their customers, and Mastercard will benefit from

Payoneer’s global B2B footprint, gaining access to the company’s

ecosystem of more than 5 million businesses.

Through the new Payoneer Digital Purchasing Mastercard,

businesses receiving payment through Payoneer benefit from:

- Immediate access to funds earned which they can now invest into

their growth through digital advertising platforms such as Facebook

and Google

- Making purchases anywhere around the world where Mastercard is

accepted, and the ability to connect the card to mobile

wallets

- Access to multiple cards, streamlining the management of

expenses for businesses across platforms, storefronts and product

lines

- Virtual card access, providing SMBs with choice in how they pay

and get paid as the demand for digital payments continues to

accelerate

“This partnership with Mastercard is an essential step in

providing our customers with another easy way to access and spend

their funds from marketplace sales and B2B commerce,” said Charles

Rosenblatt, Chief Strategy Officer, Payoneer. “With the launch of

the Payoneer Digital Purchasing Mastercard, our global customer

base can pay for online advertising and other digital services, as

well as have another way to pay suppliers. We are very excited to

partner with Mastercard as we expand our global offerings,

providing our marketplaces and SMBs the best solution

available.”

“We have been laser-focused on enabling faster, more convenient,

and secure digital payments to address the evolving needs of

businesses and consumers alike,” said Sherri Haymond, executive

vice president, Digital Partnerships at Mastercard. “We look

forward to working closely with Payoneer to further address the

critical SMB segment through the combination of their significant

reach with the power of the Mastercard network.”

For those that have existing Payoneer cards, users will not need

to take any action to ensure continued access to their existing

card. The digital purchasing cards will be available widely in the

second half of 2021.

For more information on the Payoneer Digital Purchasing

Mastercard and this partnership, please visit:

https://explore.payoneer.com/en/solution/digital-purchasing-mastercard/

Note: In February 2021, Payoneer entered into an Agreement and

Plan of Reorganization with FTAC Olympus Acquisition Corp (NASDAQ:

FTOC) in a transaction that would result in Payoneer becoming a

U.S. publicly listed entity. The transaction is expected to close

in the second quarter of 2021, subject to satisfaction of customary

closing conditions.

About Payoneer

Payoneer’s mission is to empower businesses to go beyond

– beyond borders, limits and expectations. In today’s digital

world, Payoneer enables any business of any size from anywhere to

access new economic opportunities by making it possible to transact

as easily globally as they do locally.

Payoneer’s digital platform streamlines global commerce for

millions of small businesses, marketplaces and enterprises from 190

countries and territories. Leveraging its robust technology,

compliance, operations and banking infrastructure, Payoneer

delivers a suite of services that includes cross-border payments,

working capital, tax solutions, merchant services and risk

management. Powering growth for customers ranging from aspiring

entrepreneurs in emerging markets to the world’s leading digital

brands like Airbnb, Amazon, Google and Upwork, Payoneer makes

global commerce easy and secure. Founded in 2005, Payoneer has a

team based all around the world.

In February 2021, Payoneer entered into a definitive merger

agreement with FT Olympus Acquisition Corp (NASDAQ: FTOCU) in a

transaction that would result in Payoneer becoming a U.S. publicly

listed entity. The transaction is expected to close in the first

half of 2021, subject to satisfaction of customary closing

conditions.

www.payoneer.com

About Mastercard (NYSE: MA)

Mastercard is a global technology company in the payments

industry. Our mission is to connect and power an inclusive, digital

economy that benefits everyone, everywhere by making transactions

safe, simple, smart and accessible. Using secure data and networks,

partnerships and passion, our innovations and solutions help

individuals, financial institutions, governments and businesses

realize their greatest potential. Our decency quotient, or DQ,

drives our culture and everything we do inside and outside of our

company. With connections across more than 210 countries and

territories, we are building a sustainable world that unlocks

priceless possibilities for all.

www.mastercard.com

Forward-Looking Statements

This press release includes, and oral statements made from time

to time by representatives of Payoneer, may be considered

“forward-looking statements”. Forward-looking statements generally

relate to future events or Payoneer’s future financial or operating

performance. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “expect,”

“intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,”

“potential” or “continue,” or the negatives of these terms or

variations of them or similar terminology. Such forward-looking

statements are subject to risks, uncertainties, and other factors

which could cause actual results to differ materially from those

expressed or implied by such forward looking statements. These

forward-looking statements are based upon estimates and assumptions

that, while considered reasonable by Payoneer and its management,

as the case may be, are inherently uncertain. Factors that may

cause actual results to differ materially from current expectations

include, but are not limited to: (1) the occurrence of any event,

change or other circumstances that could give rise to the

termination of the relationship with Mastercard; and (2) other

risks and uncertainties set forth in the section entitled “Risk

Factors” and “Cautionary Statement Regarding Forward-Looking

Statements”,, as well as any further risks and uncertainties

contained, in the proxy statement filed by New Starship Parent Inc.

on February 16, 2021. Nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Payoneer

does not undertakes any duty to update these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210310005151/en/

PAN Communications Rima Masubuchi 347 304 0681

Payoneer@pancomm.com

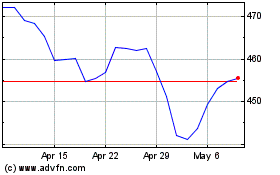

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024