UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

☒

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material under

§240.14a-12

|

KILROY REALTY CORPORATION

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy

Statement, If Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1)

and

0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary

materials.

|

|

☐

|

|

Check box if any part of the fee is offset as

provided by Exchange Act Rule

0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the

date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

KILROY REALTY 2019 Proxy Season Update

Spring 2019

This presentation contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our current expectations, beliefs and assumptions,

and are not guarantees of future performance. Forward-looking statements are generally identified through the inclusion of words such as “believe,” “expect,” “goals” and “target” or similar statements

or variations of such terms and other similar expressions. Numerous factors could cause actual future performance, results and events to differ materially from those indicated in the forward-looking statements, including, among others: global market

and general economic conditions and their effect on our liquidity and financial conditions and those of our tenants; adverse economic or real estate conditions generally, and specifically, in the States of California and Washington; risks associated

with our investment in real estate assets, which are illiquid, and with trends in the real estate industry; defaults on or non-renewal of leases by tenants; any significant downturn in tenants’ businesses; our ability to re-lease property at

or above current market rates; costs to comply with government regulations, including environmental remediation; the availability of cash for distribution and debt service and exposure to risk of default under debt obligations; increases in interest

rates and our ability to manage interest rate exposure; the availability of financing on attractive terms or at all, which may adversely impact our future interest expense and our ability to pursue development, redevelopment and acquisition

opportunities and refinance existing debt; a decline in real estate asset valuations, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing, and which may result in write-offs or impairment

charges; significant competition, which may decrease the occupancy and rental rates of properties; potential losses that may not be covered by insurance; the ability to successfully complete acquisitions and dispositions on announced terms; the

ability to successfully operate acquired, developed and redeveloped properties; the ability to successfully complete development and redevelopment projects on schedule and within budgeted amounts; delays or refusals in obtaining all necessary

zoning, land use and other required entitlements, governmental permits and authorizations for our development and redevelopment properties; increases in anticipated capital expenditures, tenant improvement and/or leasing costs; defaults on leases

for land on which some of our properties are located; adverse changes to, or enactment or implementations of, tax laws or other applicable laws, regulations or legislation, as well as business and consumer reactions to such changes; risks associated

with joint venture investments, including our lack of sole decision-making authority, our reliance on co-venturers’ financial condition and disputes between us and our co-venturers; environmental uncertainties and risks related to natural

disasters; and our ability to maintain our status as a REIT; and the other factors discussed in the risk factors section of Kilroy Realty Corporation’s most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. All

forward-looking statements are based on currently available information, and speak only as of the dates on which they are made. We assume no obligation to update any forward-looking statement that becomes untrue because of subsequent events, new

information or otherwise, except to the extent we are required to do so in connection with our ongoing requirements under federal securities laws. DISCLAIMER

PREMIER WEST COAST REIT KRC’s

competitive advantages and current market strength position us well for the long-term High Quality Stabilized Portfolio Premier West Coast Markets Strong Balance Sheet Life Science – Additional Catalyst for Growth Recognized Leader in

Sustainability Highly Experienced Management Team Strong Market Fundamentals Value Creating Development Program

STRONG VALUE CREATION Track record of

outperformance KRC has generated long-term value for stockholders as a result of investments in our transformation, a disciplined approach to capital allocation and development, and conservative balance sheet. Under John Kilroy’s leadership,

KRC has continued to outperform the SNL US REIT Office and MSCI US REIT Indices. +237% SNL US REIT OFFICE INDEX +110% MSCI US REIT INDEX +188% Note: Total stockholder return (“TSR”) for the period 12/31/2009 to 5/6/2019. For purposes of

this disclosure, TSR is calculated assuming dividend reinvestment. (1) The debt to earnings before interest, taxes depreciation and amortization (“EBITDA”) ratio is calculated as the Company’s consolidated debt balance for the

applicable period, adjusted for the undrawn $360 million equity forward offering executed in August 2018, divided by the Company’s EBITDA, as adjusted for such period. See Appendix A of the Company’s 2019 Proxy Statement for a definition

of EBITDA, as adjusted, and a reconciliation of net income available to common stockholders computed in accordance with generally accepted accounting principles (“GAAP”) to EBITDA, as adjusted. (2) Calculated as of 5/6/2019. 96.6%

YEAR-END PERCENT LEASED 7.1% DIVIDEND GROWTH 3.4 MM SF TOTAL LEASES EXECUTED 5.9X YEAR-END DEBT/EBITDA(1) 2018 Business Highlights +24% YTD TSR(2) OUTPERFORMING BBG REIT OFFICE PROPERTY, SNL US REIT OFFICE, AND MSCI US REIT INDICES Beginning of John

Kilroy’s 2012-2018 employment agreement LONG-TERM TSR PERFORMANCE

Our executive compensation program is

designed to incentivize achievement of key strategic and financial performance measures, ensure alignment with stockholder interests, and help the Company attract and retain talent in the highly competitive West Coast employment and commercial real

estate markets EXECUTIVE COMPENSATION PROGRAM Element Objective Design Features Base Salary Provide a regular source of income so employees can focus on day-to-day responsibilities Recognize ongoing performance of job responsibilities Competitive

pay, taking into account job scope, position, knowledge, tenure, skills and experience Short-Term Incentives Motivate and reward for achievement of pre-established annual financial and operational goals and other strategic objectives Payouts awarded

under a cash incentive performance measurement framework based on specific performance metrics and qualitative goals that are established at the beginning of each year based on KRC’s business plan NEOs can earn 0% - 150% of target incentive,

based on annual performance against the pre-established goals Long-Term Incentives Emphasize long-term performance objectives Align NEO and stockholder interests Retain key executives through the performance and vesting periods

Approximately 75% of CEO’s annual LTI award is allocated in performance-based RSUs and approximately 25% in time-based RSUs (and approximately 66% of our other NEOs’ annual LTI award is allocated in performance-based RSUs)

Performance-based RSU award is aligned with long-term performance: Subject to performance-based vesting requirements over a three-year performance period; cliff vests to the extent performance goals are achieved at the end of that period Subject to

complete forfeiture if minimum FFO Per Share threshold is not achieved in the grant year Award is further subject to relative TSR and average ratio of debt to EBITDA modifiers over the entire three-year vesting period Time-based RSUs vest in three

annual installments, and payouts are subject to continued service through the applicable vesting date Program structure aligns executive and stockholder interests At-Risk Pay: 88% Performance-Based Pay: 74% 2018 Target CEO Total Direct Compensation

*Grant date fair value approved by the Compensation Committee used to determine number of shares subject to annual long-term incentive awards

Introduced new process with specific

weightings and maximums for each metric category Performance within each metric category will be assessed individually against pre-established objective goals and is assigned a maximum level of achievement Each metric category assigned a rating from

“Extraordinary” to “Well below expectations” Payouts range from 0-150% of target Compensation Committee may also take succession planning into account Added new ESG metric category Rewards achievement of key sustainability

and governance goals that tie to the Company’s strategy Updated annual cash incentive program in response to stockholder feedback leads to increased transparency 2019 COMPENSATION PROGRAM UPDATES Since our 2018 annual meeting of stockholders,

we actively engaged with stockholders owning collectively more than 80% of our outstanding common stock, with our Lead Independent Director and Chair of our Executive Compensation Committee, and the Chair of our Corporate Social Responsibility &

Sustainability Committee, personally leading meetings with stockholders owning collectively more than 57% of our outstanding common stock In response to valuable stockholder feedback, we made several enhancements to our NEOs’ annual cash

incentive program structure to strengthen performance alignment and increase program transparency Metric Category Weighting Operations 20% Balance Sheet Management 20% Acquisitions 10% Dispositions 15% Development 20% ESG 15% Performance Measurement

Framework Key Changes for 2019

The Board determined to put a new

employment agreement in place to secure Mr. Kilroy’s continued service, and to ensure alignment with stockholder value creation objectives for years to come The new employment agreement was a result of year-long negotiations Since September

2017, the Compensation Committee and the Board discussed Mr. Kilroy’s updated employment agreement numerous times, including over the course of nine separate in-person and telephonic meetings, and in additional calls and meetings amongst

directors and with the Compensation Committee’s independent compensation consultant * Based on closing price of the Company’s common stock on such date KRC Board determined that John Kilroy is the right

leader for the future $9.4 Billion Enterprise Value* 13.2 Million Square Feet of Stabilized Office Properties West Coast REIT Properties Located in the Coastal Regions of Greater Los Angeles County, Orange County, San Diego County, the San Francisco

Bay Area and the Greater Seattle Areas 200 Residential Units Located in the Hollywood Submarket of Los Angeles 3 Projects Under Construction Totaling Approximately 1.3 Million Square Feet of Office Space, 801 Residential Units and 96,000 Square Feet

of Retail Space 2 Projects in the Tenant Improvement Phase Totaling Approximately 1.2 Million Square Feet of Office and Production, Distribution and Repair Space $2.6 Billion Enterprise Value* 12.4 Million Square Feet of Stabilized Office and

Industrial Properties SoCal-Centric REIT All Properties Located in Southern California January 1, 2010 December 31, 2018 171% TSR (Assuming Dividend Reinvestment) vs. 76% TSR for SNL US REIT Office Index 10.5% Annualized Return on Investment in

Company Common Stock vs. 5.8% Annualized Return on Investment in SNL US REIT Office Index 125% Greater Increase in Value vs. Similar Investment in SNL US REIT Office Index Kilroy Realty Corporation January 1, 2010 – December 31, 2018 NEW CEO

EMPLOYMENT AGREEMENT Considerations in New CEO Employment Agreement Negotiations

NEW CEO EMPLOYMENT AGREEMENT Our

CEO’s new employment agreement secures his continued service and ensures alignment with the Company’s strategic and financial objectives for years to come Element Provision Key Features Base Salary $1.225 MM Consistent with base salary

since 2012 Subject to annual review Annual Cash Incentive Award Annual target incentive of $3 MM Aligned with 2018 target Annual Stock Incentive Award Annual target LTI grant of $6 MM Aligned with actual 2018 LTI grant Employment Agreement Award

Term ending December 31, 2023 CEO award delivered through two grants Mr. Kilroy was already retirement eligible. The grants were awarded for entering into the long-term employment agreement and to delay his retirement The grants were also awarded to

provide additional incentives during the term of the agreement and to recognize the transformation of the Company under Mr. Kilroy’s leadership 45% of target total $30 MM award in time-based RSUs Delayed vesting of 50% after year three and 50%

after year four, to strengthen long-term retention value 55% of target total $30 MM award in performance-based RSUs (PRSUs) Can earn between 0-200% of target Determined by KRC’s relative TSR performance versus a relevant third-party peer index

(SNL U.S. REIT Office Index) Ultimate size of award based on performance over a four-year period TSR performance at or below Index results in reduced award (~66% of target) - must achieve 100bps above Index to receive 100% of target award

Compensation associated with the new agreement continues to be majority performance-based, subject to rigorous and relative performance conditions

OUR BOARD OF DIRECTORS Highly qualified and

experienced Board DIVERSE SKILLSET * Knowledge and experience with the top five industries that make up the majority of our tenant base (Technology; Life Science & Health Care; Media; and F.I.R.E – Finance, Insurance, and Real Estate) John

Kilroy President, CEO and Chairman of the Board 50+ years of experience with KRC, including serving as President and CEO since incorporation and leading private predecessor, Kilroy Industries; has been involved in all aspects of commercial real

estate for KRC Edward Brennan, PhD Lead Independent Director, Compensation Committee Chair Acting Chief Executive Officer of Abram Scientific, a privately held medical diagnostics company Brings executive management and board experience with public

and private companies; 30+ years of experience with companies in target tenant industries Jolie Hunt Corporate Social Responsibility & Sustainability Committee Chair Chief Executive Officer of Hunt & Gather, a marketing and communications

agency Brings significant marketing and communications experience, knowledge of trends in the media, entertainment and technology world, and the use of technology to advance brands Scott Ingraham Audit Committee Chair Co-owner of Zuma Capital, a

firm engaged in private equity and angel investing Brings extensive financial and real estate knowledge based on experience as co-founder and CEO of Rent.com, and deep experience at REITs as an executive and director Gary Stevenson Succession

Planning Committee Chair President and Managing Director of MLS Business Ventures of Major League Soccer Brings extensive business, operational and entrepreneurship experience from former roles as founder of OnSport Strategies and President of

Pac-12 Peter Stoneberg Governance Committee Chair Managing Partner of Velocity Ventures, a merchant banking and M&A advisory firm he founded in 2000 Brings significant relationships and experience with and knowledge of large and small companies

in the high-tech industry, particularly within the San Francisco Bay Area where key target tenants are located Target Tenant Industry Experience* Executive Leadership Public Company Board Service Investment Experience Financial Literacy/Accounting

Experience Finance/Capital Markets Experience Risk Management Experience Advanced Degree/Professional Accreditation Kilroy Brennan Hunt Ingraham Stevenson Stoneberg BALANCED TENURE

BEST PRACTICES Compensation, Board &

Governance BOARD COMPENSATION Lead Independent Director with well-defined role and robust responsibilities Majority of directors are independent All principal Board committees composed of independent directors Established Corporate Social

Responsibility & Sustainability Committee in April 2018 Commitment to Board refreshment with three new independent directors in last five years Commitment to include women and individuals from minority groups in the qualified pool from which new

director candidates are selected Regular executive sessions of independent directors Regular Board and committee self-evaluations Succession Planning Committee oversees regular succession planning efforts CEO may only serve on one other public

company board Meaningful stock ownership guidelines for our CEO (6x salary) and other NEOs (3x salary) Meaningful stock ownership guidelines for non-employee directors (5x annual retainer) Stock holding requirements

Anti-hedging policy Anti-pledging policy Clawback policy Related party transactions policy No single trigger change in control provisions No excise tax gross-ups No repricing of underwater stock

options without stockholder approval GOVERNANCE Regular engagement with investors, including discussions since our 2018 Annual Meeting with stockholders representing over 80% of our outstanding common stock Amended proxy access right in 2017 to

align with emerging best practices and respond to stockholder feedback Majority voting for directors in uncontested elections Annual director elections (declassified Board) Annual Say-on-Pay voting Stockholder right to call a special meeting

Stockholder right to amend bylaws by a majority vote No stockholder rights plan

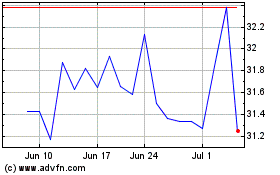

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Aug 2024 to Sep 2024

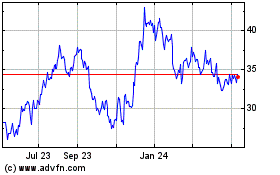

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Sep 2023 to Sep 2024